Written Communication Relating to an Issuer or Third Party (sc To-c)

August 29 2016 - 10:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO-C

(Rule 13e-4)

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

METALINK LTD.

(Name of Subject Company (Issuer))

METALINK LTD. (ISSUER)

(Name of Filing Person (Identifying Status as

Offeror, Issuer or Other Person))

ORDINARY SHARES, NIS 1.0 NOMINAL (PAR) VALUE PER SHARE

(Title of Class of Securities)

M69897110

(CUSIP Number of Class of Securities)

c/o Fahn Kahne, Hamasger Street 32, Tel Aviv 6721118, Israel

Attn.: Shay Evron

Tel: +972-77-7706770

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

|

Ido Zemach, Adv.

Goldfarb Seligman & Co.

98 Yigal Alon Street

Tel Aviv 6789141, Israel

Tel: +972 (3) 608-9834

|

|

CALCULATION OF FILING FEE

|

|

TRANSACTION VALUATION

|

AMOUNT OF FILING FEE

|

|

N/A*

|

N/A*

|

|

*

|

Pursuant to Instruction D to Schedule TO, a filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

Amount Previously Paid: ____________________

|

Filing Party: __________________________

|

|

|

Form or Registration No.:____________________

|

Date Filed: ___________________________

|

|

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

Shay Evron, Acting CEO & CFO

Metalink Ltd.

Tel: 972-3-7111690

Fax: 972-3-7111691

Shay.Evron@il.gt.com

|

Metalink Plans to Distribute Cash to Shareholders

** Distribution is expected to be by way of a Self Tender Offer and/or Cash Dividend;

Distribution is subject to conditions, including Israeli Court Approval **

Tel-Aviv, Israel, August 29, 2016 - Metalink Ltd. (OTCQB: MTLK), today announced that its Board of Directors has approved a plan to distribute up to $3.5 million in cash to shareholders

.

The distribution, which is expected to be conducted through a repurchase of shares from Metalink shareholders by means of a self tender offer and/or a cash dividend, is subject to the satisfaction of certain conditions, including the approval of the Tel Aviv District Court. To that end, Metalink intends to file an application to the court seeking the court’s approval for distribution of up to $3.5 million by means of a repurchase of shares from Metalink shareholders and/or cash distribution.

Subject to the satisfaction of the requisite conditions, Metalink expects to announce the final size of the distribution and the manner in which it shall be conducted (including the allocation, if any, between a self tender offer and cash dividend) in the next couple of months. If and when applicable, Metalink will also issue a press release announcing the commencement of the self tender offer, the size thereof, the offer price and additional details regarding the offer.

There can be no assurance, however, if and when the conditions to the distribution will be satisfied nor as to the final size thereof (which may be below the requested court approval of $3.5 million), timing and terms thereof, including the allocation, if any, between a self tender offer and cash dividend and, with respect to a self tender offer, the final size and offer price thereof.

This is not an offer to buy or the solicitation of an offer to sell any ordinary shares. The possible tender offer that is described in this press release has not yet commenced. Once a tender offer commences, Metalink will file a tender offer statement (including an offer to purchase, letter of transmittal and related tender offer documents) with the Securities and Exchange Commission (SEC). Shareholders should read the tender offer statement when it becomes available because it will contain important information about the offer. The tender offer statements and other filed documents will be available at no charge on the SEC’s website at

http://www.sec.gov

and will also be made available without charge to all shareholders by contacting Metalink’s corporate secretary at 972-77-7706770. Shareholders are urged to read these materials carefully before making any decision with respect to any tender offer.

ABOUT METALINK

Metalink shares are quoted on OTCQB under the symbol “MTLK”. For more information, please see our public filings at the SEC's website at www.sec.gov.

###

SAFE HARBOR STATEMENT

This press release contains “forward looking statements” within the meaning of the United States securities laws. Words such as “aim,” "expect," "estimate," "project," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believe," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. Because such statements deal with future events, they are subject to various risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the distribution plan of the Company, the amount of cash that will be returned to shareholders, the terms and timing of the process, and other matters set forth from time to time in Metalink's filings with the Securities and Exchange Commission, including Metalink's Annual Report in Form 20-F. Readers are cautioned not to place undue reliance on forward-looking statements. Except as required by applicable law, the Company undertakes no obligation to republish or revise forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrences of unanticipated events. The Company cannot guarantee future results, events, and levels of activity, performance, or achievements.

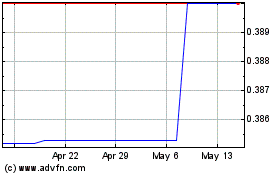

Metalink (PK) (USOTC:MTLK)

Historical Stock Chart

From Oct 2024 to Nov 2024

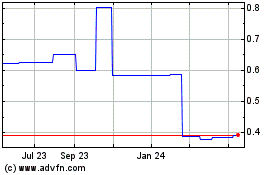

Metalink (PK) (USOTC:MTLK)

Historical Stock Chart

From Nov 2023 to Nov 2024