Keppel-KBS Lodges Prospectus to List U.S. Office Assets via Singapore IPO

October 25 2017 - 5:11AM

Dow Jones News

By P.R. Venkat

SINGAPORE--KBS Realty Advisors LLC, a U.S. real-estate

investment firm, and Keppel Capital Holdings have started taking

orders for a planned US$448 million Singapore initial public

offering of U.S. office assets.

The Newport Beach, Calif.-based company along with the

asset-management arm of Singapore conglomerate Keppel Corp. on

Wednesday lodged an IPO prospectus with Singapore's central bank to

sell 509 million units at US$0.88 each.

Keppel KBS US REIT would have an initial portfolio of 11 U.S.

properties, including office buildings in Seattle, Houston, Denver,

the prospectus showed.

The company has secured commitments from four investors

including Malaysia's Affin Hwang Asset Management Bhd. and

Philippines based private investment holding company Hillsboro

Capital. These investors have agreed to take units totaling

US$216.8 million ahead of the IPO.

The remaining units will be offered to institutional and retail

investors.

The company is projecting a 6.8% yield next year.

Singapore is a sought-after destination for REITs in Asia. The

country is home to more than 40 REITs with a combined market

capitalization of nearly $60 billion. Large and small investors are

drawn to their yields, which average 6% to 7%.

If the IPO is successful, the company would be the second

Singapore-listed REIT to give investors in the city-state exposure

to U.S. commercial properties.

Last year, Canadian insurer Manulife Financial Corp. raised $470

million with a Singapore listing of some of its U.S. office

properties under a real-estate investment trust called Manulife US

REIT.

Founded in 1992, KBS Realty invests, manages, develops and sells

U.S. commercial real estate on behalf of pension funds,

sovereign-wealth funds and other institutional investors. As of

June 30, the total value of KBS's real estate and

real-estate-related investments totaled about $11 billion,

according to the company's website. It owns office towers, hotels,

apartment complexes and other properties across the U.S.

Write to P.R. Venkat at venkat.pr@dowjones.com

(END) Dow Jones Newswires

October 25, 2017 04:56 ET (08:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

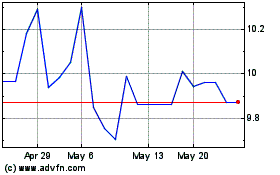

Keppel (PK) (USOTC:KPELY)

Historical Stock Chart

From Feb 2025 to Mar 2025

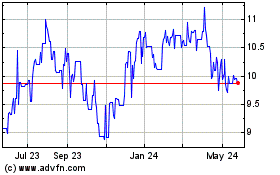

Keppel (PK) (USOTC:KPELY)

Historical Stock Chart

From Mar 2024 to Mar 2025