UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

July 2024

Commission File Number 1-14728

LATAM Airlines Group S.A.

(Translation of Registrant’s Name Into

English)

Presidente Riesco 5711, 20th floor

Las Condes

Santiago, Chile

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

LATAM AIRLINES GROUP S.A.

The following exhibits are attached:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

LATAM Airlines Group S.A. |

| |

|

|

| |

By: |

/s/ Ramiro Alfonsin |

| |

|

Name: |

Ramiro Alfonsin |

| |

|

Title: |

CFO |

Date: July 18, 2024

2

Exhibit 99.1

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024

| CLP |

- |

CHILEAN PESO |

| UF |

- |

CHILEAN UNIDAD DE FOMENTO |

| ARS |

- |

ARGENTINE PESO |

| US$ |

- |

UNITED STATES DOLLAR |

| THUS$ |

- |

THOUSANDS OF UNITED STATES DOLLARS |

| MUS$ |

- |

MILLIONS OF UNITED STATES DOLLARS |

| COP |

- |

COLOMBIAN PESO |

| BRL/R$ |

- |

BRAZILIAN REAL |

| THR$ |

- |

THOUSANDS OF BRAZILIAN REAL |

Contents of the Notes to the interim consolidated financial statements

of LATAM Airlines Group S.A. and Subsidiaries.

| Notes |

|

Page |

| 1 - General information |

|

F-10 |

| 2 - Summary of material accounting policies |

|

F-15 |

| 2.1. Basis of Preparation |

|

F-15 |

| 2.2. Basis of Consolidation |

|

F-17 |

| 2.3. Foreign currency transactions |

|

F-17 |

| 2.4. Property, plant and equipment |

|

F-19 |

| 2.5. Intangible assets other than goodwill |

|

F-19 |

| 2.6. Borrowing costs |

|

F-19 |

| 2.7. Losses for impairment of non-financial assets

|

|

F-20 |

| 2.8. Financial assets |

|

F-20 |

| 2.9. Derivative financial instruments and embedded

derivatives |

|

F-20 |

| 2.10. Inventories |

|

F-22 |

| 2.11. Trade and other accounts receivable |

|

F-22 |

| 2.12. Cash and cash equivalents |

|

F-22 |

| 2.13. Capital |

|

F-22 |

| 2.14. Trade and other accounts payables |

|

F-22 |

| 2.15. Interest-bearing loans |

|

F-22 |

| 2.16. Current and deferred taxes |

|

F-23 |

| 2.17. Employee benefits |

|

F-23 |

| 2.18. Provisions |

|

F-24 |

| 2.19. Revenue from contracts with customers |

|

F-24 |

| 2.20. Leases |

|

F-25 |

| 2.21. Non-current assets (or disposal groups) classified

as held for sale |

|

F-26 |

| 2.22. Maintenance |

|

F-26 |

| 2.23. Environmental costs |

|

F-27 |

| 3 - Financial risk management |

|

F-27 |

| 3.1. Financial risk factors |

|

F-27 |

| 3.2. Capital risk management |

|

F-37 |

| 3.3. Estimates of fair value |

|

F-37 |

| 4 - Accounting estimates and judgments |

|

F-39 |

| 5 - Segment information |

|

F-41 |

| 6 - Cash and cash equivalents |

|

F-43 |

| 7 - Financial instruments |

|

F-44 |

| 8 - Trade and other accounts receivable current, and non-current accounts receivable |

|

F-45 |

| 9 - Accounts receivable from/payable to related entities |

|

F-47 |

| 10 - Inventories |

|

F-48 |

| 11 - Other financial assets |

|

F-49 |

| 12 - Other non-financial assets |

|

F-50 |

| 13 - Non-current assets and disposal group classified as held for sale |

|

F-51 |

| 14 - Investments in subsidiaries |

|

F-52 |

| 15 - Intangible assets other than goodwill |

|

F-55 |

| 16 - Property, plant and equipment |

|

F-57 |

| 17 - Current and deferred tax |

|

F-62 |

| 18 - Other financial liabilities |

|

F-67 |

| 19 - Trade and other accounts payables |

|

F-75 |

| 20 - Other provisions |

|

F-76 |

| 21 - Other non financial liabilities |

|

F-78 |

| 22 - Employee benefits |

|

F-79 |

| 23 - Accounts payable, non-current |

|

F-82 |

| 24 - Equity |

|

F-82 |

| 25 - Revenue |

|

F-89 |

| 26 - Costs and expenses by nature |

|

F-89 |

| 27 - Other income, by function |

|

F-91 |

| 28 - Foreign currency and exchange rate differences |

|

F-91 |

| 29 - Earning (Loss) per share |

|

F-97 |

| 30 - Contingencies |

|

F-98 |

| 31 - Commitments |

|

F-122 |

| 32 - Transactions with related parties |

|

F-125 |

| 33 - Share based payments |

|

F-127 |

| 34 - Statement of cash flows |

|

F-130 |

| 35 - Events subsequent to the date of the financial statements |

|

F-133 |

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

ASSETS

| | |

| |

As of | | |

As of | |

| | |

Note | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

| |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | | |

| |

| Current Assets | |

| |

| | |

| |

| Cash and cash equivalents | |

6 - 7 | |

| 1,851,373 | | |

| 1,714,761 | |

| Other financial assets | |

7 - 11 | |

| 178,325 | | |

| 174,819 | |

| Other non-financial assets | |

12 | |

| 181,786 | | |

| 185,264 | |

| Trade and other accounts receivable | |

7 - 8 | |

| 1,369,166 | | |

| 1,385,910 | |

| Accounts receivable from related entities | |

7 - 9 | |

| 7 | | |

| 28 | |

| Inventories | |

10 | |

| 585,315 | | |

| 592,880 | |

| Current tax assets | |

17 | |

| 67,276 | | |

| 47,030 | |

| Total

current assets other than non-current assets (or disposal groups) classified as held for sale | |

| |

| 4,233,248 | | |

| 4,100,692 | |

| Non-current assets (or disposal groups) classified as held for sale | |

13 | |

| 102,863 | | |

| 102,670 | |

| Total current assets | |

| |

| 4,336,111 | | |

| 4,203,362 | |

| Non-current assets | |

| |

| | | |

| | |

| Other financial assets | |

7 - 11 | |

| 39,260 | | |

| 34,485 | |

| Other non-financial assets | |

12 | |

| 161,388 | | |

| 168,621 | |

| Accounts receivable | |

7 - 8 | |

| 12,371 | | |

| 12,949 | |

| Intangible assets other than goodwill | |

15 | |

| 1,124,053 | | |

| 1,151,986 | |

| Property, plant and equipment | |

16 | |

| 9,225,657 | | |

| 9,091,130 | |

| Deferred tax assets | |

17 | |

| 4,374 | | |

| 4,782 | |

| Total non-current assets | |

| |

| 10,567,103 | | |

| 10,463,953 | |

| Total assets | |

| |

| 14,903,214 | | |

| 14,667,315 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

LIABILITIES AND EQUITY

| LIABILITIES | |

Note | |

As of

March 31,

2024 | | |

As of

December 31,

2023 | |

| | |

| |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | | |

| |

| Current liabilities | |

| |

| | |

| |

| Other financial liabilities | |

7 - 18 | |

| 676,638 | | |

| 596,063 | |

| Trade and other accounts payables | |

7 - 19 | |

| 1,742,214 | | |

| 1,765,279 | |

| Accounts payable to related entities | |

7 - 9 | |

| 12,291 | | |

| 7,444 | |

| Other provisions | |

20 | |

| 9,533 | | |

| 15,072 | |

| Current tax liabilities | |

17 | |

| 2,658 | | |

| 2,371 | |

| Other non-financial liabilities | |

21 | |

| 3,242,240 | | |

| 3,301,906 | |

| Total current liabilities | |

| |

| 5,685,574 | | |

| 5,688,135 | |

| | |

| |

| | | |

| | |

| Non-current liabilities | |

| |

| | | |

| | |

| Other financial liabilities | |

7 - 18 | |

| 6,400,346 | | |

| 6,341,669 | |

| Accounts payable | |

7 - 23 | |

| 435,147 | | |

| 418,587 | |

| Other provisions | |

20 | |

| 983,749 | | |

| 926,736 | |

| Deferred tax liabilities | |

17 | |

| 372,448 | | |

| 382,359 | |

| Employee benefits | |

22 | |

| 139,845 | | |

| 122,618 | |

| Other non-financial liabilities | |

21 | |

| 298,051 | | |

| 348,936 | |

| Total non-current liabilities | |

| |

| 8,629,586 | | |

| 8,540,905 | |

| Total liabilities | |

| |

| 14,315,160 | | |

| 14,229,040 | |

| | |

| |

| | | |

| | |

| EQUITY | |

| |

| | | |

| | |

| Share capital | |

24 | |

| 5,003,534 | | |

| 5,003,534 | |

| Retained earnings/(losses) | |

24 | |

| 645,207 | | |

| 464,411 | |

| Other equity | |

24 | |

| 39 | | |

| 39 | |

| Other reserves | |

24 | |

| (5,050,063 | ) | |

| (5,017,682 | ) |

| Parent’s ownership interest | |

| |

| 598,717 | | |

| 450,302 | |

| Non-controlling interest | |

14 | |

| (10,663 | ) | |

| (12,027 | ) |

| Total equity | |

| |

| 588,054 | | |

| 438,275 | |

| Total liabilities and equity | |

| |

| 14,903,214 | | |

| 14,667,315 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME BY FUNCTION

| | |

| |

For the period ended

March 31, | |

| | |

Note | |

2024 | | |

2023 | |

| | |

| |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | | |

| |

| | |

| |

| | |

| |

| Revenue | |

5 - 25 | |

| 3,267,199 | | |

| 2,771,642 | |

| Cost of sales | |

26 | |

| (2,393,859 | ) | |

| (2,169,069 | ) |

| Gross margin | |

| |

| 873,340 | | |

| 602,573 | |

| Other income | |

27 | |

| 54,134 | | |

| 33,816 | |

| Distribution costs | |

26 | |

| (158,292 | ) | |

| (121,359 | ) |

| Administrative expenses | |

26 | |

| (187,442 | ) | |

| (145,552 | ) |

| Other expenses | |

26 | |

| (140,978 | ) | |

| (106,445 | ) |

| Other (losses) | |

| |

| (46,431 | ) | |

| (19,683 | ) |

| Income from the operational activities | |

| |

| 394,331 | | |

| 243,350 | |

| Financial income | |

| |

| 31,450 | | |

| 17,922 | |

| Financial costs | |

26 | |

| (191,385 | ) | |

| (164,164 | ) |

| Foreign exchange gains | |

| |

| 39,627 | | |

| 17,408 | |

| Result of indexation units | |

| |

| 1,075 | | |

| (338 | ) |

| Income before taxes | |

| |

| 275,098 | | |

| 114,178 | |

| Income tax benefits/(expense) | |

17 | |

| (15,143 | ) | |

| 6,879 | |

| NET INCOME FOR THE PERIOD | |

| |

| 259,955 | | |

| 121,057 | |

| | |

| |

| | | |

| | |

| Income attributable to owners of the parent | |

| |

| 258,279 | | |

| 121,801 | |

| Income attributable to non-controlling interest | |

14 | |

| 1,676 | | |

| (744 | ) |

| NET INCOME FOR THE PERIOD | |

| |

| 259,955 | | |

| 121,057 | |

| EARNING PER SHARE | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Basic earnings per share (US$) | |

29 | |

| 0.000427 | | |

| 0.000202 | |

| Diluted earnings per share (US$) | |

29 | |

| 0.000427 | | |

| 0.000201 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| | |

| |

For the period ended at

March 31, | |

| | |

Note | |

2024 | | |

2023 | |

| | |

| |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | | |

| |

| | |

| |

| |

| NET INCOME FOR THE PERIOD | |

| |

| 259,955 | | |

| 121,057 | |

| Components of other comprehensive income (loss) that will not be reclassified to income before taxes | |

| |

| | | |

| | |

| Other comprehensive (loss), before taxes, (losses) by new measurements on defined benefit plans | |

24 | |

| (15,295 | ) | |

| (5,777 | ) |

| Total other comprehensive (loss) that will not be reclassified to income before taxes | |

| |

| (15,295 | ) | |

| (5,777 | ) |

| Components of other comprehensive income that will be reclassified to income before taxes | |

| |

| | | |

| | |

| Currency translation differences (losses) on currency translation, before tax | |

| |

| (43,769 | ) | |

| (5,804 | ) |

| Other comprehensive loss, before taxes, currency translation differences | |

| |

| (43,769 | ) | |

| (5,804 | ) |

| Cash flow hedges | |

| |

| | | |

| | |

| Gains (losses) on cash flow hedges before taxes | |

24 | |

| 72,287 | | |

| (28,876 | ) |

| Reclassification adjustment on cash flow hedges before tax | |

24 | |

| (26,406 | ) | |

| (1,833 | ) |

| Other comprehensive income (losses), before taxes, cash flow hedges | |

| |

| 45,881 | | |

| (30,709 | ) |

| Change in value of time value of options | |

| |

| | | |

| | |

| Gains/(Losses) on change in value of time value of options before tax | |

24 | |

| (28,627 | ) | |

| 16,359 | |

| Reclassification adjustments on change in value of time value of options before tax | |

24 | |

| 8,812 | | |

| 5,598 | |

| Other comprehensive income, before taxes, changes in the time value of the options | |

| |

| (19,815 | ) | |

| 21,957 | |

| Total other comprehensive income that will be reclassified to income before taxes | |

| |

| (17,703 | ) | |

| (14,556 | ) |

| Other components of other comprehensive income (loss), before taxes | |

| |

| (32,998 | ) | |

| (20,333 | ) |

| Income tax relating to other comprehensive income that will not be reclassified to income | |

| |

| | | |

| | |

| Income tax relating to new measurements on defined benefit plans | |

17 | |

| 594 | | |

| 70 | |

| Income tax relating to other comprehensive income that will not be reclassified to income | |

| |

| 594 | | |

| 70 | |

| Income tax relating to other comprehensive income (loss) that will be reclassified to income | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Income tax related to cash flow hedges in other comprehensive income (loss) | |

17 | |

| — | | |

| (97 | ) |

| Income taxes related to components of other comprehensive loss will be reclassified to income | |

| |

| — | | |

| (97 | ) |

| Total Other comprehensive income | |

| |

| (32,404 | ) | |

| (20,360 | ) |

| Total comprehensive income | |

| |

| 227,551 | | |

| 100,697 | |

| | |

| |

| | | |

| | |

| Comprehensive income attributable to owners of the parent | |

| |

| 225,898 | | |

| 101,600 | |

| Comprehensive income attributable to non-controlling interests | |

| |

| 1,653 | | |

| (903 | ) |

| TOTAL COMPREHENSIVE INCOME | |

| |

| 227,551 | | |

| 100,697 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | |

| |

Attributable

to owners of the parent | | |

| | |

| |

| | |

| |

| | |

| | |

| | |

Change

in other reserves | | |

| | |

| | |

| | |

| |

| | |

Note | |

Share

capital | | |

Other

equity | | |

Treasury

shares | | |

Currency

translation

reserve | | |

Cash

flow

hedging

reserve | | |

Gains

(Losses)

from

changes in

the time

value of

the

options | | |

Actuarial

gains or

losses on

defined

benefit

plans

reserve | | |

Shares

based

payments

reserve | | |

Other

sundry

reserve | | |

Total

other

reserve | | |

Retained

earnings/

(losses) | | |

Parent’s

ownership

interest | | |

Non-

controlling

interest | | |

Total

equity | |

| | |

| |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | |

| Equity

as of January 1, 2024 | |

| |

| 5,003,534 | | |

| 39 | | |

| — | | |

| (3,830,611 | ) | |

| (38,678 | ) | |

| 32,947 | | |

| (48,559 | ) | |

| 37,235 | | |

| (1,170,016 | ) | |

| (5,017,682 | ) | |

| 464,411 | | |

| 450,302 | | |

| (12,027 | ) | |

| 438,275 | |

| Total

increase (decrease) in equity | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income for the period | |

24 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 258,279 | | |

| 258,279 | | |

| 1,676 | | |

| 259,955 | |

| Other

comprehensive income (loss) | |

| |

| — | | |

| — | | |

| — | | |

| (43,750 | ) | |

| 45,881 | | |

| (19,815 | ) | |

| (14,697 | ) | |

| — | | |

| — | | |

| (32,381 | ) | |

| — | | |

| (32,381 | ) | |

| (23 | ) | |

| (32,404 | ) |

| Total

comprehensive income | |

| |

| — | | |

| — | | |

| — | | |

| (43,750 | ) | |

| 45,881 | | |

| (19,815 | ) | |

| (14,697 | ) | |

| — | | |

| — | | |

| (32,381 | ) | |

| 258,279 | | |

| 225,898 | | |

| 1,653 | | |

| 227,551 | |

| Transactions

with shareholders | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividends | |

25 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (77,483 | ) | |

| (77,483 | ) | |

| — | | |

| (77,483 | ) |

| Increase

(decrease) through transfers and other changes, equity | |

24-34 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| | | |

| — | | |

| (289 | ) | |

| (289 | ) |

| Total

transactions with shareholders | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (77,483 | ) | |

| (77,483 | ) | |

| (289 | ) | |

| (77,772 | ) |

| Closing

balance as of March 31, 2024 (Unaudited) | |

| |

| 5,003,534 | | |

| 39 | | |

| — | | |

| (3,874,361 | ) | |

| 7,203 | | |

| 13,132 | | |

| (63,256 | ) | |

| 37,235 | | |

| (1,170,016 | ) | |

| (5,050,063 | ) | |

| 645,207 | | |

| 598,717 | | |

| (10,663 | ) | |

| 588,054 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

| | |

| |

Attributable

to owners of the parent | | |

| | |

| |

| | |

| |

| | |

| | |

| | |

Change

in other reserves | | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

Cash | | |

Gains

(Losses) from changes in the time | | |

Actuarial

gains or losses on defined | | |

Shares | | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

| | |

Currency | | |

flow | | |

value

of | | |

benefit | | |

based | | |

Other | | |

Total | | |

Retained | | |

Parent’s | | |

Non- | | |

| |

| | |

| |

Share | | |

Other | | |

Treasury | | |

translation | | |

hedging | | |

the | | |

plans | | |

payments | | |

sundry | | |

other | | |

earnings/ | | |

ownership | | |

controlling | | |

Total | |

| | |

Note | |

capital | | |

equity | | |

shares | | |

reserve | | |

reserve | | |

options | | |

reserve | | |

reserve | | |

reserve | | |

reserve | | |

(losses) | | |

interest | | |

interest | | |

equity | |

| | |

| |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | |

| Equity

as of January 1, 2023 | |

| |

| 13,298,486 | | |

| 39 | | |

| (178 | ) | |

| (3,805,560 | ) | |

| 36,542 | | |

| (21,622 | ) | |

| (28,117 | ) | |

| 37,235 | | |

| (1,972,651 | ) | |

| (5,754,173 | ) | |

| (7,501,896 | ) | |

| 42,278 | | |

| (11,557 | ) | |

| 30,721 | |

| Total

increase (decrease) in equity | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income/(loss) for the period | |

24 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 121,801 | | |

| 121,801 | | |

| (744 | ) | |

| 121,057 | |

| Other

comprehensive income | |

| |

| — | | |

| — | | |

| — | | |

| (5,646 | ) | |

| (30,806 | ) | |

| 21,957 | | |

| (5,706 | ) | |

| — | | |

| — | | |

| (20,201 | ) | |

| — | | |

| (20,201 | ) | |

| (159 | ) | |

| (20,360 | ) |

| Total

comprehensive income | |

| |

| — | | |

| — | | |

| — | | |

| (5,646 | ) | |

| (30,806 | ) | |

| 21,957 | | |

| (5,706 | ) | |

| — | | |

| — | | |

| (20,201 | ) | |

| 121,801 | | |

| 101,600 | | |

| (903 | ) | |

| 100,697 | |

| Transactions

with shareholders Increase for other Contributions from the owners | |

24 | |

| — | | |

| 4,926 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,076 | ) | |

| (4,076 | ) | |

| — | | |

| 850 | | |

| — | | |

| 850 | |

| Increase

(decrease) Through transfers and other changes, Equity | |

24

-33 | |

| 4,926 | | |

| (4,926 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 57,129 | | |

| 57,129 | | |

| (79 | ) | |

| 57,050 | |

| Total

transactions with shareholders | |

| |

| 4,926 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,076 | ) | |

| (4,076 | ) | |

| 57,129 | | |

| 57,979 | | |

| (79 | ) | |

| 57,900 | |

| Closing

balance as of March 31, 2023 (Unaudited) | |

| |

| 13,303,412 | | |

| 39 | | |

| (178 | ) | |

| (3,811,206 | ) | |

| 5,736 | | |

| 335 | | |

| (33,823 | ) | |

| 37,235 | | |

| (1,976,727 | ) | |

| (5,778,450 | ) | |

| (7,322,966 | ) | |

| 201,857 | | |

| (12,539 | ) | |

| 189,318 | |

The accompanying Notes 1 to 35 form an integral part of these

interim consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS - DIRECT

METHOD

| | |

| |

For the period ended | |

| | |

| |

March 31, | |

| | |

Note | |

2024 | | |

2023 | |

| | |

| |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | |

| Cash flows from operating activities | |

| |

| | |

| |

| Cash collection from operating activities | |

| |

| | |

| |

| Proceeds from sales of goods and services | |

| |

| 3,313,955 | | |

| 3,062,687 | |

| Other cash receipts from operating activities | |

| |

| 79,829 | | |

| 42,779 | |

| Payments for operating activities | |

| |

| | | |

| | |

| Payments to suppliers for the supply goods and services | |

34 | |

| (2,510,340 | ) | |

| (2,198,954 | ) |

| Payments to and on behalf of employees | |

| |

| (344,111 | ) | |

| (363,929 | ) |

| Other payments for operating activities | |

| |

| (94,536 | ) | |

| (64,261 | ) |

| Income taxes (paid) | |

| |

| (22,644 | ) | |

| (5,653 | ) |

| Other cash inflows (outflows) | |

34 | |

| 35,972 | | |

| (30,734 | ) |

| Net cash (outflow) inflow from operating activities | |

| |

| 458,125 | | |

| 441,935 | |

| Amounts raised from sale of property, plant and equipment | |

| |

| 19,966 | | |

| 42,349 | |

| Purchases of property, plant and equipment | |

| |

| (102,484 | ) | |

| (97,886 | ) |

| Purchases of intangible assets | |

| |

| (13,297 | ) | |

| (13,593 | ) |

| Interest received | |

| |

| 37,417 | | |

| 23,273 | |

| Other cash inflows (outflows) | |

34 | |

| 27,589 | | |

| 20,111 | |

| Net cash (outflow) inflow from investing activities | |

| |

| (30,809 | ) | |

| (25,746 | ) |

| Cash flows inflow (out flow) from financing activities | |

| |

| | | |

| | |

| Loans repayments | |

34 | |

| (51,350 | ) | |

| (82,363 | ) |

| Payments of lease liabilities | |

34 | |

| (86,035 | ) | |

| (56,687 | ) |

| Dividends paid | |

34 | |

| (289 | ) | |

| — | |

| Interest paid | |

| |

| (129,510 | ) | |

| (84,298 | ) |

| Other cash (outflows) inflows | |

34 | |

| 719 | | |

| (2,946 | ) |

| Net cash inflow (outflow) from financing activities | |

| |

| (266,465 | ) | |

| (226,294 | ) |

| Net (decrease) increase in cash and cash equivalents before effect of exchanges rate change | |

| |

| 160,851 | | |

| 189,895 | |

| Effects of variation in the exchange rate on cash and cash equivalents | |

| |

| (24,239 | ) | |

| 8,850 | |

| Net (decrease) increase in cash and cash equivalents | |

| |

| 136,612 | | |

| 198,745 | |

| CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD | |

6 | |

| 1,714,761 | | |

| 1,216,675 | |

| CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD | |

6 | |

| 1,851,373 | | |

| 1,415,420 | |

The accompanying Notes 1 to 35 form an integral part of these interim

consolidated financial statements.

LATAM AIRLINES GROUP S.A. AND SUBSIDIARIES

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2024 (UNAUDITED)

NOTE 1 - GENERAL INFORMATION

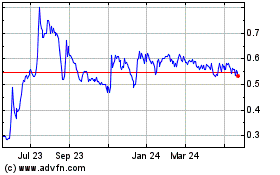

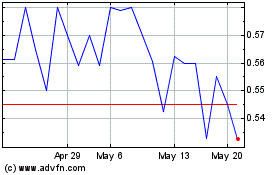

LATAM Airlines Group S.A. (“LATAM” or the

“Company”) is an open stock company which holds the values inscribed in the Registro de Valores of the Commission for the

Financial Market, whose shares are listed in Chile on the Electronic Stock Exchange of Chile - Stock Exchange and the Santiago Stock

Exchange. LATAM’s ADRs are currently trading in the United States of America on the OTC (Over-The-Counter) markets.

Its main business is the air transport of passengers and cargo, both

in the domestic markets of Chile, Peru, Colombia, Ecuador and Brazil, as well as in a series of regional and international routes in

America, Europe and Oceania. These businesses are developed directly or by its subsidiaries in Chile, Ecuador, Peru, Brazil, Colombia

and Paraguay. In addition, the Company has subsidiaries that operate in the cargo business in Chile, Brazil and Colombia.

The Company is located in Chile, in the city of Santiago, on Avenida

Presidente Riesco No. 5711, Las Condes commune.

As of March 31, 2024, the Company’s statutory capital is represented

by 604,441,789,335 ordinary shares without nominal value. As of that date, 604,437,877,587 shares were subscribed and paid. The foregoing,

considering the capital increase approved by the shareholders of the company at an extraordinary meeting held on July 5, 2022, in the

context of the implementation of its reorganization plan approved and confirmed in the Chapter 11 Proceedings, as well as the Capital

decrease required for the Chilean Capital Markets law that appears in a public deed dated September 6, 2023, granted at the Notaría

of Santiago of Mr. Eduardo Javier Diez Morello.

The major shareholders of the Company, considering the total

amount of subscribed and paid shares, are Banco de Chile on behalf of State Street which owns 45.98%, Banco de Chile on behalf of

Non-Resident Third Parties with 11.54%, Delta Air Lines with 10.05% and Qatar Airways with 10.03% ownership.

As of March 31, 2024, the Company had a total of 2,163 shareholders

in its registry. At that date, approximately 0.01% of the Company’s capital stock was in the form of ADRs.

During 2024, the Company had an average of 36,190 employees, ending

this period with a total of 36,477 collaborator, distributed in 5,178 Administration employees, 18,289 in Operations, 8,840 Cabin Crew

and 4,170 Command crew.

The main subsidiaries included in these consolidated financial statements

are as follows:

| | |

| |

Country | |

Functional | |

As March 31, 2024 | | |

As December 31, 2023 | |

| Tax No. | |

Company | |

of origin | |

Currency | |

Direct | | |

Indirect | | |

Total | | |

Direct | | |

Indirect | | |

Total | |

| | |

| |

| |

| |

% | | |

% | | |

% | | |

% | | |

% | | |

% | |

| | |

| |

| |

| |

Unaudited | | |

| | |

| | |

| |

| 96.969.680-0 | |

Lan Pax Group S.A. and Subsidiaries | |

Chile | |

US$ | |

| 99.9959 | | |

| 0.0041 | | |

| 100.0000 | | |

| 99.9959 | | |

| 0.0041 | | |

| 100.0000 | |

| Foreign | |

Latam Airlines Perú S.A. | |

Peru | |

US$ | |

| 23.6200 | | |

| 76.1900 | | |

| 99.8100 | | |

| 23.6200 | | |

| 76.1900 | | |

| 99.8100 | |

| 93.383.000-4 | |

Lan Cargo S.A. | |

Chile | |

US$ | |

| 99.8940 | | |

| 0.0041 | | |

| 99.8981 | | |

| 99.8940 | | |

| 0.0041 | | |

| 99.8981 | |

| 76.717.244-3 | |

Prime Cargo SpA. | |

Chile | |

CLP | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| Foreign | |

Connecta Corporation | |

U.S.A. | |

US$ | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| Foreign | |

Prime Airport Services Inc. and Subsidiary | |

U.S.A. | |

US$ | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| 96.951.280-7 | |

Transporte Aéreo S.A. | |

Chile | |

US$ | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| 96.631.520-2 | |

Fast Air Almacenes de Carga S.A. | |

Chile | |

CLP | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| Foreign | |

Laser Cargo S.R.L. | |

Argentina | |

ARS | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| 96.969.690-8 | |

Lan Cargo Inversiones S.A. and Subsidiary | |

Chile | |

US$ | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| 96.575.810-0 | |

Inversiones Lan S.A. | |

Chile | |

US$ | |

| 99.9000 | | |

| 0.1000 | | |

| 100.0000 | | |

| 99.9000 | | |

| 0.1000 | | |

| 100.0000 | |

| 96.847.880-K | |

Technical Training LATAM S.A. | |

Chile | |

CLP | |

| 99.8300 | | |

| 0.1700 | | |

| 100.0000 | | |

| 99.8300 | | |

| 0.1700 | | |

| 100.0000 | |

| Foreign | |

Latam Finance Limited | |

Cayman Island | |

US$ | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | |

| Foreign | |

Peuco Finance Limited | |

Cayman Island | |

US$ | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | |

| Foreign | |

Professional Airline Services INC. | |

U.S.A. | |

US$ | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | |

| Foreign | |

Jarletul S.A. | |

Uruguay | |

US$ | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | | |

| 0.0000 | | |

| 100.0000 | | |

| 100.0000 | |

| Foreign | |

Latam Travel S.R.L. | |

Bolivia | |

US$ | |

| 99.0000 | | |

| 1.0000 | | |

| 100.0000 | | |

| 99.0000 | | |

| 1.0000 | | |

| 100.0000 | |

| 76.262.894-5 | |

Latam Travel Chile II S.A. | |

Chile | |

US$ | |

| 99.9900 | | |

| 0.0100 | | |

| 100.0000 | | |

| 99.9900 | | |

| 0.0100 | | |

| 100.0000 | |

| Foreign | |

Latam Travel S.A. | |

Argentina | |

ARS | |

| 94.0100 | | |

| 5.9900 | | |

| 100.0000 | | |

| 94.0100 | | |

| 5.9900 | | |

| 100.0000 | |

| Foreign | |

TAM S.A. and Subsidiaries (*) | |

Brazil | |

BRL | |

| 63.0987 | | |

| 36.9013 | | |

| 100.0000 | | |

| 63.0987 | | |

| 36.9013 | | |

| 100.0000 | |

| (*) | As of March 31, 2024, the indirect participation percentage

of TAM S.A. and its Subsidiaries is from Holdco I S.A., a company which LATAM Airlines Group S.A. has a 100% share on economic rights

and 51.04% of political rights. Its percentage arose as a result of the provisional measure No. 863 of the Brazilian government implemented

in December of 2018 that allows foreign capital to have up to 100% of the share ownership of a Brazilian Airline. |

| | |

| |

Statement of financial position | | |

Net Income | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

For the period ended | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

At March 31, | |

| | |

| |

As of March 31, 2024 | | |

As of December 31, 2023 | | |

2024 | | |

2023 | |

| Tax No. | |

Company | |

Assets | | |

Liabilities | | |

Equity | | |

Assets | | |

Liabilities | | |

Equity | | |

Gain/(loss) | |

| | |

| |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | | |

ThUS$ | |

| | |

| |

Unaudited | | |

| | |

| | |

| | |

Unaudited | |

| 96.969.680-0 | |

Lan Pax Group S.A. and Subsidiaries (*) | |

| 391,940 | | |

| 1,793,206 | | |

| (1,046,717 | ) | |

| 487,236 | | |

| 1,835,537 | | |

| (1,000,622 | ) | |

| (53,974 | ) | |

| 44,557 | |

| Foreign | |

Latam Airlines Perú S.A. | |

| 374,525 | | |

| 287,981 | | |

| 86,544 | | |

| 334,481 | | |

| 285,645 | | |

| 48,836 | | |

| 37,707 | | |

| (14,356 | ) |

| 93.383.000-4 | |

Lan Cargo S.A. | |

| 423,771 | | |

| 210,954 | | |

| 212,817 | | |

| 391,430 | | |

| 189,019 | | |

| 202,411 | | |

| 12,417 | | |

| (25,684 | ) |

| 76.717.244-3 | |

Prime Cargo SpA. | |

| 815 | | |

| — | | |

| 815 | | |

| 912 | | |

| — | | |

| 912 | | |

| — | | |

| — | |

| Foreign | |

Connecta Corporation | |

| 61,795 | | |

| 6,804 | | |

| 54,991 | | |

| 64,054 | | |

| 6,790 | | |

| 57,264 | | |

| (2,273 | ) | |

| (790 | ) |

| Foreign | |

Prime Airport Services Inc. and Subsidiary (*) | |

| 19,487 | | |

| 16,926 | | |

| 2,560 | | |

| 19,435 | | |

| 17,241 | | |

| 2,194 | | |

| 368 | | |

| 195 | |

| 96.951.280-7 | |

Transporte Aéreo S.A. | |

| 280,084 | | |

| 152,730 | | |

| 127,354 | | |

| 280,117 | | |

| 151,066 | | |

| 129,051 | | |

| (78 | ) | |

| 17,092 | |

| 96.631.520-2 | |

Fast Air Almacenes de Carga S.A. | |

| 12,526 | | |

| 7,931 | | |

| 4,595 | | |

| 14,255 | | |

| 10,455 | | |

| 3,800 | | |

| 1,592 | | |

| 250 | |

| Foreign | |

Laser Cargo S.R.L. | |

| — | | |

| 1 | | |

| (1 | ) | |

| — | | |

| 1 | | |

| (1 | ) | |

| — | | |

| — | |

| Foreign | |

Lan Cargo Overseas Limited and Subsidiaries (*) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (319 | ) |

| 96.969.690-8 | |

Lan Cargo Inversiones S.A. and Subsidiary (*) | |

| 198,792 | | |

| 96,816 | | |

| (58,884 | ) | |

| 166,503 | | |

| 80,502 | | |

| (71,744 | ) | |

| 15,975 | | |

| (6,202 | ) |

| 96.575.810-0 | |

Inversiones Lan S.A. (*) | |

| 1,196 | | |

| 47 | | |

| 1,149 | | |

| 1,238 | | |

| 50 | | |

| 1,188 | | |

| (40 | ) | |

| 33 | |

| 96.847.880-K | |

Technical Training LATAM S.A. | |

| 1,297 | | |

| 892 | | |

| 405 | | |

| 1,246 | | |

| 893 | | |

| 353 | | |

| 110 | | |

| 118 | |

| Foreign | |

Latam Finance Limited | |

| 113 | | |

| 208,620 | | |

| (208,507 | ) | |

| 114 | | |

| 208,621 | | |

| (208,507 | ) | |

| — | | |

| — | |

| Foreign | |

Professional Airline Services INC. | |

| 17,337 | | |

| 12,154 | | |

| 5,183 | | |

| 15,571 | | |

| 10,943 | | |

| 4,628 | | |

| 310 | | |

| 413 | |

| Foreign | |

Jarletul S.A. | |

| 16 | | |

| 1,101 | | |

| (1,085 | ) | |

| 16 | | |

| 1,101 | | |

| (1,085 | ) | |

| — | | |

| (2 | ) |

| Foreign | |

Latam Travel S.R.L. | |

| 93 | | |

| — | | |

| 93 | | |

| 92 | | |

| — | | |

| 92 | | |

| — | | |

| — | |

| 76.262.894-5 | |

Latam Travel Chile II S.A. | |

| 356 | | |

| 1,239 | | |

| (883 | ) | |

| 356 | | |

| 1,239 | | |

| (883 | ) | |

| — | | |

| — | |

| Foreign | |

Latam Travel S.A. | |

| 3,987 | | |

| 1,301 | | |

| 2,686 | | |

| 4,547 | | |

| 1,554 | | |

| 2,993 | | |

| (3,136 | ) | |

| (1,079 | ) |

| Foreign | |

TAM S.A. and Subsidiaries (*) | |

| 4,251,039 | | |

| 2,909,425 | | |

| 1,341,614 | | |

| 4,240,748 | | |

| 3,027,373 | | |

| 1,212,329 | | |

| 168,595 | | |

| 3,693 | |

| (*) | The Equity reported corresponds to Equity attributable to

owners of the parent, it does not include Non-controlling participation. |

In addition, the following special purpose entities have been consolidated:

(1) Chercán Leasing Limited, intended to finance advance payments of aircraft; (2) Guanay Finance Limited, intended for the issue

of a securitized bond with future credit card payments (Liquidated in May 2023); and (3) Yamasa Sangyo Aircraft LA1 Kumiai, Yamasa Sangyo

Aircraft LA2 Kumiai, earmarked for aircraft financing. These companies have been consolidated as required by IFRS 10.

All entities over which LATAM has control have been included

in the consolidation. The Company has analyzed the control criteria in accordance with the requirements of IFRS 10.

Changes occurred in the consolidation perimeter between January 1,

2023 and March 31, 2024, are detailed below:

| (1) | Incorporation or acquisition of companies |

| - | On March 29, 2023, a capital increase was made in TAM S.A. carried out a capital increase, through the

contribution of LATAM Airlines Group S.A. of accounts receivable for ThUS$785,865; consequently, there were no significant changes in

the shareholder composition and therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On March 29, 2023, a capital increase was made in TAM Linheas Aéreas S.A carried out a capital

increase, through the contribution of TAM S.A. of accounts receivable for ThUS$785,865; consequently, there were no significant changes

in the shareholder composition and therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On March 29, 2023, a capital increase was made in Aerovías de Integración Regional S.A.

through the contribution of made a capital increase where Holdco Colombia I SpA made a contribution through accounts receivable for ThUS$120,410,

consequently, there were no significant changes in the shareholder composition and therefore did not generate any effect within the Consolidated

Financial Statements. |

| - | On April 14, 2023, a capital reduction was carried out in Lan Argentina S.A. through the absorption of

losses in the sum of ThUS$160,170. Consequently, there were no significant changes in the shareholding composition and therefore it did

not generate any effect within the Consolidated Financial Statements. |

| - | On June 7, 2023, a capital increase was made in TAM S.A. carried out a capital increase, through the contribution

of LATAM Airlines Group S.A. of accounts receivable for ThUS$308,031, consequently, there were no significant changes in the shareholder

composition and therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On June 7, 2023, a capital increase was made in TAM Linheas Aéreas S.A carried out a capital increase,

through the contribution of TAM S.A. of accounts receivable for ThUS$308,031, consequently, there were no significant changes in the shareholder

composition and therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On June 13 and 14, 2023, Inversiones Lan S.A. made a purchase of 923 shares from third parties, for an

a total amount of ThUS$23, of the subsidiary Aerovías de Integración Regional S.A., consequently, these transactions generated

a decrease in the non-controlling interest, without generating significant effects on the Consolidated Financial Statements. |

| - | On July 21, 2023, a capital increase was carried out in Latam Airlines Ecuador S.A through the contribution

of accounts receivable held by Holdco Ecuador S.A for ThUS$3,100, consequently, there were no significant changes in the shareholding

composition and Therefore, it did not generate any effect within the Consolidated Financial Statements. |

| - | On July 28, 2023, Lan Cargo S.A purchased 1 share of Lan Cargo Overseas Limited from Inversiones Lan S.A.

Consequently, there were no significant changes in the shareholding composition and therefore did not generate any effect within the Consolidated

Financial Statements. |

| - | On August 1, 2023, Inversiones Lan S.A. purchased 1 share of Americonsult SA de CV

from Lan Cargo Overseas Limited. Consequently, there were no significant changes in the shareholding composition and therefore did not

generate any effect within the Consolidated Financial Statements. |

| - | On August 4, 2023, the merger of Holdco Colombia II SpA into Lan Pax Group S.A takes place, acquiring

the latter all of its assets, liabilities, rights and obligations. As a result of the above, Holdco Colombia II SpA is dissolved. On the

same date Lan Pax Group S.A carries out a capital increase of ThUS$347 in Holdco Colombia I SpA through the contribution of 47,010 shares

of Aerovías de Integración Regional S.A. These transactions were carried out between entities under common control of LATAM

Airlines Group S.A. Group. and, therefore, did not generate any effect within the Consolidated Financial Statements. |

| - | On September 11, 2023, the company Mas Investment Limited was liquidated and its controller Lan Cargo

Overseas Limited acquired all its assets, liabilities, rights and obligations, as a result of the liquidation, including the investments

that Mas Investment Limited held in the following companies: (i) Consultoría Administrativa Profesional S.A. de C.V., equivalent

to 49,500 shares; (ii) Americonsult, S.A. de C.V., equivalent to 499 shares; (iii) Transporte Aéreo S.A. equivalent to 109,662

shares; and (iv) Inversiones Aereas S.A., equivalent to 15,216 shares. These transactions were carried out between entities under common

control of LATAM Airlines Group S.A. and, therefore, did not generate any effect within the Consolidated Financial Statements. |

| - | On September 11, 2023, the company Lan Cargo Overseas Limited was liquidated and its controller Lan Cargo

S.A acquired all its all its assets, liabilities, rights and obligations, as a result of the liquidation, including the investments that

Lan Cargo Overseas Limited held in the following companies: (i) Prime Airport Services Inc., equivalent to 105 shares; (ii) Americonsult

de Costa Rica S.A, equivalent to 66 shares; (iii) Americonsult de Guatemala, Sociedad Anónima, equivalent to 50 shares; (iv) Consultoría

Administrativa Profesional S.A. de C.V., equivalent to 49,500 shares; (v) Americonsult, S.A. de C.V., equivalent to 499 shares; (vi) Transporte

Aéreo S.A. equivalent to 109,662 shares; and (vii) Inversiones Aereas S.A., equivalent to 15,216 shares. These transactions were

carried out between entities under common control of LATAM Airlines Group S.A. and, therefore, did not generate any effect within the

Consolidated Financial Statements. |

| - | On September 15, 2023, a capital increase was made in TAM S.A. through the contribution of ThUS$106,104

on accounts receivable from LATAM Airlines Group S.A.; consequently, there were no significant changes in the shareholder composition

and therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On September 15, 2023, a capital increase was made in TAM Linheas Aéreas S.A through the contribution

of ThUS$106,104 on accounts receivable from TAM S.A., consequently, there were no significant changes in the shareholder composition and

therefore did not generate any effect within the Consolidated Financial Statements. |

| - | On October 23 and 30, 2023, Inversiones Lan S.A. purchased a total 183 shares from Non- controlling interest,

for an a total amount of ThUS$2, of the subsidiary Aerovías de Integración Regional S.A., consequently, these transactions

generated a decrease in non-controlling interest, with no generating significant effects on the Consolidated Financial Statements. |

| - | On December 6, 2023, the company Prime Cargo SpA was incorporated, which is 100% owned by Lan Cargo S.A.,

whose exclusive purpose is to carry out storage activities for all types of products and/or merchandise. |

| - | On December 29, 2023, LATAM Airlines Group S.A. purchased of 2,392,166 preferred shares of Inversora Cordillera

S.A. a Transportes Aéreos del Mercosur S.A.;consequently, the shareholding composition of Inversora Cordillera S.A. is as follows:

Lan Pax Group S.A. with 99.95% and LATAM Airlines Group S.A. with 0.05%. These transactions were between subsidiaries of LATAM Airlines

Group not generating any effects within the Consolidated Financial Statements. |

| - | On December 29, 2023, LATAM Airlines Group S.A. purchased of 53,376 preferred shares of LAN Argentina

S.A. a Transportes Aéreos del Mercosur S.A.;consequently, the shareholding composition of LAN Argentina S.A. is as follows: Lan

Pax Group S.A. with 4.99%, Inversora Cordillera S.A. with 94.96% and LATAM Airlines Group S.A. with 0.05%. These transactions were between

subsidiaries of LATAM Airlines Group not generating any effects within the Consolidated Financial Statements. |

| - | On March 18, 2024, a capital reduction was carried out in Inversiones Aéreas S.A. through the absorption

of accumulated losses in the sum of ThUS$175,140. As a consequence of this decrease in capital, the number of shares was reduced by 6,634,496,

without modifying the original participation of its shareholders. This transaction did not generate any effect within the Consolidated

Financial Statements. |

NOTE 2 - SUMMARY OF MATERIAL ACCOUNTING POLICIES

The following describes the principal accounting policies adopted in

the preparation of these consolidated financial statements.

These consolidated financial statements of LATAM

Airlines Group S.A. and Subsidiaries as of March 31, 2024 and for the three months ended March 31, 2024 and 2023, have been prepared in

accordance with International Accounting Standard 34 (IAS 34), Interim Financial Reporting, as issued by the International Accounting

Standards Board.

The consolidated financial statements have been prepared under

the historic-cost criterion, although modified by the valuation at fair value of certain financial instruments.

The preparation of the consolidated financial statements in accordance

with IFRS Accounting Standards requires the use of certain critical accounting estimates. It also requires management to use its judgment

in applying the Company’s accounting policies. Note 4 describe the areas that imply a greater degree of judgment or complexity or

the areas where the assumptions and estimates are significant to the consolidated financial statements.

These consolidated financial statements have been prepared in accordance

with the accounting policies used by the Company in the preparation of the 2023 consolidated financial statements, except for the standards

and interpretations adopted as of January 1, 2024.

| (a) | Application of new standards for the year 2024: |

Accounting pronouncements with implementation effective from January

1, 2024:

| |

Issuance Date |

|

Effective Date: |

| (i) Standards and amendments |

|

|

|

| |

|

|

|

| Amendment to IAS 1: Presentation of financial statements, on classification of liabilities. |

January 2020 |

|

01/01/2024 |

| |

|

|

|

| Amendment to IAS 1: Presentation of financial statements, on noncurrent liabilities with covenants. |

October 2022 |

|

01/01/2024 |

| |

|

|

|

| Amendment to IFRS 16: Leases, on sales with leaseback. |

September 2022 |

|

01/01/2024 |

| |

|

|

|

| Amendments to IAS 7 “Statement of cash flows” and IFRS 7 “Financial Instruments: Information to be Disclosed” |

May 2023 |

|

01/01/2024 |

The application of these accounting standards as of January 1, 2024,

had no significant effect on the Company’s consolidated financial statements.

| (b) | Accounting pronouncements not in force for the financial

year beginning on January 1, 2024: |

| |

Issuance Date |

|

Effective Date: |

| (i) Standards and amendments |

|

|

|

| |

|

|

|

| Amendments to IAS 21: Lack of Exchangeability |

August 2023 |

|

01/01/2025 |

| |

|

|

|

| IFRS 18: Presentation and disclosures in the financial statements |

April 2024 |

|

01/01/2027 |

The Company’s management is evaluating

the impacts that the application of IFRS 18 Presentation and disclosures in the financial statements may have on the consolidated

financial statements. Where it is estimated that the adoption of the amendment to IAS 21 will not have significant effects on the

company’s consolidated financial statements in the year of its first adoption.

| (c) | Chapter 11 Filing and Exit |

Chapter 11 Filing and Procedure: Due to the effects

on the operation of the restrictions established in the countries to control the effects of the COVID-19 pandemic, on May 25, 2020 the

Board of LATAM Airlines Group S.A. (“LATAM Parent”) resolved unanimously that LATAM Parent and some its subsidiaries should

initiate a reorganization process in the United States of America according to the rules established in the Bankruptcy Code by filing

a voluntary petition for relief in accordance with the same, which petition was submitted on May 26, 2020 and was jointly administered

under Case Number 20- 11254. Subsequently, Piquero Leasing Limited (July 7, 2020) and TAM S.A. and its subsidiaries in Brazil (July 9,

2020) joined the process (the voluntary petitions, collectively, the “Bankruptcy Filing” and each LATAM entity that filed

a petition, a “Debtor” and jointly, the “Debtors”).

As part of their overall reorganization process,

while the Chapter 11 proceedings were outstanding the Debtors sought and received relief in certain non-U.S. jurisdictions (i.e., Cayman

Islands, Chile and Colombia).

The Bankruptcy Filing for

each of the Debtors (each one, respectively, a “Petition Date”) was jointly administered under the caption “In re

LATAM Airlines Group S.A. et al.” Case Number 20- 11254. On June 18, 2022, the Bankruptcy Court issued a memorandum decision

approving the Debtors’ joint plan of reorganization (the “Plan”) and rejecting all remaining objections and

entered an order confirming the Plan (the “Confirmation Order”). On November 3, 2022 (the “Effective Date”),

the Plan was substantially consummated and each of the Debtors emerged from the Chapter 11 proceedings as “Reorganized

Debtors”. Thereafter, the Reorganized Debtors were permitted to operate their businesses and manage their properties without

supervision of the Bankruptcy Court and free of the restrictions of the Bankruptcy Code.

Pursuant to the Plan, the Company received an infusion of approximately

US$8.19 billion through a mix of new equity, convertible notes and debt, which enabled the Company to exit Chapter 11 with appropriate

capitalization to effectuate its business plan. Upon emergence, the Company had total debt of approximately US$6.8 billion, cash and cash

equivalents of approximately US$1.1 billion and revolving undrawn facilities in the amount of US$1.1 billion.

Pursuant to the Plan and Backstop Agreements,

LATAM raised up to US$500 million through a new revolving credit facility and approximately US$2.25 billion in total new money debt financing

through exit financing (new term loan and new notes).

As customary in this type of restructurings, the

docket of the Chapter 11 proceedings remained open after the Effective Date to finalize the reconciliation process of certain claims that

were still outstanding as of the Effective Date, as well as to resolve certain administrative matters.

On June 29, 2023, the Bankruptcy Court entered

a final decree in the Chapter 11 proceedings ordering that Case Number 20- 11254 and its docket be closed (the “Final Decree”).

The foregoing, as a result of the resolution of substantially all remaining matters in the Chapter 11 proceedings and all appeals of the

Confirmation Order.

| 2.2. | Basis of Consolidation |

Subsidiaries are all the entities (including special-purpose

entities) over which the Company has the power to control the financial and operating policies, which are generally accompanied by a holding

of more than half of the voting rights. In evaluating whether the Company controls another entity, the existence and effect of potential

voting rights that are currently exercisable or convertible at the date of the consolidated financial statements are considered. The subsidiaries

are consolidated from the date on which control is passed to the Company and they are excluded from the consolidation on the date they

cease to be so controlled. The results and cash are incorporated from the date of acquisition.

Balances, transactions and unrealized gains on

transactions between the Company’s entities are eliminated. Unrealized losses are also eliminated unless the transaction provides

evidence of an impairment loss of the asset transferred. When necessary, in order to ensure uniformity with the policies adopted by the

Company, the accounting policies of the subsidiaries are modified.

To account for and identify the financial

information to be disclosed when carrying out a business combination, such as the acquisition of an entity by the Company, the acquisition

method provided for in IFRS 3: Business combinations is used.

| (b) | Transactions with non-controlling interests |

The Group applies the policy of considering transactions

with non-controlling interests, when not related to the loss of control, as equity transactions without an effect on income.

When a subsidiary is sold and a percentage of participation is not

retained, the Company derecognizes the assets and liabilities of the subsidiary, the non-controlling interest and other components of

equity related to the subsidiary. Any gain or loss resulting from the loss of control is recognized in the consolidated income statement

by function within Other gains (losses).

If LATAM Airlines Group S.A. and Subsidiaries retain an ownership of

participation in the disposed subsidiary which does not represent control, this is recognized at fair value on the date that control is

lost and the amounts previously recognized in Other comprehensive income are accounted as if the Company had disposed directly the assets

and related liabilities, which can cause these amounts to be reclassified to profit or loss. The percentage retained valued at fair value

is subsequently accounted using the equity method.

| (d) | Investees or associates |

Investees or associates are all entities over

which LATAM Airlines Group S.A. and Subsidiaries have significant influence but have no control. This usually arises from holding between

20% and 50% of the voting rights. Investments in associates are booked using the equity method and are initially recognized at their cost.

| 2.3. | Foreign currency transactions |

| (a) | Presentation and functional currencies |

The items included in the financial statements of each of the entities

of LATAM Airlines Group S.A. and its Subsidiaries are valued using the currency of the main economic environment in which the entity operates

(the functional currency). The functional currency of LATAM Airlines Group S.A. is the United States Dollar, which is also the presentation

currency of the consolidated financial statements of LATAM Airlines Group S.A. and Subsidiaries.

| (b) | Transactions and balances |

Foreign currency transactions are translated to

the functional currency using the exchange rates on the transaction dates. Foreign currency gains and losses resulting from the liquidation

of these transactions and from the translation at the closing exchange rates of the monetary assets and liabilities denominated in foreign

currency are shown in the consolidated statement of income by function except when deferred in Other comprehensive income as qualifying

cash flow hedges.

| (c) | Adjustment due to hyperinflation |

After July 1, 2018, the Argentine economy was considered, for

purposes of IFRS Accounting Standards, hyperinflationary. The consolidated financial statements of the subsidiaries whose functional currency

is the Argentine Peso have been restated.

The non-monetary items of the statement of financial position as well

as the income statement, comprehensive income and cash flows of the group’s entities, whose functional currency corresponds to a

hyperinflationary economy, are adjusted for inflation and re-expressed in accordance with the variation of the consumer price index (“CPI”),

at each presentation date of its financial statements. The re-expression of non-monetary items is made from the date of initial recognition

in the statements of financial position and considering that the financial statements are prepared under the historical cost criterion.

Net losses or gains arising from the re-expression of non-monetary

ítems and income and costs are recognized in the consolidated income statement under “Result of indexation units”.

Net gains and losses on the re-expression of opening balances due to

the initial application of IAS 29 are recognized in consolidated retained earnings.

Re-expression due to hyperinflation will be recorded until the period

or exercise in which the economy of the entity ceases to be considered as a hyperinflationary economy. At that time, the adjustments made

by hyperinflation will be part of the cost of non-monetary assets and liabilities.

The comparative amounts in the consolidated financial statements of

the Company are presented in a stable currency and are not adjusted for subsequent changes in the price level or exchange rates.

The results and the financial situation of the Group’s entities,

whose functional currency is different from the presentation currency of the consolidated financial statements, of LATAM Airlines Group

S.A., which does not correspond to the currency of a hyperinflationary economy, are converted into the currency of presentation as follows:

| (i) | Assets and liabilities of each consolidated statement of

financial position presented are translated at the closing exchange rate on the consolidated statement of financial position date; |

| (ii) | The revenues and expenses of each income statement account

are translated at the exchange rates prevailing on the transaction dates, and |

| (iii) | All the resultant exchange differences by conversion are

shown as a separate component in other comprehensive income, within “Gain (losses) from exchange rate difference, before tax”. |

For those subsidiaries of the group whose

functional currency is different from the presentation currency and corresponds to the currency of a hyperinflationary economy; its restated

results, cash flow and financial situation are converted to the presentation currency at the closing exchange rate on the date of the

consolidated financial statements.

The exchange rates used correspond to

those fixed in the country where the subsidiary is located, whose functional currency is different to the U.S. dollar.

| 2.4. | Property, plant and equipment |

The land of LATAM Airlines Group S.A. and its Subsidiaries, are recognized

at cost less any accumulated impairment loss. The rest of the Property, plant and equipment are recorded, both at their initial recognition

and their subsequent measurement, at their historical cost, restated for inflation when appropriate, less the corresponding depreciation

and any loss due to impairment.

The amounts of advances paid to the aircraft manufacturers are capitalized

by the Company under Construction in progress until they are received.

Subsequent costs (replacement of components, improvements,

extensions, etc.) are included in the value of the initial asset or are recognized as a separate asset, only when it is probable that

the future economic benefits associated with the elements of property, plant and equipment, will flow to the Company and the cost of the

item can be determined reliably. The value of the replaced component is written off. The rest of the repairs and maintenance are charged

to income when they are incurred.

The depreciation of the Property, plant and equipment is calculated

using the linear method over their estimated technical useful lives; except in the case of certain technical components which are depreciated

on the basis of cycles and hours flown. This charge is recognized in the captions “Cost of sale” and “Administrative

expenses”.

The residual value and the useful life of assets are reviewed and adjusted,

if necessary, once a year. Useful lives are detailed in Note 16 (d).

When the value of an asset exceeds its estimated recoverable amount,

its value is immediately reduced to its recoverable amount.

Losses and gains from the sale of property, plant and equipment

are calculated by comparing the consideration with the book value and are included in the consolidated statement of income.

| 2.5. | Intangible assets other than goodwill |

| (a) | Airport slots and Loyalty program |

Airport slots and the Loyalty program correspond to intangible assets

with indefinite useful lives and are annually tested for impairment as an integral part of the CGU Air Transport.

Airport Slots correspond to an administrative authorization

to carry out operations of arrival and departure of aircraft, at a specific airport, within a certain period of time.

The Loyalty program corresponds to the system of accumulation and exchange

of points that is part of TAM Linhas Aereas S.A.

The airport slots and Loyalty program were recognized at fair value

under IFRS 3, as a consequence of the business combination with TAM S.A. and Subsidiaries.

Licenses for computer software acquired are capitalized on the basis

of the costs incurred in acquiring them and preparing them for using the specific software. These costs are amortized over their estimated

useful lives, for which the Company has defined useful lives between 3 and 10 years.

Expenses related to the development or maintenance of computer software

which do not qualify for capitalization, are shown as an expense when incurred. The personnel costs and other costs directly related to

the production of unique and identifiable computer software controlled by the Company, are shown as intangible Assets other than Goodwill

when they have met all the criteria for capitalization.

Interest costs incurred for the construction of any qualified

asset are capitalized over the time necessary for completing and preparing the asset for its intended use. Other interest costs are recognized

in the consolidated statement of income by function when accrued.

| 2.7. | Losses for impairment of non-financial assets |

Intangible assets that have an indefinite useful life are not subject

to amortization and are tested annually for impairment, or more frequently if events or changes in circumstances indicate that they might

be impaired. Assets subject to amortization are tested for impairment losses whenever any event or change in circumstances indicates that

the carrying amount may not be recoverable. An impairment loss is recognized for the excess of the carrying amount of the asset over its

recoverable amount. The recoverable amount is the fair value of an asset less the costs of sale or the value in use, whichever is greater.

For the purpose of evaluating impairment losses, assets are grouped at the lowest level for which there are largely independent cash inflows

(cash generating unit. Non-financial assets, other than goodwill, that would have suffered an impairment loss are reviewed if there are

indicators of reversal of losses. Impairment losses are recognized in the consolidated statement of income by function under “Other

gains (losses)”.

The Company classifies its financial assets in the following categories:

at fair value (either through other comprehensive income, or through gains or losses), and at amortized cost. The classification depends

on the business model of the entity to manage the financial assets and the contractual terms of the cash flows.

The group reclassifies debt investments when, and only when, it changes

its business model to manage those assets.

In the initial recognition, the Company measures a financial asset

at its fair value plus, in the case of a financial asset classified at amortized cost, the transaction costs that are directly attributable

to the acquisition of the financial asset. Transaction costs of financial assets accounted for at fair value through profit or loss are

recorded as expenses in the consolidated statement of income by function.

The subsequent measurement of debt instruments depends on the

group’s business model to manage the asset and cash flow characteristics of the asset. The Company has two measurement categories

in which the group classifies its debt instruments:

Amortized cost: the assets held for the collection of contractual cash

flows where those cash flows represent only payments of principal and interest are measured at amortized cost. A gain or loss on a debt

investment that is subsequently measured at amortized cost and is not part of a hedging relationship is recognized in income when the

asset is derecognized or impaired. Interest income from these financial assets is included in financial income using the effective interest

rate method.

Fair value through profit or loss: assets that do not meet the criteria

of amortized cost or fair value through other comprehensive income are measured at fair value through profit or loss. A gain or loss on

a debt investment that is subsequently measured at fair value through profit or loss and is not part of a hedging relationship is recognized

in profit or loss and is presented net in the consolidated statement of income by function within other gains / (losses) in the period

or exercise in which it arises.

Changes in the fair value of financial assets at fair value

through profit or loss are recognized in other gains / (losses) in the consolidated statement of income by function as appropriate.

The Company evaluates in advance the expected credit losses

associated with its debt instruments recorded at amortized cost. The applied impairment methodology depends on whether there has been

a significant increase in credit.

| 2.9. | Derivative financial instruments and embedded derivatives |

Derivative financial instruments and hedging activities

Initially at fair value on the date on which the derivative contract

was made and are subsequently valued at their fair value. The method to recognize the resulting loss or gain depends on whether the derivative

designated as a hedging instrument and, if so, the nature of the item being hedged.

The Company designates certain derivatives as:

| (a) | Hedge of an identified risk associated with a recognized

liability or an expected highly- probable transaction (cash-flow hedge), or |

| (b) | Derivatives that do not qualify for hedge accounting. |

At the beginning of the transaction, the

Company documents the economic relationship between the hedged items existing between the hedging instruments and the hedged items,

as well as its objectives for risk management and the strategy to carry out various hedging operations. The Company also documents

its assessment, both at the beginning and on an ongoing basis, as to whether the derivatives used in the hedging transactions are

highly effective in offsetting the changes in the fair value or cash flows of the items being hedged.

The total fair value of the hedging derivatives

is booked as Other non-current financial asset or liability if the remaining maturity of the item hedged is over 12 months, and as an

Other current financial asset or liability if the remaining term of the item hedged is less than 12 months.

Derivatives not booked as hedges are classified as Other financial

assets or liabilities.

The effective portion of changes in the fair value of derivatives that

are designated and qualify as cash flow hedges is shown in the statement of other comprehensive income. The loss or gain relating to the