Amended Statement of Beneficial Ownership (sc 13d/a)

August 01 2016 - 3:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of

1934

Legend

oil and gas, ltd.

(Name of Issuer)

Common

Stock

(Title of Class of Securities)

52490C101

(CUSIP Number)

Sean M.

McAvoy

c/o Hillair Capital Management LLC

345 Lorton Ave, Suite 303

Burlingame, California 94010

United States of America

Tel. No.: (415) 306-6945

(Name, Address and Telephone

Number of Person Authorized to

Receive Notices and Communications)

July 27,

2016

(Date of Event Which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are

to be sent.

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“

Act

”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

1

|

NAMES OF REPORTING PERSON, I.R.S. IDENTIFICATION NO. OF ABOVE

PERSON

Hillair Capital Investments L.P.

ID # 90-0809696

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

None.

|

|

8

|

SHARED VOTING POWER

1,070,295,219

(1)

|

|

9

|

SOLE DISPOSITIVE POWER

None.

|

|

10

|

SHARED DISPOSITIVE POWER

1,070,295,219

(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,070,295,219

(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

76.00%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSON, I.R.S. IDENTIFICATION NO. OF ABOVE

PERSON

Hillair Capital Management LLC

ID # 27-2577240

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

None

|

|

8

|

SHARED VOTING POWER

1,070,295,219

(1)

|

|

9

|

SOLE DISPOSITIVE POWER

None

|

|

10

|

SHARED DISPOSITIVE POWER

1,070,295,219

(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,070,295,219 (1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

76.00%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSON, I.R.S. IDENTIFICATION NO. OF ABOVE

PERSON

Sean M. McAvoy

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

None.

|

|

8

|

SHARED VOTING POWER

1,070,295,219

(1)

|

|

9

|

SOLE DISPOSITIVE POWER

None.

|

|

10

|

SHARED DISPOSITIVE POWER

1,070,295,219

(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,070,295,219

(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

76.00%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

|

|

|

(1)

|

Based on (i) 942,083,273 shares of Common Stock of the Issuer issued and outstanding,

as stated by the Issuer in its most recently filed Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

on May 23, 2016, (ii) 321,456,675 shares of Common Stock issuable upon conversion of the Company’s Series B Convertible Preferred

Stock beneficially owned by the Reporting Persons (as defined below in Item 5), (iii) 47,980,000 shares of Common Stock issuable

upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued on January 29, 2016 and beneficially

owned by the Reporting Persons, (iv) 13,692,933 shares of Common Stock issuable upon conversion of the Company’s Original

Issue Discount Senior Convertible Debenture issued on March 25, 2016 and beneficially owned by the Reporting Persons, (v) 38,340,200

shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued

on April 7, 2016 and beneficially owned by the Reporting Persons, (vi) 15,336,080 shares of Common Stock issuable upon conversion

of the Company’s Original Issue Discount Senior Convertible Debenture issued on May 27, 2016, (vii) 11,000,000 shares of

Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued on July

5, 2016, and (viii) 18,333,333 shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior

Convertible Debenture issued on July 27, 2016 and beneficially owned by the Reporting Persons, for an aggregate of 1,408,222,494

shares of Common Stock.

|

Item 1. Security and Issuer

This Amendment No. 3 (this “

Amendment

”)

to the statement on Schedule 13D filed with the Securities and Exchange Commission on May 11, 2015 (the “

Original Statement

”),

as amended and supplemented through the date of this Amendment No. 3, relates to the shares of common stock, $0.001 par value per

share (the “

Common Stock

”), of Legend Oil and Gas, Ltd., a Colorado corporation (the “

Issuer

”).

The address of the principal executive offices of the Issuer is 555 North Point Center East, Suite 410, Alpharetta, Georgia 30022.

Information contained in the Original Statement remains effective except to the extent that it is amended, restated, supplemented

or superseded by information contained in this Amendment.

Item 5. Interest in Securities

of the Issuer

Item 5 of the Original Statement

is hereby amended and supplemented by adding the following information

|

|

(a)

|

As of the date hereof,

each of the Reporting Persons (as defined below)

may be deemed to be the beneficial owner of 1,070,295,219

(1)

Shares, constituting 76.00% of the outstanding shares

of Common Stock of the Issuer, based on 1,408,222,494

(2)

issued and outstanding shares of Common Stock as of July 27,

2016.

|

|

|

(b)

|

Each of the Reporting Persons

(i) has the sole power to vote

or direct the vote of no Shares; (ii) has the shared power to vote or direct the vote of 1,070,295,219 Shares; (iii) has the sole

power to dispose or direct the disposition of no Shares; and (iv) has the shared power to dispose or direct the disposition of

1,070,295,219 Shares.

|

|

|

|

Hillair Capital Management LLC (“

Hillair Management

”) is the investment advisor

to Hillair Capital Investments L.P., a Cayman Islands limited partnership (“

Hillair Investments

”). By virtue

of such relationship, Hillair Management may be deemed to have dispositive power over the shares owned by Hillair Investments.

Hillair Management disclaims beneficial ownership of such shares.

|

|

|

|

As calculated in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended,

Hillair Capital, Hillair Management, and Sean McAvoy

(“

McAvoy

”

and, collectively with Hillair Investments and Hillair Management, the “

Reporting Persons

” and, each, a “

Reporting

Person

”)

each beneficially own 1,070,295,219 Shares of the Issuer, representing approximately 76.00% of the Shares.

Hillair Management, and McAvoy do not directly own any Shares, but each indirectly owns 1,070,295,219 shares of Common Stock. Hillair

Management indirectly owns 1,070,295,219 Shares because it serves as the investment manager of Hillair Investments, which directly

holds 1,070,295,219 Shares. McAvoy indirectly owns 1,070,295,219 Shares in his capacity as manager of Hillair Management.

|

|

|

(c)

|

On July 27, 2016, the Reporting Persons have acquired the 18,333,333 Shares through the purchase

of Original Issue Discount Senior Convertible Debentures (the “

July 27 Debentures

”) with a principal amount

of $550,000.00, convertible into 18,333,333 Shares in a private placement on July 27, 2016. No additional consideration will be

paid upon the conversion of the July 27 Debentures.

|

|

|

(1)

|

Includes 604,155,998 shares of Common Stock beneficially owned by the Reporting

Persons, (ii) 321,456,675 shares of Common Stock issuable upon conversion of the Company’s Series B Convertible Preferred

Stock beneficially owned by the Reporting Persons, (iii) 47,980,000 shares of Common Stock issuable upon conversion of the Company’s

Original Issue Discount Senior Convertible Debenture issued on January 29, 2016 and beneficially owned by the Reporting Persons,

(iv) 13,692,933 shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible

Debenture issued on March 25, 2016 and beneficially owned by the Reporting Persons, (v) 38,340,200 shares of Common Stock issuable

upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued on April 7, 2016 and beneficially

owned by the Reporting Persons, (vi) 15,336,080 shares of Common Stock issuable upon conversion of the Company’s Original

Issue Discount Senior Convertible Debenture issued on May 27, 2016 and beneficially owned by the Reporting Persons, (vii) 11,000,000

shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued

on July 5, 2016, and (viii) 18,333,333 shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount

Senior Convertible Debenture issued on July 27, 2016 and beneficially owned by the Reporting Persons

|

|

|

(2)

|

Includes 942,083,273 shares of Common Stock of the Issuer issued and outstanding,

as stated by the Issuer in its most recently filed Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

on May 23, 2016, (ii) 321,456,675 shares of Common Stock issuable upon conversion of the Company’s Series B Convertible Preferred

Stock beneficially owned by the Reporting Persons, (iii) 47,980,000 shares of Common Stock issuable upon conversion of the Company’s

Original Issue Discount Senior Convertible Debenture issued on January 29, 2016 and beneficially owned by the Reporting Persons,

(iv) 13,692,933 shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible

Debenture issued on March 25, 2016 and beneficially owned by the Reporting Persons, (v) 38,340,200 shares of Common Stock issuable

upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued on April 7, 2016 and beneficially

owned by the Reporting Persons, (vi) 15,336,080 shares of Common Stock issuable upon conversion of the Company’s Original

Issue Discount Senior Convertible Debenture issued on May 27, 2016 and beneficially owned by the Reporting Persons; (vii) 11,000,000

shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount Senior Convertible Debenture issued

on July 5, 2016, and (viii) 18,333,333 shares of Common Stock issuable upon conversion of the Company’s Original Issue Discount

Senior Convertible Debenture issued on July 27, 2016 and beneficially owned by the Reporting Persons.

|

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer

The Reporting Persons have entered

into a Joint Filing Agreement, dated as of the date hereof, a copy of which is filed with this Schedule 13D as Exhibit 99.1 (which

is incorporated herein by reference), pursuant to which the Reporting Persons have agreed to file this statement jointly in accordance

with the provisions of Rule 13d-1(k) under the Act.

Item 7. Material to Be Filed as Exhibits

|

|

Exhibit 99.1

|

Joint Filing Agreement, dated July 29, 2016, among Hillair

Investments, Hillair Management and Sean McAvoy.

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

July

29, 2016

|

|

|

|

(Date)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hillair

Capital Investments L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Sean M. McAvoy

|

|

|

|

|

Name:

|

Sean M. McAvoy

|

|

|

|

|

Title:

|

Authorized

Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hillair

Capital Management LLC*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Sean M. McAvoy

|

|

|

|

|

Name:

|

Sean M. McAvoy

|

|

|

|

|

Title:

|

Authorized

Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Sean M. McAvoy

|

|

|

|

Sean

M. McAvoy*

|

|

*This Reporting Person disclaims beneficial ownership over the

securities reported herein except to the extent of its pecuniary interest therein.

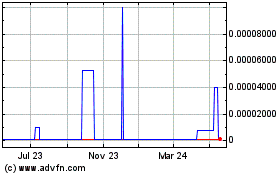

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Dec 2024 to Jan 2025

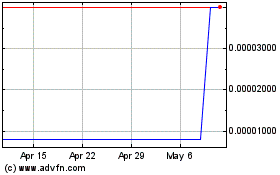

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Jan 2024 to Jan 2025