0001434601

true

various edits

0001434601

2022-06-01

2022-11-30

0001434601

2022-11-30

0001434601

2022-05-31

0001434601

2022-09-01

2022-11-30

0001434601

2021-09-01

2021-11-30

0001434601

2021-06-01

2021-11-30

0001434601

us-gaap:PreferredStockMember

2022-05-31

0001434601

us-gaap:CommonStockMember

2022-05-31

0001434601

TMGI:CommonStockPayableMember

2022-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-05-31

0001434601

us-gaap:RetainedEarningsMember

2022-05-31

0001434601

us-gaap:PreferredStockMember

2022-08-31

0001434601

us-gaap:CommonStockMember

2022-08-31

0001434601

TMGI:CommonStockPayableMember

2022-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-08-31

0001434601

us-gaap:RetainedEarningsMember

2022-08-31

0001434601

2022-08-31

0001434601

us-gaap:PreferredStockMember

2021-05-31

0001434601

us-gaap:CommonStockMember

2021-05-31

0001434601

TMGI:CommonStockPayableMember

2021-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2021-05-31

0001434601

us-gaap:RetainedEarningsMember

2021-05-31

0001434601

2021-05-31

0001434601

us-gaap:PreferredStockMember

2021-08-31

0001434601

us-gaap:CommonStockMember

2021-08-31

0001434601

TMGI:CommonStockPayableMember

2021-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2021-08-31

0001434601

us-gaap:RetainedEarningsMember

2021-08-31

0001434601

2021-08-31

0001434601

us-gaap:PreferredStockMember

2022-06-01

2022-08-31

0001434601

us-gaap:CommonStockMember

2022-06-01

2022-08-31

0001434601

TMGI:CommonStockPayableMember

2022-06-01

2022-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-06-01

2022-08-31

0001434601

us-gaap:RetainedEarningsMember

2022-06-01

2022-08-31

0001434601

2022-06-01

2022-08-31

0001434601

us-gaap:PreferredStockMember

2022-09-01

2022-11-30

0001434601

us-gaap:CommonStockMember

2022-09-01

2022-11-30

0001434601

TMGI:CommonStockPayableMember

2022-09-01

2022-11-30

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-09-01

2022-11-30

0001434601

us-gaap:RetainedEarningsMember

2022-09-01

2022-11-30

0001434601

us-gaap:PreferredStockMember

2021-06-01

2021-08-31

0001434601

us-gaap:CommonStockMember

2021-06-01

2021-08-31

0001434601

TMGI:CommonStockPayableMember

2021-06-01

2021-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2021-06-01

2021-08-31

0001434601

us-gaap:RetainedEarningsMember

2021-06-01

2021-08-31

0001434601

2021-06-01

2021-08-31

0001434601

us-gaap:PreferredStockMember

2021-09-01

2021-11-30

0001434601

us-gaap:CommonStockMember

2021-09-01

2021-11-30

0001434601

TMGI:CommonStockPayableMember

2021-09-01

2021-11-30

0001434601

us-gaap:AdditionalPaidInCapitalMember

2021-09-01

2021-11-30

0001434601

us-gaap:RetainedEarningsMember

2021-09-01

2021-11-30

0001434601

us-gaap:PreferredStockMember

2022-11-30

0001434601

us-gaap:CommonStockMember

2022-11-30

0001434601

TMGI:CommonStockPayableMember

2022-11-30

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-11-30

0001434601

us-gaap:RetainedEarningsMember

2022-11-30

0001434601

us-gaap:PreferredStockMember

2021-11-30

0001434601

us-gaap:CommonStockMember

2021-11-30

0001434601

TMGI:CommonStockPayableMember

2021-11-30

0001434601

us-gaap:AdditionalPaidInCapitalMember

2021-11-30

0001434601

us-gaap:RetainedEarningsMember

2021-11-30

0001434601

2021-11-30

0001434601

TMGI:CEOAgreement2017Member

2022-11-30

0001434601

TMGI:CEOAgreement2017Member

2022-05-31

0001434601

TMGI:WifeOfCEOMember

2022-11-30

0001434601

TMGI:WifeOfCEOMember

2022-05-31

0001434601

TMGI:MotherOfCEOMember

2022-11-30

0001434601

TMGI:MotherOfCEOMember

2022-05-31

0001434601

TMGI:ServiceProviderMember

2022-11-30

0001434601

TMGI:ServiceProviderMember

2022-05-31

0001434601

TMGI:ServiceProvider1Member

2022-11-30

0001434601

TMGI:ServiceProvider1Member

2022-05-31

0001434601

TMGI:TwoOtherServiceProvidersMember

2022-11-30

0001434601

TMGI:TwoOtherServiceProvidersMember

2022-05-31

0001434601

2021-06-01

2022-05-31

0001434601

TMGI:NotePayable1Member

2022-11-30

0001434601

TMGI:NotePayable1Member

2022-05-31

0001434601

TMGI:NotePayable2Member

2022-11-30

0001434601

TMGI:NotePayable2Member

2022-05-31

0001434601

TMGI:NotePayable3Member

2022-11-30

0001434601

TMGI:NotePayable3Member

2022-05-31

0001434601

TMGI:NotePayable4Member

2022-11-30

0001434601

TMGI:NotePayable4Member

2022-05-31

0001434601

TMGI:NotePayable5Member

2022-11-30

0001434601

TMGI:NotePayable5Member

2022-05-31

0001434601

TMGI:NotePayable6Member

2022-11-30

0001434601

TMGI:NotePayable6Member

2022-05-31

0001434601

TMGI:NotePayable7Member

2022-11-30

0001434601

TMGI:NotePayable7Member

2022-05-31

0001434601

TMGI:NotePayable8Member

2022-11-30

0001434601

TMGI:NotePayable8Member

2022-05-31

0001434601

TMGI:NotePayable9Member

2022-11-30

0001434601

TMGI:NotePayable9Member

2022-05-31

0001434601

TMGI:NotePayable10Member

2022-11-30

0001434601

TMGI:NotePayable10Member

2022-05-31

0001434601

TMGI:NotePayable11Member

2022-11-30

0001434601

TMGI:NotePayable11Member

2022-05-31

0001434601

TMGI:NotePayable12Member

2022-11-30

0001434601

TMGI:NotePayable12Member

2022-05-31

0001434601

TMGI:NotePayable13Member

2022-11-30

0001434601

TMGI:NotePayable13Member

2022-05-31

0001434601

TMGI:NotePayable14Member

2022-11-30

0001434601

TMGI:NotePayable14Member

2022-05-31

0001434601

TMGI:NotePayable15Member

2022-11-30

0001434601

TMGI:NotePayable15Member

2022-05-31

0001434601

TMGI:NotePayable16Member

2022-11-30

0001434601

TMGI:NotePayable16Member

2022-05-31

0001434601

TMGI:NotePayable17Member

2022-11-30

0001434601

TMGI:NotePayable17Member

2022-05-31

0001434601

TMGI:NotePayable18Member

2022-11-30

0001434601

TMGI:NotePayable18Member

2022-05-31

0001434601

TMGI:NotePayable19Member

2022-11-30

0001434601

TMGI:NotePayable19Member

2022-05-31

0001434601

TMGI:NotePayable20Member

2022-11-30

0001434601

TMGI:NotePayable20Member

2022-05-31

0001434601

TMGI:NotePayable21Member

2022-11-30

0001434601

TMGI:NotePayable21Member

2022-05-31

0001434601

TMGI:NotePayable22Member

2022-11-30

0001434601

TMGI:NotePayable22Member

2022-05-31

0001434601

TMGI:NotePayable23Member

2022-11-30

0001434601

TMGI:NotePayable23Member

2022-05-31

0001434601

TMGI:NotePayable24Member

2022-11-30

0001434601

TMGI:NotePayable24Member

2022-05-31

0001434601

TMGI:NotePayable25Member

2022-11-30

0001434601

TMGI:NotePayable25Member

2022-05-31

0001434601

TMGI:NotePayable26Member

2022-11-30

0001434601

TMGI:NotePayable26Member

2022-05-31

0001434601

TMGI:LenderAMember

2022-11-30

0001434601

TMGI:LenderAMember

2022-05-31

0001434601

TMGI:LenderBMember

2022-11-30

0001434601

TMGI:LenderBMember

2022-05-31

0001434601

TMGI:OtherLenders14Member

2022-11-30

0001434601

TMGI:OtherLenders14Member

2022-05-31

0001434601

TMGI:CompanyLawFirmMember

2022-11-30

0001434601

TMGI:CompanyLawFirmMember

2022-05-31

0001434601

TMGI:OZCorporationMember

2022-11-30

0001434601

TMGI:OZCorporationMember

2022-05-31

0001434601

srt:ChiefExecutiveOfficerMember

2022-11-30

0001434601

srt:ChiefExecutiveOfficerMember

2022-05-31

0001434601

TMGI:WifeOfCEOMember

2022-11-30

0001434601

TMGI:WifeOfCEOMember

2022-05-31

0001434601

TMGI:JohnThomasMember

2022-11-30

0001434601

TMGI:JohnThomasMember

2022-05-31

0001434601

TMGI:ConvertibleNote1Member

2022-11-30

0001434601

TMGI:ConvertibleNote1Member

2022-05-31

0001434601

TMGI:ConvertibleNote2Member

2022-11-30

0001434601

TMGI:ConvertibleNote2Member

2022-05-31

0001434601

TMGI:ConvertibleNote3Member

2022-11-30

0001434601

TMGI:ConvertibleNote3Member

2022-05-31

0001434601

TMGI:ConvertibleNote4Member

2022-11-30

0001434601

TMGI:ConvertibleNote4Member

2022-05-31

0001434601

TMGI:ConvertibleNote5Member

2022-11-30

0001434601

TMGI:ConvertibleNote5Member

2022-05-31

0001434601

TMGI:ConvertibleNote6Member

2022-11-30

0001434601

TMGI:ConvertibleNote6Member

2022-05-31

0001434601

TMGI:ConvertibleNote7Member

2022-11-30

0001434601

TMGI:ConvertibleNote7Member

2022-05-31

0001434601

TMGI:ConvertibleNote8Member

2022-11-30

0001434601

TMGI:ConvertibleNote8Member

2022-05-31

0001434601

TMGI:ConvertibleNote9Member

2022-11-30

0001434601

TMGI:ConvertibleNote9Member

2022-05-31

0001434601

TMGI:ConvertibleNote10Member

2022-11-30

0001434601

TMGI:ConvertibleNote10Member

2022-05-31

0001434601

TMGI:ConvertibleNote11Member

2022-11-30

0001434601

TMGI:ConvertibleNote11Member

2022-05-31

0001434601

TMGI:ConvertibleNote12Member

2022-11-30

0001434601

TMGI:ConvertibleNote12Member

2022-05-31

0001434601

TMGI:LenderAMember

2022-11-30

0001434601

TMGI:LenderAMember

2022-05-31

0001434601

TMGI:LenderBMember

2022-11-30

0001434601

TMGI:LenderBMember

2022-05-31

0001434601

TMGI:LenderCMember

2022-11-30

0001434601

TMGI:LenderCMember

2022-05-31

0001434601

TMGI:LenderDMember

2022-11-30

0001434601

TMGI:LenderDMember

2022-05-31

0001434601

TMGI:OtherLenders5Member

2022-11-30

0001434601

TMGI:OtherLenders5Member

2022-05-31

0001434601

2020-06-01

2021-05-31

0001434601

2022-04-20

2022-04-21

0001434601

TMGI:SimplyWhimMember

2022-09-01

2022-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Table of Contents

Securities Act File No. 333-267970

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

| |

☒ |

Registration

Statement Under the Securities Act OF 1933 |

| |

☒ |

Pre-effective Amendment

No. 4 |

| |

☐ |

Post-effective Amendment No. |

THE MARQUIE GROUP, INC.

(Exact Name of Registrant as Specified in Charter)

7901 4th Street North, Suite 4000

St. Petersburg, FL 33702-4305

(Address of Principal Executive Offices)

(800) 351-3021

(Registrant’s Telephone Number, Including Area

Code)

Marc Angell, Chief Executive Officer

The Marquie Group, Inc.

7901 4th Street North, Suite 4000

St. Petersburg, FL 33702-4305

(Name and Address of Agent for Service)

Copies to:

John D. Thomas,

Esq.

John D. Thomas,

P.C.

11616 South State Street, Suite 1504

Draper, UT 84020

Telephone: (801) 816-2536

Facsimile: (801) 816-2599 |

Approximate Date of Proposed Public Offering:

As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this form are offered on a delayed or continuous basis in reliance on Rule 415 under the Securities

Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging Growth Company ☐ |

The Registrant hereby amends this Registration Statement

on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until

the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section

8(a), may determine.

| PRELIMINARY PROSPECTUS |

|

SUBJECT

TO COMPLETION, FEBRUARY 28, 2023 |

Up to 75,000,000 Shares of Common Stock

|

THE MARQUIE GROUP, INC.

________________________________________

|

|

This prospectus relates

to the resale from time to time, of up to 75,000,000 shares of the common stock of The Marquie Group, Inc. (hereafter, “we,”

“us,” “our,” “TMGI” or the “Company”) by the Selling Stockholder. We are not selling

any shares of common stock in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the Selling

Stockholder. We do however, receive proceeds from the sale of securities pursuant to the Equity Commitment Agreement. Any participating

broker-dealers and, if the Selling Stockholder is an affiliate of any such broker-dealers, are “underwriters” within

the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given

to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities

Act. The Selling Stockholder has informed us that they are broker-dealers. Our common stock is traded on the over-the-counter market

under the symbol “TMGI”. The closing price for our common stock on January 3, 2023 was $0.0029 per share, as reported

by the OTC Pink.

The shares being registered

herein are comprised of 75,000,000 shares of common stock that are issuable pursuant to the Equity Commitment Agreement that we entered

into with the Selling Stockholder on October 12, 2022. The purchase price of the shares that may be sold to MacRab under the Equity Commitment

Agreement will be equal to 90% of the average of the two (2) lowest volume weighted average prices of the Company’s Common Stock

on OTC Pink during the six (6) Trading Days immediately following the Clearing Date. Because the actual date and price per share of the

Company’s common stock pursuant to any such put right under the Equity Commitment Agreement is unknown, the actual purchase price

for the shares is unknown. Accordingly, we caution readers that, although we are registering 75,000,000 shares, there is a minimum purchase

price of $0.01 under the Equity Commitment Agreement, and therefore a potential for a maximum of 500,000,000 shares that may be issued

by the Company pursuant to the Equity Commitment Agreement. Therefore, the number of shares issued from the Equity Commitment Agreement

may be substantially greater than the number of shares being registered hereunder. See “Summary of Equity Commitment Agreement”

on page 27 for a more complete discussion of the Equity Commitment Agreement and the terms by which we may issue additional shares of

our common stock.

Our auditors have expressed

substantial doubt as to our ability to continue as a going concern. We expect that we will need approximately $600,000 in capital to

continue as a going concern for the next twelve months from the date of this prospectus. We intend to raise capital to fund our operations

through sales of multi-media and entertainment related products and services, borrowings, and private placements of our common stock.

An investment in our common

stock is subject to many risks and an investment in our shares will also involve a high degree of risk. The shares issuable from

the Equity Commitment Agreement will dilute the ownership interest and voting power of existing stockholders. See “Risk Factors”

on page 8 to read about factors you should consider before purchasing shares of our common stock.

_______________________________________

Neither the Securities and

Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The information in this prospectus

is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the SEC.

The Selling Stockholder may not sell these securities until the registration statement becomes effective. This prospectus

is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale

is not permitted.

The date of this prospectus is February 1,

2023

|

You should rely only on the information

contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you

with different or inconsistent information, you should not rely on it. The Selling Stockholder is not offering to sell these securities

in any jurisdiction where such offering or sale is not permitted. You should assume that the information appearing in this prospectus

is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects

may have changed since that date.

TABLE OF CONTENTS

FORWARD-LOOKING

STATEMENTS AND PROJECTIONS

All statements contained in this

prospectus that are not historical facts, including statements regarding anticipated activity, are “forward-looking statements”

within the meaning of the federal securities laws, involve a number of risks and uncertainties and are based on our beliefs and assumptions

and information currently available to us. In some cases, you can identify forward-looking statements by words such as “may,”

“will,” “should,” “expect,” “objective,” “plan,” “intend,” “anticipate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “forecast,”

“continue,” “strategy,” or “position” or the negative of such terms or other variations of them or

by comparable terminology. In particular, statements, express or implied, concerning future actions, conditions or events, future operating

results or the ability to generate sales, income or cash flow are forward-looking statements. These statements are not guarantees of future

performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and

could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including:

| · | The level of competition in the health and beauty

product industry and multi-media entertainment; |

| | | |

| · | The availability of wholesale goods to fulfill

product orders, and expand the product line; |

| | | |

| · | Our ability to obtain additional capital to finance

the expansion of our business, to maintain reporting requirements, to maintain adequate inventory, or to extend terms of credit to our

customers; |

| | | |

| · | Our reliance upon management and particularly

Marc Angell, our Chief Executive Officer, to execute our business plan; |

| | | |

| · | The willingness and ability of third parties

to honor their contractual commitments; |

| | | |

| · | The amount of dilution that our shareholders

will experience as a result of the Equity Commitment Agreement and the underlying shares that that may be sold from time to time pursuant

thereto; |

| | | |

| · | The volatility of our common stock price; and |

| | | |

| · | The risks, uncertainties and other factors we

identify in “Risk Factors” and elsewhere in this prospectus and in our filings with the SEC. |

We caution readers not to place

undue reliance on any such forward-looking statements, which statements are made pursuant to the Private Securities Litigation Reform

Act of 1995 and, as such, speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise, after the date of this prospectus.

PROSPECTUS

SUMMARY

This summary highlights some

of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. You

should read carefully the more detailed information set forth under “Risk Factors” and the other information included in this

prospectus. Except where the context suggests otherwise, the terms “we,” “us,” “our,” “TMGI”

and the “Company” refer to The Marquie Group, Inc. We refer in this prospectus to our executive officers and other members

of our management team, collectively, as “Management.”

The Marquie Group, Inc. was incorporated

on January 30, 2008, in the State of Florida, as Maximum Consulting, Inc. and shortly thereafter changed its name to ZhongSen International

Tea Company, with the principal business objective of providing sales and marketing consulting services to small to medium sized Chinese

tea producing companies who wish to export and distribute high quality Chinese tea products worldwide. The Company commenced business

activities in August, 2008, when it entered into a related party Sales and Marketing Agreement with Yunnan Zhongsen Group, Ltd. However,

due to lack of capital, the Company was unable to implement its business plan fully. On May 31, 2013 the Company acquired Music of Your

Life, Inc., a Nevada corporation (“MYL Nevada”). As a result of the acquisition, MYL Nevada became a wholly owned subsidiary

of the Company, and the Company changed its name to Music of Your Life, Inc. effective July 26, 2013 operating as a syndicated radio network

producing live concerts, television shows and radio programming. With the dramatic increase in music licensing fees and the decrease in

traditional radio advertising formats, the Company found it difficult to achieve profitability with its Music of Your Life syndication

radio service. In response to this, the Company began to explore partnering with products to be marketed through radio spots on the Company’s

wide-reaching radio network. On August 16, 2018, the Company merged into The Marquie Group, Inc., a development stage health and beauty

products company for the exclusive right to market and sell products under development, and subsequently changed its name to The Marquie

Group, Inc.

On September 26, 2022, the Company

acquired 25% of Simply Whim, LLC, a skincare company with a full line of health and beauty products under the “Whim” brand.

As a result, the Company is now a direct-to-consumer sales and marketing company with its own line of innovative health and beauty products.

The Company markets these products through its wholly owned subsidiary Music of Your Life, a syndicated radio network heard nationwide

on AM, FM and HD terrestrial radio stations, and simulcast over the internet. This is made possible by 30 and 60 second commercials airing

every hour which are targeted toward the Music of Your Life listening audience. Broadcasting more than 40 years, Music of Your Life is

the longest running music radio format in syndication. Information regarding the Whim products, including the Whim store can be found

at www.simplywhim.com. You can learn more about the Company at www.themarquiegroup.com. Our website, however, does not constitute

a part of this prospectus.

We are governed by our sole officer

and director Marc Angell. Our principal office is located at 7901 4th Street North, Suite 4000, St. Petersburg, FL 33702-4305. We have

one full time employee and utilize the services of various contract personnel from time to time.

We are filing this prospectus

in connection with shares of our common stock that may be offered and sold from time to time by the Selling Stockholder pursuant to the

Equity Commitment Agreement. the Selling Stockholder is offering for sale up to 75,000,000 shares of our common stock. The Selling Stockholder

is not an affiliate of the Company. On October 12, 2022, we entered into the Equity Commitment Agreement with the Selling Stockholder,

pursuant to which, the Selling Stockholder agreed to purchase in excess of $5 million worth of our common stock pursuant to the respective

terms of their Equity Commitment Agreement. Additionally, we entered into Registration Rights Agreements (the “Registration Rights

Agreements”) with the Selling Stockholder, pursuant to which we have filed with the U.S. Securities and Exchange Commission (the

“SEC”) the registration statement that includes this prospectus to register for resale under the Securities Act of 1933,

as amended (the “Securities Act”), the shares that may be issued to the Selling Stockholder under the Equity Commitment Agreement.

The Selling Stockholder

is considered an underwriter of The Marquie Group, Inc. The term “underwriter” means any person who has purchased from an

issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any security, or participates or has

a direct or indirect participation in any such undertaking, or participates or has a participation in the direct or indirect underwriting

of any such undertaking; but such term shall not include a person whose interest is limited to a commission from an underwriter or dealer

not in excess of the usual and customary distributors’ or sellers’ commission. As used in this paragraph the term “issuer”

shall include, in addition to an issuer, any person directly or indirectly controlling or controlled by the issuer, or any person under

direct or indirect common control with the issuer. In other words, an underwriter must make public disclosure similar to disclosure made

by an issuer in the event of purchases and sales of securities.

Under the terms of the

Equity Commitment Agreement, we do not have the right to commence any sales to MacRab under the Equity Commitment Agreement until the

SEC has declared effective the registration statement of which this prospectus forms a part and provided the lowest traded price of the

Common Stock in the six (6) Trading Days immediately preceding the respective sale date exceeds $0.01 per share. Thereafter, we may,

from time to time and at our sole discretion, direct MacRab to purchase shares of our common stock, but we would be unable to sell shares

to them if such purchase would result in their respective beneficial ownership equaling more than 4.99% of the outstanding common stock

of the Company. The shares will be issuable at a purchase price of 90% of the average of the two (2) lowest volume weighted average prices

of the Company’s Common Stock on OTC Pink during the six (6) Trading Days immediately following the Clearing Date. For purposes

of this prospectus, we have assumed a purchase price of $0.01 and the initial registration of 75,000,000 shares. Except as described

in this prospectus, there are no trading volume requirements or restrictions under the Equity Commitment Agreement, and we will control

the timing and amount of any sales of our common stock to MacRab. We may at any time in our sole discretion terminate the Equity Commitment

Agreement without fee, penalty or cost upon one business day notice.

Issuances of our common stock

in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests

of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock

that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage

of our total outstanding shares after any such issuance to the Selling Stockholder.

We are subject to the information

requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith file quarterly and annual reports, as well

as other information with the Securities and Exchange Commission (“SEC”) under File No. 000-54163. Such reports and other

information filed with the SEC can be inspected and copied at the public reference facilities maintained by the SEC at 450 Fifth Street,

N.W., Washington, D.C. 20549 at prescribed rates, and at various regional and district offices maintained by the SEC throughout the United

States. Information about the operation of the SEC’s public reference facilities may be obtained by calling the SEC at 1-800-SEC-0330.

The SEC also maintains a website at http://www.sec.gov that contains reports and other information regarding us and other registrants

that file electronic reports and information with the SEC.

SUMMARY

OF THE OFFERING

| Securities Offered |

The Selling Stockholder is offering up

to 75,000,000 shares of our common stock for public and private resale.

|

| Offering Price |

The Selling Stockholder will offer and

sell its shares of common stock at a price of $0.01 per share as quoted on the OTC Pink as of February 1, 2023, at other

prevailing prices, or at privately negotiated prices.

|

| Shares Outstanding |

We are authorized to issue 50,000,000,000

shares of common stock, par value $0.0001 per share. As of the date of this prospectus, we have 756,612,000 shares of common stock

issued and outstanding. We entered into the Equity Commitment Agreement (the “Equity Commitment Agreement”) pursuant

to which MacRab has agreed to purchase up to $5 million worth of shares of our common stock from time to time. These put shares are

issuable from time to time, as the Company may direct, at a purchase price of 90% of the average of the two (2) lowest volume weighted

average prices of the Company’s Common Stock on OTC Pink during the six (6) Trading Days immediately following the Clearing

Date. For purposes of this prospectus, we have assumed a purchase price of $0.01 and the initial registration of 75,000,000 shares

of common stock issued pursuant to the Equity Commitment Agreement to the Selling Stockholder. However, because the actual date and

price per share of the Company’s common stock pursuant to any put right under the Equity Commitment Agreement is unknown, the

actual purchase price for the shares is unknown. Accordingly, we caution readers that, although we are registering 75,000,000 shares,

there is a minimum purchase price of $0.01 under the Equity Commitment Agreement, and therefore a potential for a maximum of 500,000,000

shares that may be issued by the Company pursuant to the Equity Commitment Agreement. Therefore, the number of shares issued from

the Equity Commitment Agreement may be substantially greater than the number of shares being registered hereunder. (see “Business

– Summary of Equity Commitment Agreement” on page 27).

We are also authorized to issue 20,000,000 shares

of preferred stock, par value $0.0001 per share. 200 shares of our preferred stock are designated Series A Preferred Stock and issued

and outstanding at this time.

|

|

Symbol for

Our Common Stock |

TMGI.

|

| Use of Proceeds |

We are not selling any shares of common

stock in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the Selling Stockholder. We do

however, receive proceeds from the sale of securities pursuant to the Equity Commitment Agreement.

|

|

Distribution

Arrangements

|

The Selling Stockholder may, from time to time,

sell any or all of their shares of common stock on the OTC Pink or other market or trading platform on which our shares are traded or

quoted or in private transactions. These sales may be at fixed or negotiated prices. We will not be involved in any of the selling efforts

of the Selling Stockholder.

|

| Risk Factors |

An

investment in our common stock is subject to significant risks that you should carefully consider before investing in our common

stock. For a further discussion of these risk factors, please see “Risk Factors” beginning on page

8. |

|

Underwriter |

The Selling Stockholder is considered

an underwriter of The Marquie Group, Inc. An underwriter must make public disclosure similar to disclosure made by an issuer in the

event of purchases and sales of securities. |

RISK FACTORS

An investment in our securities

involves certain risks relating to our business and operations. You should carefully consider these risks, together with all of the other

information included in this prospectus, before you decide whether to purchase shares of our Company. If any of the following risks actually

occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, the trading

price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

Our auditors have expressed

substantial doubt about our ability to continue as a going concern.

Our audited financial statements

for the fiscal years ended May 31, 2022 and 2021 were prepared assuming that we will continue our operations as a going concern. We do

not, however, have a history of operating profitably. Consequently, our independent accountants in their audit report have expressed

substantial doubt about our ability to continue as a going concern. Our continued operations are highly dependent upon our ability to

increase revenues, decrease operating costs, and complete equity and/or debt financings. Such financings may not be available or may

not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this

uncertainty. We estimate that we will not be able to continue as a going concern after March 31, 2023 unless we are able to secure

capital from one of these sources of financing. If we are unable to secure such financing, we may cease operations and investors in our

common stock could lose all of their investment.

We have not voluntarily

implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested

director transactions, conflicts of interest and similar matters.

Federal legislation, including

the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity

of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others

have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock

Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities

exchanges are those that address board of directors' independence, and audit committee oversight. We have not yet adopted any of these

corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do

so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat

greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented

to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating

their investment decisions.

As a smaller public company,

our costs of complying with SEC reporting rules are disproportionately high relative to other larger companies.

The Marquie Group, Inc. is considered

a “reporting issuer” under the Securities Exchange Act of 1934, as amended. Therefore, we incur certain costs of compliance

with applicable SEC reporting rules and regulations including, but not limited to attorney’s fees, accounting and auditing fees,

other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $200,000

per year. In proportion to our operations, these costs are far more significant than our publicly-traded competitors. Unless we are able

to reduce these costs or increase our operating revenues, our costs to remain a reporting issuer will limit our ability to use our cash

resources for other more productive uses that could provide returns to our shareholders.

We are highly dependent

upon a few key contracts, the termination of which would have a material adverse effect on our business and financial condition.

Although we intend to grow The

Marquie Group, Inc. to become a larger health and beauty product, and broadcasting company, at present we have a small customer base and

are highly dependent upon a few key customers. We are therefore highly dependent upon repeat orders from our existing customers while

we generate sales to new customers. The loss of any of these customers until we have added new customers, would have a material adverse

effect on our business and financial condition.

We do not presently have

a traditional credit facility with a financial institution. This absence may adversely affect our operations.

To expand our business, we require

access to capital and credit. We do not presently have a traditional credit facility with a financial institution. The absence of a traditional

credit facility with a financial institution could adversely impact our operations. If we are unable to access lines of credit, we may

be unable to produce health and beauty products to certain customers who would otherwise be willing to enter into purchase contracts with

us. The loss of potential and existing customers because of an inability to finance the purchase of products and services would have a

material adverse effect on our financial condition and results of operations.

Non-performance

of suppliers on their sale commitments and customers on their purchase commitments could disrupt our business.

We enter into sales and purchase

orders with customers and suppliers for products and services at fixed prices. To the extent either a customer or supplier fails to perform

on their commitment, we may be required to sell or purchase other available products and services at prevailing market prices, which could

be significantly different than the fixed price within the sale and purchase order and therefore significant differences in these prices

could cause losses that would have a material adverse effect on our business, financial condition, results of operations and cash flows.

If we are unable to retain

our sales staff, our business and results of operations could be harmed.

Our ability to compete with other

health, beauty and broadcasting companies, and develop our business is largely dependent on the services of Marc Angell, our Chief Executive

Officer, and certain other third-party consultants and suppliers which assist him in securing sales of certain products and services.

If we are unable to retain Mr. Angell’s services and to attract other qualified senior management and key personnel on terms satisfactory

to us, our business will be adversely affected. We do not have key man life insurance covering the life of Mr. Angell and, even if we

are able to afford such a key man policy, our coverage levels may not be sufficient to offset any losses we may suffer as a result of

Mr. Angell’s death, disability, or other inability to perform services for us.

We may acquire businesses

and enter into joint ventures that will expose us to increased operating risks.

As part of our growth strategy,

we intend to acquire other health, beauty companies and other related service businesses in broadcasting. We cannot provide any assurance

that we will find attractive acquisition candidates in the future, that we will be able to acquire such candidates on economically acceptable

terms or that we will be able to finance acquisitions on economically acceptable terms. Even if we are able to acquire new businesses

in the future, they could result in the incurrence of substantial additional indebtedness and other expenses or potentially dilutive

issuances of equity securities and may affect the market price of our common stock or restrict our operations. We have also entered into

joint venture arrangements intended to complement or expand our business and will likely continue to do so in the future. These joint

ventures are subject to substantial risks and liabilities associated with their operations, as well as the risk that our relationships

with our joint venture partners do not succeed in the manner that we anticipate.

We face intense competition

and, if we are not able to effectively compete in our markets, our revenues may decrease.

Competitive pressures in our markets

could adversely affect our competitive position, leading to a possible loss of customers or a decrease in sales, either of which could

result in decreased revenues and profits. Our competitors are numerous, ranging from large multinational corporations, which have significantly

greater capital resources than us, to relatively small and specialized firms. Our business could be adversely affected because of increased

competition from these companies, who may choose to increase their direct marketing or provide less advantageous price and credit terms

to us than to our competitors.

Current and future litigation

could adversely affect us.

Though we are currently not involved

in any legal proceedings, from time to time we are involved in legal proceedings in our ordinary course of business. Lawsuits and other

legal proceedings can involve substantial costs, including the costs associated with investigation, litigation and possible settlement,

judgment, penalty or fine. As a smaller company, the collective costs of litigation proceedings can represent a drain on our cash resources,

as well as an inordinate amount of our management’s time and addition. Moreover, an adverse ruling in respect of certain litigation

could have a material adverse effect on our results of operation and financial condition.

We have limited the liability

of our board of directors and management.

We have adopted provisions in

our Articles of Incorporation which limit the liability of our directors and officers and have also adopted provisions in our bylaws which

provide for indemnification by the Company of our officers and directors to the fullest extent permitted by Florida corporate law. Our

articles of incorporation generally provides that our directors shall have no personal liability to the Company or its stockholders for

monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions

not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or

unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions

substantially limit our shareholders’ ability to hold directors liable for breaches of fiduciary duty.

In addition to provisions in

our Articles of Incorporation and Bylaws, we have also entered into indemnification agreements with our directors and officers that provide

a right of indemnification to the fullest extent permissible under Florida law. These charter, Bylaw, and contractual provisions may

limit our shareholders’ ability to hold our directors and officers accountable for breaches of their duties, or otherwise discourage

shareholders from enforcing their rights, either directly or derivatively, against our directors or officers.

Risks Relating To This Offering and Our Common

Stock

If the Selling Stockholder

sells a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The Selling Stockholder

is offering up to 75,000,000 shares of our common stock through this prospectus. Should the Selling Stockholder decide to sell our

shares at a price below the current market price at which they are quoted, such sales will cause that market price to decline. Moreover,

we believe that the offer or sale of a large number of shares at any price may cause the market price to fall. A steep decline in the

price of our common stock would adversely affect our ability to raise additional equity capital, and even if we were successful in raising

such capital, the terms of such raise may be substantially dilutive to current shareholders.

The sale of our

common stock to the Selling Stockholder may cause dilution, and the sale of the shares of common stock acquired by the Selling Stockholder,

or the perception that such sales may occur, could cause the price of our common stock to fall.

On October 12, 2022, we

entered into the Equity Commitment Agreement with the Selling Stockholder. Pursuant to the Equity Commitment Agreement, the Selling Stockholder

committed to purchase in excess of $5 million of our common stock. The shares issuable and that may be sold in the future pursuant to

the Equity Commitment Agreement may be sold by us to the Selling Stockholder at our discretion from time to time, commencing after the

SEC has declared effective the registration statement that includes this prospectus. The per share purchase price for the shares issuable

and that we may sell to the Selling Stockholder under the Equity Commitment Agreement will fluctuate based on the price of our common

stock, and will be equal to 90% of the average of the two (2) lowest volume weighted average prices of the Company’s Common Stock

on OTC Pink during the six (6) Trading Days immediately following the Clearing Date. Depending on market liquidity at the time, sales

of such shares may cause the trading price of our common stock to fall.

The Selling Stockholder

is considered an underwriter of The Marquie Group, Inc. An underwriter must make public disclosure similar to disclosure made by an issuer

in the event of purchases and sales of securities.

The Selling Stockholder

will pay less than the then-prevailing market price for our common stock.

The common stock issuable

and to be issued to the Selling Stockholder pursuant to the Equity Commitment Agreement will be purchased at a discount to market. The

Selling Stockholder has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal

to the difference between the discounted price and the market price. If the Selling Stockholder sells the shares, the price of our common

stock could decrease. If our stock price decreases, the Selling Stockholder may have a further incentive to sell the shares of our common

stock that they hold. These sales may have a further impact on our stock price.

Shares issuable

under the Company’s put right under the Equity Commitment Agreement may convert into a greater number of shares than we have assumed

in this prospectus.

We are registering 75,000,000

shares of our common stock for resale by the Selling Stockholder pursuant to the Equity Commitment Agreement, but the actual number of

shares we may end up issuing to the Selling Stockholder may be substantially higher. For purposes of this prospectus, we have assumed

a purchase price of $0.01. There is a minimum purchase price of $0.01 under the Equity Commitment Agreement. However, even though this

prospectus covers only 75,000,000 shares, we may be required to issue a much larger number of shares of our common stock if the trading

price were to decrease substantially. In such a circumstance, our existing shareholders could suffer substantial dilution and we cannot

guarantee that investors would not lose their entire investment.

The market price of our

common stock may fluctuate significantly.

The market price and marketability

of shares of our common stock may be affected significantly by numerous factors, including some over which we have no control and which

may not be directly related to us. These factors include the following:

| · | The lack of trading volume in our shares; |

| | | |

| · | Price and volume fluctuations in the stock market

from time to time, which often are unrelated to our operating performance; |

| | | |

| · | Variations in our operating results; |

| | | |

| · | Any shortfall in revenue or any increase in losses

from expected levels; |

| | | |

| · | Announcements of new initiatives, joint ventures,

or commercial arrangements; and |

| | | |

| · | General economic trends and other external factors. |

| | | |

| · | If the trading price of our common stock falls

significantly following completion of this offering, this may cause some of our shareholders to sell our shares, which would further adversely

affect the trading market for, and liquidity of, our common stock. If we seek to raise capital through future equity financings, this

volatility may adversely affect our ability to raise such equity capital |

Our common stock is subject

to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our

stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities

legislation, our common stock will constitute “penny stock”. A penny stock is any equity security that has a market price

of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require

that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive

from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information

and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable

for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions

in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by

the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability

determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This

may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend

to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell

them.

We have never paid a dividend

and we intend to retain any future earnings to finance the development and expansion of our business. Consequently, we do not anticipate

paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to

receive a return on their shares unless they sell them. We cannot assure you that stockholders will be able to sell shares when desired.

PLAN OF DISTRIBUTION

As of the date of this prospectus,

our shares of common stock are quoted on the OTC Pink. The Selling Stockholder may, from time to time, sell any or all of their shares

of common stock on any stock exchange, market or trading facility on which the shares are traded or quoted or in private transactions.

These sales may be at fixed or negotiated prices.

Based upon the terms of

the Equity Commitment Agreement as described on page 27 of this prospectus under “Summary of Equity Commitment Agreement”,

the following table illustrates the number and percentage of shares of our common stock held by the Selling Stockholder upon issuance

of the shares that are covered by this prospectus:

|

Conversion

at Assumed Price(1) |

Principal

Amount |

|

Number

of

Shares

Received(2) |

|

Pct.

of

Total

Outstanding

Shares(3) |

|

Pct.

of

Outstanding

Shares

Held

by

Non-Affiliates(4) |

| |

|

|

|

|

|

|

| $ |

5,000,000 |

|

|

|

75,000,000 |

|

|

|

9.01 |

% |

|

|

45.52 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

5,000,000 |

|

|

|

75,000,000 |

|

|

|

9.01 |

% |

|

|

45.52 |

% |

| |

(1) |

The

purchase price of the shares that may be sold to MacRab under the Equity Commitment Agreement will be equal to 90% of the average

of the two (2) lowest volume weighted average prices of the Company’s Common Stock on OTC Pink during the six (6) Trading Days

immediately following the Clearing Date. For

purposes of this prospectus, we have assumed a share price of $0.01. |

| |

(2) |

Because

the actual date and price per share under the Equity Commitment Agreement is unknown, the actual price per share is undetermined.

Consequently, the number of shares actually issuable may be substantially greater than the number being registered. |

| |

(3) |

Based

on 756,612,000 shares of our common stock issued and outstanding as of January 3, 2023, and assuming the issuance of 75,000,000 new

shares of common stock to the Selling Stockholder. |

| |

(4) |

Based

on 756,612,000 shares of our common stock issued and outstanding as of January 3, 2023, and assuming the issuance of 75,000,000 new

shares of common stock to the Selling Stockholder, but excluding shares held by executive officers, directors, and beneficial holders

of more than 10% of our common stock equaling 666,859,618 shares. |

The Selling Stockholders

may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions

in which the broker-dealer solicits investors; |

| | | |

| · | block trades in which the broker-dealer will

attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| | | |

| · | purchases by a broker-dealer as principal and

resale by the broker-dealer for its account; |

| | | |

| · | an exchange distribution in accordance with the

rules of the applicable exchange; |

| | | |

| · | privately negotiated transactions; |

| | | |

| · | to cover short sales made after the date that

this registration statement is declared effective by the SEC; |

| | | |

| · | broker-dealers may agree with the Selling Stockholder

to sell a specified number of such shares at a stipulated price per share; |

| | | |

| · | a combination of any such methods of sale; and |

| | | |

| · | any other method permitted pursuant to applicable

law. |

The Selling Stockholder may

also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by

the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be

negotiated. The Selling Stockholder do not expect these commissions and discounts to exceed what is customary in the types of transactions

involved.

The Selling Stockholder and

any broker-dealers or agents that are involved in selling the shares are “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We have advised the Selling

Stockholder that it may not use shares registered on this registration statement to cover short sales of common stock made prior to the

date on which this registration statement shall have been declared effective by the SEC. If a Selling Stockholder uses this prospectus

for any sale of the common stock, it will be subject to the prospectus delivery requirements of the Securities Act. The Selling Stockholder

will be responsible to comply with the applicable provisions of the Securities Act and Exchange Act, and the rules and regulations thereunder

promulgated, including, without limitation, Regulation M, as applicable to the Selling Stockholder in connection with resales of its shares

under this registration statement.

Penny Stock Rules

The SEC has also adopted rules

that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9.

Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities

exchanges or quoted on the Nasdaq system provided that current price and volume information with respect to transactions in such securities

is provided by the exchange or system).

The shares offered by this prospectus

constitute penny stocks under the Exchange Act. The shares may remain penny stocks for the foreseeable future. The classification of our

shares as penny stocks makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult

for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares

in The Marquie Group, Inc. will be subject to the penny stock rules.

The penny stock rules require

a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure

document approved by the SEC, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both

public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and

of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities

Act; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance

of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines

significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and

is in such form as the SEC shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting

any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its

salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating

to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock

held in the customer’s account.

In addition, the penny stock rules

require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment

of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy

of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary

market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those

securities.

Regulation M

During such time as we may be

engaged in a distribution of any of the shares we are registering by this registration statement, we are required to comply with Regulation

M of the Securities Exchange Act of 1934. In general, Regulation M precludes any selling security holder, any affiliated purchasers and

any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person

to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M

defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude

of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant”

as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a

distribution.

Regulation M prohibits, with

certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial

interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to

stabilize the price of a security in connection with a distribution of the security. We have informed the Selling Stockholder that the

anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and we have also advised

the Selling Stockholder of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by

this prospectus.

USE OF PROCEEDS

This prospectus relates

to shares of our common stock that may be offered and sold from time to time by the Selling Stockholder. We will not receive any proceeds

upon the sale of shares by the Selling Stockholder in this offering. However, We do receive proceeds from the sale of securities pursuant

to the Equity Commitment Agreement, including, up to $5 million under the Equity Commitment Agreement, assuming that we sell the full

amount of our common stock that we have the right, but not the obligation, to sell to the MacRab under the Equity Commitment Agreement.

See “Plan of Distribution” elsewhere in this prospectus for more information.

We currently expect to

use the net proceeds from the sale of shares to the Selling Stockholder under the Equity Commitment Agreement to further develop our

health and beauty product lines and marketing of the same through our internet radio service and for other general corporate purposes.

We will have broad discretion in determining how we will allocate the proceeds from any sales to the Selling Stockholder.

Even if we sell in excess

of $5 million worth of shares of our common stock to the Selling Stockholder pursuant to the Equity Commitment Agreement, we will need

to obtain additional financing in the future in order to fully fund all of our planned product and service-related research and development

activities. Furthermore, it is likely that we will need to do further registration statements to fill the Selling Stockholder Equity

Commitment Agreement. We may seek additional capital in the private and/or public equity markets, pursue government contracts and grants

as well as business development activities to continue our operations, respond to competitive pressures, develop new products and

services, and to support new strategic partnerships. We are evaluating additional equity financing opportunities on an ongoing basis

and may execute them when appropriate. However, there can be no assurances that we can consummate such a transaction, or consummate a

transaction at favorable pricing.

DETERMINATION

OF THE OFFERING PRICE

The Selling Stockholder will

determine at what price it may sell the offered shares, and such sales may be made at prevailing market prices or at privately negotiated

prices.

selling

stockholder

The following table sets

forth the shares beneficially owned, as of February 1, 2023, by the Selling

Stockholder prior to the offering contemplated by this prospectus, the number of shares the Selling Stockholder is offering by this

prospectus and the number of shares it would own beneficially if all such offered shares are sold.

Beneficial ownership is determined

in accordance with rules of attribution as promulgated by the SEC. Under these rules, a person is deemed to be a beneficial owner of a

security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment

power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any

security of which that person has a right to acquire beneficial ownership within 60 days. Under SEC rules, more than one person may be

deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which

he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below

are calculated based on 756,612,000 shares of our common stock issued and outstanding as of February 1, 2023. The Selling Stockholder does not hold

any options, warrants or other securities exercisable for or convertible into shares of our common stock.

| Selling

Stockholder |

|

Shares

Beneficially Owned Before this Offering(1) |

|

Percentage

of Outstanding Shares Beneficially Owned Before this Offering |

|

Shares

to be Sold in this Offering(2) |

|

Number

Of Shares Beneficially Owned After this Offering(3) |

|

Percentage

of Outstanding Shares Beneficially Owned After this Offering |

|

| MacRab (4) |

|

|

|

1.6% |

|

75,000,000 |

|

-0- |

|

-0- |

|

_____________________

| |

(1) |

Based

on 756,612,000 outstanding shares of our common stock as of February 1, 2023. Although we may at our discretion elect to issue

to the Selling Stockholder up to $5 million of our common stock under the Equity Commitment Agreement, such shares are not included

in determining the percentage of shares beneficially owned before this offering. |

| |

(2) |

Assumes

a purchase price of 0.01 which price represents a 10% discount to the average of the two (2) lowest Volume Weighted Average Price

of the Issuer’s common stock during the six (6) trading days after the clearing date. Because the actual date and price per

share for the Company’s put right under the Equity Commitment Agreement is unknown, the actual purchase price for the shares

is unknown. Accordingly, the actual shares issuable pursuant to the Equity Commitment Agreement may be significantly more than the

amount of shares being registered herein. |

| |

(3) |

Includes:

(i) shares of common stock held by the Selling Stockholder that are issued and outstanding, (ii) shares of common stock issuable

pursuant to the Equity Commitment Agreement that are being registered hereunder. |

| |

(4) |

Mackey McFarlane, manager of MacRab

LLC, has sole voting and dispositive power over the shares held by or issuable to MacRab LLC. Mr. McFarlane disclaims beneficial ownership

over the securities listed except to the extent of his pecuniary interest therein. The principal business address of MacRab LLC is 738

Mandalay Grove Ct. Merritt Island, FL 32953. MacRab is a broker-dealer. |

Except for the Equity

Commitment Agreement and other documents ancillary thereto, and the shares as described in this prospectus, there is no prior or existing

material relationship between us or any of our directors, executive officers, or control persons and the Selling Stockholder.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON EQUITY

AND RELATED

STOCKHOLDER MATTERS

Our common stock is listed

on the OTC Pink under the symbol “TMGI”. We had approximately 2,262 registered holders of our common stock as of February

1, 2023. Registered holders do not include those stockholders whose stock has been issued in street name. The last reported price

for our common stock on February 1, 2023 was $0.0037 per share.

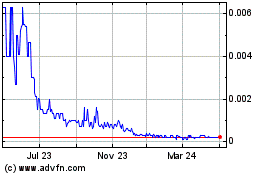

The following table reflects the

high and low closing sales prices per share of our common stock during each calendar quarter as reported on the OTC Pink, during the two

previous years.

| | |

| |

| | |

Price Range(1) | |

| | |

High | |

Low | |

| FYE ended May 31, 2023 | |

| |

| |

| Third quarter | |

$ | 0.009 | |

$ | 0.0022 | |

| Second quarter | |

$ | 0.009 | |

$ | 0.0032 | |

| First quarter | |

$ | 0.10 | |

$ | 0.001 | |

| | |

| | |

| | |

| FYE ended May 31, 2022 | |

| | |

| | |

| Fourth quarter | |

$ | 0.20 | |

$ | 0.001 | |

| Third quarter | |

$ | 0.20 | |

$ | 0.001 | |

| Second quarter | |

$ | 0.80 | |

$ | 0.10 | |

| First quarter | |

$ | 0.70 | |

$ | 0.30 | |

| | |

| | |

| | |

| FYE ended May 31, 2021 | |

| | |

| | |

| Fourth quarter | |

$ | 2.50 | |

$ | 0.50 | |

| Third quarter | |

$ | 4.50 | |

$ | 0.10 | |

____________________

| |

(1) |

The above quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent actual transactions. |

Dividends and Distributions

We have not paid any cash dividends

on our common stock since inception and do not anticipate paying cash dividends in the foreseeable future. We expect that that any future

earnings will be retained for use in developing and/or expanding our business.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This report contains forward-looking

statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions

to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results

are likely to differ materially from those anticipated in these forward-looking statements for many reasons.

Overview

We are a direct-to-consumer sales

and marketing company with an exclusive pipeline of innovative health and beauty products. The Company markets these products through

its wholly owned subsidiary Music of Your Life, a syndicated radio network heard nationwide on AM, FM and HD terrestrial radio stations,

and simulcast over the internet at www.musicofyourlife.com. This is made possible by 30 and 60 second commercials airing every

hour which are targeted toward the Music of Your Life listening audience. Broadcasting more than 40 years, Music of Your Life is the longest

running music radio format in syndication. With the acquisition of Simply Whim, LLC, the Company will report revenue from the Whim health

and beauty products on its balance sheet, assuming the product line continues generating revenue. Working with the product development

team at Simply Whim, the Company will be able to create new and innovative products under the Whim brand. The primary sales channel for

the Whim products is found at the Simply Whim website, www.simplywhim.com.

Because we have incurred losses,

income tax expenses are immaterial. No tax benefits have been booked related to operating loss carry-forwards, given our uncertainty of

being able to utilize such loss carry-forwards in future years. We anticipate incurring additional losses during the coming year.

Results of Operations