FY 2014 Third Quarter Financial Highlights (all comparisons

to the prior year period)

- Revenues were $6,869,504 compared to

$8,513,742, due to lower insurance distribution revenue and lower

construction revenues versus prior period

- Net operating revenue (gross profit)

decreased to $1,774,704, compared to $2,351,801

- Operating income was $222,699, compared

to $1,328,846

- Operating EBITDA (excluding investment

portfolio income) was $387,278, compared to $1,490,859

- Net income of $252,145, or $0.04 per

share, as compared to net income of $864,706, or $0.14 per

share

The Marketing Alliance, Inc. (OTC: MAAL) (“TMA”), today

announced financial results for its fiscal 2014 third quarter and

nine months ended December 31, 2013.

Mr. Timothy M. Klusas, TMA’s Chief Executive Officer, stated,

“Despite an unfavorable comparison to the prior year we were

pleased with our results given the business conditions of the

quarter and fiscal year-to-date. Our insurance distribution

business declined in revenue versus the prior year quarter as we

continued to adjust to changes in product offerings from our

insurance carrier partners. Historically, during the third quarter

TMA benefits from calendar year-end reconciliations of our annual

distribution agreements with carriers. However, we experienced

lower than anticipated production levels, which affected our

revenue and margins. We focused on operating profitability while

exploring new opportunities for growth during the quarter, and will

continue to provide value for our distributors in support of

helping their businesses grow during this time.

“Our land improvement business was also adversely affected by

the weather compared to the prior year, as the early onset of

winter drastically reduced our working season this year and its

associated potential revenues. During the quarter, due to TMA’s

capital position, the Company’s Board of Directors authorized a

13.7% increase in its annual cash dividend to shareholders of

record as of December 20, 2013. We believe this demonstrated TMA’s

ongoing commitment to its shareholders.”

Mr. Klusas provided additional details below on each of the

Company’s operations for the third quarter of the fiscal 2014

year:

- Insurance Distribution Business:

“In our insurance distribution business, we continued to assist our

customers in utilizing our broad selection of life insurance

products and carriers in response to industry changes. As we have

mentioned in previous quarters, our results have been affected by

life insurance carriers changing their product lines in reaction to

current interest rate and regulatory conditions (a notable example

was changes in reserving methodologies). In turn, this has lead to

our distributors revising their product mix to adjust to market

conditions. When these revisions by our distributors occur faster

than we can create new opportunities with carriers, it becomes very

difficult for us to achieve our planned levels to drive our revenue

and profit margins. Some of the revisions were caused by the

discontinuance of products while others were caused by in-force

rate increases that reduced demand for those products. While this

dislocation may lead to short-term fluctuations, especially as we

witnessed in this quarter, we feel it creates long-term benefits as

our distributors are able to offer a wider array of products and

thus be less susceptible to these product and carrier changes. For

this, I commend our distributors for their flexibility and

professionalism in adapting their practices to highlight different

carriers’ products. Recently, we have been pleased with the

increasingly favorable trends from new carriers and look to develop

new carrier suppliers.

- Earth Moving (Land Improvement –

Construction): “Our land improvement business historically had

two periods, during the first and third fiscal (second and third

calendar) quarters, where it could actively enter a farmer’s field

and provide excavating (tiling) and terracing services to increase

the farm’s crop yield. The year began with a wet spring that caused

a late start to the growing season, pushing back planting, which

carried through the growing season and delayed the harvest well

into the third quarter of the fiscal 2014 year. The delayed harvest

further set the business back when an early winter arrived and

brought an end to the working season, which was essentially

shortened from both directions. An early winter froze the ground

and resulted in interruptions of the services we were able to

provide. We are determined to continue our efforts to develop

alternative uses of our equipment during the down periods. In

addition, we continue to strive to improve operational efficiencies

and are pleased with our [directional] progress.

- Family Entertainment: “We have

been pleased with the performance of this business. We continued to

add upgrades at our two locations, such as video game machines

which were added at the end of the previous quarter in one

location, and during this quarter at the second location. We expect

these items to help to enhance our customers’ experience while also

creating new revenue streams and bringing more customers into the

stores.”

Fiscal 2014 Third Quarter Financial Review

- Total revenues for the three-month

period ended December 31, 2013 were $6,869,504, as compared to

$8,513,742 in the prior year quarter. The decrease was due to a

$1,189,302 decrease in insurance distribution revenue and a

$501,469 decline in construction revenue, offset by a $46,533

increase from the two family entertainment facilities.

- Net operating revenue (gross profit)

for the quarter was $1,774,704, compared to net operating revenue

of $2,351,801 in the prior-year fiscal period. Gross profit in the

prior year period would have been increased by $295,000 if that

same amount had not been included in direct and indirect

construction expenses versus being included in operating expenses.

Going forward, the Company believes the current quarter

classification of this cost is more accurate.

- Operating income was $222,699, compared

to operating income of $1,328,846 reported in the prior-year

period. This change was due in part to the factors discussed above

in each of the businesses and increases in operating expenses that

exceeded the increase in net operating revenue.

- Operating EBITDA (excluding investment

portfolio income) for the quarter was $387,278 compared to

$1,490,859 in the prior-year period. A note reconciling operating

EBITDA to operating income can be found at the end of this

release.

- Net income for the fiscal 2014 third

quarter was $252,145, or $0.04 per share, as compared to net income

of $864,706, or $0.14 per share, in the prior year period.

(Operating EPS and Net EPS are stated after giving effect to the

100% stock split effective February 28, 2014 for all periods.

Shares outstanding increased to 6,024,200 from 3,012,100 with this

stock split, and per share information has been retroactively

adjusted to account for the split.)

- Investment gain, net (from investment

portfolio) for the third quarter ended December 31, 2013 was

$227,105, as compared to investment gain, net of $42,682, for the

same quarter of the previous fiscal year.

Fiscal 2014 Nine Months Financial Review

- Total revenues for the nine months

ended December 31, 2013 were $20,120,001, compared to $21,953,101

in revenues for the prior-year period.

- Net operating revenue (gross profit)

was $5,605,937, which compares to net operating revenue of

$5,774,537 in the prior-year fiscal period.

- Operating income was $977,639 compared

to $2,161,989 for the prior-year period.

- Operating EBITDA (excluding investment

revenue) for the nine months was $1,455,271 versus $2,561,896 in

the prior-year period. A note reconciling Operating EBITDA to

Operating Income can be found at the end of this release.

- Net income for the nine months ended

December 31, 2013 was $729,964, or $0.12 per share, compared to

$1,432,567 or $0.24 per share, in the prior-year period. (As noted

above, per share information has been retroactively adjusted to

account for the 100% stock split effective February 28, 2014.)

Balance Sheet Information

- TMA’s balance sheet at December 31,

2013 reflected cash and cash equivalents of approximately $6.5

million, working capital of $12.9 million, and shareholders’ equity

of $14.0 million; compared to $6.0 million, $12.7 million, and

$13.3 million, respectively, at March 31, 2013.

About The Marketing Alliance, Inc.

Headquartered in St. Louis, MO, TMA operates three business

segments. TMA provides support to independent insurance brokerage

agencies, with a goal of providing members value-added services on

a more efficient basis than they can achieve individually. The

Company also owns an earth moving and excavating business and two

children’s play and party facilities. Investor information can be

accessed through the shareholder section of TMA’s website

at:http://www.themarketingalliance.com/shareholder-information.

TMA’s common stock is quoted on the OTC Markets

(http://www.otcmarkets.com) under the symbol “MAAL”.

Forward Looking Statement

Investors are cautioned that forward-looking statements involve

risks and uncertainties that may affect TMA's business and

prospects. Any forward-looking statements contained in this press

release represent our estimates only as of the date hereof, or as

of such earlier dates as are indicated, and should not be relied

upon as representing our estimates as of any subsequent date. These

statements involve a number of risks and uncertainties, including,

but not limited to: the product lines, and the prices and other

terms and characteristics of the product lines, offered by life

insurance carriers; the desirability of carrier product lines the

desirability of carrier product lines to our distributors and their

customers; expectations of the economic environment; material

adverse changes in economic conditions in the markets we serve and

in the general economy; future regulatory actions and conditions in

the states in which we conduct our business; the integration of our

operations with those of businesses or assets we have acquired or

may acquire in the future and the failure to realize the expected

benefits of such acquisition and integration. While we may elect to

update forward-looking statements at some point in the future, we

specifically disclaim any obligation to do so.

Three-months ended Nine-months ended

December 31, December 31,

2013

2012 2013

2012 Commission revenue $ 5,877,841 $ 7,067,143 $

16,946,100 $ 18,663,515 Construction revenue 630,415 1,131,884

2,190,939 2,929,089 Family entertainment revenue 361,248 314,715

982,962 360,497 Total revenues

6,869,504 8,513,742

20,120,001 21,953,101 Distributor related

expenses: Distributor bonuses and commissions 4,210,579 4,542,643

11,680,431 12,363,989 Business processing and distributor costs

343,556 520,340 1,156,763 1,662,827 Depreciation 3,145 4,068 8,833

11,417

4,557,280 5,067,051 12,846,027

14,038,233 Costs of construction: Direct and indirect costs

of construction 374,363 960,043 1,227,032 1,820,772 Depreciation

86,712 91,065 265,744 272,244

461,075 1,051,108

1,492,776 2,093,016 Family entertainment

costs of sales: 76,445 43,782 175,261

47,315 Net operating revenue

1,774,704 2,351,801 5,605,937 5,774,537

Operating Expenses 1,552,005 1,022,955

4,628,298 3,612,548 Operating income

222,699 1,328,846 977,639 2,161,989

Other income (expense): Investment gain, net 227,105

42,682 257,055 148,514 Interest expense (29,750) (34,283) (80,395)

(79,119) Gain on sale of assets (3,184) - 8,196 - Interest rate

swap, fair value adjustment 4,265 - 19,570 -

Income

before provision for income taxes 421,135

1,337,245 1,182,065 2,231,384 Provision

for income taxes 168,990 472,539 452,101 798,817

Net

income $ 252,145 $ 864,706 $ 729,964 $

1,432,567 Average Shares Outstanding

6,024,200 6,024,200 6,024,200 6,024,200

Operating Income per Share $ 0.04 $

0.22 $ 0.16 $ 0.36 Net Income per Share

$ 0.04 $ 0.14 $ 0.12 $ 0.24

Note: * - Operating EPS and Net EPS stated after giving effect

to the 100% stock split for shareholders effective February 28,

2014 for all periods. Shares outstanding increased to 6,024,200

from 3,012,100 with this stock split and have been retroactively

adjusted to account for the split.

Consolidated Selected Balance Sheet Items

As of Assets 12/31/13

3/31/13 Cash & Equivalents $ 6,453,033 $

6,007,286 Investments 4,394,572 4,237,026 Receivables 8,845,734

9,251,879 Other 652,518 621,312

Total Current Assets

20,345,857 20,117,503 Property and Equipment,

Net 1,596,275 1,652,031 Intangible Assets, net 313,940 960,899

Other 1,373,368 801,576

Total Non-Current Assets

3,283,583 3,414,506 Total Assets $

23,629,440 $ 23,532,009 Liabilities &

Stockholders' Equity Total Current Liabilities $

7,493,899 $ 7,463,975

Long Term Liabilities

2,112,553

2,775,010

Total Liabilities 9,606,452 10,238,985

Stockholders' Equity 14,022,988

13,293,024 Liabilities & Stockholders'

Equity $ 23,629,440 $ 23,532,009

Note – Operating EBITDA (excluding

investment portfolio income)

Fiscal year 2014 third quarter operating EBITDA (excluding

investment portfolio income) was determined by adding fiscal year

2014 third quarter operating income of $222,699 and depreciation

and amortization expense of $164,579 for a sum of $387,278. Fiscal

year 2013 third quarter operating EBITDA (excluding investment

portfolio income) was determined by adding fiscal year 2013 third

quarter operating income of $1,328,846 and depreciation and

amortization expense of $162,013 for a sum of $1,490,859. The

Company elects not to include investment portfolio income because

the Company believes it is non-operating in nature.

Fiscal year 2014 nine months operating EBITDA (excluding

investment portfolio income) was determined by adding fiscal year

2014 nine month operating income of $977,639 and depreciation and

amortization expense of $477,632 for a sum of $1,455,271. Fiscal

year 2013 nine months operating EBITDA (excluding investment

portfolio income) was determined by adding fiscal year 2013 nine

months operating income of $2,161,989 and depreciation and

amortization expense of $399,907 for a sum of $2,561,896. The

Company elects not to include investment portfolio income because

the Company believes it is non-operating in nature.

The Company uses Operating EBITDA as a measure of operating

performance. However, Operating EBITDA is not a recognized

measurement under U.S. generally accepted accounting principles, or

GAAP, and when analyzing its operating performance, investors

should use Operating EBITDA in addition to, and not as an

alternative for, income as determined in accordance with GAAP.

Because not all companies use identical calculations, its

presentation of Operating EBITDA may not be comparable to similarly

titled measures of other companies and is therefore limited as a

comparative measure. Furthermore, as an analytical tool, Operating

EBITDA has additional limitations, including that (a) it is not

intended to be a measure of free cash flow, as it does not consider

certain cash requirements such as tax payments; (b) it does not

reflect changes in, or cash requirements for, its working capital

needs; and (c) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized often will have

to be replaced in the future, and Operating EBITDA does not reflect

any cash requirements for such replacements, or future requirements

for capital expenditures or contractual commitments. To compensate

for these limitations, the Company evaluates its profitability by

considering the economic effect of the excluded expense items

independently as well as in connection with its analysis of cash

flows from operations and through the use of other financial

measures.

The Company believes Operating EBITDA is useful to an investor

in evaluating its operating performance because it is widely used

to measure a company’s operating performance without regard to

certain non-cash or unrealized expenses (such as depreciation and

amortization) and expenses that are not reflective of its core

operating results over time. The Company believes Operating EBITDA

presents a meaningful measure of corporate performance exclusive of

its capital structure, the method by which assets were acquired and

non-cash charges, and provides additional useful information to

measure performance on a consistent basis, particularly with

respect to changes in performance from period to period.

The Marketing Alliance, Inc.Timothy M. Klusas,

314-275-8713Presidenttklusas@themarketingalliance.comwww.themarketingalliance.comorInvestor

RelationsAdam Prior, 212-836-9606Senior Vice

Presidentaprior@equityny.comorTerry Downs,

212-836-9615Associatetdowns@equityny.com

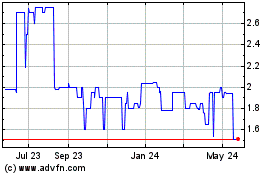

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

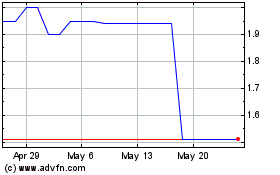

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Dec 2023 to Dec 2024