- Additional Proxy Soliciting Materials - Non-Management (definitive) (DFAN14A)

September 30 2010 - 4:28PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

Filed by

the Registrant

¨

Filed by a Party other than the Registrant

þ

Check the

appropriate box:

|

|

Preliminary

Proxy Statement

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

Definitive

Proxy Statement

|

|

|

Definitive

Additional Materials

|

|

¨

|

Soliciting

Material Pursuant to §240.14a-12

|

LIVE CURRENT MEDIA,

INC.

(Name of

the Registrant as Specified In Its Charter)

DAVID

JEFFS

JOHN DA

COSTA

CARL

JACKSON

SUSAN

JEFFS

CAMERON

PAN

ADAM

RABINER

AMIR

VAHABZADEH

(Name(s)

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

þ

|

No

fee required.

|

|

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and

0-11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

N/A

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies: N/A

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

|

N/A

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction: N/A

|

|

|

(5)

|

Total

fee paid: N/A

|

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

|

|

¨

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

(1)

|

Amount

Previously Paid: N/A

|

|

|

(2)

|

Form.

Schedule or Registration Statement No.: N/A

|

|

|

(3)

|

Filing

Party: N/A

|

|

|

(4)

|

Date

Filed: N/A

|

|

|

|

|

|

|

|

|

|

442,688

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,215,285

|

1,475,002

|

|

|

|

1,907,531

|

|

3.308978499

|

|

|

|

8,434,468

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/02

|

3/31/03

|

6/30/03

|

9/30/03

|

12/31/03

|

3/31/04

|

6/30/04

|

9/30/04

|

12/31/04

|

3/31/05

|

6/30/05

|

9/30/05

|

12/31/05

|

3/31/06

|

6/30/06

|

9/30/06

|

12/31/06

|

3/31/07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

81,157

|

173,895

|

394,734

|

581,049

|

496,109

|

733,107

|

817,156

|

1,469,079

|

978,326

|

1,050,055

|

1,017,659

|

2,722,023

|

1,531,946

|

1,585,330

|

2,127,828

|

3,189,364

|

1,691,245

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

|

5,870

|

27,801

|

144,481

|

71,641

|

45,221

|

120,908

|

137,257

|

194,711

|

133,472

|

115,670

|

116,609

|

8,189

|

(39,117)

|

81,738

|

347,859

|

23,957

|

(28,772)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

64,654

|

88,823

|

113,611

|

234,859

|

208,794

|

212,328

|

262,514

|

475,244

|

297,782

|

347,447

|

368,869

|

729,990

|

419,955

|

536,104

|

427,709

|

590,281

|

434,820

|

|

AMZN

|

|

|

|

|

|

|

54.40

|

34.13

|

44.29

|

34.27

|

33.09

|

45.30

|

47.15

|

36.53

|

38.68

|

32.12

|

39.46

|

39.39

|

|

Quote

|

|

0.04

|

0.15

|

0.17

|

0.25

|

0.42

|

0.32

|

0.6

|

0.6

|

0.62

|

0.81

|

1.15

|

1.35

|

1.3

|

0.94

|

0.99

|

1.35

|

1.03

|

|

|

359,204

|

1,810,944

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffs

|

Hampson

|

|

|

|

|

-0.085628937

|

|

|

|

-0.339634211

|

|

|

|

|

|

1,238,679

|

2,025,680

|

|

|

|

|

|

|

|

|

|

-0.481714603

|

-0.59154557

|

|

|

|

6/30/07

|

9/30/07

|

12/31/07

|

3/31/08

|

6/30/08

|

9/30/08

|

12/31/08

|

3/31/09

|

6/30/09

|

9/30/09

|

12/31/09

|

3/31/10

|

6/30/10

|

9/30/2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

1,656,164

|

1,770,594

|

3,961,231

|

1,852,660

|

1,935,454

|

1,954,684

|

3,622,035

|

1,752,382

|

1,704,905

|

1,757,736

|

2,391,868

|

908,234

|

696,376

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

(219,180)

|

(429,166)

|

(1,340,831)

|

(1,994,218)

|

(2,025,905)

|

(3,050,207)

|

(2,936,126)

|

(916,408)

|

(1,407,423)

|

703,127

|

(2,389,309)

|

84,078

|

(384,194)

|

|

|

|

71,573

|

(1,340,549)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

651,896

|

935,013

|

2,450,360

|

2,567,339

|

2,399,153

|

2,343,285

|

3,906,785

|

2,110,994

|

1,530,396

|

1,212,560

|

1,276,304

|

1,007,271

|

1,150,917

|

|

|

AMZN

|

68.41

|

93.15

|

92.64

|

71.30

|

73.33

|

72.76

|

51.28

|

73.44

|

83.66

|

93.36

|

134.52

|

135.77

|

109.26

|

|

|

Quote

|

2

|

2.15

|

2.06

|

2.54

|

2.82

|

1.45

|

0.37

|

0.35

|

0.28

|

0.2

|

0.29

|

0.18

|

0.13

|

0.08

|

|

*

|

Mr.

Jeffs left the management team of LIVC in Q2-2007 at a stock price of

approximately

$2.00/sh.

While shares did spike during 1Q-2008, it has subsequently fallen to

$0.08/sh.

|

|

*

|

During

Mr. Jeffs' leadership, the share price rose from $0.04/share in Q1-2003,

to

$2.00

at the end of Q2-2007, an increase of

4.900%!

|

|

*

|

While

the share pricre did spike early in Mr. Sampson's tenure, the shre price

has dropped

precipitously

since 3Q-2008. Since the end of Q2-2007, the share price has declined form

$2.00/sh to $0.08/share or 98%.

|

|

*

|

Sales

have risen since Mr. Hampson took over in Q2-2007, but are down

considerably this year.

|

|

*

|

While

sales are up, profits have been suffering under Mr. Hampson's

leadership.

|

|

*

|

In

addition, operating expenses have increased dramatically during Mr.

Hampson's tenure.

|

|

*

|

For

the 4 years up until Mr. Jeffs' departure in Q2-2007, quarterly profits

averaged $71,573

|

|

*

|

Since

Mr. Hampson has been in control, quarterly

LOSSES

have

averaged $1,340,549

|

|

*

|

During

Mr. Jeffs's tenure as head of LIVC, the company showed profits 15 out of

18 quarters

|

|

*

|

For

the 3 years Mr. Hampson has been in control, there have been only 2

quarters out of 12 that LIVC has achieved a net

profit.

|

|

*

|

During

Mr. Jeffs' tenure (1Q-2003, through

2Q-2007, quarterly sales averaged

$1,238,679

|

|

*

|

While

the average quarterly sales for the 3 years Mr. Hampson has been in

control averaged $2,025,680, this year's 1Q sales are down 48%

year-to-year and 2Q sales are down 59%

year-to-year.

|

|

*

|

Sales

showed continued growth during Mr. Jeffs' tenure. The sales for each

subsequent quarter every year, were higher than the previous year's

corresponding quarter.

|

|

*

|

Sales

have not showed the steady growth during Mr Hampson's leadership. In

addition to the aforementioned decline in sales during the first two

quarters of 2010 compared to 2009, sales in the traditionally strong 4Q

were down 9% from 4Q-2007 to 4Q-2008, and down 34% from 4Q-2008 to

4Q-2009

|

|

*

|

Under

the leadership of Mr. Jeffs, operatiing expenses were held in check (Q1 –

2003 through Q2-2007). Conversely, operating expenses rose dramatically

during Mr. Sampson's leadership.

|

|

*

|

Prior

to Mr. Jeffs departure in Q2-2007, quarterly operating expenses averaged

just $359,204

|

|

*

|

In

the 3 years Mr. Hampson has been in control, quarterly operating expenses

have

increased

404%, to an average of $1,811,000 per

quarter.

|

|

12/31/04

|

3/31/05

|

6/30/05

|

9/30/05

|

12/31/05

|

3/31/06

|

6/30/06

|

9/30/06

|

12/31/06

|

3/31/07

|

6/30/07

|

|

44.29

|

34.27

|

33.09

|

45.30

|

47.15

|

36.53

|

38.68

|

32.12

|

39.46

|

39.39

|

68.41

|

|

0.6

|

0.62

|

0.81

|

1.15

|

1.35

|

1.3

|

0.94

|

0.99

|

1.35

|

1.03

|

2

|

|

693.63

|

675.45

|

687.61

|

712.21

|

723.31

|

758.45

|

740.14

|

771.07

|

822.13

|

829.05

|

873.19

|

|

328.8

|

321.26

|

333.1

|

350.2

|

350.67

|

394.83

|

375.97

|

371.78

|

400.02

|

411.9

|

432.31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-18.58%

|

-37.00%

|

-39.17%

|

-16.73%

|

-13.33%

|

-32.85%

|

-28.90%

|

-40.96%

|

-27.46%

|

-27.59%

|

25.75%

|

|

1400.00%

|

1450.00%

|

1925.00%

|

2775.00%

|

3275.00%

|

3150.00%

|

2250.00%

|

2375.00%

|

3275.00%

|

2475.00%

|

4900.00%

|

|

46.83%

|

42.99%

|

45.56%

|

50.77%

|

53.12%

|

60.56%

|

56.68%

|

63.23%

|

74.04%

|

75.50%

|

84.85%

|

|

77.94%

|

73.86%

|

80.27%

|

89.52%

|

89.78%

|

113.68%

|

103.47%

|

101.20%

|

116.48%

|

122.91%

|

133.96%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/07

|

12/31/07

|

3/31/08

|

6/30/08

|

9/30/08

|

12/31/08

|

3/31/09

|

6/30/09

|

9/30/09

|

12/31/09

|

3/31/10

|

6/30/10

|

|

9/29/2010

|

|

93.15

|

92.64

|

71.30

|

73.33

|

72.76

|

51.28

|

73.44

|

83.66

|

93.36

|

134.52

|

135.77

|

109.26

|

|

158.99

|

|

2.15

|

2.06

|

2.54

|

2.82

|

1.45

|

0.37

|

0.35

|

0.28

|

0.2

|

0.29

|

0.18

|

0.13

|

|

0.08

|

|

882.79

|

849.22

|

764.63

|

748.1

|

678.5

|

520.6

|

461.14

|

535.62

|

619.87

|

653.13

|

688.74

|

607.92

|

|

676.56

|

|

423.43

|

395.14

|

364.59

|

364.94

|

360.68

|

268.73

|

222.43

|

268.32

|

317.43

|

332.63

|

360.3

|

327.97

|

|

359.93

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

71.23%

|

70.29%

|

31.07%

|

34.80%

|

33.75%

|

-5.74%

|

35.00%

|

53.79%

|

71.62%

|

147.28%

|

149.58%

|

100.85%

|

|

|

|

5275.00%

|

5050.00%

|

6250.00%

|

6950.00%

|

3525.00%

|

825.00%

|

775.00%

|

600.00%

|

400.00%

|

625.00%

|

350.00%

|

225.00%

|

|

100.00%

|

|

86.88%

|

79.77%

|

61.86%

|

58.36%

|

43.63%

|

10.21%

|

-2.38%

|

13.39%

|

31.22%

|

38.26%

|

45.80%

|

28.69%

|

|

43.22%

|

|

129.15%

|

113.84%

|

97.31%

|

97.50%

|

95.19%

|

45.43%

|

20.38%

|

45.21%

|

71.79%

|

80.01%

|

94.99%

|

77.49%

|

|

94.79%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

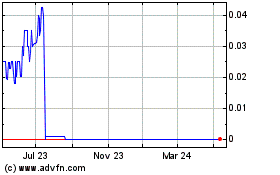

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Jul 2023 to Jul 2024