|

|

Registration No. 333-153306

|

|

|

|

|

UNITED

STATES

|

|

SECURITIES

AND EXCHANGE COMMISSION

|

|

WASHINGTON,

D.C. 20549

|

|

|

|

|

POST-EFFECTIVE

AMENDMENT NO. 3 TO FORM S-1

|

|

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF

1933

|

|

|

|

|

LADYBUG

RESOURCE GROUP, INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

NEVADA

|

|

(State

or other jurisdiction of incorporation or organization

|

|

|

|

|

7370

|

|

(Primary

Standard Industrial Classification Code Number

|

|

|

|

|

26-1973389

|

|

(I.R.S.

Employer Identification Number)

|

|

|

|

|

11630

Slater Avenue Northeast, Suite 1A, Kirkland, WA 98034

|

|

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

|

|

|

|

|

11630

Slater Avenue Northeast, Suite 1A, Kirkland, WA 98034

|

|

(Name,

address, including zip code, and telephone number, including area code, of

agent of service)

|

|

Copies

to:

|

|

David

M. Loev

|

|

John

S. Gillies

|

|

The

Loev Law Firm, PC

|

|

The

Loev Law Firm, PC

|

|

6300

West Loop South, Suite 280

|

&

|

6300

West Loop South, Suite 280

|

|

Bellaire,

Texas 77401

|

|

Bellaire,

Texas 77401

|

|

Phone:

(713) 524-4110

|

|

Phone:

(713) 524-4110

|

|

Fax:

(713) 524-4122

|

|

Fax:

(713) 456-7908

|

|

From

time to time after the effective date of this Registration

Statement

|

|

(Approximate

date of commencement of proposed sale to the

public)

|

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box:

x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering.

o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer," "accelerated filer,” and "smaller

reporting company" in Rule 12b-2 of the Exchange Act (Check One):

|

|

|

Large

accelerated filer

o

|

Accelerated

filer

o

|

|

Non-accelerated

filer

o

|

Smaller

reporting company

x

|

|

(Do

not check if a smaller reporting

company)

|

The

Registrant hereby amends its Registration Statement, on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The

information contained in this Prospectus is not complete and may be changed.

These securities may not be sold until the Registration Statement filed with the

Securities and Exchange Commission is declared effective. This Prospectus is not

an offer to sell these securities and it is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not

permitted.

Explanatory

Note

The

registrant hereby amends this registration statement after the effective date of

the registration statement, September 19, 2009, so as to be in compliance with

Section 10(a)(3) of the Securities Act of 1933, as amended. Post Effective

Amendment No. 3 supercedes Post Effective Amendment No. 2 and Post Effective

Amendment No. 1.

PROSPECTUS

LADYBUG

RESOURCE GROUP, INC.

RESALE OF

560,000

SHARES OF

COMMON STOCK

This is a

resale Prospectus for the resale of up to

560,000

shares of our

common stock by the selling stockholders listed in this Prospectus on page 33.

We will not receive any proceeds from the sale of the shares.

The

Company's Common Stock has been quoted on the Over-the-Counter Bulletin Board

under the symbol "LBRG" since approximately December 23, 2008; however, none of

our shares have traded to date. Accordingly, an investment in our

Company is an illiquid investment.

Selling

stockholders will sell at prevailing market prices or privately negotiated

prices.

A current

Prospectus must be in effect at the time of the sale of the shares of common

stock discussed above. The selling stockholders will be responsible for any

commissions or discounts due to brokers or dealers. We will pay all of the other

offering expenses.

Each

selling stockholder or dealer selling the common stock is required to deliver a

current Prospectus upon the sale. In addition, for the purposes of the

Securities Act of 1933, as amended, selling stockholders may be deemed

underwriters.

Investing

in our common stock involves very high risks. See "Risk Factors" beginning on

page 8.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of the Prospectus. Any representation to the contrary is a criminal

offense.

The date

of this Prospectus is ___, 2010.

TABLE

OF CONTENTS

|

|

Page(s)

|

|

|

|

|

SUMMARY

FINANCIAL DATA

|

7

|

|

|

|

|

RISK

FACTORS

|

8

|

|

|

|

|

USE

OF PROCEEDS

|

17

|

|

|

|

|

SELLING

STOCKHOLDERS

|

17

|

|

|

|

|

DIVIDEND

POLICY

|

18

|

|

|

|

|

MARKET

FOR SECURITIES

|

18

|

|

|

|

|

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

|

20

|

|

|

|

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

20

|

|

|

|

|

DIRECTORS,

EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

29

|

|

|

|

|

PRINCIPAL

SHAREHOLDERS

|

33

|

|

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

33

|

|

|

|

|

CONTROLS

AND PROCEDURES

|

34

|

|

|

|

|

DESCRIPTION

OF CAPITAL STOCK

|

35

|

|

|

|

|

PLAN

OF DISTRIBUTION

|

36

|

|

|

|

|

LEGAL

MATTERS

|

40

|

|

|

|

|

EXPERTS

|

40

|

|

|

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

41

|

Part

I

INFORMATION

REQUIRED IN PROSPECTUS

PROSPECTUS

SUMMARY

About

Ladybug Resource Group, Inc.

Ladybug

Resource Group, Inc. was incorporated in the State of Nevada on November 27,

2007 by Molly S. Ramage, our former President and Director. Our business purpose

is to assist in the design of websites and website components that use specific

marketing messages or themes to reach target audiences. Our initial marketing

focus is the websites of the funeral industry in the Seattle, Washington

area.

Ladybug

Resource Group, Inc. has limited financial resources and has not established a

source of equity or debt financing.

Our

executive offices are located at 11630 Slater Avenue Northeast, Suite 1A,

Kirkland, WA 98034, and our telephone number is 425-306-5028. Our Website is

www.ladybugresource.com, which contains information that we do not wish to

incorporate by reference into this Prospectus.

We may

refer to ourselves in this document as “Ladybug,” “we”, “us,” “our,” the

“Company,” or the “Registrant.”

The

Offering

The

560,000 shares being offered for resale under this Prospectus by the selling

stockholders identified herein represent

4.9

% of the

outstanding shares of our common stock. The Company has 11,320,000 shares

of common stock outstanding as of the date of this Prospectus.

|

Common

stock offered:

|

560,000

shares

by the selling stockholders

|

|

|

|

|

Common

stock outstanding before the Offering:

|

11,320,000

shares

|

|

|

|

|

Common

stock outstanding after the Offering:

|

11,320,000

shares

|

|

|

|

|

Use

of proceeds

|

We

will not receive any proceeds from the resale of shares offered by the

selling stockholders hereby, all of which proceeds will be paid to the

selling stockholders.

|

|

|

|

|

Risk

factors

|

The

purchase of our common stock involves a high degree of risk. See

“Risk Factors.”

|

|

|

|

|

No

Market

|

While

our common stock has been approved for trading on the OTC

Bulletin Board under the symbol “LBRG;” no securities have traded as of

the date of this Prospectus.

No assurance is

provided that a market will be created for our securities in the

future.

|

|

Need

for Additional Financing:

|

We

have generated limited revenues to date and anticipate the need for

additional capital in the future. If we are unable to raise the

additional funding, the value of our securities, if any, would likely

become worthless, and we may be forced to abandon our business

plan. We anticipate incurring net losses for the foreseeable

future.

|

|

|

|

|

Address:

|

11630

Slater Avenue Northeast, Suite 1A

Kirkland,

WA 98034

|

|

|

|

|

Telephone

Number:

|

(425)

306-5028

|

Selling

stockholders will sell at prevailing market prices or privately negotiated

prices.

SUMMARY

FINANCIAL DATA

The

following summary financial data should be read in conjunction with the

financial statements and the notes thereto included elsewhere in this

Prospectus.

Summary

Balance Sheet

|

|

|

|

|

|

Balance

Sheet Data:

|

|

September

30,2009

|

|

|

|

|

|

|

|

Current

assets

|

|

$

|

989

|

|

|

|

|

|

|

|

|

Total

assets

|

|

$

|

3,950

|

|

|

|

|

|

|

|

|

Current

liabilities

|

|

$

|

82,382

|

|

|

|

|

|

|

|

|

Stockholders’

equity

|

|

$

|

82,382

|

|

Summary

Statement of Operations

|

|

|

For

the Three Months Ended September 30, 2009

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

3,059

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

Compensation

|

|

|

4,500

|

|

|

Professional

fees

|

|

|

14,352

|

|

|

Office

and subcontractor costs

|

|

|

4,658

|

|

|

Total

|

|

|

23,510

|

|

|

|

|

|

|

|

|

Net

Loss

|

|

$

|

(20,451

|

)

|

RISK FACTORS

You

should be aware that there are various risks to an investment in our common

stock. You should carefully consider these risk factors, together with all of

the other information included in this Prospectus, before you decide to invest

in shares of our common stock.

If any of

the following risks develop into actual events, then our business, financial

condition, results of operations and/or prospects could be materially adversely

affected. If that happens, the market price of our common stock, if any, could

decline, and investors may lose all or part of their investment.

Ladybug’s

founder and former President resigned in October 2009 because of health issues.

It is unclear whether our current officers and Directors can implement

successfully the business plan that she created.

Ladybug’s

current business strategy was developed and dependent upon the knowledge,

reputation and business contacts of Molly S. Ramage, its founder and former

President, who resigned in October 2009 because of health issues. She will be

available to us on a limited consulting basis moving forward. We can provide no

assurances that Ms. Ramage’s successors will be able to implement her business

plan successfully. If they are unable to successfully implement her

business plan, we may be forced to scale back our business plan and/or seek

additional funding, which may have a materially adverse effect on the value of

our common stock.

Ladybug

has a very limited operating history and anticipates generating losses for the

foreseeable future.

Ladybug

was formed in November 2007. Therefore, we have insufficient operating history

upon which an evaluation of our future performance and prospects can be made.

Ladybug’s future prospects must be considered in light of the risks, expenses,

delays, problems and difficulties frequently encountered in the establishment of

a new business. An investor in our common stock must consider the risks and

difficulties frequently encountered by early stage companies operating in new

and competitive markets such as ours. These risks include:

|

|

·

|

competition

from entities that are much more established and have greater financial

and technical resources than do we;

|

|

|

·

|

the

need to develop corporate

infrastructure;

|

|

|

·

|

the

ability to access and obtain capital when required;

and

|

|

|

·

|

the

dependence upon key personnel.

|

Ladybug

cannot be certain that its business strategy will be successful or that it will

ever have profitable business activities or generate sustainable revenues.

Furthermore, Ladybug believes that it is probable that it will incur operating

losses and negative cash flow for the foreseeable future.

Ladybug has limited financial

resources, and its independent registered auditors’ report includes an

explanatory paragraph stating that there is substantial doubt about its ability

to continue as a going concern

.

Ladybug has very limited financial

resources and had negative working capital of $81,393 and an accumulated deficit

of $134,572 at September 30, 2009. Our independent registered auditors included

an explanatory paragraph in their opinion on Ladybug’s financial statements as

of September 30, 2009 that states that this lack of resources causes substantial

doubt about our ability to continue as a going concern. No assurances can be

given that we will generate sufficient revenue or obtain necessary financing to

continue as a going concern.

Ladybug

is and will continue to be significantly dependent on the services of its

President, Mitchell Trace, and its Secretary, Patricia Barton, the loss of whose

services would likely cause its business operations to cease.

Ladybug’s

current business strategy is completely dependent upon the knowledge, reputation

and business contacts of Mitchell Trace, its President, and Patricia Barton, its

Secretary. If we were to lose the services of either one or both for any reason,

it is unlikely that we would be able to continue conducting our business plan

even if financing is obtained.

Our

President, Mitchell Trace and our Secretary Patricia Barton, are principally

responsible for the execution of our business. They are under no contractual

obligation to remain employed by us. If they should choose to leave us for any

reason before we have hired qualified additional personnel, our operations are

likely to fail. Even if we are able to find additional personnel, it is

uncertain whether we could find someone who could develop our business along the

lines with our business plan.

We

depend on a very limited number of customers.

During

the three months ended September 30, 2009, all revenue was derived from two

entities related to our Secretary and Director, Patricia Barton. During the

fiscal year ended June 30, 2009, the Company derived 34% of its revenues from

two companies, VOF (23.95%) and Seattle Cremations (10.45%). The work done

for VOF related to politically oriented websites and is not expected to result

in recurring engagements. We do not have long-term agreements with any customer

and cannot predict the likelihood of getting additional engagements from

them.

We

operate in a highly competitive industry with low barriers to entry, and we may

be unable to compete successfully against existing or new

competitors.

The Web

applications markets are highly competitive and have low barriers of entry,

which could hinder our ability to successfully market our products and services.

We may not have the resources, expertise or other competitive factors to compete

successfully in the future. Because there are few substantial barriers to entry,

we expect that we will face additional competition from existing competitors and

new market entrants in the future. Some of these competitors are part-time

contractors willing to provide services at low rates to enter the industry or

earn extra money. On the other hand, many of our current and potential

competitors have greater name recognition and more established relationships in

the industry and greater resources. As a result, these competitors may be able

to:

|

|

·

|

Develop

and expand their network infrastructures and service offerings more

rapidly;

|

|

|

·

|

Adapt

to new or emerging technologies and changes in customer requirements more

quickly; and

|

|

|

·

|

Devote

greater resources to the marketing and sale of their services and adopt

more aggressive pricing policies than we

can.

|

Current

and potential competitors in the market include Web hosting service providers,

applications hosting providers, Internet service providers, telecommunications

companies, large information technology firms and computer hardware

suppliers.

Our

success depends on our ability to maintain our professional reputation and name.

If we are unable to do so, our business would be significantly and negatively

impacted.

We depend

on our overall reputation and name recognition to secure new engagements. We

expect to obtain and are likely to continue obtaining many of our new

engagements from existing clients or from referrals by those clients. A client

who is dissatisfied with our work can adversely affect our ability to secure new

engagements. If any factor hurts our reputation, including poor performance, we

may experience difficulties in competing successfully for new engagements.

Failure to maintain our professional reputation and brand name could seriously

harm our business, financial condition and results of operations.

We

currently are likely to complete a limited number of engagements in a year. Our

revenues and operating results will fluctuate significantly from quarter to

quarter, which may cause our stock price, if one exists, to

decline.

Our current limited sources

of resources permit us to perform a limited number of engagements in any one

financial reporting period. Performance of a small number of engagements in any

one financial reporting quarter compared with the number of engagements

performed in other surrounding periods will have a significant percentage impact

on that quarter compared to the other quarters. As a result of these and other

factors, we believe that period-to-period comparisons of our operating results

will not be meaningful in the short term and that you should not rely upon our

performance in a particular period as an indication of our performance in any

future period.

We

are subject to the periodic reporting requirements of the Securities Exchange

Act of 1934, as amended, and will incur audit fees and legal fees in connection

with the preparation of such reports. These additional costs could reduce or

eliminate our ability to earn a profit.

We are

required to file periodic reports with the Securities and Exchange Commission

(the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended, and the

rules and regulations promulgated thereunder. In order to comply with these

requirements, our independent registered public accounting firm has to review

our financial statements on a quarterly basis and audit our financial statements

on an annual basis. Moreover, our legal counsel has to review and assist in the

preparation of such reports. The costs charged by these professionals for such

services cannot be accurately predicted because factors such as the number and

type of transactions that we engage in and the complexity of our reports cannot

be determined at this time and will have a major affect on the amount of time to

be spent by our auditors and attorneys. However, the incurrence of such costs

will obviously be an expense to our operations and thus have a negative effect

on our ability to meet our overhead requirements and earn a profit. We may be

exposed to potential risks resulting from new requirements under

Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide

reliable financial reports or prevent fraud, our business and operating results

could be harmed, investors could lose confidence in our reported financial

information, and the trading price of our common stock, if a market ever

develops, could drop significantly.

Pursuant

to Section 404 of the Sarbanes-Oxley Act of 2002, we will be required,

beginning with our fiscal year ending June 30, 2010, to include in our annual

report our assessment of the effectiveness of our internal control over

financial reporting as of the end of the fiscal year ended June 30, 2010.

Furthermore, in the following fiscal year, our independent registered public

accounting firm will be required to report separately on whether it believes

that we have maintained, in all material respects, effective internal control

over financial reporting. We have not yet completed our assessment of the

effectiveness of our internal control over financial reporting. We expect to

incur additional expenses and diversion of management’s time as a result of

performing the system and process evaluation, testing and remediation required

in order to comply with the management certification and auditor attestation

requirements.

We

currently have only three employees. We may be unable to afford the cost of

increasing our staff or engaging outside consultants or professionals to

overcome our lack of employees. During the course of our testing, we may

identify other deficiencies that we may not be able to remediate in time to meet

the deadline imposed by the Sarbanes-Oxley Act for compliance with the

requirements of Section 404. In addition, if we fail to achieve and maintain

adequate internal controls, as such standards are modified, supplemented or

amended from time to time, we may not be able to ensure that we can conclude on

an ongoing basis that we have effective internal controls over financial

reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover,

effective internal controls, particularly those related to revenue recognition,

are necessary for us to produce reliable financial reports and are important to

help prevent financial fraud. If we cannot provide reliable financial reports or

prevent fraud, our business and operating results could be harmed, investors

could lose confidence in our reported financial information, and the trading

price of our common stock, if a market ever develops, could drop

significantly.

Mitchell

Trace, our Chief Executive Officer and Chief Financial Officer, has no

meaningful accounting or financial reporting education or experience and,

accordingly, our ability to meet Exchange Act reporting requirements on a timely

basis will be dependent to a significant degree upon others.

Mitchell

Trace, our Chief Executive Officer and Chief Accounting Officer, has no

meaningful financial reporting education or experience. He is heavily dependent

on advisors and consultants. As such, there is risk about our ability to comply

with all financial reporting requirements accurately and on a timely

basis.

Our

internal controls may be inadequate, which could cause our financial reporting

to be unreliable and lead to misinformation being disseminated to the

public.

Our

management is responsible for establishing and maintaining adequate internal

control over financial reporting. As defined in the Securities Exchange Act of

1934, as amended, Rule 13a-15(f), internal control over financial reporting is a

process designed by, or under the supervision of, the principal executive and

principal financial officer and effected by the board of directors, management

and other personnel, to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external

purposes in accordance with generally accepted accounting principles and

includes those policies and procedures that: (i) pertain to the maintenance of

records that in reasonable detail accurately and fairly reflect the transactions

and dispositions of the assets of the Company; (ii) provide reasonable assurance

that transactions are recorded as necessary to permit preparation of financial

statements in accordance with generally accepted accounting principles, and that

receipts and expenditures of the Company are being made only in accordance with

authorizations of management and/or directors of the Company; and (iii) provide

reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use or disposition of the Company's assets that could have a

material effect on the financial statements. Our internal controls may be

inadequate or ineffective, which could cause our financial reporting to be

unreliable and lead to misinformation being disseminated to the public.

Investors relying upon this misinformation may make an uninformed investment

decision.

Having

only two Directors limits our ability to establish effective independent

corporate governance procedures and increases the control of our

President/Director.

We have

only two Directors, one of whom is also our Chief Executive Officer.

Accordingly, we cannot establish Board committees comprised of independent

members to oversee functions like compensation or audit issues.

Until we

have a larger Board of Directors that would include some independent members, if

ever, there will be limited oversight of our President’s decisions and

activities and little ability for minority shareholders to challenge or reverse

those activities and decisions, even if they are not in the best interests of

minority shareholders.

Risks

Related to Our Common Stock

Shareholders

may be diluted significantly through our efforts to obtain financing and satisfy

obligations through the issuance of additional shares of our common

stock.

We have

no committed source of financing. Wherever possible, our Board of Directors will

attempt to use non-cash consideration to satisfy obligations. In many instances,

we believe that the non-cash consideration will consist of restricted shares of

our common stock. Our Board of Directors has authority, without action or vote

of the shareholders, to issue all or part of the authorized but unissued common

shares. We have authorized 300,000,000 shares of common stock, and as of January

27, 2010, 288,680,000 shares remain unissued. In addition, if a trading market

develops for our common stock, we may attempt to raise capital by selling shares

of our common stock, possibly at a discount to market. These actions will result

in dilution of the ownership interests of existing shareholders, may further

dilute common stock book value, and that dilution may be material. Such

issuances may also serve to enhance existing management’s ability to maintain

control of Ladybug

because

the shares may be issued to parties or entities committed to supporting existing

management.

Nevada

law and our Articles of Incorporation authorize us to issue shares of stock,

which shares may cause substantial dilution to our existing

shareholders.

We have

authorized capital stock consisting of 300,000,000 shares of common stock,

$0.001 par value per share and 20,000,000 shares of preferred stock, $0.001 par

value per share (“Preferred Stock”). As of the date of this Prospectus, we have

11,320,000 shares of common stock issued and outstanding and no shares of

Preferred Stock issued and outstanding. As a result, our Board of Directors

has the ability to issue a large number of additional shares of common stock

without shareholder approval, which if issued could cause substantial dilution

to our then shareholders. Additionally, shares of Preferred Stock may be issued

by our Board of Directors without shareholder approval with voting powers, and

such preferences and relative, participating, optional or other special rights

and powers as determined by our Board of Directors, which may be greater than

the shares of common stock currently outstanding. As a result, shares of

Preferred Stock may be issued by our Board of Directors which cause the holders

to have super majority voting power over our shares, provide the holders of the

Preferred Stock the right to convert the shares of Preferred Stock they hold

into shares of our common stock, which may cause substantial dilution to our

then common stock shareholders and/or have other rights and preferences greater

than those of our common stock shareholders. Investors should keep in mind that

the Board of Directors has the authority to issue additional shares of common

stock and Preferred Stock, which could cause substantial dilution to our

existing shareholders. Additionally, the dilutive effect of any Preferred

Stock, which we may issue may be exacerbated given the fact that such Preferred

Stock may have super majority voting rights and/or other rights or preferences

which could provide the preferred shareholders with voting control over us

subsequent to this offering and/or give those holders the power to prevent or

cause a change in control. As a result, the issuance of shares of

common stock and/or Preferred Stock may cause the value of our securities to

decrease and/or become worthless.

Our Articles of Incorporation

provide for indemnification of officers and Directors at our expense and limit

their liability. These provisions may result in a major cost to us and hurt the

interests of our shareholders because corporate resources may be expended for

the benefit of officers and/or Directors.

Our

Articles of Incorporation and applicable Nevada law provide for the

indemnification of our Directors, officers, employees, and agents, under certain

circumstances, against attorney's fees and other expenses incurred by them in

any litigation to which they become a party arising from their association with

or activities on our behalf. We will also bear the expenses of such litigation

for any of our Directors, officers, employees, or agents, upon such person's

written promise to repay us even if it is ultimately determined that any such

person shall not have been entitled to indemnification. This indemnification

policy could result in substantial expenditures by us that we may be unable to

recoup.

We have

been advised that, in the opinion of the SEC, indemnification for liabilities

arising under federal securities laws is against public policy as expressed in

the Securities Act of 1933, as amended, and is, therefore, unenforceable. In the

event that a claim for indemnification for liabilities arising under federal

securities laws, other than the payment by us of expenses incurred or paid by a

Director, officer or controlling person in the successful defense of any action,

suit or proceeding, is asserted by a Director, officer or controlling person in

connection with the securities being registered, we will (unless in the opinion

of our counsel, the matter has been settled by controlling precedent) submit to

a court of appropriate jurisdiction, the question whether indemnification by us

is against public policy as expressed in the Securities Act and will be governed

by the final adjudication of such issue. The legal process relating to this

matter if it were to occur is likely to be very costly and may result in us

receiving negative publicity, either

of which factors is

likely to materially reduce the market and price for our shares, if such a

market ever develops.

Currently,

there is no established public market for our securities, and there can be no

assurances that any established public market will ever develop or that our

common stock will be quoted for trading, and even if quoted, it is likely to be

subject to significant price fluctuations.

There has

not been any established trading market for our common stock. The Financial

Industry Regulatory Authority ("FINRA") has assigned us a trading symbol

(“LBRG”) which enables a market maker to quote the shares of our common stock on

the OTCBB maintained by FINRA. There can be no assurances as to

whether:

|

|

1.

|

any

market for our shares will ever

develop;

|

|

|

2.

|

the

prices at which our common stock will trade;

or

|

|

|

3.

|

the

extent to which investor interest in us will lead to the development of an

active, liquid trading market. Active trading markets generally

result in lower price volatility and more efficient execution of buy and

sell orders for investors.

|

In

addition, in the event a market develops, our common stock is unlikely to be

followed by any market analysts, and there may be few institutions acting as

market makers for our common stock. Either of these factors could adversely

affect the liquidity and trading price of our common stock. Until an orderly

market develops in our common stock, if ever, the price at which it trades is

likely to fluctuate significantly. Prices for our common stock will be

determined in the marketplace and may be influenced by many factors, including

the depth and liquidity of the market for shares of our common stock,

developments affecting our business, including the impact of the factors

referred to elsewhere in these Risk Factors, investor perception of us

and

general economic and market conditions. No assurances can be given that an

orderly or liquid market will ever develop for the shares of our common

stock.

Because

of the anticipated low price of the securities being registered, many brokerage

firms may not be willing to effect transactions in these securities. Purchasers

of our securities should be aware that any market that develops in our stock

will be subject to the penny stock restrictions.

Any

market that develops in shares of our common stock will be subject to the penny

stock regulations and restrictions pertaining to low priced stocks that will

create a lack of liquidity and make trading difficult or

impossible.

The

trading of our securities, if any, will likely be on the OTCBB as maintained by

FINRA. As a result, an investor may find it difficult to dispose of, or to

obtain accurate quotations as to the price of our securities.

Rule

3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a

"penny stock," for purposes relevant to us, as any equity security that has a

minimum bid price of less than $4.00 per share or with an exercise price of less

than $4.00 per share, subject to a limited number of exceptions which are not

available to us. It is likely that our shares will be considered to be penny

stocks for the immediately foreseeable future. This classification severely and

adversely affects any market liquidity for our common stock.

For any

transaction involving a penny stock, unless exempt, the penny stock rules

require that a broker or dealer approve a person's account for transactions in

penny stocks and the broker or dealer receive from the investor a written

agreement to the transaction setting forth the identity and quantity of the

penny stock to be purchased. In order to approve a person's account for

transactions in penny stocks, the broker or dealer must obtain financial

information and investment experience and objectives of the person and make a

reasonable determination that the transactions in penny stocks are suitable for

that person and that that person has sufficient knowledge and experience in

financial matters to be capable of evaluating the risks of transactions in penny

stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a

disclosure schedule prepared by the SEC relating to the penny stock market,

which, in highlight form, sets forth:

|

|

·

|

the

basis on which the broker or dealer made the suitability determination,

and

|

|

|

·

|

that

the broker or dealer received a signed, written agreement from the

investor prior to the transaction.

|

Disclosure

also has to be made about the risks of investing in penny stock in both public

offerings and in secondary trading and commissions payable to both the

broker-dealer and the registered representative, current quotations for the

securities and the rights and remedies available to an investor in cases of

fraud in penny stock transactions. Finally, monthly statements have to be sent

disclosing recent price information for the penny stock held in the account and

information on the limited market in penny stocks.

Because

of these regulations, broker-dealers may not wish to engage in the

above-referenced necessary paperwork and disclosures and/or may encounter

difficulties in their attempt to sell shares of our common stock, which may

affect the ability of selling shareholders or other holders to sell their shares

in any secondary market. Our common stock’s penny stock status may also have the

effect of reducing the level of trading activity in any secondary market. These

additional sales practice and disclosure requirements could impede the sale of

our securities, if and when our securities become publicly traded. In addition,

the liquidity for our securities may decrease, with a corresponding decrease in

the price of our securities. Our shares, in all probability, if they trade at

all, will be subject to such penny stock rules for the foreseeable future, and

our shareholders will, in all likelihood, find it difficult to sell their

securities.

The

market for penny stocks has experienced numerous frauds and abuses that could

adversely impact investors in our stock.

Company

management believes that the market for penny stocks has suffered from patterns

of fraud and abuse. Such patterns include:

|

|

·

|

Control

of the market for the security by one or a few broker-dealers that are

often related to the promoter or

issuer;

|

|

|

·

|

Manipulation

of prices through prearranged matching of purchases and sales and false

and misleading press releases;

|

|

|

·

|

"Boiler

room" practices involving high pressure sales tactics and unrealistic

price projections by sales persons;

|

|

|

·

|

Excessive

and undisclosed bid-ask differentials and markups by selling

broker-dealers; and

|

|

|

·

|

Wholesale

dumping of the same securities by promoters and broker-dealers after

prices have been manipulated to a desired level, along with the inevitable

collapse of those prices with consequent investor

losses.

|

State

securities laws may limit secondary trading, which may restrict the states in

which and conditions under which you can sell shares.

Secondary

trading in our common stock may not be possible in any state until the common

stock is qualified for sale under the applicable securities laws of the state or

there is confirmation that an exemption, such as listing in certain recognized

securities manuals, is available for secondary trading in the state. If we fail

to register or qualify, or to obtain or verify an exemption for the secondary

trading of, the common stock in any particular state, the common stock could not

be offered or sold to, or purchased by, a resident of that state. In the event

that a significant number of states refuse to permit secondary trading in our

common stock, the liquidity for the common stock could be significantly

impacted.

The

ability of our majority shareholder to control our business may limit or

eliminate minority shareholders’ ability to influence corporate

affairs.

Our

largest shareholder, Patricia Barton, also our Secretary and Director,

beneficially owns 66.3% of our outstanding common stock. Because of this level

of beneficial stock ownership, she is and will be in a position to continue to

elect our Board of Directors, decide all matters requiring stockholder approval

and determine our policies. Her interests may differ from the interests of other

shareholders with respect to the issuance of shares, business transactions with

or sales to other companies, selection of officers and Directors and other

business decisions. The minority shareholders would have no way of overriding

decisions made by such principal shareholder. This level of control may also

have an adverse impact on the market value of our shares because she may

institute or undertake transactions, policies or programs that result in losses,

may not take any steps to increase our visibility in the financial community

and

/

or may sell

sufficient numbers of shares to significantly decrease our price per

share.

Future

sales of common stock by our existing shareholders could adversely affect our

stock price.

As of

January 27, 2010, Ladybug has 11,320,000 issued and outstanding shares of common

stock. Sales of substantial amounts of common stock in the public market, or the

perception that such sales will occur, could have a materially negative effect

on the market price of our common stock if a market ever develops. This problem

would be exacerbated if we issue common stock in exchange for services or in

connection with fund raising transactions.

We

do not expect to pay cash dividends in the foreseeable future

We have

never paid cash dividends on our common stock. We do not expect to pay cash

dividends on our common stock at any time in the foreseeable future. The future

payment of dividends directly depends upon our future earnings, capital

requirements, financial requirements and other factors that our Board of

Directors will consider. Since we do not anticipate paying cash dividends on our

common stock, return on your investment, if any, will depend solely on an

increase, if any, in the market value of our common stock.

Because

we are not subject to compliance with rules requiring the adoption of certain

corporate governance measures, our stockholders have limited protections against

interested director transactions, conflicts of interest and similar

matters.

The

Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the

SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a

result of Sarbanes-Oxley, require the implementation of various measures

relating to corporate governance. These measures are designed to enhance the

integrity of corporate management and the securities markets and apply to

securities that are listed on those exchanges or the Nasdaq Stock Market.

Because we are not presently required to comply with many of the corporate

governance provisions and because we chose to avoid incurring the substantial

additional costs associated with such compliance any sooner than legally

required, we have not yet adopted these measures.

Because

our Directors are not independent directors, we do not currently have

independent audit or compensation committees. As a result, our Directors have

the ability to, among other things, determine their own level of compensation.

Until we comply with such corporate governance measures, regardless of whether

such compliance is required, the absence of such standards of corporate

governance may leave our stockholders without protections against interested

director transactions, conflicts of interest, if any, and similar matters and

any potential investors may be reluctant to provide us with funds necessary to

expand our operations.

We intend

to comply with all corporate governance measures relating to director

independence as and when required. However, we may find it very difficult or be

unable to attract and retain qualified officers, Directors and members of board

committees required to provide for our effective management as a result of the

Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has

resulted in a series of rules and regulations by the SEC that increase

responsibilities and liabilities of directors and executive officers. The

perceived increased personal risk associated with these recent changes may make

it more costly or deter qualified individuals from accepting these

roles.

We

are required to remain current in our filings with the SEC and our securities

will not be eligible for quotation if we are not current in our filings with the

SEC.

As our

shares are currently quoted on the OTCBB, we are required to remain current

in our filings with the SEC in order for shares of our common stock to remain

eligible for quotation on the OTCBB. In the event that we become delinquent in

our required quarterly and annual filings with the SEC, quotation of our common

stock will be terminated following a 30 day grace period if we do not make our

required filing during that time. If our shares are not eligible for quotation

on the OTCBB, investors in our common stock may find it difficult to sell their

shares.

Additionally,

pursuant to OTCBB rules relating to the timely filing of periodic reports with

the SEC, any OTCBB issuer which fails to file a periodic report (Form 10-Q's or

10-K's) by the due date of such report (not withstanding any extension granted

to the issuer by the filing of a Form 12b-25), three (3) times during any

twenty-four (24) month period is automatically de-listed from the OTCBB. Such

removed issuer would not be re-eligible to be listed on the OTCBB for a period

of one-year, during which time any subsequent late filing would reset the

one-year period of de-listing. Furthermore, any issuer delisted from the OTCBB

more than one (1) time in any twenty-four (24) month period for failure to file

a periodic report would be ineligible to be re-listed for a period of one-year

year, during which time any subsequent late filing would reset the one-year

period of de-listing. As such, if we are late in our filings three times

in any twenty-four (24) month period and are de-listed from the OTCBB, or if our

securities are de-listed from the OTCBB two times in any twenty-four (24) month

period for failure to file a periodic report, our securities may become

worthless and we may be forced to curtail or abandon our business

plan.

You

may have limited access to information regarding our business because our

obligations to file periodic reports with the SEC could be automatically

suspended under certain circumstances.

As of the

effectiveness date of our Registration Statement, September 19, 2008, we are

required to file periodic reports with the SEC which are immediately available

to the public for inspection and copying. Except during the year that our

Registration Statement became effective, these reporting obligations may (in our

discretion) be automatically suspended under Section 15(d) of the Securities

Exchange Act of 1934 if we have less than 300 shareholders. If this occurs after

the year in which our Registration Statement became effective, we will no longer

be obligated to file periodic reports with the SEC and your access to our

business information would then be even more restricted. Although we currently

deliver periodic reports to security holders, we will not be required to furnish

proxy statements to security holders and our Directors, officers and principal

beneficial owners will not be required to report their beneficial ownership of

securities to the SEC pursuant to Section 16 of the Securities Exchange Act of

1934, as amended, until we have both 500 or more security holders and greater

than $10 million in assets. This means that your access to information regarding

our business will be limited.

For

all of the foregoing reasons and others set forth herein, an investment in our

securities involves a high degree of risk.

USE

OF PROCEEDS

We will

not receive any of the proceeds from the sale of shares of the common stock

offered by the selling stockholders, none of which are acting in concert with us

or as a conduit of us. We are registering

560,000 of our 11,320,000

currently outstanding shares of common stock for resale to provide the

holders thereof with freely tradable securities, but the registration of such

shares does not necessarily mean that any of such shares will be offered or sold

by the holders thereof.

SELLING

STOCKHOLDERS

At

January 27, 2010, we had approximately 39 shareholders of record.

The

Registrant has issued securities pursuant to exemptions from registration under

the Securities Act on the terms and circumstances described in the following

paragraphs:

At

inception, we issued 6,300,000 shares of our common stock to Molly S. Ramage

(800,000 shares), Stephen H. Ramage (2,000,000 shares) and Benjamin Ramage

(3,500,000 shares) in consideration for their efforts to incorporate us and

establish our initial business plan. A portion of which shares were subsequently

sold to Patricia Barton, our current Secretary and Director, as described

below. We also issued 4,000,000 shares to Patricia Barton, our

Secretary and Director for $4,000. Shortly after inception, we issued 90,000

shares to Keith Barton in consideration for services rendered in connection with

the formation of the Company and other related services. In March 2008 we

issued 540,000 shares to David Loev, our outside counsel, for professional

services performed. We claim an exemption from registration afforded by

Section 4(2) of the Securities Act of 1933 for the above issuances, since

the foregoing issuances did not involve a public offering, the recipients took

the shares for investment and not resale and we took appropriate measures to

restrict transfer.

In March

through May 2008, we raised $3,900 through the sale of 390,000 shares of our

common stock to 36 investors for $0.01 per share. This transaction was exempt

from registration under the Securities Act of 1933 pursuant to

Rule

504

of Regulation D of the Securities Act of 1933.

In the

foregoing issuances, neither the Registrant nor any person acting on its behalf

offered or sold the securities by means of any form of general solicitation or

general advertising, no underwriters or agents were involved, and we paid no

underwriting discounts or commissions.

|

|

|

|

|

|

|

Selling

Security Holders

|

Shares

Owned Before Offering

|

Shares

Being Offered

|

Number

and Percentage of Shares To Be Owned After Offering Completed

(1)

|

Relationship

to Ladybug or Affiliates

|

|

|

|

|

|

|

|

Laney,

Ashley

|

5,000

|

4,900

|

100

|

Minor

child of Lori Laney

|

|

|

|

|

|

|

|

Laney,

Elisabeth

|

5,000

|

4,900

|

100

|

Minor

child of Lori Laney

|

|

|

|

|

|

|

|

Laney,

Lori

|

1,109,000

|

9,900

|

1,108,900

|

Shareholder

(not including those shares held by Ashley and Elisabeth Laney, as

described above)

|

|

|

|

|

|

|

|

Loev,

David

|

540,000

|

539,000

|

1,000

|

Counsel

to Ladybug.

|

|

|

|

|

|

|

|

Total

|

560,000

|

560,000

|

1,300

|

|

(1)

Assumes that none of the selling stockholders sells shares of common stock not

being offered in this Prospectus or purchases additional shares of common stock,

and assumes that all shares offered are sold.

To the

best of management’s knowledge, none of the Selling Stockholders are

broker/dealers or affiliates of broker/dealers.

Selling

stockholders will sell at prevailing market prices or privately

negotiated prices.

DIVIDEND

POLICY

We have

never paid cash or any other form of dividend on our common stock, and we do not

anticipate paying cash dividends in the foreseeable future. Moreover, any

future credit facilities might contain restrictions on our ability to declare

and pay dividends on our common stock. We plan to retain all earnings, if any,

for the foreseeable future for use in the operation of our business and to fund

the pursuit of future growth. Future dividends, if any, will depend on, among

other things, our results of operations, capital requirements and on such other

factors as our Board of Directors, in its discretion, may consider

relevant.

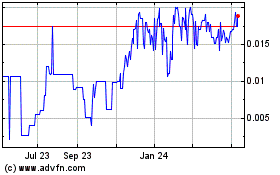

MARKET

FOR SECURITIES

The

Company's common stock has been quoted on the Over-the-Counter Bulletin Board

under the symbol "

LBRG

" since

approximately December 23, 2008; however, none of our shares have traded to

date. As of January 27, 2010, the Company had 11,320,000 shares of common stock

outstanding held by approximately 41 shareholders of record.

There are

currently no outstanding options or warrants to purchase stock of the Company or

any securities convertible into our common equity.

Rule

144

Sales

by Non-Affiliates

In

general, under Rule 144, a holder of restricted common shares who is not and has

not been one of our affiliates at any time during the three months preceding the

proposed sale can resell the shares as follows, which discussion assumes that we

are not and never were a “shell company” as defined in the Securities

Act:

|

|

·

|

If

we have been a reporting company under the Exchange Act for at least 90

days immediately before the sale, then:

|

|

|

|

|

|

|

·

|

Beginning

six months after the shares were acquired from us or any of our

affiliates, the holder can resell the shares, subject to the condition

that current public information about us must be available (as described

below) until one year from the date the shareholder acquired the shares,

but without any other restrictions; and

|

|

|

|

|

|

|

·

|

Beginning

one year after the shares were acquired from us or any of our affiliates,

the holder can resell the shares without any

restrictions.

|

|

|

|

|

|

|

·

|

If

we have not been a public reporting company under the Exchange Act for at

least 90 days immediately before the sale, then the holder may not resell

the shares until at least one year has elapsed since the shares were

acquired from us or any of our affiliates, and may resell the shares

without restrictions after that

time.

|

Sales

by Affiliates

In

general, under Rule 144, a holder of restricted common shares who is one of our

affiliates at the time of the sale or any time during the three months preceding

the sale can resell shares, subject to the restrictions described

below.

|

|

·

|

If

we have been a public reporting company under the Exchange Act for at

least 90 days immediately before the sale, then at least six months must

have elapsed since the shares were acquired from us or one of our

affiliates, and we must remain current in our filings for an additional

period of six months; in all other cases, at least one year must have

elapsed since the shares were acquired from us or one of our

affiliates.

|

|

|

|

|

|

|

·

|

The

number of shares sold by such person within any three-month period cannot

exceed the greater of:

|

|

|

|

1%

of the total number of our common shares then outstanding;

or

|

|

|

|

|

|

|

|

The

average weekly trading volume of our common shares during the four

calendar weeks preceding the date on which notice on Form 144 with respect

to the sale is filed with the SEC (or, if Form 144 is not required to be

filed, the four calendar weeks preceding the date the selling broker

receives the sell order).

|

|

|

·

|

Conditions

relating to the manner of sale, notice requirements (filing of Form 144

with the SEC) and the availability of public information about us must

also be satisfied.

|

Current

Public Information

In

general, for sales by affiliates and non-affiliates, the satisfaction of the

current public information requirement depends on whether we are a public

reporting company under the Exchange Act:

|

|

·

|

If

we have been a public reporting company for at least 90 days immediately

before the sale, then the current public information requirement is

satisfied if we have filed all periodic reports (other than Form 8-K)

required to be filed under the Exchange Act during the 12 months

immediately before the sale (or such shorter period as we have been

required to file those reports).

|

|

|

·

|

If

we have not been a public reporting company for at least 90 days

immediately before the sale, then the requirement is satisfied if

specified types of basic information about us (including our business,

management and our financial condition and results of operations) are

publicly available.

|

However,

no assurance can be given as to (1) the likelihood of a market for our common

shares developing, (2) the liquidity of any such market, (3) the ability of the

shareholders to sell the shares, or (4) the prices that shareholders may obtain

for any of the shares. No prediction can be made as to the effect, if any, that

future sales of shares or the availability of shares for future sale will have

on the market price prevailing from time to time. Sales of substantial amounts

of our common shares, or the perception that such sales could occur, may

adversely affect prevailing market prices of the common shares.

Ladybug

has

agreed to register

560,000

shares of the

11,320,000 shares currently outstanding for sale by security holders, although

not obligated to do so by virtue of any registration rights agreement or other

agreement.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

Certain

matters discussed herein are forward-looking statements. Such

forward-looking statements contained in this Prospectus which is a part of our

Registration Statement involve risks and uncertainties, including statements as

to:

|

|

·

|

our

future operating results;

|

|

|

·

|

our

business prospects;

|

|

|

·

|

any

contractual arrangements and relationships with third

parties;

|

|

|

·

|

the

dependence of our future success on the general

economy;

|

|

|

·

|

any

possible financings; and

|

|

|

·

|

the

adequacy of our cash resources and working

capital.

|

These forward-looking

statements can generally be identified as such because the context of the

statement will include words such as we “believe,” “anticipate,” “expect,”

“estimate” or words of similar meaning. Similarly, statements that describe our

future plans, objectives or goals are also forward-looking statements. Such

forward-looking statements are subject to certain risks and uncertainties which

are described in close proximity to such statements and which could cause actual

results to differ materially from those anticipated as of the date of this

Prospectus. Shareholders, potential investors and other readers are urged

to consider these factors in evaluating the forward-looking statements and are

cautioned not to place undue reliance on such forward-looking statements.

The forward-looking statements included herein are only made as of

the date of this Prospectus, and we undertake no obligation to publicly update

such forward-looking statements to reflect subsequent events or

circumstances.

MANAGEMENT'S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

RESULTS

OF OPERATIONS FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2009

COMPARED

TO THE THREE MONTHS ENDED SEPTEMBER 30, 2008

Operations

for the three months ended September 30, 2009 and 2008 consisted of the

following (changes between the periods on a cash and percentage basis are also

provided below):

|

|

|

2009

|

|

|

2008

|

|

|

Change

($)

|

|

|

Change

(%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

3,059

|

|

|

$

|

24,357

|

|

|

$

|

(21,298

|

)

|

|

|

(87

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation

|

|

|

4,500

|

|

|

|

4,500

|

|

|

|

-

|

|

|

|

-

|

|

|

Professional

fees

|

|

|

14,352

|

|

|

|

1,500

|

|

|

|

12,852

|

|

|

|

857

|

|

|

Office

and subcontractor costs

|

|

|

4,658

|

|

|

|

33,384

|

|

|

|

(28,726

|

)

|

|

|

(86

|

)

|

|

Total

Expenses

|

|

|

23,510

|

|

|

|

39,384

|

|

|

|

(15,874

|

)

|

|

|

(40

|

)

|

|

Net

Loss

|

|

$

|

(20,451

|

)

|

|

$

|

(15,027

|

)

|

|

$

|

(5,424

|

)

|

|

|

36

|

|

Substantially

all the revenue in both periods was referred by or related to a Director or

major shareholder. Our revenue during the three months ended September 30, 2009

was adversely impacted by health issues affecting our former President, Molly

Ramage, which reduced the number of hours that she was able to work each week.

Ms. Ramage resigned in October 2009 because of health issues; however, she is

available to consult with us on a limited basis moving forward. The

Company’s revenues were also impacted by the overall economic recession and the

fact that fewer customers are willing to spend funds on advertising expenses,

such as the creation of websites.

Molly S.

Ramage, our former President, performed work for us and permitted us to use

facilities and equipment owned by her without charge to us during the three

months ended September 30, 2009 and 2008. The estimated cost of this service,

$4,500, was recorded as an expense and as a contribution to paid-in-capital in

each period.

Professional

fees increased for the three months ended September 30, 2009, compared to the

three months ended September 30, 2008, mainly due to the increased legal and

accounting costs associated with the Company being a public reporting company,

which it was not during the prior period.

Office

and subcontractor costs decreased for the three months ended September 30, 2009,

compared to the three months ended September 30, 2008, mainly as a result of the

decrease in revenues for the same period. The Company previously

subcontracted out the majority of its work to third parties, and due to the

decrease in services performed for the three months ended September 30, 2009,

compared to the prior period, there were less subcontractor costs as a result of

the decrease in revenues.

Our net

loss increased for the three months ended September 30, 2009, compared to the

three months ended September 30, 2008, mainly due to the 87% decrease in revenue

and the 857% increase in professional fees, which was not sufficiently offset by

the 86% decrease in office and subcontractor costs.

Other -

As a corporate

policy, we will not incur any cash obligations that we cannot satisfy with known

resources, of which there are currently none except as described in “Liquidity”

below.

RESULTS

OF OPERATIONS FOR THE YEAR ENDED JUNE 30, 2009

COMPARED

TO THE YEAR ENDED JUNE 30, 2008

We had

total revenue of $52,186 for the year ended June 30, 2009, compared to total

revenues of $22,850 for the period from November 27, 2007 (inception) through

June 30, 2008, which represented an increase in revenue of $29,336 or 128% from

the prior period. Revenues increased due to approximately doubling

the number of clients we had during the prior period, including a one-time

client involved in politically oriented web sites. That client, VOF, constituted

approximately 24% of our annual revenue for the fiscal year ended June 30,

2009.

We had

total expenses of $148,274 for the year ended June 30, 2009, compared to total

expenses of $40,833 for the period from November 27, 2007 (inception) through

June 30, 2008, an increase in total expenses of $107,441 or 263% from the prior

period. The reason for the increase in expenses was due to a $63,043

or 383% increase in professional fees, to $79,483 for the year ended June 30,

2009, compared to $16,440 for the period from November 27, 2007 (inception)

through June 30, 2008, due to expenses associated with becoming a

publicly-traded company and a $50,649 increase in office and subcontractor fees

to $50,792 for the year ended June 30, 2009, compared to $143 for the period

from November 27, 2007 (inception) through June 30, 2008, due to health related

issues of our President, offset by a $6,300 decrease in organizational expenses

to no expenses for the year ended June 30, 2009, compared to $6,300 in total

organizational expenses for the period from November 27, 2007 (inception)

through June 30, 2008.

We had a

net loss of $96,088 for the year ended June 30, 2009, compared to a net loss of

$18,033 for the period from November 27, 2007 (inception) through June 30, 2008,

an increase in net loss of $78,055 or 433%, which increase in net loss was

primarily due to the increase in professional fees and office and subcontractor

costs.

LIQUIDITY

AND CAPITAL RESOURCES

Ladybug

had $3,950 in total assets as of September 30, 2009, which included $989 of

current assets consisting of cash and $2,961 of long-term assets consisting of

computer equipment, net of accumulated depreciation.

Ladybug

had total liabilities of $82,382 as of September 30, 2009, consisting

principally of accrued professional fees.

Ladybug

had negative working capital of $81,393 and an accumulated deficit of $134,572

as of September 30, 2009.

Ladybug

had net cash used in operating activities of $7,224 for the three months ended

September 30, 2009, consisting of net loss of $20,451, offset by $4,500 of

contributed services, $425 of depreciation and $8,302 of change in net operating

activities.

Ladybug

does not have any credit facilities or other commitments for debt or equity

financing. No assurances can be given that advances when needed will be

available. We do not believe that we need funding to cover current operations

because we do not have a capital intensive business plan and can also use

independent contractors to assist in many projects. We will use funding, if

obtained, to cover the salary of our President and to pay for marketing

materials and proposal efforts. We currently have no formal salary arrangements

with our President. While no annual salary or length of employment has been

determined to date, we anticipate providing an annual salary not to exceed

$100,000 commencing after the successful completion of several engagements. The

salary will be paid out of revenues, if any, or accrued if sufficient cash is

not available to make payments.

The accrual will begin

after we generate annual revenue of at least $100,000 per year.

We may

seek private capital at some time in the future. Such funding, which we

anticipate would not exceed $100,000, will, if obtained, be used to pay salaries

and for the production of marketing materials. However, we will conduct

operations and seek client engagements even if no funding is obtained. The

private capital will be sought from former business associates of our President

or private investors referred to us by those associates. If a market for our

shares ever develops, of which there can be no assurances and which is unlikely

in the foreseeable future, we will use shares to compensate

employees/consultants wherever possible. To date, we have not sought any funding

source and have not authorized any person or entity to seek out funding on our

behalf.

We are