UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A/A

AMENDMENT

NO. 1

Tier

1 offering

Offering

Statement UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

LifeQuest

World Corp.

(Exact name of registrant as specified in its

charter)

Date: May 29, 2024

| Minnesota |

4950 |

88-0407679 |

|

(State or Other Jurisdiction

of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer

Identification No.)

|

100 Challenger Road, 8th Floor

Ridgefield Park, NJ 07660

Phone: 646-201-5242

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

CT Corporation System Inc.

100 S 5th Str #1075

Minneapolis, MN 55402

Phone: 562-986-8043

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE

COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION

A.

PART I - NOTIFICATION

Part I should be read in conjunction with the

attached XML Document for Items 1-6

PART I - END

Please send copies of all correspondence to:

The Doney Law Firm

4955 S. Durango Rd. Ste. 165

Las Vegas, NV 89113

(702) 982-5686

PRELIMINARY OFFERING CIRCULAR DATED MAY 29,

2024

An offering statement pursuant to Regulation A relating to

these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information

contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may

offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall

not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in

which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may

elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular

was filed may be obtained.

LifeQuest

World Corp.

13,000,000 SHARES OF COMMON STOCK

$0.001 PAR VALUE PER SHARE

In this public offering of 13,000,000 shares of our common stock, we are

offering 10,000,000 shares of our common stock and the selling shareholders are offering 3,000,000 shares of our common stock underlying

warrants. We will not receive any of the proceeds from the sale of shares by the selling shareholders unless the warrants are exercised.

This offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount

will be sold.

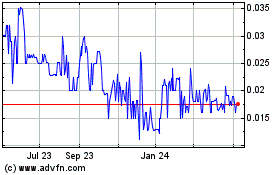

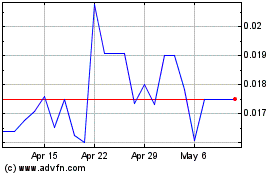

Our Common Stock trades in the OTCMarket Pink Open Market under the symbol

LQWC. There is currently no active trading market for our securities. There is no assurance that a regular trading market will develop,

or if developed, that it will be sustained. Therefore, shareholders may be unable to resell their securities in our company.

All of the shares being registered for sale by us will be sold at a fixed

price, which will be within a range of $0.05 to $0.10 per share, established at qualification for the duration of the offering. There

is no minimum amount we are required to raise from the shares being offered by the Company. There is no minimum amount we are required

to raise from the shares being offered by the Company. There are no arrangements to place the funds received in an escrow, trust, or similar

arrangement and the funds will be available to us following deposit into the Company’s bank account. There is no guarantee that

we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this offering will successfully

raise enough funds to institute our company’s business plan.

Resale shares may be sold to or through underwriters or dealers, directly

to purchasers or through agents designated from time to time by the selling shareholders. For additional information regarding the methods

of sale, you should refer to the section entitled “Plan of Distribution” in this offering. There is no minimum number of shares

required to be purchased by each investor.

This primary offering will terminate upon the earliest of (i) such time

as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days

from the qualified date of this offering circular, unless extended by our directors for an additional 90 days. We may, however, at any

time and for any reason terminate the offering.

| SHARES

OFFERED BY COMPANY |

|

PRICE

TO PUBLIC(1) |

|

SELLING

AGENT COMMISSIONS |

|

PROCEEDS

TO THE COMPANY(2) |

| Per Share |

|

$ |

0.10 |

|

|

$ |

Not applicable |

|

$ |

0.10 |

| Minimum Purchase |

|

|

None |

|

|

|

Not applicable |

|

|

Not applicable |

| Total (10,000,000 shares) |

|

$ |

1,000,000 |

|

|

$ |

Not applicable |

|

$ |

1,000,000 |

| |

(1) |

Price range of offering being estimated

pursuant to Rule 253(b). Estimate includes a maximum offering price of $0.10 and a maximum number of shares offered in this offering

of 10,000,000 shares for an estimated maximum aggregate offering of $1,000,000. |

| |

(2) |

Does not include expenses of the offering, estimated

to be $65,000 including legal, accounting and other costs of registration. |

| SHARES

OFFERED SELLING SHAREHOLDERS |

|

PRICE

TO PUBLIC(1) |

|

SELLING

AGENT COMMISSIONS |

|

PROCEEDS

TO THE SELLING SHAREHOLDERS |

| Per

Share |

|

$ |

0.10 |

|

Not

applicable |

|

$ |

0.10 |

| Minimum

Purchase |

|

None |

|

Not

applicable |

|

Not

applicable |

| Total

(3,000,000 shares) |

|

$ |

300,000 |

|

Not

applicable |

|

$ |

300,000 |

| |

(1) |

Price range of offering being estimated

pursuant to Rule 253(b). Estimate includes a maximum offering price of $0.10 and a maximum number of shares offered in this

offering of 3,000,000 shares for an estimated maximum aggregate offering of $300,000. |

We

expect to commence the offer and sale of the shares of common stock being offered pursuant to this offering circular within two

calendar days of the qualification date, but only after filing a supplement to include the offering price per share within the range

presented.

NO FEDERAL OR STATE SECURITIES COMMISSION HAS APPROVED, DISAPPROVED,

ENDORSED, OR RECOMMENDED THIS OFFERING. YOU SHOULD MAKE AN INDEPENDENT DECISION WHETHER THIS OFFERING MEETS YOUR INVESTMENT OBJECTIVES

AND FINANCIAL RISK TOLERANCE LEVEL. NO INDEPENDENT PERSON HAS CONFIRMED THE ACCURACY OR TRUTHFULNESS OF THIS DISCLOSURE, NOR WHETHER

IT IS COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS ILLEGAL.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT

PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY

OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM

REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER

ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE

PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS

AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU

TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK.

YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING

ON PAGE 14.

The date of this

offering circular is May 29, 2024

The following table of contents has been designed to help you find important

information contained in this offering circular. We encourage you to read the entire offering circular.

TABLE OF CONTENTS

PART II – OFFERING CIRCULAR

You should rely only on the information contained in this offering

circular or contained in any free writing offering circular filed with the Securities and Exchange Commission. We have not authorized

anyone to provide you with additional information or information different from that contained in this offering circular filed with the

Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and

sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering circular, regardless

of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial condition, results

of operations and prospects may have changed since that date.

PART - II

offering

circular SUMMARY

This summary highlights information contained elsewhere

in this Offering Circular and does not contain all of the information that you should consider in making your investment decision. Before

investing in our common stock, you should carefully read this entire Offering Circular, including our consolidated financial statements

and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this Offering Circular. Unless

otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations

refer to LifeQuest World Corp and its wholly owned subsidiary, BioPipe Global Corp.

This offering circular, and any supplement to this offering circular include

“forward-looking statements.” To the extent that the information presented in this offering circular discusses financial projections,

information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about

future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”,

“anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”,

“plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements

are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially

from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section

and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this offering

circular.

This summary only highlights selected information contained in greater

detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before investing

in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning on Page 14,

and the financial statements, before making an investment decision.

Generally, no sale may be made to you in this offering if the aggregate

purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors

and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you

to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Sale of these shares will commence within two calendar days of the qualification

date and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

The Company

LifeQuest World Corp., through its our wholly owned subsidiary, BioPipe

Global Corp., is a wastewater treatment company that treats domestic sewage (wastewater from toilets, kitchens, showers, laundry, etc.)

into clean water ready for secondary purposes like flushing of toilets or irrigation, without producing sludge.

On April 17, 2019, we entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with BioPipe Acquisition, Inc., a New Jersey corporation (“Merger Sub”) and BioPipe Global

Corp., a privately held New Jersey corporation (“BioPipe Global”). In connection with the closing of this merger transaction,

Merger Sub merged with and into BioPipe Global (the “Merger”) on April 30, 2019, with the filing of Articles of Merger with

the New Jersey Secretary of State.

In addition, pursuant to the terms and conditions of the Merger Agreement:

| |

• |

All of the outstanding shares of BioPipe Global was

exchanged for the right to receive an aggregate of 75,000,000 share of the Company’s common stock, par value $0.001 per share,

which was issued to certain shareholders in connection with an Intellectual Property Purchase Agreement set forth below; |

| |

• |

BioPipe Global provided customary representations and

warranties and closing conditions, including approval of the Merger by a majority of its voting shareholders; and |

| |

• |

Bradford Brock, our prior officer and director, was

required to cancel 55,000,000 shares of his Common Stock in the Company but permitted to retain 1,000,000 shares in the Company.

|

From the date of the Merger Agreement, we have been engaged in eco-friendly

decentralized wastewater treatment. The Company’s mission is to become a singular platform for highly efficient, scalable, low footprint

onsite treatment technologies for treatment sewage wastewater and industrial wastewater. Our flagship product is Biopipe STP, (sewage

wastewater treatment), which is a highly scalable and biological sewage wastewater system that treats domestic sewage into clean water

ready for secondary purposes.

On May 7, 2019, under an Intellectual Property Purchase Agreement,

BioPipe Global acquired all the assets of BioPipe Global AG, a Swiss company, and its wholly-owned Turkish subsidiary, BioPipe Cevre

Teknolojileri A.S. We acquired all trade receivables, income, royalties, damages, rights to sue, rights to enforce and any and all payments

unpaid and due now or hereafter due or payable with respect to the patented BioPipe System. In exchange, the Company issued 71,846,667

shares of common stock to the shareholders of Biopipe Cevre Teknolojileri A.S and 3,153,333 shares of common stock to Biopipe Global

AG.

On September 26, 2019, the Company entered into a 50-50 joint venture

and technology transfer agreement with South Africa based, Abrimix Pty Ltd. The purpose of the agreement was to introduce our Biopipe

STP into southern Africa and eventually introduce Abrimix in the countries we operate in. Abrimix is a patented, low footprint, scalable

industrial wastewater treatment technology with the ability to treat a wide variety of industrial wastewater. Due to disruptions related

to Covid-19 and a lack of funding, the parties to the joint venture dissolved the venture and, on May 30, 2022, a technology license

agreement was put in place which includes royalty payment of 7.5% of Net Revenue.

On October 2, 2019, the Company entered into a 50-50 Joint Venture

Agreement with Environest Private Global Ltd. for the purpose of commercialization of Biopipe’s technology in India and any and

all activities related or incidental thereto and any other business as mutually agreed upon within the ambit of the objects of the Company

as determined in the Memorandum of Association of the same. The Joint Venture was dissolved and the Company has set up a 99% owned subsidiary

in India in 2022.

On September 28, 2020, the Company entered into a 40-60 Joint Venture

Agreement with Biopipe Corporation for the purpose of commercialization of Biopipe’s technology in the Philippines and any and

all activities related or incidental thereto and any other business as mutually agreed upon within the ambit of the objects of the Company

as determined in the Memorandum of Association of the same. Although the Joint Venture is 40-60, the shareholders will split profits

on a 50-50 basis.

On

July 2, 2021, Lifequest World Corp acquired 70% of Aquity Capital Pty Ltd. a company domiciled in South Africa for ZAR 1,400,000 ($104,000)

and Biopipe Global Corp entered into a credit agreement and provided fully secured project finance debt of $350,000 at South African

prime (7%) + 2% with month amortization and seven-year term. The debt can be prepaid without any penalty. The debt was eliminated in

consolidation. The $454,000 was used for engineering, procurement, construction, installation, and commissioning of a wastewater treatment

plant at an abattoir. The abattoir owner has entered into a 10+10-year water-as-a-service agreement. The plant has not been operating

since May 2022 and requires an upgrade which the Company is currently in the process of doing. The Company entered into a revised water-as-a-service

agreement on October 10, 2023 under which it will upgrade the plant to higher capacity at circa 42% higher tariff. The upgraded plant

is expected to come online in the first quarter of 2024.

On June 10, 2022, the Company entered into a 99-1 Joint Venture Agreement

with Biopipe India for the purpose of commercialization of Biopipe’s technology in India and any and all activities related or

incidental thereto and any other business as mutually agreed upon within the ambit of the objects of the Company as determined in the

Memorandum of Association of the same.

In the last five years, the BioPipe STP system has been installed in

Bangladesh, India, Ethiopia, the Philippines, South Africa, Turkey, UAE, Qatar, Saudi Arabia, Oman, and Maldives. These BioPipe systems

are running at hospitals, resorts, hotels, commercial and government buildings, labor camps, ports and individual homes.

Despite having installed systems on an international level, however,

we are only responsible for a small fraction of the overall wastewater treatment market in these regions. We compete with other companies,

most of which have far greater brand recognition and market share of the industry, and far greater marketing and financial resources

and experience than we do.

There

is substantial doubt about our ability to continue as a going concern. As of November 30, 2023, we had cash on hand of $303,531 and we

had working capital of $244,242. We expect to experience negative cash flow in the foreseeable future as we fund our operating losses

and capital expenditures. As of November 30, 2023, we have an accumulated deficit of $1,401,511 and we may not be able to generate sufficient

revenues or achieve profitability in the future. Our failure to generate significant revenues, achieve or maintain profitability, could

negatively impact the value of our common stock.

Traditional centralized wastewater treatment systems are expensive

to install and operate, energy-intensive and are dependent on chemicals. The world is seeking sustainable solutions through decentralized

wastewater treatment that is environmentally friendly while using 21st century technologies and management. Reuse of Biopipe treated

water may include irrigation of gardens and agricultural fields or replenishing surface water and groundwater. Reused water may also

be directed toward fulfilling certain needs in residences (e.g. toilet flushing), businesses and industry, and where necessary, treated

to reach potable standards.

The circular water economy as a business model provides sustainable production

and consumption of treated water and recovery of resources. Recycled water can meet some of this need, benefited by the nutrient content

inherent in wastewater. Only mid-range treatment levels would be required, as irrigation can be accomplished while minimizing the potential

for human contact with the recycled water. Reusing wastewater as part of sustainable water management allows water to remain as an alternative

water source for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies.

Circular Economy of Water

Lifequest is seeking to build a platform of disruptive decentralized

wastewater treatment systems (DEWATS) that are highly efficient, scalable, cost effective with small footprint. Our flagship biological

treatment system, Biopipe STP, can be adapted to treat all types of wastewaters, but our current focus is on domestic wastewater. Our

Abrimix process through our technology partnership is a versatile primary treatment for all types of industrial wastewater with a small

footprint and is superior to the nearest Dissolve Air Floatation technology. The treated water from our Biopipe system can be reused for

irrigation, exterior washing, irrigation and re-flushing of toilets. Both solutions offer a pathway to zero liquid discharge solutions.

Reclaiming water from waste for reuse applications (instead of using

freshwater supplies) can be a water-saving measure. When treated waste water is eventually discharged back into natural water sources,

it still has significant benefits to the ecosystem, such as improving streamflow, nourishing plant life and recharging aquifers, as part

of the natural water cycle. With the number of water-stressed countries rising, treatment and reuse of wastewater is becoming increasingly

necessary.

BioPipe is a revolutionary sewage wastewater treatment system.

Biopipe is a highly scalable, eco-friendly and extremely cost-effective wastewater treatment with a broad installed base. It is the

planet’s first biological wastewater treatment system where the process takes place entirely inside the pipe and:

| | • | | |

100% biological system with NO

chemicals used |

| | • | | |

There is absolutely no sludge produced and

no odor |

| | • | | |

Lower energy consumption versus competing systems |

| | • | | |

Very low operation and maintenance cost |

| | • | | |

Virtually silent |

| | • | | |

Modular design |

| | • | | |

Low footprint |

| | • | | |

Meets or exceeds discharge standards globally |

Biopipe currently has around 44 plants installed around the globe,

and we expect significant number of projects in India and Ethiopia and limited numbers in South Africa and the Philippines. Some of these

plants were installed prior to the merger agreement. We have now set up joint ventures, licensing and distribution in five countries.

As mentioned above, we maintain a small fraction of the overall wastewater market, have significant capital expenditures on our projects,

and have yet to reach profitability. Our plan is to continue our marketing efforts to educate our target customers on the benefits of

our wastewater solutions, and hopefully reach more customers and generate more revenue. There is no assurance that our company will be

successful in these efforts.

Abrimix is an industrial effluent treatment technology.

It is an innovative technology that applies “shear” to increase the kinetics and completeness of reactions within aqueous

solutions. The Abrimix Technology can be applied to various influents where certain reactions are desired to achieve the dissolution,

oxidation, and/or precipitation of certain elements, the phase separation of ultra-fine suspended solids and the breaking of emulsions

within a liquid. Abrimix (Pty) Ltd. has several plants running in South Africa and Biopipe’s subsidiary in India has done two plants

in India to date under the joint venture.

The key component to the Abrimix Technology is the powerful static in-line

mixer or “Reaction Enhancing Unit.” This patented unit improves the speed and thoroughness of liquid and gaseous chemical

interactions within aqueous solutions. The unit, most commonly referred to as a High Shear Reactor (HSR), utilizes a specifically designed

and researched hydrodynamic flow path that is derived from proven and sound fluid engineering mechanics.

Glanris Media is a green hybrid media made from rice hull and is

extremely effective in removing heavy metals, color/turbidity, chlorine and chloramine, suspended solids and colloids, gas and oil, solvents

and low molecular weight organics, as well as odors. The media can be regenerated with a weak acid. Glanris media is produced by Glanris

Corp and the Company is a distributor in India.

Our Strategy

Our initial focus is on countries that have what is known as “high

water stress” and a large gap between production of sewage and industrial wastewater versus installed capacity or simply lag adequate

wastewater treatment infrastructure. High water stress occurs when demand for safe, usable water in any given area exceeds the supply.

Our core strategy is to introduce Biopipe and Abrimix through joint ventures,

license agreements partners or distribution partners with strategic and well-established partners in the top 10 countries with sewage

problems. The JV partner, license partner or distribution partner handles sales marketing, installation, operations, and maintenance.

This includes India, Bangladesh, the Philippines, Ethiopia, and South Africa.

Our Market

Packaged Treatment

Our decentralized wastewater treatment falls into the category of

packaged wastewater technology. According to Ken Research estimates[1],

the Global Water and Wastewater Treatment Equipment Market is valued around ~US$ 50 billion by 2022 and it is further expected

to reach a market size of ~US$ 75 billion opportunity by 2028. The key drivers are (a) rising population and rapid urbanization. According

to The World Bank Group, the urban population has seen a rise from 55% of the world population in 2018 to 57% of the world population

in 2021, as many people from rural area shift to the urban region for better employment opportunities.

Biological Treatment

According to a report published by Research Dive[2],

the global biological wastewater treatment market is anticipated to reach $15 billion and rising at a CAGR of 5.2% through 2031. Our

Biopipe biological treatment technology, currently being applied to domestic sewage wastewater, can be applied to many other types of

wastewaters. Abrimix wastewater treatment technology has the ability to treat a wide variety of industrial wastewaters.

Countries We Operate In:

India

Biopipe Global has a 99% owned subsidiary in Biopipe India Private

Ltd. for our operations in India. Our operations were completely disrupted due to Covid-19, but last year we installed our first sewage

treatment plant in the basement of a hospital and first plant at a university campus. We are in the process of installing two more plants

and have a strong sales funnel. The most consequential development in India has been the selection of Biopipe as innovative technology

in a tender for twenty sewage treatment plants in Panvel, Maharashtra. The tender, which includes piping, lighting, pumping stations

and some road construction, was won by Eagle Infra India Ltd. in 2023 and we are expecting work orders to be released post elections

in India. Biopipe is also the technology of choice in another tender for Navi Mumbai, Maharashtra, which is also expected to proceed

after elections.

To date, Biopipe India Private Ltd. has not made any profits but due

to the tenders we are part of , we expected to generate meaningful revenue and profits in in the fiscal year starting June 1, 2024. We

have a one-of-a-kind sewage treatment technology and new regulations requiring universities and hotels that are not connected to central

sewerage network to install onsite treatment system.

India possesses 4% of the world’s water resources and is home

to 17.7% of the world’s population and ranks 13th for overall water stress. India is also recognized as one of the world’s

“very highly water-stressed countries” on the Aqueduct’s Water Risk Atlas, ranking 13th. (World Resources Institute,

2019[3]).

Water stress has developed in most places due to the imbalance between

local supplies and demand from people, agriculture, and industry. According to a study done by the Asian Development Bank Institute[4],

in 26 of India’s 32 major cities, 10%–60% of total water demand remains unmet. Two facts exacerbate the water scarcity: (i)

most of India’s water sources are highly polluted; and (ii) very little wastewater is actually treated and reused, making water

the other single-use resource wreaking havoc on the climate with its pollution.

It has also made it mandatory by certain state pollution control

boards for apartments and commercial complexes to install STPs. According to a report done by the Council on Energy, Environment and

Water (CEEW)[5], India

generates 72,368 million liters (MLD) of sewage every day, only 28% is treated and reused. A new report by the Council on Energy, Environment

and Water (CEEW), states that 80% of wastewater generated by urban India has the potential to be treated and reused for non-potable purposes

like irrigation, which can relieve the immense pressure on water bodies, lower pollution levels and provide water security in the face

of climate crisis-induced weather events that can render water bodies unreliable. According to the India Investment Grid as projected

by Ministry and Commerce and Industry of India[6],

The Indian water and wastewater treatment market is on a dynamic trajectory, projected to rise from USD 1.31 billion in 2020 to an impressive

USD 2.08 billion by 2025, showcasing a compelling CAGR of 9.7%.

| |

[1] |

https://www.globenewswire.com/en/news-release/2024/04/08/2859309/0/en/Water-and-Wastewater-Treatment-Equipment-Market-Size-is-projected-to-reach-USD-85-68-billion-by-2030-growing-at-a-CAGR-of-4-Straits-Research.html |

| |

[2] |

https://www.researchdive.com/163/biological-wastewater-treatment-market |

| |

[3] |

https://www.wri.org/data/aqueduct-water-risk-atlas |

| |

[4] |

https://www.adb.org/sites/default/files/publication/634586/adbi-cs2020-2.pdf |

| |

[5] |

https://www.ceew.in/sites/default/files/scaling-wastewater-reuse-treatment-and-management-india.pdf |

| |

[6] |

https://indiainvestmentgrid.gov.in/sectors/waste-and-water/water-treatment-plants |

Bangladesh

We currently have nine Biopipe STPs running in Bangladesh and we are

in the process of introducing our Abrimix industrial wastewater solution under our license agreement. In Bangladesh, most commercial

activity has been frozen due to lack of availability of dollars in the country which has prevented the licensee from opening letter of

credit with foreign suppliers. With recent release of funds by the IMF, it is now possible to open letters of credit and the licensee

is now pursuing several projects.

It should be noted that timing of projects in emerging markets is very

difficult to pin down and countries like Ethiopia and Bangladesh have acute financial shortages making it difficult to issue letters

of credits.

Bangladesh is an important market for our solutions. According to

Bangladesh Institute of Planners[1],

capital Dhaka alone dumps 1.16 million m3 of sewage per day into the local rivers. According to www.water.org, out of its population

of 165 million people, 68 million people (41% of the population) lack access to a reliable, safely managed source of water, and 100 million

people (61%) lack access to safely managed household sanitation facilities.

According to official records of the Bangladesh Inland Water Transport

Authority (BIWTA)[2],

around 350,000 kilograms (350 metric tons) of toxic waste is dumped into rivers every day from about 7,000 industries and other residential

areas in greater Dhaka and adjacent areas. Bangladesh annually discharges 1.03 billion tons of textile wastewater without treatment.

The government has implemented a Zero Liquid Discharge (ZLD) policy to address industrial wastewater discharge. Under this policy, industries

are required to treat and recycle their wastewater to ensure zero discharge into water bodies.

South Africa

We currently have one Biopipe sewage treatment plant in South Africa under

the 50-50 joint venture. Abrimix Pty Ltd. has eleven of its own industrial wastewater treatment plants in South Africa. The Company teamed

with Abrimix to introduce Biopipe in South Africa and Abrimix’s technology in the countries we currently operate in. The agreement

is for 50-50 distribution of profits.

In South Africa, we successfully installed a demonstration plant 2

years ago at St. Andrews College in Grahamstown. The plant remains idle due to lack of sewage and unwillingness of the college to incur

the expenses to bring connect a new pipeline to the plant that would provide enough sewage wastewater to operate the plant. The plant

is very difficult to get to which has prevented us from using it as a reference site. Recently, we received an order and a deposit for

a 10m3/day plant for a resort in South Africa and our distribution partner spent 2023 in developing the local for market and has developed

a strong pipeline of projects, which are expected to come through once we have demonstrated the efficiency of our Biopipe STP with the

resort plant.

South Africa is another water stressed country with massive sewage

problem. According to the Blue and Green Drop Project Report published in 2023[3],

81% of sewage discharge is not adequately treated. The local governments are asking developers to have their own decentralized sewage

wastewater systems before any development is approved. This creates what we believe is a highly scalable Build Own & Operate (BOO)

or leasing opportunity whereby we will provide the system and charge the customers for the amount of water reused. BOO or Leasing is

expected to produce a long term stable cashflow.

South Africa is heavily dependent on centralized

wastewater treatment plants and most are not functioning well or not meeting the standards. According to a report by the Water

Institute of Southern Africa NPC (WISA)[4],a

total of 334 (39%) of municipal wastewater systems were identified to be in a critical state in 2021, compared to 248 (29%) in 2013.

A total of 102 (89%) out of the 115 DPW systems were identified in critical state, compared to 84% in 2013.

| |

[1] |

https://bdnews24.com/environment/2019/05/25/dhaka-pumps-1.1-million-cubic-metres-of-sewage-into-rivers-daily-study-says |

| |

[2] |

http://rpis.mowr.gov.bd/ |

| |

[3] |

https://afriforum.b-cdn.net/wp-content/uploads/2023/11/Blue-and-green-drop-project-report_2023-1.pdf |

| |

[4] |

https://wisa.org.za/2022/04/01/green-drop-2022-report-release/ |

South Africa represents a huge opportunity for decentralized wastewater

systems or packaged treatment plants like Biopipe. There was only one packaged treatment plant installed by the government sector. However,

due to budget constraints, as well as Covid, we have not been able to penetrate the market in South Africa as we had planned. Also, we

have experienced operated plant issues with Morgan Beef and we have to upgrade the plant to produce better quality effluent. For South

Africa, we expect business activity to pick up in the second half of fiscal year 2024.

Source:

Green Drop 2022[1]

Capex Advantage

Biopipe has considerable advantages over other packaged or decentralized

wastewater treatment technologies when it comes to operating cost. It currently costs circa $2,550,000 per 1000m3 for a centralized

system which involves $1,481,000 per 1000m3 capex on reticulated sewerage, circa $162,000 per 1000m3 for main sewer

lines and $891,890 per 1000m3 on conventional treatment plant. Biopipe offers considerably lower capex.

| |

[1] |

https://wisa.org.za/2022/04/01/green-drop-2022-report-release/ |

Opex Advantage

The average cost to treat 1 m3 of wastewater is circa

$1/m3 and median cost is $0.48/m3, with the latter giving a more representative estimate of treatment cost. Biopipe

does not use energy hogging blowers for aeration, dosing of chemicals and minimal maintenance.

Source: Green Drop

2022[1]

Ethiopia

On October 1, 2019, we entered into an Exclusive Distribution Agreement

with Tesurcon Trading PLC . Under the agreement, we have been working in Ethiopia for the past 3 years to develop the market

for our Biopipe system. The exercise started with a shipment of a demo plant in 2021 to the Ministry of Water & Irrigation. Due to

political uncertainty and longer government approval process, we were able to finally install and commission the demo plant at the Ministry

of Water & Irrigation facility in 2023. We are currently installing our first commercial plant after a successful demonstration of

a plant at Ministry of Irrigation & Water. The commercial plant is a 100m3/day plant in Addis Ababa University campus. Upon successful

commission, our local distribution partner, Texel Global, is expecting to receive orders for additional plants of various sizes and has

at least seven projects where the Biopipe technology has been accepted and awaiting the tender process to go through.

Ethiopia is considered water-stressed because the rapid population

growth over the last decade has put a strain on its abundant water sources. Despite estimations showing that 13.5 to 28 billion cubic

meters of renewable annual groundwater is available per year, only 2.6 billion cubic meters is usable[3]

. According to the UNICEF/WHO Joint Monitoring Program[2],

only half of the population in Ethiopia has access to basic water services, while less than 10 percent of the population can access basic

sanitation services. Access to basic WASH services is substantially lower among rural populations than urban. As of 2020, only 40 percent

of Ethiopia’s rural population could access basic water, compared with 84 percent in urban areas. Rural and urban access to at

least basic sanitation reflects a similarly large gap with only five percent of the rural population having access compared to 21 percent

of the urban. Since 78 percent (93.6 million people) of Ethiopia’s total population resides in rural areas, overcoming these access

gaps is key to Ethiopia’s national development. On the other hand, rapid urban population growth is estimated to be nearly five

percent per year[4].

This puts pressure on the need to maintain and expand water and sanitation infrastructure in Ethiopia’s cities and small towns.

Sanitation and water deficit remains a problem. According to a 2021

Joint Monitoring Program[2],

only 7 percent of the households in Ethiopia have an individual toilet where fecal waste ends up safely disposed of and treated insitu

or offsite.

| |

[1] |

https://wisa.org.za/2022/04/01/green-drop-2022-report-release/ |

| |

[2] |

https://www.unicef.org/ethiopia/stories/accelerating-safely-managed-sanitation-sms-ethiopia |

| |

[3] |

https://shega.co/post/waterlife-ethiopia-introduces-sustainable-clean-water-access-through-smart-water-kiosks/ |

| |

[4] |

https://www.globalwaters.org/sites/default/files/ethiopia_hpc_plan_508_external_0.pdf |

The Philippines

We have a joint venture with Bpipe Corporation on a 40-60 basis. The

Philippines like India was at a standstill due to Covid-19. The local partner, Bpipe Corporation, successfully sold and installed a plant

at Dunkin Donuts headquarter in 2023. This plant has been an excellent reference site and has resulted in another sale and the pipeline

that was developed in the past 2 years is now being actively pursued. BPipe recently received an order for a 10m3/day plant from a major

property development company and has seven projects at various stages of negotiation.

It should be noted that timing of projects in emerging markets is very

difficult to pin down and countries like Ethiopia and Bangladesh have acute financial shortages making it difficult to issue letters

of credits.

The Philippines

has the two factors that cause us to operate there (a) water deficit and (b) sanitation deficit. According to the Department of Health

in the Republic of Philippines[1], around 50.3 million Filipinos (around 10 million

families) do not have access to safely managed sanitation services and of these some 24 million use limited/unimproved toilets or none

at all. The main sources of water pollution include:

|

• |

untreated domestic

(also called ‘municipal’) wastewater discharges (33%); |

|

• |

industrial sources (27%); |

| |

• |

agriculture and livestock (29%); |

| |

• |

and non-point sources such as agricultural farms (11%). |

The pollution of the Philippines waters comes for a significant part

from untreated domestic and industrial wastewater. According to a UNIDO study[2],

only about five percent of households are connected to sewerage networks and treatment facilities. In Metro Manila alone, approximately

2,000 cubic meters of solvent wastes, 22,000 tons of heavy metals, infectious wastes, biological sludge, lubricants, and intractable

wastes, as well as 25 million cubic meters of acid/alkaline liquid wastes are improperly disposed of annually.

Our principal place of business is located at

100 Challenger Road, 8th Floor Ridgefield Park, NJ 07660. General information about us can be found at http://biopipe.co/. The information

contained on or connected to our website is not incorporated by reference into this Offering Circular on Form 1-A and should not be considered

part of this or any other report filed with the SEC.

Governmental Regulations

We have operations in multiple jurisdictions and service clients across

multiple geographic regions. We are required to comply with numerous, and sometimes conflicting and uncertain, laws and regulations.

In addition, we are required to obtain and maintain permits and licenses for the conduct of our business in various jurisdictions. Our

clients’ business operations are also subject to numerous regulations in the jurisdiction in which they operate or that are applicable

to their industry, and our clients may contractually require that we perform our services in compliance with regulations applicable to

them or in a manner that will enable them to comply with such regulations.

On account of the global nature of our and our clients’ operations,

compliance with diverse legal and regulatory requirements is difficult, time-consuming and requires significant resources. Further, the

extent of development of legal systems varies across the countries in which we operate and local laws may not be adequately developed

or be able to provide us clear guidance to sufficiently protect our rights. Specifically, in many countries including those in which

we operate and/or seek to expand to, the practices of local businesses may not be in accordance with international business standards

and could violate anti-corruption laws and regulations. Our employees, subcontractors, agents, business partners, the companies we acquire

and their employees, subcontractors and agents, and other third parties with which we associate, could act in a manner which violates

policies or procedures intended to ensure compliance with laws and regulations, including applicable anti-corruption laws or regulations.

Violations of such laws or regulations by us, our employees or any

of these third parties could subject us to criminal or civil enforcement actions (whether or not we participated or were aware of the

actions leading to the violations), including fines or penalties, breach of contract damages, disgorgement of profits and suspension

or disqualification from work, any of which could materially and adversely affect our business, including our results of operations and

our reputation. If we are unable to maintain our licenses, permits or other qualifications necessary to provide our services, we may

not be able to provide services to existing clients or be able to attract new clients and could lose revenue, which could have a material

adverse effect on our business.

| |

[1] |

https://ncroffice.doh.gov.ph/LatestNews/Details/73 |

| |

[2] |

https://docslib.org/doc/8151886/wastewater-management-in-the-philippines |

India

The Central Pollution Control Board (CPCB) under the Ministry of Environment,

Forest and Climate Change sets the standards and discharge norms for treated sewage from STPs across India.

In 2015, the CPCB proposed stricter discharge standards for STPs, which

were further revised in 2017 after a court case filed with the National Green Tribunal (NGT). The NGT order in 2019, upheld by the Supreme

Court in 2021, set stringent new discharge standards for STPs that are on par or even more stringent than developed nations. These new

standards include limits for parameters like Biochemical Oxygen Demand (BOD), Chemical Oxygen Demand (COD), Total Suspended Solids (TSS),

ammonia, nitrates, fecal coliforms, etc. For example, the COD limit is ≤30 mg/L for discharges into water bodies listed under Schedule

1 (more sensitive), and ≤75 mg/L for general discharges. State Pollution Control Boards (SPCBs) are responsible for reviewing and

determining specific standards and norms for wastewater treatment facilities and effluent discharges within their states. Industrial

units are also required to install effluent treatment plants (ETPs) and treat their effluents to comply with stipulated discharge standards

set by CPCB/SPCBs.

The regulations aim to improve the quality of water bodies by enforcing

stricter sewage treatment and minimizing the discharge of untreated or partially treated sewage.

Biopipe is uniquely positioned to address the onsite sewage wastewater

treatment market in India due to its efficiency, small foot print (real estate is very expensive) and low maintenance. The challenges

are with government tenders that take extraordinarily long times to mature and Biopipe has to rely on other General Contractors to pursue

government tenders and cheaper treatment plants that do not meet the discharge standards or routinely fail after two years or so. The

average customer is highly sensitive to upfront capex and Biopipe is slightly more expensive than MBBR systems.

South Africa

South Africa discharge standards are somewhat weaker than India and

the standards are set by the Department of Water and Sanitation (DWS) under the National Green Drop certification program. The regulations

set standards and discharge norms for treated effluent from wastewater treatment works (WWTWs) across parameters like BOD, COD, TSS,

ammonia, nitrates, fecal coliforms etc. The standards appear to be more stringent for discharges into sensitive water bodies listed under

Schedule 1, with lower permissible limits (e.g. COD ≤30 mg/L) compared to general discharges. Local municipalities and provinces can

further define specific by-laws and regulations for wastewater treatment and effluent discharge within their jurisdictions, in line with

the national DWS guidelines.

Bangladesh

The government has now made it mandatory for all commercial and government

buildings to have onsite sewage treatment plants but the discharge standards are rarely enforced.

The Philippines has tough discharge standards but enforcement is lax.

The Clean Water Act of 2004 (Republic Act 9275) is the primary law governing wastewater management in the Philippines. It sets standards

to prevent and reduce water pollution, including from sewage and wastewater discharges. The Department of Environment and Natural Resources

(DENR) is the lead agency responsible for implementing and enforcing the Clean Water Act. The Act requires all sources of pollution,

including domestic, industrial, and agricultural, to have appropriate wastewater treatment facilities before discharging effluents. The

Department of Health (DOH) has issued Implementing Rules and Regulations under the Sanitation Code, covering sewage collection, disposal,

excreta disposal, and drainage. These include regulations for domestic sludge and septage handling.

Ethiopia

Ethiopia’s environmental regulations are still evolving and there

is no well-established national guidelines or standards specifically for the discharge of treated wastewater into water bodies in Ethiopia.

However, the Environmental Pollution Control Proclamation (Proclamation No. 300/2002) provides a general legal framework for regulating

pollution from various sources, including wastewater discharges. Article 6 of the Proclamation requires the Environment, Forest and Climate

Change Commission (EFCCC) to formulate practicable environmental standards based on scientific principles, including standards for the

discharge of effluents into water bodies and sewage systems The Prevention of Industrial Pollution Council of Ministers Regulation No.

159/2008 imposes requirements on industries to minimize pollutant generation, not exceed limits set by environmental standards, obtain

licensing, and provide emergency response plans. The EFCCC has published the "Guideline Ambient Environmental Standards for Ethiopia",

which sets water quality standards, but these appear to be general ambient standards rather than specific discharge limits. Regional

states in Ethiopia can adopt environmental standards that are more stringent than the federal level, but not less rigorous.

Risks Affecting Us

Our business will be subject to numerous risks and uncertainties, including

those described in “Risk Factors” immediately following this offering circular summary and elsewhere in this offering circular.

These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business.

These risks include, but are not limited to, the following:

| |

• |

Company has failed to generate profits; |

| |

• |

Disruption due to Covid-19 disrupted our

business development and resulted is loss of sales pipeline; |

| |

• |

Significant competition; |

| |

• |

The business risks of international operations,

particularly in emerging markets; |

| |

• |

Our business may be adversely affected by regulations; |

| |

• |

Geopolitical situation in countries we

operate in; |

| |

• |

Risk of not getting paid by customers; |

| |

• |

Inability to finance fulfilment of orders; |

| |

• |

failure of manufacturers to deliver products

or provide services in a cost effective and timely manner; |

| |

• |

Risk of exposure of our intellectual property

and confidential information; |

| |

• |

Risk associated with water treatment industry; |

| |

• |

Failure of Build Own Operate plants; |

| |

• |

Risk of repatriation of profits from overseas

operations; and |

| |

• |

we are not a 12g reporting company. |

The Offering

| Securities being offered by the Company |

10,000,000 shares of common stock, at a fixed price of $____ offered by us on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold, through our officers and directors. |

| |

|

| Securities being offered by the Selling Stockholders |

3,000,000 shares of common stock underlying warrants, at a fixed price of $____ offered by selling stockholder in a resale offering. This fixed price applies at all times for the duration of the offering. |

| |

|

| Offering price per share |

We and the selling shareholder will sell the shares at a fixed price per share of $___ for the duration of this Offering. |

| |

|

| Number

of shares of common stock outstanding before the offering of common stock |

121,484,150

common shares are currently issued and outstanding. |

| |

|

| Number

of shares of common stock outstanding after the offering of common stock |

131,484,150

common shares will be issued and outstanding if we sell all of the shares we are offering herein. |

| |

|

|

The minimum number of shares to be

sold in this offering |

None |

| |

|

| Use of Proceeds |

We intend to use the gross proceeds to us for working capital and for other corporate purposes. |

| |

|

| Termination of the Offering |

The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

| |

|

| Subscriptions |

All subscriptions once accepted by us are irrevocable. |

| |

|

| Registration

Costs |

We estimate our total offering registration costs and selling expenses

to be approximately $65,000. |

| |

|

| Risk Factors |

See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information contained in this offering circular.

We have not authorized anyone to provide you with information different from that which is contained in this offering circular. We are

offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

MANAGEMENT’S DISCUSSION AND ANALYSIS

You should read the following discussion and analysis

of our financial condition and results of our operations together with our financial statements and related notes appearing at the end

of this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations that involve risks

and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements

due to a number of factors, including those discussed in the section entitled "Risk Factors" and elsewhere in this Offering

Circular.

Results of Operations for the Years Ended May 31,

2022 and 2023

Revenues

Our total revenue reported for the year ended May

31, 2023, was $149,806, compared with $349,297 for the year ended May 31, 2022.

Our revenues fiscal year ended 2023 revenue declined

largely due to delays in a major government tender that was pushed out into fiscal year 2024, lack of sales activity in Bangladesh due

to shortage of hard currency and delays in getting our demo plant commissioned on time. We could not generate any revenue from our South

African operated plant due to issues with Morgan Beef and need for upgrading the plant to produce better quality effluent. The key issues

involved generation of wastewater at twice the capacity of the designed plant, high variability in incoming wastewater, management turnover

at Morgan Beef and suspension of its export license due to outbreak of foot and mouth disease. Additionally, the client would like the

water to be treated to point where the treated water can be used for washing the inside of the abattoir. Unless we experience continued

setbacks, such as those described above, we expect business activity to pick up in the second half of fiscal year 2024 after the plant

upgrade is completed. We have selected an engineering procurement and construction (EPC) company to provide the secondary and tertiary

treatments to meet the client’s quality and volume needs. Our Biopipe sewage treatment technology was selected as the technology

of choice in a municipal tender involving twenty-one plants. We are in the middle of final negotiations of the terms with the general

contractor who has won the tender. All plants have to delivered within the next twelve months. Additionally, we have entered into an agreement

with a channel partner in India which has already secured one contract and upon successful commissioning of the 200 m3/day

plant, expect additional orders of two 400 m3/day plants. We are also seeing strong activity in Ethiopia where Biopipe has

been approved by the government. We shipped our first commercial plant after successfully demonstrating the efficiency of Biopipe system

at Ministry of Water and Irrigation.

Cost of Revenues

Our total cost of revenues for the year ended May

31, 2023, was to $111,936 compared with $258,336 for the year ended May 31, 2022. Our gross margins were relatively stable year over year.

Operating Expenses

Operating expenses declined to $307,324 for the year

ended May 31, 2023, from $378,564 for the year ended May 31, 2022. The decrease in operating expenses is largely the result of a decline

in professional fees and wages.

We expect our operating expenses will increase in

future quarters with the expenses for professional fees in connection with this offering, as well as increased operational activity.

Other Expenses/Other Income

We had other expenses of $41,959 for the year ended May 31, 2023, as compared

with other expenses of $24,641 for the year ended 2022. We booked an expense on the Bangladesh joint venture, which was dissolved and

our relationship with restructured into a licensing agreement. We also booked an expense based on fluctuations in foreign currency rates.

Each foreign entity maintains the books in the foreign currency and then translates them to USD for the financial statements, which results

in fluctuations throughout the year.

Net Loss

We finished the year ended May 31, 2023, with a loss of $379,714, as compared

to a net loss of $217,338 during the year ended May 31, 2022.

Results

of Operations for the Six Months Ended November 30, 2023 and 2022

Revenues

Our total revenue reported for the six months

ended November 30, 2023, was $42,251, compared with $45,591 for the six months ended November 30, 2022. The decrease in revenues is the

result of delays in delivery and commissioning of two new plants. Additionally, a tender in which our Biopipe STP was selected as the

system of choice was delayed and was opened in April of 2023.

Cost of Revenues

Our total cost of revenues for the six months

ended November 30, 2023, was to $23,464 compared with $6,441 for the six months ended November 30, 2022. The increase in cost of revenues

is the result of purchases of high sheer reactors from Abrimix Pty Ltd.

Operating Expenses

Operating expenses declined to $100,730 for the

six months ended November 30, 2023, from $150,374 for the six months ended November 30, 2022. The decrease in operating expenses is the

result of decline in SG&A.

We expect our operating expenses will increase in

future quarters with the expenses for professional fees in connection with this offering, as well as increased operational activity.

Other Expenses/Other Income

We had other income of $79 for the six months ended November 30, 2023,

as compared with other expenses of $88,570 for the six months ended November 30, 2022. The other expenses in 2022 were the result of

loss of $92,227 from dissolution of the joint venture in Bangladesh.

Net Loss

We finished the six months ended November 30, 2023, with a loss of $89,725,

as compared to a net loss of $261,393 during the six months ended November 30, 2022.

Liquidity and Capital Resources

As of November 30, 2023, we had total current assets of $345,591 and current

liabilities of $101,349, resulting in working capital of $244,242 as of November 20, 2023, as compared with working capital of $228,480

at May 31, 2023.

Our operating activities used $259,141 in cash for the year ended May 31,

2023, as compared with cash used of $242,929 from operating activities in the year ended May 31, 2022. Our negative operating cash flow

for 2023 was mainly the result of changes in accounts receivable, net operating loss and net loss allocated to noncontrolling interest.

Our operating activities used $52,865 in cash for the six months ended

November 30, 2023, as compared with cash used of $143,009 from operating activities in the six months ended November 30, 2022. Our negative

operating cash flow for 2023 was mainly the result of our net loss for the period, offset by adjustments to operating activities.

Our investing activities provided $38,679 for the year ended May 31, 2023,

as compared with net cash used of $397,847 for the year ended May 31, 2022. Our positive investing cash flow in 2023 is the result of

changes to the basis of purchased fixed assets from foreign currency.

Our investing activities used $750 for the six months ended November 30,

2023, as compared with net cash provided of $38,849 for the six months ended November 30, 2022. Our negative investing cash flow in 2023

is the result of changes in the fixed asset basis from foreign currency.

Financing activities provided $11,500 in cash for the six months ended

November 30, 2023, compared with $12,942 in cash provided in the six months ended November 30, 2022. Our positive financing cash flow

was mainly the result of sale of common sure pursuant to Reg D.

Based upon our current financial condition, we have sufficient capital

to operate our business for the next twelve months at the current levels, but we lack funds for our expansion efforts. We are

seeking financing to upgrade our operating plant at Morgan Beef Pty Ltd. in South Africa, to finance government tenders and work orders

received from Eagle Infrastructure Ltd. where we must supply 21 Biopipe sewage wastewater treatment plants in India and to ramp up the

marketing of our products. We intend to fund these expansion efforts through this offering, or through increased sales and debt and/or

equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. There can be no assurance that

we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business

plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Inflation

Although our operations are influenced by general economic conditions,

we do not believe that inflation had a material effect on our results of operations during the years ended May 31, 2023 and 2022 or for

the six months ended November 30, 2023.

Critical Accounting Polices

In December 2001, the SEC requested that all registrants list their most

“critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting

policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s

most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are

inherently uncertain. Our critical accounting policies are disclosed in Note 2 of our unaudited consolidated financial statements included

in this Offering Circular with the Securities and Exchange Commission.

Off Balance Sheet Arrangements

As of November 30, 2023, there were no off-balance sheet arrangements.

Recent Accounting Pronouncements

The recent accounting pronouncements that are material to our financial

statements are disclosed in Note 2 of our consolidated unaudited yearend financial statements included in this Offering Circular filed

with the Securities and Exchange Commission and in Note 2 of our unaudited consolidated financial statements included herein.

RISK FACTORS

Please consider the following risk factors and other information in this

offering circular relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree

of risk. You should carefully consider the risks described below and all of the information contained in this offering circular before

deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results

of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or

part of your investment.

We consider the following to be the material risks for an investor regarding

this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may

result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only

be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and

other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur,

our business and financial results could be negatively affected to a significant extent.

Risk Factors Related to Our Financial Condition

We have limited cash on hand and there is substantial doubt as to

our ability to continue as a going concern.

As at November 30, 2023, we had cash on hand of $303,531 and we had working

capital of $244,242. While this is enough to operate at present levels for the next 12 months, our current capital resources will limit

our ability to make capital investments in Build Own & Operate or Leased projects. We also expect to continue to incur significant

operating and capital expenditures for the next twelve months as we ramp our marketing and funding of purchase orders, government tenders,

upgrading of Morgan Beef Build Own & Operate plant, and other initiatives. We also expect to experience negative cash flow in the

foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues

in order to achieve and thereafter maintain profitability. As of November 30, 2023, we have an accumulated deficit of $1,401,511and we

may not be able to generate sufficient revenues or achieve profitability in the future. Our failure to generate significant revenues,

achieve or maintain profitability could negatively impact the value of our Common Stock.

Risk Factors Related to Our Business

We have a limited operating history upon which investors can evaluate

our future prospects.

Our operating subsidiary, BioPipe Global Corp., was incorporated in the

State of New Jersey on April 23, 2019. Therefore, we have limited operating history upon which an evaluation of our business plan or performance

and prospects can be made. The business and prospects of the Company must be considered in the light of the potential problems, delays,

uncertainties and complications encountered in connection with a newly established business. To successfully introduce and market our

products and services at a profit, we must establish brand name recognition and competitive advantages for our products. There are no

assurances that the Company can successfully address these challenges. If it is unsuccessful, the Company and its business, financial

condition and operating results could be materially and adversely affected.

Given the limited operating history, management has little basis on which

to forecast future demand for our products and services from our existing customer base, much less new customers. We are depended on our

in-country joint venture, license and distribution partners. It is difficult to accurately forecast future revenues because the business

of the Company is new and its market has not been developed. If the forecasts for the Company prove incorrect, the business, operating

results and financial condition of the Company will be materially and adversely affected. Moreover, the Company may be unable to adjust

its spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction in revenues

would immediately and adversely affect the business, financial condition and operating results of the Company.

We are dependent on our in-country Joint Venture partners, Licensors

and Distributors

Our success depends on the ability of our joint venture, license and distribution

partners to effectively market, install and support our wastewater treatment systems. Acquisitions, strategic investments, partnerships,

or alliances could be difficult to identify, pose integration challenges, divert the attention of management, disrupt our business, dilute

stockholder value, and adversely affect our business, financial condition, and results of operations.

We have in the past and may in the future seek to obtain joint venture,

license, and distribution partners that we believe could complement or expand product offerings, enhance our technology, or otherwise

offer growth opportunities.

Any such transaction may divert the attention of management and cause us

to incur various expenses in identifying, investigating, and pursuing suitable opportunities, whether or not the transactions are completed,

and may result in unforeseen operating difficulties and expenditures. Any such transactions that we are able to complete may not result

in synergies or other benefits we expect to achieve, which could result in substantial impairment charges. These transactions could also

result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our results of operations.

We may not be able to compete successfully with current and future

competitors.

We have many potential competitors in the wastewater equipment and services

industry. We will compete, in our current and proposed businesses, with other companies, most of which have far greater marketing and

financial resources and experience than we do. We cannot guarantee that we will be able to penetrate our intended market and be able to

compete profitably, if at all.

If we do not continually upgrade our technology, it may become obsolete

and we may not be able to compete with other companies.

We cannot assure you that we will be able to keep pace with advances in

technology for wastewater treatment or that our services will not become obsolete. We cannot assure you that competitors will not develop

related or similar wastewater treatment systems.

Defects in our products or failures in quality control could impair

our ability to sell our products or could result in product liability claims, litigation and other significant events involving substantial

costs.

Detection of any significant defects in our products or failure in our

quality control procedures may result in, among other things, delay in time-to-market, loss of sales and market acceptance of our products,

diversion of development resources, and injury to our reputation. The costs we may incur in correcting any product defects may be substantial.

Additionally, errors, defects or other performance problems could result in financial or other damages to our customers, which could result

in litigation. Product liability litigation, even if we prevail, would be time consuming and costly to defend, and if we do not prevail,

could result in the imposition of a damages award. Our offshore operating entities carry general liability insurance. The company uses

off-the-shelf components which our covered by manufacturer warranties.

There can be no assurances of protection for proprietary rights or

reliance on trade secrets.

The ownership and protection of the Company’s trademarks, patents,

trade secrets and intellectual property rights are significant aspects of its future success. Unauthorized parties may attempt to replicate

or otherwise obtain and use the Company’s products and technology. Policing the unauthorized use of current or future trademarks,

patents, trade secrets or intellectual property rights could be difficult, expensive, time-consuming and unpredictable, as may be enforcing

these rights against unauthorized use by others. Identifying unauthorized use of intellectual property rights is difficult as the Company

may be unable to effectively monitor and evaluate the intellectual property used by its competitors, including parties such as unlicensed

dispensaries, and the processes used to produce such products. In addition, in any infringement proceeding, some or all of the trademarks,

patents or other intellectual property rights or other proprietary know-how, or arrangements or agreements seeking to protect the same

may be found invalid, unenforceable, anti-competitive or not infringed. An adverse result in any litigation or defense proceedings could

put one or more of the trademarks, patents or other intellectual property rights at risk of being invalidated or interpreted narrowly

and could put existing intellectual property applications at risk of not being issued. Any or all of these events could materially and

adversely affect the Company’s business, financial condition and results of operations.

In addition, other parties may claim that the Company’s products

infringe on their proprietary and perhaps patent protected rights. Such claims, whether or not meritorious, may result in the expenditure

of significant financial and managerial resources, legal fees, result in injunctions, temporary restraining orders and/or require the

payment of damages.

We may not be able to manage our growth effectively.

We must continually implement and improve our products and/or services,

operations, operating procedures and quality controls on a timely basis, as well as expand, train, motivate and manage our work force

in order to accommodate anticipated growth and compete effectively in our market segment. Successful implementation of our strategy also

requires that we establish and manage a competent, dedicated work force and employ additional key employees in corporate management, product

development, client service and sales. We can give no assurance that our personnel, systems, procedures and controls will be adequate

to support our existing and future operations. If we fail to implement and improve these operations, there could be a material, adverse

effect on our business, operating results and financial condition.

Risks associated with operating abroad may negatively affect our

ability to implement our business plan.

The Company’s expansion into jurisdictions outside of the United

States is subject to risks. In addition, in jurisdictions outside of the United States, there can be no assurance that any market for