0001737193

true

Update to Sept financials

0001737193

2021-01-01

2021-09-30

0001737193

2021-09-30

0001737193

2020-12-31

0001737193

2021-07-01

2021-09-30

0001737193

2020-07-01

2020-09-30

0001737193

2020-01-01

2020-09-30

0001737193

2019-12-31

0001737193

2020-09-30

0001737193

us-gaap:CommonStockMember

2019-12-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0001737193

us-gaap:RetainedEarningsMember

2019-12-31

0001737193

us-gaap:CommonStockMember

2020-01-01

2020-03-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-03-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-01-01

2020-03-31

0001737193

us-gaap:RetainedEarningsMember

2020-01-01

2020-03-31

0001737193

2020-01-01

2020-03-31

0001737193

us-gaap:CommonStockMember

2020-03-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-03-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-03-31

0001737193

us-gaap:RetainedEarningsMember

2020-03-31

0001737193

2020-03-31

0001737193

us-gaap:CommonStockMember

2020-04-01

2020-06-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-04-01

2020-06-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-04-01

2020-06-30

0001737193

us-gaap:RetainedEarningsMember

2020-04-01

2020-06-30

0001737193

2020-04-01

2020-06-30

0001737193

us-gaap:CommonStockMember

2020-06-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-06-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-06-30

0001737193

us-gaap:RetainedEarningsMember

2020-06-30

0001737193

2020-06-30

0001737193

us-gaap:CommonStockMember

2020-07-01

2020-09-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-07-01

2020-09-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-07-01

2020-09-30

0001737193

us-gaap:RetainedEarningsMember

2020-07-01

2020-09-30

0001737193

us-gaap:CommonStockMember

2020-09-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-09-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-09-30

0001737193

us-gaap:RetainedEarningsMember

2020-09-30

0001737193

us-gaap:CommonStockMember

2020-12-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001737193

us-gaap:RetainedEarningsMember

2020-12-31

0001737193

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-03-31

0001737193

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001737193

2021-01-01

2021-03-31

0001737193

us-gaap:CommonStockMember

2021-03-31

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-03-31

0001737193

us-gaap:RetainedEarningsMember

2021-03-31

0001737193

2021-03-31

0001737193

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-04-01

2021-06-30

0001737193

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001737193

2021-04-01

2021-06-30

0001737193

us-gaap:CommonStockMember

2021-06-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-06-30

0001737193

us-gaap:RetainedEarningsMember

2021-06-30

0001737193

2021-06-30

0001737193

us-gaap:CommonStockMember

2021-07-01

2021-09-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2021-09-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-07-01

2021-09-30

0001737193

us-gaap:RetainedEarningsMember

2021-07-01

2021-09-30

0001737193

us-gaap:CommonStockMember

2021-09-30

0001737193

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001737193

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0001737193

us-gaap:RetainedEarningsMember

2021-09-30

0001737193

LDSN:LudusonHoldingMember

2021-09-30

0001737193

LDSN:LudusonEntertainmentMember

2021-09-30

0001737193

LDSN:GMusicAsiaMember

2021-09-30

0001737193

us-gaap:ComputerEquipmentMember

2021-01-01

2021-09-30

0001737193

us-gaap:FurnitureAndFixturesMember

2021-01-01

2021-09-30

0001737193

LDSN:PeriodEndMember

currency:HKD

2021-09-30

0001737193

LDSN:PeriodEndMember

currency:HKD

2020-09-30

0001737193

LDSN:PeriodAverageMember

currency:HKD

2021-09-30

0001737193

LDSN:PeriodAverageMember

currency:HKD

2020-09-30

0001737193

LDSN:AWarrantsMember

2021-09-30

0001737193

LDSN:BWarrantsMember

2021-09-30

0001737193

LDSN:CWarrantsMember

2021-09-30

0001737193

LDSN:DWarrantsMember

2021-09-30

0001737193

LDSN:EWarrantsMember

2021-09-30

0001737193

us-gaap:DomesticCountryMember

2021-01-01

2021-09-30

0001737193

us-gaap:DomesticCountryMember

2020-01-01

2020-09-30

0001737193

us-gaap:ForeignCountryMember

2021-01-01

2021-09-30

0001737193

us-gaap:ForeignCountryMember

2020-01-01

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2021-07-01

2021-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2021-07-01

2021-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerCMember

2021-07-01

2021-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerCMember

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2021-07-01

2021-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2020-07-01

2020-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2020-07-01

2020-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2020-07-01

2020-09-30

0001737193

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2021-01-01

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2021-01-01

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerCMember

2021-01-01

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2021-01-01

2021-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerAMember

2020-01-01

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:CustomerBMember

2020-01-01

2020-09-30

0001737193

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LDSN:TotalCustomersMember

2020-01-01

2020-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

LUDUSON G INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

7372

|

|

82-3184409

|

|

(State or Other Jurisdiction of

|

|

(Primary Standard Industrial

|

|

(IRS Employer

|

|

Incorporation or Organization)

|

|

Classification Number)

|

|

Identification Number)

|

17/F, 80 Gloucester Road

Wanchai, Hong Kong

+852 2818 7199

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Ka Leung Wong

Chief Executive Officer

Luduson G Inc.

17/F, 80 Gloucester Road

Wanchai, Hong Kong

+852 2818 7199

(Address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Jenny Chen-Drake, Esq.

Law Offices of Jenny Chen-Drake

8491 Sunset Boulevard, Suite 368

West Hollywood, California 90069

Telephone No.: (310) 358-0880

Facsimile No.: (888) 896-7763

Approximate date of proposed sale to the public: As soon as practicable

and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company; or an emerging growth company. See

definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

Emerging Growth Company

|

☐

|

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant Section 7(a)(2)(B) of the Exchange Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to Be

Registered (1)

|

|

|

Proposed

Maximum

Offering Price

per Share (2)

|

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration Fee (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share issuable pursuant to Investment Agreement (4)

|

|

|

1,000,000

|

(4)

|

|

$

|

5.00

|

|

|

|

$

|

5,000,000

|

|

|

$

|

545.50

|

|

|

Common Stock, par value $0.0001 per share (5)

|

|

|

6,100,000

|

(5)

|

|

$

|

5.00

|

|

|

|

$

|

30,500,000

|

|

|

$

|

3,327.55

|

|

|

TOTAL

|

|

|

7,100,000

|

|

|

$

|

5.00

|

|

|

|

$

|

35,500,000

|

|

|

$

|

3,873.05

|

*

|

______________

|

(1)

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”)

|

|

(2)

|

This offering price has been estimated solely for the purpose of

computing the registration fee in accordance with Rule 457(c) of the Securities Act on the basis of the average of the high and low

prices of the common stock of the Company as reported on the OTCQB on October 28, 2021. The offering price of the shares

of common stock offered by the selling stockholders was determined by the effective lack of any liquidity in the shares of common

stock of the Registrant and the desire to not offer shares at a price higher than the price of shares being offered by the

Registrant.

|

|

(3)

|

The registration fee for securities to be offered by the Registrant is based on an estimate of the proposed maximum aggregate offering price of the securities, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(c).

|

|

(4)

|

Represents the number of shares of common stock of the Registrant that we will put (“Strattner Put Shares”) to Strattner Alternative Credit Fund LP, a Delaware limited partnership (“Strattner”), pursuant to that certain Investment Agreement (the “Investment Agreement”) by and between Strattner and the Registrant, dated April 6, 2021. In the event that adjustment provisions of the Investment Agreement require the Company to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the Company will file a new registration statement to register those additional shares.

|

|

(5)

|

Represents the number of shares of common stock of the Registrant that

we will put (“Williamsburg Put Shares”) to Williamsburg Venture Holdings, LLC, a Nevada limited liability company

(“Williamsburg”), pursuant to that certain Equity Purchase Agreement (the “Equity Purchase Agreement”) by

and between Williamsburg and the Registrant, dated August 20, 2021 and 100,000 shares of common stock issued to Williamsburg as

commitment shares. In the event that adjustment provisions of the Equity Purchase Agreement require the Company to issue more shares

than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the

Company will file a new registration statement to register those additional

shares.

|

|

*

|

Previously paid.

|

The Registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a)

of the securities act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant

to section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the U.S. Securities and Exchange Commission ("SEC") is effective. This preliminary prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION DATED DECEMBER 27, 2021

7,100,000 SHARES OF COMMON STOCK OFFERED BY

SELLING STOCKHOLDERS

This prospectus relates to the resale of shares

of our common stock, par value $0.0001 per share, by (i) Strattner Alternative Credit Fund LP (“Strattner”) of 1,000,000 Strattner

Put Shares that we will put to Strattner pursuant to the Investment Agreement, and (ii) Williamsburg Venture Holdings, LLC (“Williamsburg”)

of up to 6,100,000 Williamsburg Put Shares that we will put to Williamsburg pursuant to the Equity Purchase Agreement. Strattner and Williamsburg

are collectively referred to as the “Selling Security Holders.”

The Investment Agreement with Strattner provides

that Strattner is committed to purchase up to $5,000,000 of our common stock. We may draw on the facility from time to time, as and when

we determine appropriate in accordance with the terms and conditions of the Investment Agreement. The per share purchase price for the

Strattner Put Shares shall be equal to 85% of volume weighted average price (“VWAP”) for the five (5) consecutive trading

days including and immediately after the date on which the Company submits a put notice to Strattner.

The Equity Purchase Agreement with Williamsburg

provides that Williamsburg is committed to purchase up to $30,000,000 of our common stock. We may draw on the facility from time to time,

as and when we determine appropriate in accordance with the terms and conditions of the Equity Purchase Agreement. The per share purchase

price for the Williamsburg Put Shares shall be equal to 88% the lowest traded price of the Common Stock on the principal market during

the five (5) consecutive trading days immediately preceding the date which Williamsburg received the Williamsburg Put Shares as DWAC Shares

in its brokerage account (as reported by Bloomberg Finance L.P., Quotestream, or other reputable source).

The Registrant is a Delaware holding company conducting

our operations in Hong Kong through wholly owned subsidiaries with direct equity ownership. We are not a Hong Kong operating company.

We are a holding company and do not directly own any substantive business operations in Hong Kong. We conduct our operations primarily

through our subsidiaries based in Hong Kong. This is an offering of common stock of our Delaware holding company, instead of shares of

our operating companies in Hong Kong. Therefore, you will not directly hold any equity interests in our Hong Kong operating companies.

Our holding company structure involves unique risks to investors. Chinese regulatory authorities could disallow our operating structure,

which would likely result in a material change in our operations and/or the value of our common stock, including that it could cause the

value of such securities to significantly decline or become worthless. For a detailed description of risks related to the holding corporate

structure, see “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.” for detailed discussions.

Additionally, we are subject to certain legal

and operational risks associated with our business operations in Hong Kong which is subject to significant and increasing influence and

interference from China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and we

face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to

conduct in Hong Kong and the profitability of such business. Therefore, these risks associated being based in or having the majority

of our operations in Hong Kong could cause the value of our securities to significantly decline or be worthless. Furthermore, these risks

may result in a material change in our business operations or a complete hinderance of our ability to offer or continue to offer our

securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement. The business of our subsidiaries until now are not subject to cybersecurity

review with the Cyberspace Administration of China, or CAC, given that: (i) our products and services are offered not directly to individual

users but through our institutional customers; (ii) we do not possess a large amount of personal information in our business operations;

and (iii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important

data by the authorities. In addition, we are not subject to merger control review by China’s anti-monopoly enforcement agency due

to the level of our revenues which provided from us and audited by our auditor, and the fact that we currently do not expect to propose

or implement any acquisition of control of, or decisive influence over, any company with revenues within Hong Kong or China of more than

RMB400 million. Currently, these statements and regulatory actions have had no impact on our daily business operation, the ability to

accept foreign investments and list our securities on an U.S. or other foreign exchange. However, since these statements and regulatory

actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing

or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential

impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments

and list our securities on an U.S. or other foreign exchange.

Our ability to pay dividends to our shareholders

and to service any debt we may incur may depend upon dividends paid by our Hong Kong Subsidiaries. Current Hong Kong regulations permit

our Hong Kong Subsidiaries to pay dividends to us, only out of their accumulated profits, if any, determined in accordance with Chinese

accounting standards and regulations. As of the date hereof, we have had no transactions that involved the transfer of cash or assets

throughout our corporate structure. The Hong Kong Subsidiaries have not transferred cash or other assets to Luduson G Inc., including

by way of dividends. Luduson G Inc. does not currently plan or anticipate transferring cash or other assets from our operations in Hong

Kong to any non-Chinese entity. For a detailed description of how cash is transferred through our corporate structure, see “Prospectus

Summary - Transfers of Cash to and from Our Subsidiaries.”

In light of the recent statements and regulatory

actions by the PRC government, such as those related to Hong Kong, data security, and anti-monopoly concerns, we may be subject to the

risks of uncertainty of any future actions of the PRC government in this regard, which may result in a material change in our operations,

including our ability to carry on our current business or accept foreign investments, and the resulting adverse change in value to our

common stock. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the Chinese Securities

Regulatory Commission, if we fail to comply with such rules and regulations, which could adversely affect the ability of the Company’s

securities to continue to trade on the Over-the-Counter Bulletin Board, which may cause the value of our securities to significantly

decline or become worthless. For a detailed description of the risks facing the Company and the offering associated with our operations

in Hong Kong, please refer to “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.”

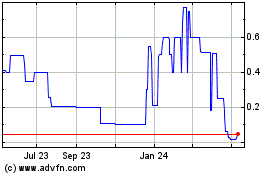

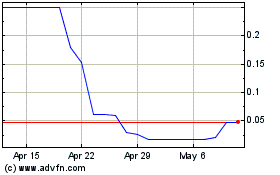

Our common stock is quoted on the QB tier of the

OTC Markets Group, Inc. (the “OTC Markets”) under the symbol “LDSN.” The shares of our common stock registered

hereunder are being offered for sale by Selling Security Holders at prices established on the OTC Markets during the term of this offering.

This offering will terminate on ____, 2022 [16 months after the effective date of this prospectus]. On October 28, 2021, the last day

that our common stock traded on the OTC Markets, the closing price of our common stock was $7.75 per share. These prices will fluctuate

based on the demand for our common stock.

We will receive gross proceeds of up to $5,000,000

from our own sale of the Strattner Put Shares and up to $30,000,000 from our own sale of the Williamsburg Put Shares. The proceeds will

be used for working capital or general corporate purposes. We will bear all costs associated with this registration.

Each of the selling stockholders are

an "underwriter" as such term is defined in the Securities Act of 1933, as amended (the "Securities Act"). The net

proceeds to be received by the selling stockholders is approximately $34,960,181 assuming that the Selling Security Holders sell the

lesser of: (i) such number of Strattner Put Shares and Williamsburg Put Shares necessary to result in gross proceeds of $35,000,000;

or (ii) all 7,100,000 shares offered herein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing in our common stock involves a high

degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock

in "Risk Factors" beginning on page 12 of this prospectus.

|

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

|

The following table of contents has been designed to help you find

information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus includes "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially

from those expected and projected. All statements, other than statements of historical facts, included in this prospectus including, without

limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

regarding the Company’s market projections, financial position, business strategy and the plans and objectives of management for

future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things

as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations;

and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company

in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other

factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's

expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions;

the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other

factors, most of which are beyond the control of the Company.

These forward-looking statements

can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates,"

"expects," "estimates," "plans," "may," "will," or similar terms. These statements appear

in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its

directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition, including without

limitation, the trend of increased government scrutiny and control into private enterprises by the PRC government or results of operations

for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned

that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and

that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such

factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history,

potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information

identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements,

please refer to the Risk Factors section of this prospectus.

Consequently, all of the forward-looking

statements made in this prospectus are qualified by these cautionary statements and there can be no assurance that the actual results

or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence

to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

PROSPECTUS SUMMARY

As used in this prospectus, references to the "Company",

"we", "our", "us", "Luduson G" refer to Luduson G Inc. unless the context otherwise indicates.

The following summary highlights selected information

contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the "Risk

Factors" section, the financial statements, and the notes to the financial statements.

THE OFFERING

|

Common Stock offered by Selling Security Holders:

|

|

This Prospectus relates to the resale of 7,100,000

million shares of our Common Stock, issuable to the Selling Security Holders.

|

|

|

|

|

|

Common Stock outstanding before the Offering:

|

|

28,200,000 shares of Common Stock as of the date of this Prospectus.

|

|

|

|

|

|

Common Stock outstanding after the Offering:

|

|

35,300,000

shares of Common Stock (1)

|

|

|

|

|

|

Terms of the Offering:

|

|

The Selling Security Holders will determine when and how it will sell the Common Stock offered in this Prospectus. The prices at which the Selling Security Holders may sell the shares of Common Stock in this Offering will be determined by the prevailing market price for the shares of Common Stock or in negotiated transactions.

|

|

|

|

|

|

Termination of the Offering

|

|

The Offering will conclude upon such time as all of the Common Stock has been sold pursuant to the Registration Statement.

|

|

|

|

|

|

Trading Market

|

|

Our Common Stock is subject to quotation on the OTC Markets QB under the symbol “LDSN.”

|

|

|

|

|

|

Use of proceeds

|

|

The Company is not selling any shares of the Common Stock covered by this Prospectus. As such, we will not receive any of the Offering proceeds from the registration of the shares of Common Stock covered by this Prospectus. See “Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of his/her/its entire investment. See “Risk Factors”.

|

(1) This total reflects the number of shares of

Common Stock that will be outstanding assuming that the Selling Security Holders purchase all of the 7,100,000 shares of our common stock

under the Investment Agreement and the Equity Purchase Agreement.

OUR COMPANY

Business Overview

We are a Nevada holding company

that, through our wholly owned Hong Kong operating subsidiaries, are a business-to-business gaming technology company. We provide events

marketing strategies with a combination of digital interactive solutions and content production services in Hong Kong. In digital marketing

industry, we offer business-to-business digital marketing solutions on our proprietary and secure network, which accommodates a wide range

of devices and theme-based gaming content, including multi-touch table, body motion sensing, indoor positioning device and electronic

circuit system, together with the customized game content, as an integrated marketing solution. We are principally engaged in developing

and distributing digital entertainment - interactive game software and providing system development consultancy, maintenance services

to our customers and providing interactive games installations in shopping mall events, exhibitions and brand promotions.

We provide our business customers

in the entertainment industry with a full line of custom-made interactive gaming services. In this entertainment segment, we offer a customized

device box with a library of self-developed interactive game contents, such as, sport-themed social games, motion-sensing action games,

logic and puzzle games, original IP characters education game for children, etc., to meet with our business customers’ operational

use or business-to-business social solutions.

Our goal is to provide innovative

and effective interactive solution services to satisfy diverse marketing needs. We are committed to working at a high-quality standard

to address the needs of differing budgets. We provide services to wide range of customer across different industry segments and regions.

Our principal executive and

registered offices are located at 17/F, 80 Gloucester Road, Wanchai, Hong Kong, telephone number +852-2119 1031.

We are not a Chinese operating

company but a Nevada holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong. We are currently

not required to obtain permission from the Chinese authorities to operate or

to issue securities to foreign investors. Our holding company structure presents unique risks as our investors may never directly

hold equity interests in our Hong Kong subsidiaries and will be dependent upon contributions from our subsidiaries to finance our cash

flow needs. Further, in light of the recent statements and regulatory actions by the PRC government, such as those related to Hong Kong’s

national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries,

which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions of the

PRC government in this regard, which may result in a material change in our operations, including our ability to continue our existing

holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our

investors, and the resulting adverse change in value to our common stock. We may also be subject to penalties and sanctions imposed by

the PRC regulatory agencies, including the Chinese Securities Regulatory Commission, if we fail to comply with such rules and regulations,

which could adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board,

which may cause the value of our securities to significantly decline or become worthless. For a detailed description of the risks facing

the Company and the offering associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Factors

Relating to Doing Business in Hong Kong.”

Our corporate structure

is below:

|

|

(1)

|

Luduson G Inc. was incorporated in

the state of Nevada on March 6, 2014.

|

|

|

(2)

|

Luduson Holding Company Limited is

a holding company incorporated under the laws of the British Virgin Islands.

|

|

|

(3)

|

Luduson Entertainment Limited is

a sales and marketing company incorporated under the laws of Hong Hong.

|

|

|

(4)

|

G Music Asia Limited is an event

planning company incorporated under the laws of the British Virgin Islands.

|

Risk Factor Summary

In addition to the foregoing risks, we face

various legal and operational risks and uncertainties arising from doing business in Hong Kong as summarized below and in “Risk

Factors — Risks Relating to Doing Business in Hong Kong.”

|

|

|

|

|

|

·

|

Adverse changes in economic

and political policies of the PRC government could have a material and adverse effect on overall economic growth in China and Hong

Kong, which could materially and adversely affect our business.

|

|

|

·

|

We

are a holding company and will rely on dividends paid by our subsidiaries for our cash needs any limitation on the ability of our

subsidiaries to make payments to us could have a material adverse effect on our ability to conduct business. We do not anticipate

paying dividends in the foreseeable future; you should not buy our stock if you expect dividends.

|

|

|

·

|

PRC

regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the

proceeds of this offering to make loans or additional capital contributions to our operating subsidiaries in Hong Kong.

|

|

|

·

|

Substantial

uncertainties exist with respect to the interpretation of the PRC Foreign Investment Law and how it may impact the viability of our

current corporate structure, corporate governance and business operations.

|

|

|

·

|

The

Chinese government exerts substantial influence over, and can intervene at any time with little to no advance notice: (i) in

the manner in which we operate and conduct our business activities; and (ii) offering conducted overseas and or foreign investment

in China-based issuers, which could result in a material change in our operations and or the value of our securities. . We are currently

not required to obtain approval from Chinese authorities to list on U.S. exchanges. However, to the extent that the Chinese government

exerts more control over offerings conducted overseas and/or foreign investment in Hong Kong-based issuers over time and if our subsidiaries

or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list

on U.S. exchanges, we will not be able to continue listing on a U.S. exchange and the value of our common stock may significantly

decline or become worthless, which would materially affect the interest of the investors.

|

|

|

·

|

Governmental

control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

|

|

|

·

|

We

may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection.

We may be liable for improper use or appropriation of personal information provided by our customers.

|

|

|

·

|

Under

the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely

result in unfavorable tax consequences to us and our non-PRC shareholders.

|

|

|

·

|

PRC

regulation of loans to, and direct investments in, Hong Kong entities by offshore holding companies may delay or prevent us from

using proceeds from this offering and/or future financing activities to make loans or additional capital contributions to our Hong

Kong operating subsidiaries.

|

|

|

·

|

Failure

to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our

PRC resident Shareholders to personal liability, may limit our ability to acquire Hong Kong and PRC companies or to inject capital

into our Hong Kong subsidiaries, may limit the ability of our Hong Kong subsidiaries to distribute profits to us or may otherwise

materially and adversely affect us.

|

|

|

·

|

The

recent joint statement by the SEC and PCAOB, and the Holding Foreign Companies Accountable Act all call for additional and more stringent

criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors

who are not inspected by the PCAOB. These requirements include requiring auditors of publicly traded companies to submit to

regular inspections every three years to assess such auditors’ compliance with applicable professional standards. If

the U.S. securities regulatory agencies are unable to conduct such investigations, they may determine to suspend or de-register our

registration with the SEC and may also delist our securities from applicable trading market within the US.

|

|

|

·

|

You

may be subject to PRC income tax on dividends from us or on any gain realized on the transfer of shares of our common stock.

|

|

|

·

|

We

face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

|

|

|

·

|

We

are organized under the laws of the State of Nevada as a holding company that conducts its business through a number of subsidiaries

organized under the laws of foreign jurisdictions such as Hong Kong. This may have an adverse impact on the ability of U.S. investors

to enforce a judgment obtained in U.S. Courts against these entities, bring actions in Hong Kong against us or our management or

to effect service of process on the officers and directors managing the foreign subsidiaries.

|

|

|

·

|

U.S.

regulatory bodies may be limited in their ability to conduct investigations or inspections of our operations in Hong Kong.

|

|

|

·

|

There

are significant uncertainties under the EIT Law relating to the withholding tax liabilities of PRC subsidiaries, and dividends payable

by PRC subsidiaries to our offshore subsidiaries may not qualify to enjoy certain treaty benefits

|

Transfers of Cash to and from Our Subsidiaries

Luduson G Inc. is a Delaware

holding company with no operations of its own. We conduct our operations in Hong Kong primarily through our subsidiaries in Hong Kong.

We may rely on dividends to be paid by our Hong Kong subsidiaries to fund our cash and financing requirements, including the funds necessary

to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses.

If our Hong Kong subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability

to pay dividends or make other distributions to us.

Luduson G Inc. is permitted

under the Delaware laws to provide funding to our subsidiaries in Hong Kong through loans or capital contributions without restrictions

on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements. Our Hong

Kong subsidiaries are also permitted under the laws of Hong Kong to provide funding to DH Enchantment, Inc. through dividend distribution

without restrictions on the amount of the funds. As of the date of this prospectus, there has been no dividends or distributions among

the holding company or the subsidiaries.

We currently intend to

retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring

or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion

of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements,

business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing

instruments.

Subject to the Nevada

Revised Statutes and our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such

an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets

will exceed our liabilities and we will be able to pay our debts as they become due. There is no further Nevada statutory restriction

on the amount of funds which may be distributed by us by dividend.

Under the current practice

of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws

and regulations of the PRC do not currently have any material impact on transfer of cash from DH Enchantment, Inc. to Ho Shun Yi Limited

or from Ho Shun Yi Limited to DH Enchantment, Inc. There are no restrictions or limitation under the laws of Hong Kong imposed on the

conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders and to U.S investors.

Current PRC regulations

permit PRC subsidiaries to pay dividends to Hong Kong subsidiaries only out of their accumulated profits, if any, determined in accordance

with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10%

of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each

of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although

the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be

used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective

companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. As of the date of this prospectus,

we do not have any PRC subsidiaries.

The PRC government also

imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may

experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of

dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments

governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive

all of the revenues from our operations, we may be unable to pay dividends on our common stock.

Cash dividends, if any,

on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends

we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at

a rate of up to 10.0%.

In order for us to pay

dividends to our shareholders, we will rely on payments made from our Hong Kong subsidiary to DH Enchantment, Inc. If in the future we

have PRC subsidiaries, certain payments from such PRC subsidiaries to Hong Kong subsidiaries will be subject to PRC taxes, including

business taxes and VAT. As of the date of this prospectus, we do not have any PRC subsidiaries and our Hong Kong subsidiary has not made

any transfers or distributions.

Pursuant to the Arrangement

between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income,

or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no

less than 25% of a PRC entity. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied,

including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong

Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt

of the dividends. In current practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to

apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case

basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and

enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by a PRC

subsidiary to its immediate holding company. As of the date of this prospectus, we do not have a PRC subsidiary. In the event that we

acquire or form a PRC subsidiary in the future and such PRC subsidiary desires to declare and pay dividends to our Hong Kong subsidiary,

our Hong Kong subsidiary will be required to apply for the tax resident certificate from the relevant Hong Kong tax authority. In such

event, we plan to inform the investors through SEC filings, such as a current report on Form 8-K, prior to such actions. See “Risk

Factors – Risk Factors Relating to Doing Business in Hong Kong.”

Corporate Developments

We were incorporated under

the laws of the State of Delaware on March 6, 2014, under the name “Jovanovic-Steele, Inc.” Our name was changed to Baja Custom

Designs, Inc. on October 26, 2017.

April 2020 Change in Control

On April 3, 2020, the Company,

Linda Masters, our Chief Executive Officer and President, entered into that certain Stock Purchase Agreement (the “SPA”),

pursuant to which Ms. Masters agreed to sell to Lan CHAN 14,960,000 shares of common stock of the Company, par value $0.0001 (the “Shares”),

representing approximately 95.8% of the issued and outstanding common stock of the Company, for aggregate consideration of Three Hundred

Ninety One Thousand Dollars ($391,000) in accordance with the terms and conditions of the SPA. The acquisition of the Shares consummated

on April 15, 2020, and was purchased by Lan CHAN with his personal funds. As a result of the acquisition, Mr. Chan holds a controlling

interest in the Company and may unilaterally determine the election of the Board and other substantive matters requiring approval of the

Company’s stockholders.

Upon the consummation of the

sale of the Shares, Linda Masters, our Chief Executive Officer, President and director, and Kathleen Chula, our Vice President and Director,

resigned from all of their positions with the Company, effective April 15, 2020. Their resignations were not due to any dispute or disagreement

with the Company on any matter relating to the Company's operations, policies or practices.

Concurrently with such resignations,

Lan CHAN was appointed to serve as the Chief Executive Officer, Chief Financial Officer, President, Secretary and sole Director of the

Company, until the next annual meeting of stockholders of the Company and until such director’s successor is elected and qualified

or until such director’s earlier death, resignation or removal. None of the directors or executive officers has a direct family

relationship with any of the Company’s directors or executive officers, or any person nominated or chosen by the Company to become

a director or executive officer. Mr. Chan will serve in his positions without compensation. The Company hopes to enter into a compensatory

arrangement with each officer in the future.

Acquisition of Luduson

Holding Company Limited

On May 8, 2020, we executed

a Share Exchange Agreement, or the “Share Exchange Agreement,” with Luduson Holding Company Limited, a limited liability company

organized under the laws of British Virgin Islands, or “LHCL,” and the shareholders of LHCL. Pursuant to the Share Exchange

Agreement, we purchased Ten Thousand (10,000) shares of LHCL, or the “LHCL Shares,” representing all of the issued and outstanding

shares of common stock of LHCL. As consideration, we agreed to issue to the shareholders of LHCL Ten Million (10,000,000) shares of our

common stock, at a value of US $0.10 per share, for an aggregate value of US $1,000,000. We consummated the acquisition of LHCL on May

22, 2020. LHCL is a business-to-business gaming technology company. As a result of our acquisition of LHCL, we entered into the business-to-business

gaming technology industry.

Investment Agreement with Strattner Alternative

Credit Fund LP

The Company is a party to

an Investment Agreement dated as of April 6, 2021, or the “Investment Agreement,” with Strattner pursuant to which Strattner

is committed to purchase up to $5,000,000, or the “Strattner Total Commitment,” worth of the Company’s common stock,

$0.0001 par value, over the 36-month term of the Investment Agreement.

From time to time over the

term of the Investment Agreement, commencing on the trading day immediately following the date on which the initial registration statement

is declared effective by the Securities and Exchange Commission, or the “Commission,” as further discussed below, the Company

may, in its sole discretion, provide Strattner with written notices, or a “Strattner Put Notice,” stating the amount of Common

Shares of the Company that the Company intends to sell to Strattner, or the “Strattner Put Amount,” with each put subject

to the limitations discussed below. The maximum amount of common stock that the Company shall be entitled to put to Strattner under any

applicable put notice, or the “Maximum Strattner Put Amount,” shall be an amount of shares up to or equal to 200% of the average

of the daily trading volume of our common stock for the ten (10) consecutive trading days immediately prior to the applicable date on

which we make our put to Strattner, so long as such amount is at least $5,000 and does not exceed $250,000, as calculated by multiplying

the number of shares under our put by the average daily volume weighted average price for the 10 consecutive trading days immediately

prior to the applicable date we submit our put to Strattner.

Once presented with a Strattner

Put Notice, Strattner is required to purchase the number of Strattner Put Shares underlying the Strattner Put Notice. The per share purchase

price for the Common Shares subject to a Strattner Put Notice shall be equal to 85% of the lowest volume weighted average price of the

Common Shares during the five (5) consecutive trading days including and immediately following the applicable Strattner Put Notice date,

provided, however, an additional 10% will be added to the discount of each Put if (i) the Company is not DWAC eligible and (ii) an additional

15% will be added to the discount of each Put if the Company is under DTC “chill” status on the applicable Strattner Put Notice

Date.

Among other conditions, the

Company is prohibited from issuing a Strattner Put Notice if (i) the amount requested in such Strattner Put Notice exceeds Two Hundred

Fifty Thousand Dollars ($250,000), as calculated by multiplying the Strattner Put Amount by the average daily VWAP for the ten (10) consecutive

trading days immediately prior to the applicable Strattner Put Notice Date, (ii) the sale of Shares pursuant to such Strattner Put Notice

would cause the Company to issue or sell or Strattner to acquire or purchase an aggregate dollar value of Shares that would exceed Five

Million Dollars ($5,000,0000), or (iii) the sale of Shares pursuant to the Strattner Put Notice would cause the Company to sell or Strattner

to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership by Strattner

of more than 9.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934,

as amended, and the rules and regulations thereunder). The Company cannot make more than one put in any pricing period and must allow

10 days to elapse between the completion of the settlement of any one put and the commencement of a pricing period for any other put.

Registration Rights Agreement with Strattner

Alternative Credit Fund LP

In connection with the execution

of the Investment Agreement, on April 6, 2021, the Company and Strattner also entered into a Registration Rights Agreement, or the “Strattner

Registration Rights Agreement.” Pursuant to the Registration Rights Agreement, the Company has agreed to file an initial registration

statement, the “Registration Statement,” with the Commission to register an agreed upon number of Strattner Put Shares, on

or prior to July 5, 2021, or the “Filing Deadline,” and have it declared effective on or before the 150th calendar day the

Company has filed the Registration Rights Agreement, or the “Effectiveness Deadline.” Notwithstanding anything to the contrary,

the Company is not obligated to file Registration Statements with respect to securities not issued pursuant to the Investment Agreement.

If at any time all of the

Registrable Securities (as defined in the Registration Rights Agreement) are not covered by the initial Registration Statement, the Company

has agreed to file with the Commission one or more additional Registration Statements so as to cover all of the Registrable Securities

not covered by such initial Registration Statement, in each case, as soon as practicable, but in no event later than the applicable filing

deadline for such additional Registration Statements as provided in the Registration Rights Agreement.

Equity Purchase Agreement with Williamsburg

Venture Holdings, LLC

The Company is a party to

an Equity Purchase Agreement dated August 20, 2021, or the “Equity Purchase Agreement,” pursuant to which Williamsburg is

committed to purchase up to $30,000,000 worth of the Company’s common stock, $0.0001 par value, over the 36-month term of the Equity

Purchase Agreement, or the “Williamsburg Total Commitment”. From time to time over the term of the Equity Purchase Agreement,

the Company may, in its sole discretion, provide Williamsburg with written notices, or a “Williamsburg Put Notice,” stating

the amount of Common Shares of the Company that the Company intends to sell to Williamsburg, or the “Williamsburg Put Amount.”

Once presented with a Williamsburg Put Notice, Williamsburg is required to purchase the number of Williamsburg Put Shares underlying

the Williamsburg Put Notice with each put subject to the limitations discussed below.

The per share purchase price

for the Williamsburg Put Shares shall be equal to 88% the lowest traded price of the Common Stock on the principal market during the five

(5) consecutive trading days immediately preceding the date which Williamsburg received the Williamsburg Put Shares as DWAC Shares in

its brokerage account (as reported by Bloomberg Finance L.P., Quotestream, or other reputable source).

The exercise of each put option is

subject to the following limitations:

|

|

(i)

|

each investment amount must be at least than $25,000

and not in excess of an amount that equals the lesser of (i) 200% of the average daily trading volume, and (ii) $500,000;

|

|

|

(ii)

|

the aggregate investment amount of all option puts shall not exceed $30,000,000;

|

|

|

(iii)

|

the lowest traded price of the Common Stock in the five trading days preceding the respective Put Date must exceed $0.01 per share;

and

|

|

|

(iv)

|

at least ten trading days must have lapsed since the most recent Put Notice.

|

The Equity Purchase Agreement provides that the

number of Williamsburg Put Shares to be sold to Williamsburg shall not exceed the number of shares that when aggregated together with

all other shares of the Company’s common stock which Williamsburg is deemed to beneficially own, would result in Williamsburg owning

more than 4.99% of the Company’s outstanding common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act

of 1934, as amended, and the rules and regulations thereunder). The Equity Purchase Agreement provides that any provision of the Investment

Agreement may be amended or waived only by an instrument in writing signed by the party to be charged with enforcement.

The Company has paid to Williamsburg a commitment

fee equal in the form of 100,000 restricted shares of the Company’s common stock (the “Williamsburg Initial Commitment Shares”).

Registration Rights Agreement with Williamsburg

Venture Holdings, LLC

In connection with the Equity

Purchase Agreement, on August 20, 2021, the Company and Williamsburg also entered into a Registration Rights Agreement, or the “Williamsburg

Registration Rights Agreement.” Pursuant to the Williamsburg Registration Rights Agreement, the Company has agreed to file an initial

registration statement, or the “Registration Statement,” with the Commission to register the Williamsburg Initial Commitment

Shares and that number of Williamsburg Put Shares as set forth in the Williamsburg Registration Rights Agreement, within 90 days after

the execution date, or the “Filing Deadline.”.

If at any time all of the

Registrable Securities (as defined in the Registration Rights Agreement) are not covered by the initial Registration Statement, the Company

has agreed to file with the Commission one or more additional Registration Statements so as to cover all of the Registrable Securities

not covered by such initial Registration Statement, in each case, as soon as practicable, but in no event later than the applicable filing

deadline for such additional Registration Statements as provided in the Registration Rights Agreement.

We are a “Smaller Reporting Company”

We are a “smaller reporting

company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company

that is not a smaller reporting company and have (i) a public float of less than $250 million or (ii) annual revenues of less than $100

million during the most recently completed fiscal year and no public float, or a public float of less than $700 million. As a “smaller

reporting company,” the disclosure we will be required to provide in our SEC filings are less than it would be if we were not considered

a “smaller reporting company.” Specifically, “smaller reporting companies” are able to provide simplified executive

compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002 requiring

that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial

reporting; are not required to conduct say-on-pay and frequency votes until annual meetings; and have certain other decreased disclosure

obligations in their SEC filings, including, among other things, being permitted to provide two years of audited financial statements

in annual reports rather than three years.

SUMMARY FINANCIAL INFORMATION

The tables and information

below are derived from our audited financial statements for the fiscal year ended December 31, 2020, and our unaudited financial statements

for the nine months ended September 30, 2021 and 2020. Our working capital as at September 30, 2021 was $_______.

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2021

|

|

|

December 31, 2020

|

|

|

|

|

(Unaudited)

|

|

|

(Audited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current asset:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

60,618

|

|

|

$

|

40,447

|

|

|

Accounts receivable

|

|

|

5,098,954

|

|

|

|

4,499,746

|

|

|

Deposits, prepayments and other receivables

|

|

|

829,108

|

|

|

|

665,052

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

5,988,680

|

|

|

|

5,205,245

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current asset:

|

|

|

|

|

|

|

|

|

|

Plant and equipment

|

|

|

301,795

|

|

|

|

422,414

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

6,290,475

|

|

|

$

|

5,627,659

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued liabilities and other payables

|

|

$

|

44,447

|

|

|

$

|

26,772

|

|

|

Tax payable

|

|

|

843,826

|

|

|

|

743,562

|

|

|

Amount due to a director

|

|

|

56,568

|

|

|

|

28,290

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

944,841

|

|

|

|

798,624

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

944,841

|

|

|

|

798,624

|

|

|

|

|

Nine Months Ended September 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Revenues

|

|

$

|

927,053

|

|

|

$

|

2,945,508

|

|

|

Cost of revenue

|

|

|

(102,986

|

)

|

|

|

(743,860

|

)

|

|

Gross profit

|

|

|

824,067

|

|

|

|

2,201,648

|

|

|

Total operating expenses

|

|

|

(181,215

|

)

|

|

|

(523,390

|

)

|

|

Other income

|

|

|

–

|

|

|

|

(1,341

|

)

|

|

Income before Income Taxes

|

|

|

642,852

|

|

|

|

1,676,917

|

|

|

Income tax expense

|

|

|

(103,772

|

)

|

|

|

(178,846

|

)

|

|

Net income

|

|

$

|

539,080

|

|

|

$

|

1,498,071

|

|

|

|

|

As of December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current asset:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

40,447

|

|

|

$

|

269,691

|

|

|

Accounts receivable

|

|

|

4,499,746

|

|

|

|

760,733

|

|

|

Deposits, prepayments and other receivables

|

|

|

665,052

|

|

|

|

142,001

|

|

|

Operating lease right-of-use assets

|

|

|

–

|

|

|

|

35,816

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

5,205,245

|

|

|

|

1,208,241

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current asset:

|

|

|

|

|

|

|

|

|

|

Plant and equipment

|

|

|

422,414

|

|

|

|

9,172

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

5,627,659

|

|

|

$

|

1,217,413

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

3,251

|

|

|

$

|

–

|

|

|

Accrued liabilities and other payables

|

|

|

23,521

|

|

|

|

1,289

|

|

|

Tax payable

|

|

|

743,562

|

|

|

|

139,804

|

|

|

Operating lease liabilities

|

|

|

–

|

|

|

|

36,690

|

|

|

Amount due to a director

|

|

|

28,290

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

798,624

|

|

|

|

177,783

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

798,624

|

|

|

|

177,783

|

|

|

|

|

Years ended December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Revenues

|

|

$

|

5,935,720

|

|

|

$

|

1,426,354

|

|

|

Cost of revenue

|

|

|

(1,027,662

|

)

|

|

|

(283,828

|

)

|

|

Gross profit

|

|

|

4,908,058

|

|

|

|

1,142,526

|

|

|

Total operating expenses

|

|

|

(659,097

|

)

|

|

|

(164,293

|

)

|

|

Other (expenses) income

|

|

|

(1,898

|

)

|

|

|

2

|

|

|

Income before Income Taxes

|

|

|

4,247,063

|

|

|

|

978,235

|

|

|

Income tax expense