Nestlé Bends Under Activist Pressure -- WSJ

September 27 2017 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 27, 2017).

LONDON -- Nestlé SA on Tuesday introduced a profit-margin target

and said it would accelerate share buybacks amid pressure from

activist investor Dan Loeb, while remaining firm on retaining a

stake in cosmetics giant L'Oréal SA.

The consumer-goods company's strategy has been in the spotlight

since Mr. Loeb's Third Point LLC hedge fund built a 1.3% stake in

Nestlé and in June advocated steps to improve its performance,

including the sale of its stake in L'Oréal and the setting of a

margin target.

Nestlé on Tuesday said it would strive for a trading operating

profit margin of 17.5% to 18.5% by 2020 on an "underlying" basis,

which among other things strips out one-time charges. Its margin in

the first half was 15.8%.

The company also plans to tweak the $20.8 billion share-buyback

program it announced in June. It will now purchase shares evenly in

each of the three years to 2020, rather than back load them in 2019

and 2020.

Nestlé said about 10% of its portfolio by sales is ripe for a

shuffling as it looks to shed slow-growth assets and invest in more

promising ventures.

Shares in the company rose 1.8% on Tuesday.

The raft of announcements accompanying a closely watched

investor day in London are the latest moves by the Swiss company to

improve its performance under a new chief executive and pressure

from Mr. Loeb.

Since Mark Schneider took the reins in January, Nestlé has said

it would sell its U.S. confectionery arm and announced investments

in Blue Bottle coffee, food-delivery startup Freshly and

plant-protein-based-foods brand Sweet Earth. Mr. Schneider in

February also scrapped a key internal sales target, which the

company had repeatedly missed.

After Mr. Loeb in June publicly disclosed his $3.5 billion stake

in Nestlé and listed his demands, Mr. Schneider announced the

share-buyback program and laid out the company's investment

priorities. He said Nestlé will focus on the high-growth areas of

petcare, coffee, infant nutrition and bottled water, while also

pursuing opportunities in consumer health care.

With Tuesday's announcement, Nestlé has largely met three of Mr.

Loeb's demands -- setting a margin target, launching buybacks and

using acquisitions and divestitures to drive growth -- but is

resisting a fourth.

Mr. Schneider said Nestlé isn't planning to change its 23.29%

stake in L'Oréal, which has been in focus following the death last

week of Liliane Bettencourt, heiress to the L'Oréal fortune.

"The investment is not diluting anything," Mr. Schneider said

Tuesday, adding that the L'Oréal stake has delivered a 12% annual

return on investment over the 42 years Nestlé has held it. "Our

approach to this investment is currently not changing."

Third Point declined to comment.

RBC analyst James Edwardes Jones said Nestlé's new margin target

was already baked into his estimates, leaving his target price

unchanged.

UBS analyst Pinar Ergun was more bullish, saying the targets

could prompt analysts to raise consensus expectations for 2020

per-share earnings. "More importantly it is likely to reassure the

skeptics that change is under way at Nestlé," she said.

Nestlé is aiming for mid-single-digit organic sales growth by

2020 even as it tries to improve margins, a balancing act Mr.

Schneider described as "going for a run and going for a dive at the

same time."

The company outlined plans to boost sales by fixing

underperforming businesses, like its Yinlu peanut milk brand in

China, making acquisitions and focusing on its four high-growth

businesses.

Nestlé will also further invest in frozen foods, noting that 90%

of U.S. households have a microwave and a freezer, making this a

big market. It also plans to focus on ready-to-drink cold coffee

and out-of-home coffee, Mr. Schneider said, highlighting the

opportunity in increase coffee consumption in China, India and

Africa.

Meanwhile, Nestlé plans to cut costs in manufacturing,

procurement and general and administrative areas, saying it will

spend 2.5 billion francs ($2.59 billion) on restructuring between

2016 and 2020 to achieve annual cost savings of between 2 billion

and 2.5 billion francs by 2020. To do this, the company will

consolidate offices, increase its global buying, close factories

and outsource management of its pension fund, among other

measures.

Nestlé has also been working to fix problems in its skin-health

business, which suffered because of what Mr. Schneider described as

"self-inflicted issues" after Nestlé invested aggressively in

consumer skin-care products and as patents on prescription products

expired. Last week, the company said it was cutting about 400 of

the 550 employees at its Galderma skin-care research and

development facility in France as it pivots away from topical

prescription creams for skin. A global review of the skin-health

business is under way.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

September 27, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

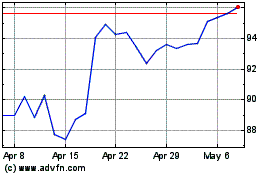

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Nov 2023 to Nov 2024