TORONTO, ON / ACCESSWIRE / May 27,

2014 / Laurion Mineral Exploration Inc. (TSX.V: LME;

OTCQX: LMEFF) ("Laurion") is pleased to

provide shareholders with the following update of its current

activities. The Corporation is most pleased with drill results

obtained to date on its Ishkoday discovery property located 220km

north east of Thunder Bay, and is maintaining its “one property,

one focus” business plan in order to maximize shareholder value.

The key priority at the top of the Corporation’s agenda is

reflected in its ability to continue monetizing its assets and

discoveries. In 2012, Laurion disposed of the Bell Mountain Project

located in Nevada to Lincoln Mining for $2.35 million in cash. To

date, Laurion has received a total of $1,539,414 inclusive of

interest. Two remaining cash payments totalling $832,900 inclusive

of interest are scheduled for payment prior to June 21, 2014.

Exploration Planning and Outlook on the Ishkoday

Discovery Property.

DIAMOND DRILLING - In February and March 2014,

the Corporation completed 924m of diamond drilling in 6 holes

(See Press Releases dated March 19 and May 14, 2014). All

of the diamond drill holes were collared to intersect geology

associated within the base metal Loki/A-Zone mineralization

reported in Laurion drilling carried out in 2012, while two of the

six holes were strategically planned with the specific objective of

defining the initial step of a phase-one drill program.

MINERALIZED ZONE INCREASED - As a result of

these drill holes, the Corporation determined the depth extent of

the mineralized zone increased from 75m to 165m almost doubling the

dip length, with the estimated thickness of the alteration zone

increasing from approximately 20m to 40m. Deeper intersections in

the mineralized A-Zone were somewhat richer in copper, with higher

associated silver values. These factors may indicate a transition

to closer proximity to mineralizing source with depth. Drilling

also determined that there were multiple narrow lenses of

higher-grade mineralization within a broader mineralized alteration

halo.

MINERALIZATION MODEL - Laurion's goal is to

develop the gold-rich massive sulphide environment at Ishkoday. To

aid this, Laurion is developing a "fingerprint" or model of the

mineralization by comparing it to other known deposits. Based on

the current drilling information, the model is stacked gold-rich

massive sulphide lenses hosting base metals trends within a large

mineralized halo.

EXPLORATION PLANNING - Over the next 6 months,

Laurion's objective is to complete a program composed of high

resolution aerial photography, retaining expertise with

volcanogenic and structural VMS perspective for guidance on

regional targeting concepts and recommendations for effective

exploration techniques and definition of priority target zones, and

a geophysics program covering 10km of IPower 3D ground geophysical

surveys.

PHASE-ONE DRILL PROGRAM - An exploration drill

program composed of 6,500m of diamond drilling will focus on

testing the depth extent of the three gold-rich base metal trends,

3,000m each in strike length, in a 1km wide corridor, targeting the

core of the VMS style mineralization and possible associated feeder

structures.

Annual and Special Meeting of

Shareholders

The Laurion Annual and Special Meeting of Shareholders will be

held on June 6, 2014 at the offices of Baker McKenzie LLP in

Toronto. Management of the Corporation will be requesting

shareholder approval for, amongst other things, a Special

Resolution to approve a consolidation of the common shares of the

Corporation in order to make the Corporation’s shares more

attractive to investors, since it may provide the Corporation with

increased flexibility to seek additional financing

opportunities.

While management believes that the Corporation’s cash position

in the interim is strong, the Corporation will need to complete a

private placement to continue developing the gold-rich base metal

environment on the Ishkoday Discovery Property. There is no

guarantee that the Corporation will be successful in completing a

Private Placement. In order to provide the Corporation with the

greatest chance of attracting new financing, the Directors would

like shareholder approval to consolidate the Company's common

shares up to a 7:1 basis at the Directors' discretion. The

Directors are seeking shareholder approval to the share

consolidation at this time in order to save the cost of holding a

separate special shareholders' meeting in the future.

Laurion will not be changing its name or its trading symbol in

conjunction with the proposed Consolidation.

The resource sector has been subject to continued softening of

commodity prices and a dramatic sell-off in equity markets, which

has created a capital desert in the junior end of the capital

market at levels not experienced in the resource sector the last 10

years. Advanced juniors and mid-tier producers have been caught in

the middle, exposed to a fragile balancing act between investors’

thirst for yield and low tolerance of risk. There is some hope in

the form of private capital investors who favor the juniors with

more advanced projects. In that respect, Laurion is practically

unique in its continuing ability to monetize non-core assets to

enable exploration focus on its primary Ishkoday discovery

property, delaying and minimizing the need for equity

injections.

Positive drill results on the Ishkoday Property have identified

a gold and base metal environment hosted in three base metal

trends, 3,000m each in strike length, within a 1km wide corridor.

The Corporation believes that its management of the short-term

needs of shareholders, coupled with its long-term strategic

planning for the development of a three-phase drilling program on

the Ishkoday Property, and the creation of a defined business plan

of growth through asset monetization and discovery, are value

drivers. Having said this, the Corporation is of the firm opinion

that a share consolidation will only proceed on a strategic

basis.

The technical information contained in this news release has

been verified by Joe Campbell, P.Geo., consulting geologist with

GeoVector Management Inc. Mr. Campbell is the project manager for

Laurion's Ishkoday project and is a Qualified Person as defined in

"National Instrument 43-101, Standards of Disclosure for Mineral

Properties."

About Laurion Mineral Exploration Inc.

Laurion’s Ishkoday discovery project is contained within a 100%

owned 4,442ha property package, located 220km northeast of Thunder

Bay with easy access off the Trans-Canada Highway.

Laurion is focussed on unlocking the value of the Ishkoday gold

and base metal environment hosted within three base metal trends,

3,000m each in strike length, in a 1 km wide corridor. Laurion is

expanding on a legacy of gold production from the Ishkoday shaft

which is hosted in a significant gold environment.

Laurion’s balanced and diversified management team is results

driven and has achieved a decade of growth through asset

monetization. Laurion’s management objective is to advance the

Ishkoday project from discovery to value creation to exit

strategy.

FOR FURTHER INFORMATION, CONTACT:

Laurion Mineral Exploration Inc.

Cynthia Le Sueur-Aquin - President

Tel: 1-705-788-9186

Fax: 1-705-788-9187

Website: http://www.laurion.ca/

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release includes certain forward-looking statements

concerning the future performance of Laurion's business, operations

and financial performance and condition, as well as management's

objectives, strategies, beliefs and intentions. Such statements

include, but are not limited to, statements concerning the approval

of Laurion's application to trade its common shares over the

facilities of the OTCQX and the commencement of such trading.

Forward-looking statements are frequently identified by such words

as "may", "will", "plan", "expect", "anticipate", "estimate",

"intend" and similar words referring to future events and results.

Forward-looking statements are based on the current opinions and

expectations of management. All forward-looking information is

inherently uncertain and subject to a variety of assumptions, risks

and uncertainties, including the speculative nature of mineral

exploration and development, fluctuating commodity prices,

competitive risks and the availability of financing, as described

in more detail in our recent securities filings available at

www.sedar.com. Actual events or results may differ materially from

those projected in the forward-looking statements and Laurion

cautions against placing undue reliance thereon. Laurion and its

management assume no obligation to revise or update these forward

looking statements.

Source: Laurion Mineral Exploration Inc.

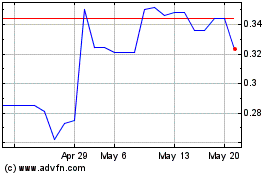

Laurion Minerals Explora... (PK) (USOTC:LMEFF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Laurion Minerals Explora... (PK) (USOTC:LMEFF)

Historical Stock Chart

From Jan 2024 to Jan 2025