UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) January 27, 2014 (January 24, 2014)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

NEVADA

|

333-156059

|

27-2636716

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

20 Trafalgar Square

Suite 455

Nashua, NH 03063

(Address of principal executive offices, including zip code.)

(603) 732-6948

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On January 24, 2014, Minerco Resources, Inc. (“we” or the “Company”) entered into an Agreement (the “Exchange Agreement”) with LOMA Management Partners, LLC. (the “Lender”), where, among other things, the Company and Lender shall exchange the Prior Note, dated July 31, 2013, currently held by Lender for a new note in the principal amount of $75,000, due May 1, 2014 (the “New Note”).

The summary of the Agreement is as follows (the entire Exchange Agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K filed with the Securities and Exchange Commission):

Recitals

A. The Company has issued to Lender a Note dated July 31, 2013 in the principal amount of $75,000 due January 31, 2014 (the “Prior Note”).

B. The Company desires to exchange the Prior Note for a new note. The Company and Lender desire to enter into this Agreement, pursuant to which, among other things, the Company and Lender shall exchange the Prior Note currently held by Lender for a new note in the principal amount of $75,000, due May 1, 2014 (the “New Note”).

Exchanges.

1.1 Exchange. Lender and the Company, hereby exchange the Prior Note for the New Note, as follows (the “Exchange”), without the payment of any additional consideration.

1.2 Delivery. In exchange for the Prior Note, the Company hereby, delivers to Lender the New Note. Lender hereby delivers to the Company (or its designee) the originally executed copy of the Prior Note on the date hereof and from and after the date hereof the Prior Note shall be null and void and any and all rights arising thereunder shall be extinguished.

Miscellaneous.

4.1 Legends. Lender acknowledges that the New Note shall conspicuously set forth on the face or back thereof a legend in substantially the following form:

“THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR THE RULES AND REGULATIONS PROMULGATED THEREUNDER, OR UNDER THE SECURITIES LAWS, RULES OR REGULATIONS OF ANY STATE; AND MAY NOT BE PLEDGED, HYPOTHECATED, SOLD OR TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE ACT AND THE APPLICABLE STATE SECURITIES LAWS, RULES OR REGULATIONS OR AN EXEMPTION THEREFROM DEEMED ACCEPTABLE BY COUNSEL TO THE COMPANY.”

The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the full text of the Exchange Agreement, attached as Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

The Prior Note, dated July 31, 2013, is qualified in its entirety by reference to the full text of the Convertible Promissory Note, referenced as Exhibit 10.12 to the Form 10-K, dated November 13, 2013, filed with the Securities and Exchange Commission and incorporated herein by reference.

The New Note, dated January 24, 2014, is qualified in its entirety by reference to the full text of the Convertible Promissory Note, attached as Exhibit 10.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

On January 14, 2014, the Company issued fourteen million four hundred thousand (14,400,000) shares of its common stock to JSJ Investments, Inc. pursuant to a Convertible Promissory Note, dated May 31, 2013. Following the conversion, the Note is paid in full and is closed.

On January 23, 2014, the Company issued fifty-one million four hundred fifty-five thousand and seven hundred (51,455,700) shares of its common stock to SE Media Partners, Inc. pursuant to a Convertible Promissory Note, dated November 6, 2011. Following the conversion, the Note is paid in full and is closed.

ITEM 8.01. OTHER EVENTS

As of January 15, 2014, our subsidiary, Level 5 Beverage Company, Inc., which we own seventy and three-tenths percent (70.3%), has placed RISE™ and COFFEE BOOST™, in 350 stores in California and Arizona.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

| |

|

|

|

Incorporated by reference

|

|

|

|

Exhibit

|

|

Document Description

|

|

Form

|

|

Date

|

|

Number

|

|

Filed herewith

|

|

|

|

Exchange Agreement, dated January 24, 2014

|

|

|

|

|

|

|

|

X

|

|

10.2

|

|

Convertible Promissory Note, dated July 31, 2013

|

|

10-K

|

|

11/13/13

|

|

10.12

|

|

|

|

|

|

Exchange Convertible Promissory Note, dated January 24, 2014

|

|

|

|

|

|

|

|

X

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: January 27, 2014

|

MINERCO RESOURCES, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ John F. Powers

|

|

| |

|

|

|

EXCHANGE AGREEMENT

THIS EXCHANGE AGREEMENT (the “Agreement”) is dated as of January 24, 2014, by and between Minerco Resources, Inc. (the “Company”), and LOMA Management Partners LLC. (“Lender”).

WHEREAS:

A. The Company has issued to Lender a Note dated July 31, 2013 in the principal amount of $75,000 due January 31, 2014 (the “Prior Note”).

B. The Company desires to exchange the Prior Note for a new note. The Company and Lender desire to enter into this Agreement, pursuant to which, among other things, the Company and Lender shall exchange the Prior Note currently held by Lender for a new note in the principal amount of $75,000, due May 1, 2014 (the “New Note”).

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants hereinafter contained, the parties hereto agree as follows:

1.1 Exchange. Lender and the Company, hereby exchange the Prior Note for the New Note, as follows (the “Exchange”), without the payment of any additional consideration.

1.2 Delivery. In exchange for the Prior Note, the Company hereby, delivers to Lender the New Note. Lender hereby delivers to the Company (or its designee) the originally executed copy of the Prior Note on the date hereof and from and after the date hereof the Prior Note shall be null and void and any and all rights arising thereunder shall be extinguished.

2. Company Representations and Warranties.

2.1 Authorization and Binding Obligation. The Company has the requisite power and authority to enter into and perform its obligations under this Agreement and to issue the New Note in accordance with the terms hereof and thereof. The execution and delivery of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby and thereby, including, without limitation, the issuance of the New Note has been duly authorized by the Company's Board of Directors. This Agreement has been duly executed and delivered by the Company, and constitute the legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their respective terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of applicable creditors' rights and remedies and except as rights to indemnification and to contribution may be limited by federal or state securities laws.

2.2 No Conflict. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby and thereby (including, without limitation, the issuance of the New Note) will not: (i) result in a violation of organizational documents of the Company; (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company is a party; or (iii) result in a violation of any law, rule, regulation, order, judgment or decree applicable to the Company or any of its subsidiaries or by which any property or asset of the Company is bound or affected except, in the case of clause (ii) or (iii) above, to the extent such violations that could not reasonably be expected to have a material adverse effect on the Company.

2.3 Securities Law Exemptions. Assuming the accuracy of the representations and warranties of Beckham contained herein, the offer and issuance by the Company of the New Note is exempt from registration under the 1933 Act.

2.4 Issuance of New Note. The New Note when issued will be duly authorized and validly issued and the shares of stock issuable upon conversion of the New Note when issued will be duly authorized, validly issued and fully paid.

2.5 Disclosure. The Company confirms that it has provided Lender with all relevant material information requested by Lender in order to make an informed decision as to whether to enter into this Agreement and the transactions contemplated hereby.

3. Lender’s Representations and Warranties. As a material inducement to the Company to enter into this Agreement and consummate the Exchange, Lender represents, warrants and covenants with and to the Company as follows:

3.1 Ownership of the Prior Note. Lender owns the Prior Note free and clear of any liens and the Prior Note has not been pledged to any third party. Lender has not sold, assigned, conveyed, transferred, mortgaged, hypothecated, pledged or encumbered or otherwise permitted any lien to be incurred with respect to the Prior Note or any portion thereof. No person other than Lender has any right or interest in the Prior Note.

No proceedings relating to the Prior Note are pending or, to the knowledge of Lender threatened before any court, arbitrator or administrative or governmental body that would adversely affect Lender’s right and ability to surrender and exchange the Prior Note.

3.2 Reliance on Exemptions. Lender understands that the Prior Note is being offered and exchanged in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and Lender’s compliance with, the representations, warranties, agreements and acknowledgments of Lender set forth herein in order to determine the availability of such exemptions and the eligibility of Lender to acquire the New Note.

3.3 No Governmental Review. Lender understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the New Note or the fairness or suitability of the investment in the New Note nor have such authorities passed upon or endorsed the merits of the offering of the New Note.

3.4 Validity; Enforcement. Lender has the requisite power and authority to enter into and perform his obligations under this Agreement and to exchange the Prior Note in accordance with the terms hereof and thereof. This Agreement has been duly and validly authorized, executed and delivered on behalf of Lender and shall constitute the legal, valid and binding obligations of Lender enforceable against Lender in accordance with their respective terms, except as such enforceability may be limited by general principles of equity or to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies and except as rights to indemnification and to contribution may be limited by federal or state securities laws.

3.5 No Conflicts. The execution, delivery and performance by Lender of this Agreement and the consummation by Lender of the transactions contemplated hereby and thereby will not (i) result in a violation of the organizational documents of Lender; (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which Lender is a party; or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws) applicable to Lender, except in the case of clauses (ii) and (iii) above, for such conflicts, defaults, rights or violations which would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the ability of the Lender to perform its obligations hereunder.

4. Miscellaneous.

4.1 Legends. Lender acknowledges that the New Note shall conspicuously set forth on the face or back thereof a legend in substantially the following form:

“THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR THE RULES AND REGULATIONS PROMULGATED THEREUNDER, OR UNDER THE SECURITIES LAWS, RULES OR REGULATIONS OF ANY STATE; AND MAY NOT BE PLEDGED, HYPOTHECATED, SOLD OR TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE ACT AND THE APPLICABLE STATE SECURITIES LAWS, RULES OR REGULATIONS OR AN EXEMPTION THEREFROM DEEMED ACCEPTABLE BY COUNSEL TO THE COMPANY.”

4.2 Governing Law; Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by the internal laws of the State of New Hampshire, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Nevada or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New Hampshire.

4.3 Arbitration. Both parties shall resolve all disputes, controversies and differences which may arise between the parties, out of or in relation to or in connection with this Agreement, after discussion in good faith attempting to reach an amicable solution. Provided that such disputes, controversies and differences remain unsettled after discussion between the parties, both parties agree that those unsettled matter(s) shall be finally settled by arbitration in New Hampshire in accordance with the latest Rules of the American Arbitration Association. Such arbitration shall be conducted by three arbitrators appointed as follows: each party will appoint one arbitrator and the appointed arbitrators shall appoint a third arbitrator. If within 30 days after confirmation of the last appointed arbitrator, such arbitrators have failed to agree upon a chairman, then the chairman will be appointed by the American Arbitration Association. The decision of the tribunal shall be final and may not be appealed. The arbitral tribunal may, in its discretion award fees and costs as part of its award. Judgment on the arbitral award may be entered by any court of competent jurisdiction, including any court that has jurisdiction over either party or any of their assets. At the request of any party, the arbitration proceeding shall be conducted in the utmost secrecy subject to a requirement of law to disclose. In such case, all documents, testimony and records shall be received, heard and maintained by the arbitrators in secrecy, available for inspection only by any party and by their attorneys and experts who shall agree, in advance and in writing, to receive all such information in secrecy.

4.4 Counterparts. This Agreement may be executed simultaneously in two or more counterparts, any one of which need not contain the signatures of more than one party, but all such counterparts taken together will constitute one and the same Agreement. This Agreement, to the extent delivered by means of a facsimile machine or electronic mail (any such delivery, an “Electronic Delivery”), shall be treated in all manner and respects as an original agreement or instrument and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. At the request of any party hereto, each other party hereto shall re-execute original forms hereof and deliver them in person to all other parties. No party hereto shall raise the use of Electronic Delivery to deliver a signature or the fact that any signature or agreement or instrument was transmitted or communicated through the use of Electronic Delivery as a defense to the formation of a contract, and each such party forever waives any such defense, except to the extent such defense related to lack of authenticity.

4.5 Headings. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement.

4.6 Severability. If any provision of this Agreement is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Agreement so long as this Agreement as so modified continues to express, without material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as close as possible to that of the prohibited, invalid or unenforceable provision(s).

4.7 Entire Agreement; Amendments. This Agreement supersedes all other prior oral or written agreements between Beckham and the Company with respect to the matters discussed herein, and this Agreement contains the entire understanding of the parties with respect to the matters covered herein and, except as specifically set forth herein, neither the Company nor Beckham makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be amended other than by an instrument in writing signed by the Company and Beckham. No provision hereof may be waived other than by an instrument in writing signed by the party against whom enforcement is sought.

IN WITNESS WHEREOF, Lender and the Company have caused their respective signature pages to this Agreement to be duly executed as of the date first written above.

MINERCO RESOURCES, INC.

By: /s/ John F. Powers

Name: John F. Powers

Title: CEO

LOMA MANAGEMENT PARTNERS LLC.

By: /s/ John Loud

Name: John Loud

Title: Managing Member

Exhibit 10.3

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

CONVERTIBLE PROMISSORY NOTE

Original Note Issue Date: July 31, 2013

Exchange Note Issue Date January 24, 2014

Principal Amount: U.S. $75,000.00

Purchase Price: U.S. $75,000.00

FOR VALUE RECEIVED, Minerco Resources Inc., a Nevada corporation (the “Maker”), hereby promises to pay to LOMA Management Partners LLC. , or its successors and assigns (the “Payee”), at its address at 405 Lexington Avenue, Chrysler Building, 25th Floor, New York City, NY 10174, or to such other address as Payee shall provide in writing to the Maker for such purpose, a principal sum of Seventy-Five Thousand Dollars and Zero Cents (U.S. $75,000.00). The aggregate principal amount outstanding under this Note will be conclusively evidenced by the schedule annexed as Exhibit B hereto (the “Loan Schedule”), up to a maximum principal amount of U.S $75,000.00. The entire principal amount hereunder shall be due and payable on May 1, 2014 (the “Maturity Date”), or on such earlier date as such principal amount may earlier become due and payable pursuant to the terms hereof.

1. Interest Rate. Interest shall accrue on the unpaid principal amount of this Convertible Promissory Note (the “Note”) at the rate of six percent (6%) per annum from the date of the first making of the loan for such principal amount until such unpaid principal amount is paid in full or earlier converted into shares (the “Shares”) of the Maker’s common stock (the “Common Stock”) in accordance with the terms hereof. Interest hereunder shall be paid on such date as the principal amount under this Note becomes due and payable or is converted in accordance with the terms hereof and shall be computed on the basis of a 360-day year for the actual number of days elapsed.

2. Conversion of Principal and Interest. Subject to the terms and conditions hereof, the Payee, at its sole option, may deliver to the Maker a notice in the form attached hereto as Exhibit A (a “Conversion Notice”) and an updated Loan Schedule, at any time and from time to time after the date hereof and prior to the payment of the principal amount and all accrued interest thereon (the date of the delivery of a Conversion Notice shall be referred to herein as a “Conversion Date”), to convert all or any portion of the outstanding principal amount of this Note plus accrued and unpaid interest thereon, for a number of Shares equal to the quotient obtained by dividing the dollar amount of such outstanding principal amount of this Note plus the accrued and unpaid interest thereon being converted by the Conversion Price (as defined in Section 15). Conversions hereunder shall have the effect of lowering the outstanding principal amount of this Note plus all accrued and unpaid interest thereunder in an amount equal to the applicable conversion, which shall be evidenced by entries set forth in the Conversion Notice and the Loan Schedule.

3. Certain Conversion Limitations. The Payee may not convert an outstanding principal amount of this Note or accrued and unpaid interest thereon to the extent such conversion would result in the Payee, together with any affiliate thereof, beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act (as defined in Section 15) and the rules promulgated thereunder) in excess of 9.999% of the then issued and outstanding shares of Common Stock. Since the Payee will not be obligated to report to the Maker the number of shares of Common Stock it may hold at the time of a conversion hereunder, unless the conversion at issue would result in the beneficial ownership in excess of 9.999% of the then outstanding shares of Common Stock (inclusive of any other shares which may be beneficially owned by the Payee or an affiliate thereof), the Payee shall have the authority and obligation to determine whether and the extent to which the restriction contained in this Section will limit any particular conversion hereunder. The Payee may waive the provisions of this Section upon not less than 75 days prior notice to the Maker.

4. Deliveries. Not later than five (5) Trading Days (as defined in Section 15) after any Conversion Date, the Maker will deliver to the Payee (i) a certificate or certificates representing the number of Shares being acquired upon the conversion of the principal amount of this Note and any interest accrued thereunder being converted pursuant to the Conversion Notice (subject to the limitations set forth in Section 3 hereof), and (ii) an endorsement by the Maker of the Loan Schedule acknowledging the remaining outstanding principal amount of this Note plus all accrued and unpaid interest thereon not converted (an “Endorsement”). The Maker’s delivery to the Payee of stocks certificates in accordance clause (i) above shall be Maker’s conclusive endorsement of the remaining outstanding principal amount of this Note plus all accrued and unpaid interest thereon not converted as set forth in the Loan Schedule.

5. Prepayment Right. The Maker shall have the right to prepay all or a portion of the outstanding principal amount of this Note plus all accrued and unpaid interest thereon.

6. No Adjustments. If the Maker, at any time while any portion of the principal amount due under this Note is outstanding, (a) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock, (b) subdivide outstanding shares of Common Stock into a larger number of shares, (c) combine (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (d) issue by reclassification of shares of the Common Stock any shares of capital stock of the Maker, then the Conversion Price (as defined in Section 15) shall not be adjusted.

7. No Waiver of Payee’s Rights, etc. All payments of principal and interest shall be made without setoff, deduction or counterclaim. No delay or failure on the part of the Payee in exercising any of its options, powers or rights, nor any partial or single exercise of its options, powers or rights shall constitute a waiver thereof or of any other option, power or right, and no waiver on the part of the Payee of any of its options, powers or rights shall constitute a waiver of any other option, power or right. The Maker hereby waives presentment of payment, protest, and notices or demands in connection with the delivery, acceptance, performance, default or endorsement of this Note. Acceptance by the Payee of less than the full amount due and payable hereunder shall in no way limit the right of the Payee to require full payment of all sums due and payable hereunder in accordance with the terms hereof.

8. Modifications. No term or provision contained herein may be modified, amended or waived except by written agreement or consent signed by the party to be bound thereby.

9. Cumulative Rights and Remedies; Usury. The rights and remedies of the Payee expressed herein are cumulative and not exclusive of any rights and remedies otherwise available. If it shall be found that any interest outstanding hereunder shall violate applicable laws governing usury, the applicable rate of interest outstanding hereunder shall be reduced to the maximum permitted rate of interest under such law.

10. Collection Expenses. If this obligation is placed in the hands of an attorney for collection after default, and provided the Payee prevails on the merits in respect to its claim of default, the Maker shall pay (and shall indemnify and hold harmless the Payee from and against), all reasonable attorneys’ fees and expenses incurred by the Payee in pursuing collection of this Note.

11. Successors and Assigns. This Note shall be binding upon the Maker and its successors and shall inure to the benefit of the Payee and its successors and assigns. The term “Payee” as used herein, shall also include any endorsee, assignee or other holder of this Note.

12. Lost or Stolen Promissory Note. If this Note is lost, stolen, mutilated or otherwise destroyed, the Maker shall execute and deliver to the Payee a new promissory note containing the same terms, and in the same form, as this Note. In such event, the Maker may require the Payee to deliver to the Maker an affidavit of lost instrument and customary indemnity in respect thereof as a condition to the delivery of any such new promissory note.

13. Due Authorization. This Note has been duly authorized, executed and delivered by the Maker and is the legal obligation of the Maker, enforceable against the Maker in accordance with its terms.

14. Governing Law. This Note shall be governed by and construed and enforced in accordance with the internal laws of the State of New Hampshire without regard to the principles of conflicts of law thereof.

15. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Business Day” means any day except Saturday, Sunday and any day that is a legal holiday or a day on which banking institutions in the State of New York or State of Nevada are authorized or required by law or other government action to close.

“Conversion Price” shall be or 50% of the lowest Per Share Market Value of the fifteen (15) Trading Days immediately preceding a Conversion Date.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Trading Day” means (a) a day on which the shares of Common Stock are traded on such Subsequent Market on which the shares of Common Stock are then listed or quoted, or (b) if the shares of Common Stock are not listed on a Subsequent Market, a day on which the shares of Common Stock are traded in the over-the-counter market, as reported by the OTC Bulletin Board, or (c) if the shares of Common Stock are not quoted on the OTC Bulletin Board, a day on which the shares of Common Stock are quoted in the over-the-counter market as reported by the National Quotation Bureau Incorporated (or any similar organization or agency succeeding its functions of reporting prices); provided, however, that in the event that the shares of Common Stock are not listed or quoted as set forth in (a), (b) and (c) hereof, then Trading Day shall mean any day except Saturday, Sunday and any day which shall be a legal holiday or a day on which banking institutions in the State of New Hampshire are authorized or required by law or other government action to close.

IN WITNESS WHEREOF, the Maker has caused this Convertible Promissory Note to be duly executed and delivered as of the date first set forth above.

MINERCO RESOURCES, INC.

By: /s/ John F. Powers

Name: John F. Powers

Title: Chief Executive Officer

LOMA MANAGEMENT PARTNERS, LLC.

By: /s/ John Loud

Name: John Loud

Title: Managing Member

EXHIBIT A

NOTICE OF CONVERSION

Dated: _________________

The undersigned hereby elects to convert the principal amount and interest indicated below of the attached Convertible Promissory Note into shares of common stock (the “Common Stock”), of Minerco Resources Inc., according to the conditions hereof, as of the date written below. No fee will be charged to the holder for any conversion.

Exchange calculations: ______________________________________________

Date to Effect Conversion: ___________________________________________

Principal Amount and Interest of

Secured Convertible Note to be Converted: ______________________________

Number of shares of Common Stock to be Issued: _________________________

Applicable Conversion Price:

Signature: __________________________________________

Name:_____________________________________________

Address:____________________________________________

EXHIBIT B

LOAN SCHEDULE

Convertible Promissory Note Issued by Minerco Resources Inc.

Dated: ___________________

SCHEDULE

OF

CONVERSIONS AND PAYMENTS OF PRINCIPAL

|

Date of Conversion

|

|

Amount of Conversion

|

|

Total Amount Due Subsequent

To Conversion

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jun 2024 to Jul 2024

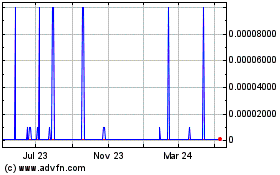

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jul 2023 to Jul 2024