Current Report Filing (8-k)

July 30 2020 - 7:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 24, 2020

LEGACY EDUCATION ALLIANCE, INC.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

|

000-55790

|

|

39-2079974

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

1612 Cape Coral Parkway East, Cape Coral, Florida

|

|

33904

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (239) 542-0643

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

Commercial Contract with Daniel Thom, as Trustee of Torstonbo

Trust

On July 24, 2020 (the “Effective

Date”), 1612 E. Cape Coral Parkway Holding Co., LLC (the Seller”) entered into a Commercial Contract with Daniel Thom,

as Trustee of Torstonbo Trust, a Florida revocable trust (“Buyer”) for the sale of the real property and improvements

located at 1612 E. Cape Coral Parkway, Cape Coral, Florida (the “Property”), subject to the terms and conditions of

the Commercial Contract. The Property is currently used as the US headquarters of the Company and various of its subsidiaries.

The aggregate purchase

price for the Property is $2.5 million to be paid in cash at closing. The Property is encumbered by a mortgage in favor of USA

Regrowth Fund LLC securing an outstanding loan in the principal amount of $0.5 million, which, along with accrued interest, will

be paid at Closing.

The material terms of the

Commercial Contract include: (i) an initial deposit from the Buyer of $200,000 which deposit shall be non-refundable to the Buyer

(except as otherwise provided in the Commercial Contract) after the expiration of a 20-day due diligence period, which began on

the Effective Date; (ii) Buyer may terminate the Commercial Contract by delivering written notice to the Seller for any reason

or no reason at any time before the expiration of the due diligence period, in which event the initial deposit shall be returned

to the Buyer; (iii) a second deposit into escrow from the Buyer of $200,000 within three (3) days after the expiration of

the 20-day due diligence period; and (iv) a closing date thirty (30) days following the Effective Date. The Commercial Contract

provides that the Seller will deliver the Property to the Buyer at closing in its current condition “as is” condition,

ordinary wear and tear excepted and without warranty other than marketability of title. There is no financing contingency.

The foregoing description

of the Commercial Contract does not purport to be complete and is qualified in its entirety by reference to the text of such agreement.

The Company plans to file the Commercial Contract with its Quarterly Report on Form 10-Q for the period ending June 30,

2020.

Item 8.01 Other Events.

On July 27, 2020, James

E. May, as Successor Trustee of the 1612 E. Cape Coral Parkway Land Trust dated November 7, 2000 (the “Trust”), conveyed

all of his right, title, and interest in the Property to 1612 E. Cape Coral Parkway Holding Co., LLC (“Grantee”). The

sole beneficiary of the Trust is Legacy Education Alliance Holdings, Inc., a Colorado corporation (“Holdings”), a wholly

owned subsidiary of the Company. Holdings holds a 95% interest in the Grantee and LEA Properties, Inc., another wholly owned subsidiary

of the Company, holds the remaining 5%.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

LEGACY EDUCATION ALLIANCE, INC.

|

|

Date:

July 30, 2020

|

|

|

|

|

|

|

|

|

By:

|

/s/ James E. May

|

|

|

|

Name: James E. May

|

|

|

|

Title: Chief Executive Officer

|

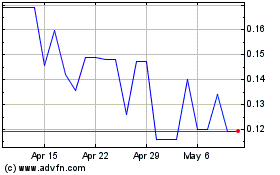

Legacy Education Alliance (CE) (USOTC:LEAI)

Historical Stock Chart

From Oct 2024 to Nov 2024

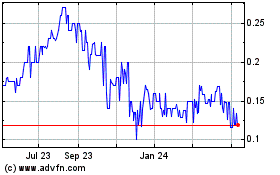

Legacy Education Alliance (CE) (USOTC:LEAI)

Historical Stock Chart

From Nov 2023 to Nov 2024