The Marketing Alliance, Inc. (OTC: MAAL) (“TMA”), today

announced financial results for its fiscal 2013 second quarter

ended September 30, 2012.

Timothy M. Klusas, TMA’s President, stated, “We are very pleased

with our results for the quarter. We saw double-digit percentage

increases in revenue, with notable growth in our net income and

operating EBITDA over the prior year. During the quarter our Board

of Directors declared a 6:5 stock split (20%), where new shares

were distributed on October 15, 2012, to shareholders of record as

of the close of business on September 15, 2012. As a result of the

20% stock split, the outstanding shares of the Company's common

stock increased by approximately 418,347 shares, from 2,091,736

shares outstanding to approximately 2,510,083 shares. During the

quarter we also completed the acquisition of two family

entertainment facilities located in Illinois and Missouri and

included approximately two weeks of operations in our quarterly

results and the completed transaction on our balance sheet.

Finally, subsequent to the end of the quarter, our Board of

Directors announced a $0.38 per share dividend payable December 26,

2012, to shareholders of record as of December 7, 2012. I would now

like to mention some of the highlights from each of the Company’s

operations during the quarter:

- Insurance Distribution Business:

“TMA increased its revenues and gross profit from the insurance

distribution business despite continued difficult market conditions

for many of the life and annuity insurance products that our

individual agent network sells to customers. The current

low-interest rate environment and continued expectations for low

interest rates into the future has led many carriers to revise

their product portfolios by increasing premiums on products with

long-term guarantees or choosing not to offer guaranteed products

at all due to the fact that longer-term guarantees are most

sensitive to interest rates. The current interest rate environment

also adversely affected our annuity business, as these products are

based on interest rates and low interest rates makes the product

less appealing for customers who may choose to defer purchases

until rates increase. Less product choice and less attractive

products reduce revenues to the Company. Although these changes can

be disruptive for distributors and consumers, we feel our value

proposition of offering more insurance products, access to more

carriers, and shared services to reduce costs to distributors helps

to alleviate these disruptions.”

- Earth Moving and Excavating:

“This quarter marks a full year that our earth moving and

excavation business has cycled through TMA’s results and despite

the effects of seasonality during the quarter; we are pleased with

the growth and potential of this segment. We continue to seek

alternative uses of the business’ resources during the off seasons

(calendar first and third quarters) to reduce earnings volatility

and produce more consistent results.”

- Entertainment Facilities:

“During the quarter (September 14), TMA completed the acquisition

of two children’s party and entertainment facilities located in the

St Louis area under the franchise name “Monkey Joe’s.” With the

facilities’ operating managers and most employees already in place,

we are excited to have completed the transaction and look forward

to reporting a full quarter of results. This transaction resulted

in the addition of goodwill and other intangible assets as shown on

our balance sheet.

Fiscal 2013 Second Quarter Financial Review

- Total revenues for the three-month

period ended September 30, 2012 were $6,606,509, an increase of

11%, from $5,955,098 in the prior year quarter. The increase was

partially due to an additional $45,782 received in revenue from the

Company’s acquisition of two entertainment facilities, as well as

an additional $605,629 received in commission and construction

revenues over the prior year period. Commission revenue increased

by 7% over the prior year quarter.

- Net operating revenue (gross profit)

for the quarter was $1,583,445, compared to net operating revenue

of $1,058,179 in the prior-year fiscal period.

- Operating income was $239,825, an

increase from operating income of $54,067 reported in the

prior-year period. Operating income in the quarter ending September

30, 2011, was revised to $54,067 from $3,319 due to a

reclassification of expenses reimbursed by a third party.

- Operating EBITDA (excluding investment

revenue) for the quarter was $359,199 versus $128,235 in the

prior-year period. A note reconciling Operating EBITDA to Operating

Income can be found at the end of this release.

- Net income for the fiscal 2013 second

quarter was $314,447, or earnings per share of $0.13, compared to a

net loss of $364,978, or $0.15 (loss) per share, in the prior year

period. The primary reason for the bottom line improvement was

increased profitability for the Company’s insurance and excavating

segments and a loss on realized and unrealized investments of

$587,442 in the prior year period versus a gain of $274,316 this

year.

- Investment gains of $274,316 compared

favorably to an Investment loss of $587,442 in the prior year

quarter. The difference in performance was due in part to a

generally more favorable time for equities.

Fiscal 2013 Six Months Financial Review

- Total revenues for the six months ended

September 30, 2012 were $13,439,359, compared to $11,762,595 in

revenues for the prior-year period, an increase of 14%. Commission

revenue increased by 7% over the prior year quarter.

- Net operating revenue (gross profit)

was $3,422,736, which compares to net operating revenue of

$2,592,314 in the prior-year fiscal period.

- Operating income increased to $833,143

from $685,099 for the prior-year period.

- Operating EBITDA (excluding investment

revenue) for the six months was $1,071,037 versus $780,672 in the

prior-year period. A note reconciling Operating EBITDA to Operating

Income can be found at the end of this release.

- Net income for the six months ended

September 30, 2012 was $567,861, or $0.23 per share, compared to

$18,032, or $0.01 per share, in the prior-year period.

- Investment gains of $105,832 compared

favorably to an Investment loss of $639,270, in the prior-year

period. Realized losses were $91,330 in the six-month period ending

September 30, 2012, versus realized losses $71,202 in the

prior-year period. Unrealized gains of $123,455 in the current

six-month period compared favorably to unrealized losses of

$606,844 in the prior-year period. The balance of Investment gain

(loss), net performance is comprised of dividend and interest

income, investment interest, and investment management fees.

Balance Sheet Information

TMA’s balance sheet at September 30, 2012 reflected cash and

cash equivalents of $5.4 million, working capital of $10 million,

and shareholders’ equity of $11.9 million; compared to $4.5

million, $7.2 million, and $9.2 million, respectively, at September

30, 2011. Intangible Assets, Net increased to $1,022,804 from

$93,606 at March 31, 2012, primarily due to the acquisition of

family entertainment centers completed in the quarter.

About The Marketing Alliance, Inc.

Headquartered in St. Louis, MO, TMA operates three business

segments. TMA provides support to independent insurance brokerage

agencies, with a goal of providing members value-added services on

a more efficient basis than they can achieve individually. The

Company also owns an earth moving and excavating business and two

children’s play and party facilities. Investor information can be

accessed through the shareholder section of TMA’s website at:

http://www.themarketingalliance.com/shareholder-information.

TMA’s common stock is quoted on the OTC Markets

(http://www.otcmarkets.com) under the symbol “MAAL”.

Forward Looking Statement

Investors are cautioned that forward-looking statements involve

risks and uncertainties that may affect TMA's business and

prospects. Any forward-looking statements contained in this press

release represent our estimates only as of the date hereof, or as

of such earlier dates as are indicated, and should not be relied

upon as representing our estimates as of any subsequent date. These

statements involve a number of risks and uncertainties, including,

but not limited to, general changes in economic conditions. While

we may elect to update forward-looking statements at some point in

the future, we specifically disclaim any obligation to do so.

Consolidated Statement of Operations

Quarter Ended Year to Date 6

Months Ended

9/30/12 9/30/11 9/30/12

9/30/11 Commission revenue $ 5,777,310 $ 5,399,240 $

11,596,372 $ 11,206,737 Construction revenue 783,417 555,858

1,797,205 555,858 Family entertainment revenue 45,782

- 45,782 -

Revenues 6,606,509 5,955,098

13,439,359 11,762,595 Distributor Related

Expenses Bonus & commissions 3,939,462 3,837,871 7,821,346

7,554,620 Processing & distribution 543,176 607,937 1,142,487

1,155,707 Depreciation 3,675 8,407

7,349 17,250

Total 4,486,313 4,454,215 8,971,182

8,727,577 Cost of Construction Direct and

Indirect costs of construction 442,201 389,059 860,729 389,059

Depreciation 91,017 53,645

181,179 53,645

Total 533,218 442,704 1,041,908

442,704 Family entertainment cost of sales

3,533 -

3,533 - Net Operating

Revenue 1,583,445 1,058,179

3,422,736 2,592,314

Operating Expenses 1,343,620

1,004,112 2,589,593 1,907,215

Operating Income 239,825 54,067

833,143 685,099 Other Income (Expense)

Investment gain, (loss) net 274,316 (587,442 ) 105,832 (639,270 )

Interest expense (18,428 ) (15,493 ) (44,836 )

(17,470 )

Income Before Provision for Income

Tax 495,713 (548,868 ) 894,139

28,359 Provision for income taxes 181,266

(183,890 ) 326,278 10,327

Net Income $ 314,447 $

(364,978 ) $ 567,861 $

18,032 Average Shares Outstanding

2,510,083 2,510,083 2,510,083 2,510,083

Operating Income per Share

$

0.10

$

0.02

$

0.33

$

0.27

Net Income per Share

$

0.13

$

(0.15

)

$

0.23

$

0.01

Note: * - Operating EPS and Net EPS stated after giving effect

to the 20% stock split for shareholders of record as of September

15, 2012 and paid October 15, 2012 for all periods. Shares

outstanding increased to 2,510,083 from 2,091,736 with this stock

split and have been retroactively adjusted to account for this

split. Operating EPS and Net EPS have also been stated and after

giving effect to the 10% stock split for shareholders of record as

of June 15, 2011 and paid July 15, 2011 for all periods. Shares

outstanding were increased to 2,091,736 from 1,901,578 with this

stock split and at the time of the split were retroactively

adjusted to account for this split.

Consolidated Selected Balance Sheet Items

As of

Assets 9/30/12 3/31/12 Cash & Equivalents

$

5,421,126

$

4,785,736

Investments 4,193,088 3,943,369 Receivables 6,614,526 7,470,958

Other 558,764 582,645

Total Current

Assets 16,787,504 16,782,708 Property and

Equipment, Net 1,871,321 1,654,862 Intangible Assets, net 1,022,804

93,606 Other 673,549 577,893

Total Non Current Assets

3,567,674 2,326,361

Total Assets $ 20,355,178

$ 19,109,069 Liabilities &

Stockholders' Equity Total Current Liabilities $

6,833,907 $ 5,869,105

Long Term

Liabilities

1,622,246

1,908,800

Total Liabilities 8,456,153

7,777,905 Stockholders'

Equity 11,899,025 11,331,164

Liabilities & Stockholders' Equity

$ 20,355,178 $ 19,109,069

Note – Operating EBITDA (excluding investments)

Q2FY 2013 Operating EBITDA (excluding investments) was

determined by adding Q2FY 2013 Operating Income of $239, 825 and

Depreciation and Amortization Expense of $119,374 for a sum of

$359,199. Q2FY2012 Operating EBITDA (excluding investments) was

determined by adding Q2FY 2012 Operating Income of $54,067 and

Depreciation and Amortization Expense of $74,168 for a sum of

$128,235.

Fiscal 2013 six months Operating EBITDA (excluding investments)

was determined by adding FY2013 six month Operating Income of

$833,143 and Depreciation and Amortization Expense of $237,894 for

a sum of $1,071,037. FY2012 six month Operating EBITDA (excluding

investments) was determined by adding FY 2012 six month Operating

Income of $685,099 and Depreciation and Amortization Expense of

$95,573 for a sum of $780,672.

The Company uses Operating EBITDA as a measure of operating

performance. However, Operating EBITDA is not a recognized

measurement under U.S. generally accepted accounting principles, or

GAAP, and when analyzing its operating performance, investors

should use Operating EBITDA in addition to, and not as an

alternative for, income as determined in accordance with GAAP.

Because not all companies use identical calculations, its

presentation of Operating EBITDA may not be comparable to similarly

titled measures of other companies and is therefore limited as a

comparative measure. Furthermore, as an analytical tool, Operating

EBITDA has additional limitations, including that (a) it is not

intended to be a measure of free cash flow, as it does not consider

certain cash requirements such as tax payments; (b) it does not

reflect changes in, or cash requirements for, its working capital

needs; and (c) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized often will have

to be replaced in the future, and Operating EBITDA does not reflect

any cash requirements for such replacements, or future requirements

for capital expenditures or contractual commitments. To compensate

for these limitations, the Company evaluates its profitability by

considering the economic effect of the excluded expense items

independently as well as in connection with its analysis of cash

flows from operations and through the use of other financial

measures.

The Company believes Operating EBITDA is useful to an investor

in evaluating its operating performance because it is widely used

to measure a company’s operating performance without regard to

certain non-cash or unrealized expenses (such as depreciation and

amortization) and expenses that are not reflective of its core

operating results over time. The Company believes Operating EBITDA

presents a meaningful measure of corporate performance exclusive of

its capital structure, the method by which assets were acquired and

non-cash charges, and provides additional useful information to

measure performance on a consistent basis, particularly with

respect to changes in performance from period to period.

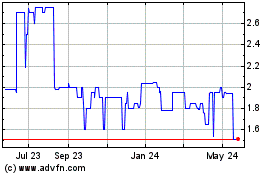

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

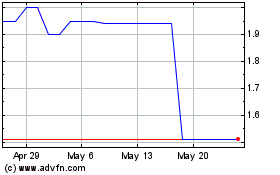

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Dec 2023 to Dec 2024