| |

UNITED STATES

|

| |

SECURITIES AND EXCHANGE COMMISSION

|

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| |

For the quarterly period ended July 31, 2015

|

❑ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| |

For the transition period from ______ to ______

|

| |

Commission file number: 000-52161

|

Jammin Java Corp.

| |

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

26-4204714

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

| 4730 Tejon St., Denver, Colorado 80211 |

| |

(Address of principal executive offices and Zip Code)

|

| |

Registrant’s telephone number, including area code: (303) 296-1756

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ❑

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ❑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ❑

|

Accelerated filer ❑

|

|

| |

Non-accelerated filer ❑

|

Smaller reporting company ☑

|

|

| |

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ❑ No ☑

At September 17, 2015, there were 125,698,127 shares of the issuer’s common stock outstanding.

| |

For the Three and Six months Ended July 31, 2015 and 2014

|

| |

|

Page

|

| |

PART I – FINANCIAL INFORMATION

|

|

| |

|

|

|

Item 1.

|

Financial Statements

|

F-1

|

| |

|

|

| |

Balance Sheets as of July 31, 2015 (unaudited) and January 31, 2015

|

F-1

|

| |

|

|

| |

Statements of Operations (unaudited) - For the three and six months ended July 31, 2015 and 2014

|

F-2

|

| |

|

|

| |

Statements of Cash Flows (unaudited) - For the six months ended July 31, 2015 and 2014

|

F-3

|

| |

|

|

| |

Notes to Financial Statements (unaudited)

|

F-4

|

| |

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

3 |

| |

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

19 |

| |

|

|

|

Item 4.

|

Controls and Procedures

|

19 |

| |

|

|

| |

PART II – OTHER INFORMATION

|

|

| |

|

|

|

Item 1.

|

Legal Proceedings

|

21 |

| |

|

|

|

Item 1A.

|

Risk Factors

|

22 |

| |

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

24 |

| |

|

|

|

Item 3.

|

Defaults Upon Senior Securities

|

25 |

| |

|

|

|

Item 4.

|

Mine Safety Disclosures

|

25 |

| |

|

|

|

Item 5.

|

Other Information

|

25 |

| |

|

|

|

Item 6.

|

Exhibits

|

28 |

| |

|

|

|

Signatures

|

|

28 |

|

PART I - FINANCIAL INFORMATION

|

Item 1. Financial Statements.

|

JAMMIN JAVA CORP.

|

|

|

BALANCE SHEETS

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

July 31,

|

|

January 31,

|

|

| |

|

2015

|

|

|

2015

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

51,035 |

|

|

$ |

443,189 |

|

|

Accounts receivable, net

|

|

|

1,354,598 |

|

|

|

1,154,252 |

|

|

Inventory

|

|

|

2,670 |

|

|

|

197,581 |

|

|

Prepaid expenses

|

|

|

46,621 |

|

|

|

18,986 |

|

|

Other current assets

|

|

|

3,000 |

|

|

|

3,784 |

|

|

Total Current Assets

|

|

|

1,457,924 |

|

|

|

1,817,792 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

285,457 |

|

|

|

381,248 |

|

|

Intangible assets, net

|

|

|

622,648 |

|

|

|

734,753 |

|

|

Other assets

|

|

|

17,966 |

|

|

|

23,567 |

|

|

Total Assets

|

|

$ |

2,383,995 |

|

|

$ |

2,957,360 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity (Deficit)

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

3,403,140 |

|

|

$ |

2,492,900 |

|

|

Accrued expenses

|

|

|

153,310 |

|

|

|

477,229 |

|

|

Accrued royalty and other expenses - related party

|

|

|

72,171 |

|

|

|

81,078 |

|

|

Notes payable

|

|

|

223,561 |

|

|

|

- |

|

|

Total Current Liabilities

|

|

|

3,852,182 |

|

|

|

3,051,207 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

3,852,182 |

|

|

|

3,051,207 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' Equity (Deficit):

|

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value, 5,112,861,525 shares authorized; 125,545,910 and 124,691,748 shares issued and outstanding, as of July 31, 2015 and January 31, 2015, respectively

|

|

|

125,546 |

|

|

|

124,692 |

|

|

Additional paid-in-capital

|

|

|

24,615,831 |

|

|

|

23,825,294 |

|

|

Accumulated deficit

|

|

|

(26,209,564 |

) |

|

|

(24,043,833 |

) |

|

Total Stockholders' Equity (Deficit)

|

|

|

(1,468,187 |

) |

|

|

(93,847 |

) |

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity (Deficit)

|

|

$ |

2,383,995 |

|

|

$ |

2,957,360 |

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed financial statements

|

|

JAMMIN JAVA CORP.

|

|

|

STATEMENTS OF OPERATIONS

|

|

|

(Unaudited)

|

|

| |

Three Months Ended July 31,

|

|

Six Months Ended July 31,

|

|

| |

2015 |

|

|

2014

|

|

|

2015 |

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue:

|

$ |

3,190,827 |

|

|

$ |

2,078,746 |

|

|

$ |

5,929,206 |

|

|

$ |

4,219,783 |

|

|

Discounts and allowances

|

|

(322,806 |

) |

|

|

(344 |

) |

|

|

(479,758 |

) |

|

|

(20,260 |

) |

|

Net revenue

|

|

2,868,021 |

|

|

|

2,078,402 |

|

|

|

5,449,448 |

|

|

|

4,199,523 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales products

|

|

2,059,049 |

|

|

|

1,583,243 |

|

|

|

3,843,861 |

|

|

|

3,251,619 |

|

|

Total cost of sales

|

|

2,059,049 |

|

|

|

1,583,243 |

|

|

|

3,843,861 |

|

|

|

3,251,619 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

808,972 |

|

|

|

495,159 |

|

|

|

1,605,587 |

|

|

|

947,904 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits

|

|

777,961 |

|

|

|

1,047,086 |

|

|

|

1,750,767 |

|

|

|

2,179,234 |

|

|

Selling and marketing

|

|

601,152 |

|

|

|

887,465 |

|

|

|

1,122,268 |

|

|

|

1,710,238 |

|

|

General and administrative

|

|

363,349 |

|

|

|

760,046 |

|

|

|

856,173 |

|

|

|

1,540,646 |

|

|

Total operating expenses

|

|

1,742,462 |

|

|

|

2,694,597 |

|

|

|

3,729,208 |

|

|

|

5,430,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

(32,537 |

) |

|

|

4,201 |

|

|

|

(32,537 |

) |

|

|

4,202 |

|

|

Loss on extinguishment of debt

|

|

- |

|

|

|

(820,164 |

) |

|

|

- |

|

|

|

(450,141 |

) |

|

Interest income (expense)

|

|

(2,468 |

) |

|

|

315 |

|

|

|

(9,573 |

) |

|

|

(122 |

) |

|

Total other income (expense)

|

|

(35,005 |

) |

|

|

(815,648 |

) |

|

|

(42,110 |

) |

|

|

(446,061 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$ |

(968,495 |

) |

|

$ |

(3,015,086 |

) |

|

$ |

(2,165,731 |

) |

|

$ |

(4,928,275 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share

|

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.04 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic and diluted

|

|

125,545,910 |

|

|

|

117,348,177 |

|

|

|

125,221,362 |

|

|

|

113,388,829 |

|

See accompanying notes to condensed financial statements

|

JAMMIN JAVA CORP.

|

|

STATEMENTS OF CASH FLOWS

|

|

(Unaudited)

|

| |

|

Six Months Ended July 31,

|

|

| |

|

2015 |

|

|

2014

|

|

|

Cash Flows From Operating Activities:

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2,165,731 |

) |

|

$ |

(4,928,275 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Common stock issued for services

|

|

|

156,381 |

|

|

|

273,647 |

|

|

Shared-based employee compensation

|

|

|

635,010 |

|

|

|

1,090,094 |

|

|

Depreciation

|

|

|

79,265 |

|

|

|

48,818 |

|

|

Amortization of intangible assets

|

|

|

30,987 |

|

|

|

26,829 |

|

|

Loss on sale of business

|

|

|

32,537 |

|

|

|

- |

|

|

Loss on settlement of liabilities

|

|

|

- |

|

|

|

820,164 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(200,346 |

) |

|

|

(586,323 |

) |

|

Inventory

|

|

|

194,911 |

|

|

|

309,464 |

|

|

Prepaid expenses and other current assets

|

|

|

(26,851 |

) |

|

|

1,010,142 |

|

|

Other assets - long term

|

|

|

5,600 |

|

|

|

(7,850 |

) |

|

Accounts payable

|

|

|

910,240 |

|

|

|

(430,110 |

) |

|

Accrued expenses

|

|

|

(323,919 |

) |

|

|

295,801 |

|

|

Accrued royalty and other expenses - related party

|

|

|

(8,907 |

) |

|

|

(102,374 |

) |

|

Net cash used in operating activities

|

|

|

(680,823 |

) |

|

|

(2,179,973 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(12,894 |

) |

|

|

(24,780 |

) |

| Sale of division |

|

|

78,002 |

|

|

|

- |

|

|

Net cash provided by (used in) investing activities

|

|

|

65,108 |

|

|

|

(24,780 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities:

|

|

|

|

|

|

|

|

|

|

Common stock issued for cash

|

|

|

- |

|

|

|

2,500,000 |

|

|

Borrowings on short term debt

|

|

|

223,561 |

|

|

|

(4,965 |

) |

|

Net cash provided by financing activities

|

|

|

223,561 |

|

|

|

2,495,035 |

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents

|

|

|

(392,154 |

) |

|

|

290,282 |

|

|

Cash and cash equivalents at beginning of period

|

|

|

443,189 |

|

|

|

857,122 |

|

|

Cash and cash equivalents at end of period

|

|

$ |

51,035 |

|

|

$ |

1,147,404 |

|

| |

|

|

|

|

|

|

|

|

|

Non-Cash Transactions:

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

$ |

4,400 |

|

|

$ |

- |

|

|

Extinguishment of debt for stock

|

|

$ |

- |

|

|

$ |

369,589 |

|

|

Addition of capital leases

|

|

$ |

73,000 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed financial statements

|

|

|

|

|

|

|

|

|

NOTES TO CONDENSED FINANCIAL STATEMENTS

July 31, 2015

(Unaudited)

Note 1. Basis of Presentation

The accompanying unaudited interim financial statements of Jammin Java Corp. (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (“SEC”) and should be read in conjunction with the audited financial statements and notes thereto contained in the Company’s latest Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year or any other future period. Notes to the financial statements that would substantially duplicate the disclosures contained in the audited financial statements for the most recent fiscal year as reported in the Company’s Annual Report on Form 10-K have been omitted. The accompanying balance sheet at July 31, 2015 has been derived from the audited balance sheet at January 31, 2015 contained in such Form 10-K.

As used in this Quarterly Report, the terms “we,” “us,” “our,” “Jammin Java” and the “Company” mean Jammin Java Corp., unless otherwise indicated. All dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

Note 2. Going Concern and Liquidity

These financial statements have been prepared by management assuming that the Company will be able to continue as a going concern and contemplate the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments to the recoverability of recorded asset amounts or the amounts or classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company incurred a net loss of $2,165,731 for the six months ended July 31, 2015, and has an accumulated deficit of $26,209,564. The Company has a history of losses and has only recently begun to generate revenue as part of its principal operations. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The operations of the Company have primarily been funded by the sale of its common stock. The Company will, in the future, need to secure additional funds through future equity sales or other fund raising activities. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company.

The Company’s ability to meet its obligations in the ordinary course of business is dependent upon its ability to sell its products directly to end-users and through distributors, establish profitable operations through increased sales and decreased expenses, and obtain additional funds when needed. Management intends to increase sales by increasing the Company’s product offerings, expanding its direct sales force and expanding its domestic and international distributor relationships.

There can be no assurance that the Company will be able to increase sales, reduce expenses or obtain additional financing, if necessary, at a level to meet its current obligations. As a result, the opinion the Company received from its independent registered public accounting firm on its January 31, 2015 financial statements contains an explanatory paragraph stating that there is a substantial doubt regarding the Company’s ability to continue as a going concern.

Note 3. Business Overview and Summary of Accounting Policies

Jammin Java, doing business as Marley Coffee, is a United States (U.S.)-based company that provides sustainably grown, ethically farmed and artisan roasted gourmet coffee through multiple U.S. and international distribution channels, using the Marley Coffee brand name. U.S. and international grocery retail channels have become the Company’s largest revenue channels, followed by online retail, office coffee services (referred to herein as OCS), food service outlets and licensing. The Company intends to continue to develop these revenue channels and achieve a leadership position in the gourmet coffee space by capitalizing on the global recognition of the Marley name through the licensing of the Marley Coffee trademarks.

Reclassifications. Certain prior period amounts have been reclassified to conform with the current period presentation for comparative purposes.

Use of Estimates in Financial Statement Preparation. The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, as well as certain financial statement disclosures. While management believes that the estimates and assumptions used in the preparation of the financial statements are appropriate, actual results could differ from those estimates.

Cash and Cash Equivalents. The Company considers all highly liquid investments with original maturities of six months or less to be cash equivalents. As of July 31, 2015, the Company had $51,035 of cash equivalents. Additionally, no interest income was recognized for the six months ended July 31, 2015.

Revenue Recognition. Revenue is derived from the sale of coffee products and is recognized on a gross basis upon shipment to the customer. All revenue is recognized when (i) persuasive evidence of an arrangement exists; (ii) the service or sale is completed; (iii) the price is fixed or determinable; and (iv) the ability to collect is reasonably assured. Revenue is recognized as the net amount estimated to be received after deducting estimated amounts for discounts, trade allowances and product terms. We record promotional and return allowances based on recent and historical trends. Promotional allowances, including customer incentive and trade promotion activities, are recorded as a reduction to sales based on amounts estimated being due to customers, based primarily on historical utilization and redemption rates.

The Company utilizes third parties for the production and fulfillment of orders placed by customers. The Company, acting as principal, takes title to the product and assumes the risks of ownership; namely, the risks of loss for collection, delivery and returns.

Allowance for Doubtful Accounts. The Company does not require collateral from its customers with respect to accounts receivable. The Company determines any required allowance by considering a number of factors, including the terms for each customer, and the length of time accounts receivable are outstanding. Management provides an allowance for accounts receivable whenever it is evident that they become uncollectible. The Company has reserved an allowance of $98,866 for doubtful accounts at July 31, 2015. Because our accounts receivable are concentrated in a relatively few number of customers, a significant change in the liquidity or financial position of any one of these customers could have a material adverse effect on the collectability of our accounts receivable and our future operating results.

Inventories. Inventories are stated at the lower of cost or market. Cost is computed using weighted average cost, which approximates actual cost, on a first-in, first-out basis. Inventories on hand are evaluated on an on-going basis to determine if any items are obsolete or in excess of future needs. Items determined to be obsolete are reserved for. The Company provides for the possible inability to sell its inventories by providing an excess inventory reserve. As of July 31, 2015, the Company determined that no reserve was required.

Property and Equipment. Equipment is stated at cost less accumulated depreciation and amortization. Maintenance and repairs, as incurred, are charged to expense. Renewals and enhancements which extend the life or improve existing equipment are capitalized. Upon disposition or retirement of equipment, the cost and related accumulated depreciation are removed and any resulting gain or loss is reflected in operations. Depreciation is provided using the straight-line method over the estimated useful lives of the assets. For computers and leasehold improvements the useful life is 3 years and for furniture and equipment the useful life is 5 years.

Depreciation was $79,265 and $48,818 for the six months ended July 31, 2015 and 2014, respectively.

Impairment of Long-Lived Assets. Long-lived assets consist primarily of a license agreement that was recorded at the estimated cost to acquire the asset. The license agreement is reviewed for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable (see Note 5). Determination of recoverability is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its eventual disposition. In the event that such cash flows are not expected to be sufficient to recover the carrying amount of the assets, the assets are written down to their estimated fair values. Management evaluated the carrying value of long-lived assets including the license and determined that no impairment existed at July 31, 2015.

Stock-Based Compensation. Pursuant to the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 718-10, “Compensation – Stock Compensation,” which establishes accounting for equity instruments exchanged for employee service, management utilizes the Black-Scholes option pricing model to estimate the fair value of employee stock option awards at the date of grant, which requires the input of highly subjective assumptions, including expected volatility and expected life. Changes in these inputs and assumptions can materially affect the measure of estimated fair value of our share-based compensation. These assumptions are subjective and generally require significant analysis and judgment to develop. When estimating fair value, some of the assumptions will be based on, or determined from, external data and other assumptions may be derived from our historical experience with stock-based payment arrangements. The appropriate weight to place on historical experience is a matter of judgment, based on relevant facts and circumstances.

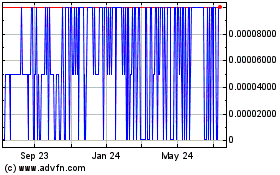

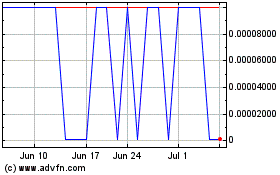

Common stock issued for services to non-employees is recorded based on the value of the services or the value of the common stock, whichever is more clearly determinable. Whenever the value of the services is not determinable, the measurement date occurs generally at the date of issuance of the stock. In more limited cases, it occurs when a commitment for performance has been reached with the counterparty and nonperformance is subject to significant disincentives. If the total value of stock issued exceeds the par value, the value in excess of the par value is added to the additional paid-in-capital. We estimate volatility of our publicly-listed common stock by considering historical stock volatility.

Income Taxes. The Company follows Financial Accounting Standards Board (“FASB”) Accounting Standards Codification No 740, Income Taxes. The Company records deferred tax assets and liabilities based on the differences between the financial statement and tax bases of assets and liabilities and on net operating loss carry forwards using enacted tax rates in effect for the year in which the differences are expected to reverse. A valuation allowance is provided when it is more likely than not that some portion or all of a deferred tax asset will not be realized.

Earnings or Loss Per Common Share. Basic earnings per common share equals net earnings or loss divided by the weighted average of shares outstanding during the reporting period. Diluted earnings per share includes the impact on dilution from all contingently issuable shares, including options, warrants and convertible securities. The common stock equivalents from contingent shares are determined by the treasury stock method. The Company incurred a net loss for the six months ended July 31, 2015 and 2014, respectively. In addition, basic and diluted earnings per share for such periods are the same because all potential common equivalent shares would be anti-dilutive including 4,487,500 “in the money” outstanding options which are exercisable as of July 31, 2015.

Recently Issued Accounting Pronouncements. Accounting standards that have been issued by the FASB or other standards setting bodies that do not require adoption until a future date are being evaluated by the Company to determine whether adoption will have a material impact on the Company’s financial statements.

The FASB has issued Accounting Standards Update (ASU) No. 2015-03, “Simplifying the Presentation of Debt Issuance Costs,” as part of its simplification initiative. The ASU changes the presentation of debt issuance costs in financial statements. Under the ASU, an entity presents such costs in the balance sheet as a direct deduction from the related debt liability rather than as an asset. Amortization of the costs is reported as interest expense. The Company recorded a Note payable on its balance sheet in the first quarter of 2015 of which no issuance costs were incurred. The Company has also entered into pending financing arrangements which have not yielded funding currently, these costs are carried as a prepaid expense on the Company’s balance sheet at July 31, 2015. The Company recognizes interest expense timely and reduces its debt liability as remittance occurs.

Note 4 – Inventories

Inventories were comprised of:

| |

|

July 31, 2015

|

|

|

January 31, 2015

|

|

|

Finished Goods - Coffee

|

|

$ |

- |

|

|

$ |

45,468 |

|

|

Non - Coffee Inventories

|

|

$ |

2,670 |

|

|

$ |

- |

|

Note 5 - Trademark License Agreements and Intangible Assets

Intangible assets include our License Agreement, and intangibles and goodwill arising from our BikeCaffe acquisition asset purchase. The goodwill of the Black Rock Beverages division was $81,118 which was removed at the time of sale in July 2015 as mentioned in our “Overview” section of “Recent Transactions”. The amortization periods are fifteen years and ten years for the license agreement and intangible assets, respectively. Amortization expense consists of the following:

| |

|

July 31,

|

|

|

January 31,

|

|

| |

|

2015

|

|

|

2015

|

|

|

License Agreement

|

|

$ |

730,000 |

|

|

$ |

730,000 |

|

|

Intangible assets

|

|

|

49,900 |

|

|

|

49,900 |

|

|

Total

|

|

$ |

779,900 |

|

|

$ |

779,900 |

|

|

Accumulated amortization

|

|

|

(164,296 |

) |

|

|

(133,309 |

) |

|

Intangibles subject to amortization

|

|

$ |

615,604 |

|

|

$ |

646,591 |

|

|

Goodwill

|

|

|

7,044 |

|

|

$ |

88,162 |

|

|

Total intangible assets

|

|

$ |

622,648 |

|

|

$ |

734,753 |

|

| |

|

Three months ended July 31,

|

|

|

Six months ended July 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

License Agreement

|

|

$ |

(12,167 |

) |

|

$ |

(12,167 |

) |

|

$ |

(24,333 |

) |

|

$ |

(24,333 |

) |

|

Intangibles Amortization Expense

|

|

$ |

(2,496 |

) |

|

$ |

(1,248 |

) |

|

$ |

(6,654 |

) |

|

$ |

(2,496 |

) |

|

Total License Agreement Amortization Expense

|

|

$ |

(14,663 |

) |

|

$ |

(13,415 |

) |

|

$ |

(30,987 |

) |

|

$ |

(26,829 |

) |

As of July 31, 2015, the remaining useful life of the Company’s license agreement was approximately 12.0 years. The following table shows the estimated amortization expense for such assets for each of the five succeeding fiscal years and thereafter.

|

Years Ending July 31,

|

|

|

|

|

2016

|

|

$ |

29,324 |

|

|

2017

|

|

$ |

58,648 |

|

|

2018

|

|

$ |

58,648 |

|

|

2019

|

|

$ |

58,648 |

|

|

2020

|

|

$ |

58,648 |

|

|

Thereafter

|

|

$ |

351,688 |

|

|

Total

|

|

$ |

615,604 |

|

Note 6 – Notes Payable

The Company entered into an unsecured Revolving Line of Credit Agreement with Colorado Medical Finance Services, LLC, dba Gold Gross Capital LLC on June 9, 2015, with an effective date of February 16, 2015. The line of credit allows the Company the right to borrow up to $500,000 from the lender from time to time. On March 26, 2015, the lender advanced $250,000 to us under the terms of the line of credit. Amounts owed under the line of credit are to be memorialized by revolving credit notes in the form attached to the line of credit, provided that no formal note has been entered into to advance amounts borrowed to date. Amounts borrowed under the line of credit accrue interest at the rate of 17.5% per annum and can be repaid at any time without penalty. A total of 10% of the interest rate is payable in cash and the other 7.5% of the interest rate is payable in cash, or coffee goods and services, at the option of the lender, with our consent. The line of credit expires, and all amounts are due under the line of credit on September 26, 2016. The line of credit contains customary events of default, and upon the occurrence of an event of default the lender can suspend further advances and require the Company to declare the entire amount then owed immediately due, subject to a 10 day period pursuant to which we have the right to cure any default. Upon the occurrence of an event of default the amounts owed under the line of credit bear interest at the rate of 20% per annum. Proceeds from the line of credit can be solely used for working capital purposes. The lender has no relationship with the Company or its affiliates. As of July 31, 2015, the Company had borrowed a total of $250,000 under the Line of Credit.

Note 7 - Related Party Transactions

Transactions with Marley Coffee Ltd.

During the six months ended July 31, 2015 and 2014, the Company made purchases of $358,989 and $234,122 respectively, from Marley Coffee Ltd. (“MC“) a producer of Jamaican Blue Mountain coffee that the Company purchases in the normal course of its business. The Company also received rebates from Marley Coffee Ltd. for the three months ending July 31, 2015 of $52,596 and 2015 year to date rebates of $97,796 on the Jamaican green coffee purchased. There were no rebates in the prior year. From inception to July 31, 2015, the Company has made purchases of $2,492,085 after credits and rebates from Marley Coffee Ltd. The Company directs these purchases to third-party roasters for fulfillment of sales orders. The Company’s Chairman, Rohan Marley, is an owner of approximately 25% of the equity of MC.

During the six months ended July 31, 2015 and 2014 the Company paid Rohan Marley Enterprises and Rohan Marley $90,909 and $95,873 respectively, for directors consulting fees. The Company has paid Rohan Marley Enterprises $319,449 and Rohan Marley $106,335 for a total of $425,784 from inception to July 31, 2015, for directors fees and expense reimbursements. Rohan Marley Enterprises is the personal S-Corporation of Rohan Marley which he uses to record all of his business transactions.

The following describe transactions with entities which are licensees of Hope Road Merchandising, LLC a company in which Rohan Marley is a beneficiary. During the six months ended July 31, 2015 and 2014, the Company made purchases of $3,496 and $28,126 respectively, from House of Marley. From inception to July 31, 2015, the Company has purchased $62,870 of product from House of Marley. Homemedics which owns House of Marley has purchased $3,780 of product from inception to July 31, 2015. House of Marley produces headphones and speakers that the Company uses for promotions and trade shows. During the six months ended July 31, 2015 and 2014, the Company made purchases of $521 and $94, respectively from Zion Rootswear. From inception to July 31, 2015, the Company has made purchases of $5,297 from Zion Rootswear. The Company has made purchases of $1,603 from inception to July 31, 2015 from Tuff Gong International. The purchases from Tuff Gong International and Zion Rootswear were for Bob Marley apparel and gifts that were used for marketing and promotions purposes.

During the six months ended July 31, 2015 and 2014, the Company has an accrual for royalties to Fifty-Six Hope Road Music Limited (“56 Hope Road”) of $131,284 and $117,425, respectively, for the license to use of the name “Marley Coffee”. From inception to July 31, 2015, the Company has incurred royalties of $586,650 to 56 Hope Road.

During the six months ended July 31, 2015, the Company paid Sondra Toevs $5,386 and Ellie Toevs $2,629 for part time employment. Sondra Toevs is the wife of the CEO, Brent Toevs, and Ellie Toevs is the daughter of Mr. Toevs. The total paid to these employees for the calendar year 2014 was $17,648 for Sondra Toevs and $6,063 for Ellie Toevs.

The total owed to Mother Parkers for accounts payable is $2,054,926 as of July 31, 2015, and the total due from Mother Parkers is $176,351 as of July 31, 2015.

Note 8 – Stockholders’ Equity

Share-based Compensation:

On August 5, 2011, the Board of Directors approved the Company’s 2011 Equity Compensation Plan (the “2011 Plan“). The 2011 Plan authorizes the issuance of various forms of stock-based awards, including incentive or non-qualified options, restricted stock awards, performance shares and other securities as described in greater detail in the 2011 Plan, to the Company’s employees, officers, directors and consultants. A total of 20,000,000 shares are authorized for issuance under the 2011 Plan, which has not been approved by the stockholders of the Company. As of July 31, 2015 a total of 16,333,333 shares are available for issuance under the 2011 Plan.

On October 14, 2012, the Board of Directors approved the Company’s 2012 Equity Incentive Plan, which was amended and restated on September 19, 2013 (as amended and restated, the “2012 Plan“). The 2012 Plan authorizes the issuance of various forms of stock-based awards, including incentive or non-qualified options, restricted stock awards, restricted units, stock appreciation rights, performance shares and other securities as described in greater detail in the 2012 Plan, to the Company’s employees, officers, directors and consultants. A total of 12,000,000 shares are authorized for issuance under the 2012 Plan, which has been approved by the stockholders of the Company, and as of July 31, 2015, a total of 36,907 shares are available for issuance under the 2012 Plan.

On September 10, 2013, the Board of Directors approved the Company’s 2013 Equity Incentive Plan (the “2013 Plan“). The 2013 Plan authorizes the issuance of various forms of stock-based awards, including incentive or non-qualified options, restricted stock awards, restricted units, stock appreciation rights, performance shares and other securities as described in greater detail in the 2013 Plan, to the Company’s employees, officers, directors and consultants. A total of 12,000,000 shares are authorized for issuance under the 2013 Plan, which has been approved by the stockholders of the Company, and as of July 31, 2015, a total of 2,341,626 shares are available for issuance under the 2013 Plan.

On June 30, 2015, the Board of Directors approved the Company’s 2015 Equity Incentive Plan (the “2015 Plan”). The 2015 Plan authorizes the issuance of various forms of stock-based awards, including incentive or non-qualified options, restricted stock awards, restricted units, stock appreciation rights, performance shares and other securities as described in greater detail in the 2015 Plan, to the Company’s employees, officers, directors and consultants. A total of 17,500,000 shares are authorized for issuance under the 2015 Plan, which has not been approved by the stockholders of the Company, and as of July 31, 2015, a total of 11,500,000 shares are available for issuance under the 2015 Plan.

The Plans are administered by the Board of Directors in its discretion. The Board of Directors interprets the Plans and has broad discretion to select the eligible persons to whom awards will be granted, as well as the type, size and terms and conditions of each award, including the exercise price of stock options, the number of shares subject to awards, the expiration date of awards, and the vesting schedule or other restrictions applicable to awards.

During the six months ended July 31, 2015 and 2014, the Company recognized share-based compensation expenses totaling $635,010 and $1,090,094, respectively. The remaining amount of unamortized stock option expense at July 31, 2015 was $2,647,793.

The intrinsic value of exercisable and outstanding options at July 31, 2015 and 2014 was $311,646 and $247,500, respectively.

The options are valued using the Black Scholes method with the grant date weighted average fair value at $0.40 per share. Activity in stock options during the six month period ended July 31, 2015 and related balances outstanding as of that date are set forth below:

| |

|

|

|

|

|

|

|

Weighted Average

|

|

| |

|

Number of

|

|

|

Weighted Average

|

|

|

Remaining Contract

|

|

| |

|

Shares

|

|

|

Exercise Price

|

|

|

Term (# of years)

|

|

|

Outstanding at February 1, 2015

|

|

|

17,830,000 |

|

|

$ |

0.35 |

|

|

|

|

|

Granted

|

|

|

1,340,000 |

|

|

|

0.20 |

|

|

|

|

|

Exercised

|

|

|

- |

|

|

|

- |

|

|

|

|

|

Forfeited and canceled

|

|

|

(1,060,000 |

) |

|

|

0.45 |

|

|

|

|

|

Outstanding at July 31, 2015

|

|

|

18,110,000 |

|

|

$ |

0.25 |

|

|

|

3.46 |

|

|

Exercisable at July 31, 2015

|

|

|

11,200,826 |

|

|

$ |

0.31 |

|

|

|

2.57 |

|

Note 9 – Commitments and Contingencies

On July 28, 2014, Shane Whittle, individually, a former significant shareholder and officer and director of the Company (“Whittle“) filed a complaint against the Company in the District Court, City and County of Denver, State of Colorado (Case No. 2014-CV-032991 Division: 209). The complaint alleged that Whittle entered into a consulting agreement with the Company for which the Company failed to make payments and that Rohan Marley, as both a director of the Company and of Marley Coffee Canada, Inc., additionally agreed that, as part of Whittle’s consulting compensation, the Company would assume a debt owed by Marley Coffee Canada to Whittle. The cause of action set forth in the complaint includes breach of contract. Damages claimed by Whittle included $60,000 under the consulting agreement and $19,715 related to payments assumed by the Company. Effective on March 31, 2015, the Company and Mr. Whittle entered into a Settlement Agreement and Release of Claims (the “Settlement“), pursuant to which the parties agreed to dismiss their claims associated with the District Court, City and County of Denver, State of Colorado (Case No. 2014-CV-032991 Division: 209), lawsuit described above. Pursuant to the terms of the Settlement, the Company agreed to pay Mr. Whittle $80,000 which was accrued as of January 31, 2015 (to be paid in equal payments of $10,000 per month beginning on April 1, 2015), the Company agreed to withdraw from a joinder in connection with the Federal Action pending between the parties (and certain other parties) as described below, the parties provided each other mutual releases and the parties agreed to mutually dismiss, with prejudice, their claims.

In a separate case, on September 30, 2014, Whittle individually, and derivatively on behalf of Marley Coffee LLC (“MC LLC“) filed a complaint against Rohan Marley, Cedella Marley, the Company, Hope Road Merchandising, LLC, Fifty-Six Hope Road Music Limited, and Marley Coffee Estate Limited in the United States District Court for the District of Colorado (Civil Action No. 2014-CV-2680). The complaint alleges that Whittle entered into a partnership with Rohan Marley, to sell premium coffee products branded after the name and likeness of Rohan Marley. The causes of action set forth in the complaint include, among others, racketeering activity, trademark infringement, breach of fiduciary duty, civil theft, and civil conspiracy (some of which causes of action are not directly alleged against the Company), which are alleged to have directly caused Whittle and Marley Coffee LLC substantial financial harm. Damages claimed by Whittle and MC LLC include economic damages to be proven at trial, profits made by defendants, treble damages, punitive damages, attorneys’ fees and pre and post judgment interest. Subsequently, all but the civil conspiracy claim against the Company was dismissed and the court ordered Whittle to amend his complaint to provide only for an alleged claim of breach of fiduciary duty (not against the Company) and conspiracy claims as an individual (not on a derivative basis). The outcome of this lawsuit cannot be predicted with any degree of reasonable certainty. In the event the matter is not settled, the Company intends to continue to vigorously defend itself against Whittle’s and MC LLC’s claims.

Note 9 – Commitments and Contingencies (Continued)

On December 15, 2014, a complaint was filed against the Company in the Superior Court of State of California, for the County of Los Angeles – Central Division (Case Number: BC566749), pursuant to which Sky Consulting Group, Inc. (“Sky“), made various claims against the Company, Mr. Tran, the Company’s President and Director, Marley C&V International, and various other parties. The complaint alleged causes of action for breach of contract, fraud, negligent representation, intentional interference with contractual relationship and negligent interference with contractual relationship, relating to a May 2013 coffee distributor agreement between the Company and Sky, which provided Sky the right to sell Company branded coffee products in Korea. The suit seeks damages, punitive damages, court costs and attorney’s fees. The Company subsequently filed a motion to compel arbitration pursuant to the terms of the agreement, which was approved by the court on April 7, 2015. The parties subsequently entered arbitration in connection with the lawsuit. On September 8, 2015, the parties entered into a mutual settlement and release agreement, whereby Sky agreed to return 130,480 shares of common stock to the Company and stop distributing our products, displaying our tradenames or using our intellectual property; the parties agreed to each dismiss their claims/lawsuits; and each party provided the other a general release of all outstanding claims. As of the date of this report, the shares have not yet been returned to the Company and the claims/lawsuits have not been dismissed, however we are confident that the shares will be returned to us (which shares we plan to cancel upon receipt) and the claims/lawsuits will be dismissed shortly after the date this report is filed.

Note 10 – Sale of Division

On July 9, 2015, with an effective date of July 1, 2015, the Company entered into an Asset Purchase Agreement with Black Rock Beverages, LLC (“BRB”), pursuant to which it sold its Black Rock Beverage division and related assets to BRB (the “Sale Agreement”). Pursuant to the Sale Agreement, BRB agreed to pay the Company $300,000, with $200,000 payable on the closing date of the transaction (July 15, 2015), and $100,000 payable in 24 equal monthly installments, provided that if BRB’s average sales do not meet a minimum of $50,000 per month during each of the first six months following the closing, the aggregate amount of $100,000 in payments due is reduced by $5,000 for each month such $50,000 monthly minimum is not met. The contingent $100,000 consideration will be recognized, if and when, the conditions for measurement have been met six months subsequent to the sale date. Additionally, the Company agreed to continue to pay the salary of one of its employees acquired in the Company’s original acquisition of the Black Rock Beverage division in August 2013 and to continue to cover the rent, for five months, on a warehouse located on Lipan St. in Denver, Colorado, and BRB agreed to assume certain of the Company’s capital and vehicle leases. We also agreed to a six month freeze on increasing any cost of goods purchased by BRB for products sold through the Black Rock Beverage operations.

Note 11 – Concentrations

A significant portion of our revenue is derived from our relationships with a limited number of vendors and distributors. The loss of one or more of our significant vendors or distributors would have a material impact on our revenues and results of operations. During the six months ended July 31, 2015, three customers accounted for 48% of net revenues. During the six months ended July 31, 2014, three customers accounted for 56% of net revenues.

During the six months ended July 31, 2015, two vendors accounted for 79% of purchases. During the six months ended July 31, 2014, three vendors accounted for 48% of purchases.

For the six months ending July 31, 2015 total sales in Canada totaled $426,662 and during the six months ended July 31, 2014 total sales in Canada totaled $670,577 including $516,120 in Green coffee sales.

For the six months ending July 31, 2015 sales in South Korea for Green and retail coffee sales totaled $461,048 and for the six months ending July 31, 2014 sales in South Korea totaled $0.

For the six months ending July 31, 2015 sales in Chile totaled $608,638 and for the six months ending July 31, 2014 sales in Chile totaled $125,412.

Note 12 – Subsequent Events

Convertible Note with JSJ Investments Inc.

On September 9, 2015, we sold a 12% Convertible Note to JSJ Investments Inc. (“JSJ” and the “JSJ Convertible Note”) in the amount of $275,000. Amounts owed under the JSJ Convertible Note accrue interest at the rate of 12% per annum (18% upon an event of default). The JSJ Convertible Note is payable by us on demand by JSJ at any time after March 6, 2016. We have the right to prepay the JSJ Convertible Note (a) for an amount equal to 135% of the then balance of such note until the 180th day following the date of the note, and (b) for an amount equal to 150% of the balance of such note subsequent to the maturity date (provided the holder consents to such payment after maturity).

The JSJ Convertible Note and all accrued interest is convertible at the option of the holder thereof into the Company’s common stock at any time. The conversion price of the JSJ Convertible Note is 60% (a 40% discount) to the third lowest intra-day trading price of the Company’s common stock during the 10 trading days prior to any conversion date of the note. In the event we do not issue the holder any shares due in connection with a conversion within three business days, we are required to issue the holder additional shares equal to 25% of the conversion amount, and an additional 25% of such shares for each additional five business days beyond such fourth business day that such failure continues. In the event we do not have a sufficient number of authorized but unissued shares of common stock to allow for the conversion of the note, the discount rate (40%) is increased by an additional 5%.

In connection with the sale of the note, we agreed to pay $5,000 of JSJ’s legal fees.

The JSJ Convertible Note contains standard and customary events of default, including in the event we fail to timely file any and all reports due with the Securities and Exchange Commission. Upon the occurrence of an event of default, JSJ can demand that we immediately repay 150% of the outstanding balance of the JSJ Convertible Note together with accrued interest (and default interest, if any).

Pursuant to the terms of the JSJ Convertible Note, JSJ agreed not to engage in any short sales or hedging transactions of our common stock. At no time may the JSJ Convertible Note be converted into shares of our common stock if such conversion would result in JSJ and its affiliates owning an aggregate of in excess of 4.99% of the then outstanding shares of our common stock, provided such percentage may be increased by JSJ to up to increases to 9.99% upon not less than 61 days prior written notice to us.

The goal is for the Company to utilize this debt as growth capital to help accelerate projects that generate revenue. We hope to repay the JSJ Convertible Note prior to any conversion. In the event that the JSJ Note is not repaid in cash in its entirety, Company shareholders may suffer dilution if and to the extent that the balance of the JSJ Note is converted into common stock.

Convertible Promissory Note with Typenex Co-Investment, LLC

On September 14, 2015 (the “Closing Date”), the Company entered into a Securities Purchase Agreement dated September 14, 2015 (the “Typenex SPA”) with Typenex Co-Investment, LLC (“Typenex”). Pursuant to the Typenex SPA, the Company issued to Typenex a convertible promissory note (the “Typenex Note”) in the principal amount of $1,005,000, deliverable in four tranches as described below.

The Typenex Note has a term of 20 months and an interest rate of 10% per annum (22% upon an event of default). The net proceeds to the Company from the Typenex Note were $1,005,000, in the form of: (a) an initial tranche of $250,000 in cash (gross proceeds of $255,000, less $5,000 in expense reimbursements), and (b) three promissory notes of $250,000 each (collectively, the “Investor Notes”). Typenex may elect, in its sole discretion, to fund one or more of the Investor Notes. Absent such an election by Typenex, the Investor Notes will not result in cash proceeds to, or an obligation to repay on the part of, the Company. Each of the Investor Notes accrue interest at the rate of 10% per annum until paid (provided that all amounts due under the Investor Notes may be offset against amounts we owe Typenex in Typenex’s sole discretion), and as such, we do not anticipate owing any interest on the Investor Notes until such notes are funded by Typenex. Each of the Investor Notes are secured by a Membership Interest Pledge Agreement entered into by Typenex for our benefit.

Beginning on the date that is six (6) months after the Closing Date and on the same day of each month thereafter until the maturity date, so long as any amount is outstanding under the Typenex Note, the Company is required to pay to Typenex installments of principal equal to $75,000 (or such lesser principal amount is then outstanding), plus the sum of any accrued and unpaid interest. Payments of each installment amount may be made in cash, subject to the terms of the note. Alternatively, Typenex or the Company may elect to convert an installment amount into Common Stock as described below.

Beginning six (6) months after the Closing Date, Typenex may convert the balance of the Typenex Note, or any installment or portion thereof, utilizing the conversion price calculation set forth below. Generally, the conversion price will be $0.30 per share; however, in the event the Company’s market capitalization falls below $3 million, then the conversion price is the lower of (a) $0.30 per share, and (b) the Market Price. The “Market Price” is calculated by applying a discount of 40% (provided that under certain events the discount may be reduced to up to 60%, upon the occurrence of certain events (with a reduction of 5% per event) such as the value of common stock (as calculated in the note) declining below $0.10 per share; the Company not being DWAC eligible; the Company’s common stock not being DTC eligible; or the occurrence of any major default (as described in the note)), to the average of the three (3) lowest intra-day trading prices of the Company’s common stock during the ten (10) trading days immediately preceding the applicable conversion. The Company may also elect to make payment of installments in the form of equity on substantially the same terms, subject to the terms and conditions of the Typenex Note, and Typenex’s right in certain cases to require a certain portion of such payment to be paid in cash or stock. Additionally, 20 days after shares issued upon redemption of the note are eligible to be freely traded by Typenex (as described in the note), there is a required true up, whereby Typenex is required to be issued additional shares in the event the trading price of the Company’s common stock has declined from the time of original issuance to the date such shares are ‘free trading’ as described in the Typenex Note.

The Company has the right to prepay the Typenex Note under certain circumstances, subject to payment of a 35% prepayment penalty during the first six months the note is outstanding and 50% thereafter.

If, at any time that the Typenex Note is outstanding, the Company sells or issues any common stock or other securities exercisable for, or convertible into, Common Stock for a price per share that is less than the conversion price applicable under the Typenex Note, then such lower price will apply to all subsequent conversions by Typenex for a period of 20 trading days.

The Typenex Note includes customary and usual events of default. In the event of a default, the Typenex Note may be accelerated by Typenex. The outstanding balance would be immediately due and payable we are required to repay Typenex additional amounts (including the value of the amount then due in common stock, at the highest intraday trading price of the amount then due under the note) and/or liquidated damages in addition to the amount owed under the Typenex Note. In addition, we owe certain fees and liquidated damages to Typenex if we fail to timely issue shares of common stock under the Typenex Note.

Typenex is prohibited from owning more than 4.99% of the Company’s outstanding shares Pursuant to the Typenex Note, unless the market capitalization of the Company’s common stock is less than $10,000,000, in which case Typenex is prohibited from owning more than 9.99% of the Company’s outstanding shares.

Amounts owed by us under the Typenex Note is secured by a first priority security interest granted to Typenex pursuant to the terms of a Security Agreement entered into with Typenex, in each of the Investor Notes.

The goal is for the Company to utilize this debt as growth capital to help accelerate projects that generate revenue. We hope to repay the Typenex Convertible Note prior to any conversion. In the event that the Typenex Note is not repaid in cash in its entirety, Company shareholders may suffer dilution if and to the extent that the balance of the Typenex Note is converted into common stock.

Convertible Promissory Note with JMJ Financial

On September 16, 2015, we sold JMJ Financial (“JMJ”) a Convertible Promissory Note in the principal amount of up to $900,000 (the “JMJ Convertible Note”). The initial amount received in connection with the sale of the JMJ Convertible Note was $350,000, and a total of $385,000 is currently due under the JMJ Convertible Note (not including the interest charge described below), as all amounts borrowed under the note include a 10% original issue discount. Moving forward, JMJ may loan us additional funds (up to $900,000 in aggregate) at our request, provided that JMJ has the right in its sole discretion to approve any future request for additional funding. Each advance under the JMJ Convertible Note is due two years from the date of such advance, with the amount initially funded under the note due on September 16, 2017.

The JMJ Convertible Note (including principal and accrued interest and where applicable other fees) is convertible into our common stock, at any time, at the lesser of $0.75 per share or 65% (a 35% discount) of the two lowest closing prices of our common stock in the 20 trading days prior to the date of any conversion, provided that if we are not DWAC eligible at the time of any conversion an additional 10% discount applies, and in the event our common stock is not DTC eligible at the time of any conversion, an additional 5% discount applies. The JMJ Convertible Note provides that unless we and JMJ agree in writing, JMJ is not eligible to convert any amount of the note into common stock which would result in JMJ owning more than 4.99% of our common stock.

A one-time interest charge of 12% was applied to the principal amount of the note, which remains payable regardless of the repayment (or conversion) date of the note.

Until 180 days after the date of the note, we are able to prepay the note assuming we prepay all outstanding principal together with a penalty of 40% of such amount, interest, fees, liquidated damages (if any), and the original issuance discount due thereon; and after 160 days, we are not able to prepay the note without JMJ’s written approval.

We agreed that we would reserve 25 million shares of common stock for conversion of the note. In the event we fail to deliver shares within four days of the date of any conversion by JMJ, we are required to pay JMJ $2,000 per day in penalties.

The JMJ Convertible Note provides for customary events of default including, our failure to timely make payments under the JMJ Convertible Note when due, our entry into bankruptcy proceedings, our failure to file reports with the SEC, our loss of DTC eligibility for our common stock, and the investor’s loss of the ability to rely on Rule 144. Additionally, upon the occurrence of an event of default, as described in greater detail in the JMJ Convertible Note, and at the election of JMJ, we are required to pay JMJ, either (i) the amount then owed under the note divided by the applicable conversion price, on the date the default occurs or the default amount is demanded (whichever is lower), multiplied by the volume weighted average price on the date the default occurs or the default amount is demanded (whichever is higher), or (ii) 150% of the principal amount of the note, plus all of the unpaid interest, fees, liquidated damages (if any) and other amounts due. Any amount not paid when due accrues interest at the rate of 18% per annum until paid in full. JMJ is not required to provide us any written notice in order to accelerate the amounts owed under the JMJ Convertible Note in the event of the occurrence of an event of default.

For so long as the JMJ Convertible Note is outstanding JMJ agreed not to effect any “short sales” of our common stock.

The goal is for the Company to utilize this debt as growth capital to help accelerate projects that generate revenue. We hope to repay the JMJ Convertible Note prior to any conversion. In the event that the JMJ Note is not repaid in cash in its entirety, Company shareholders may suffer dilution if and to the extent that the balance of the JMJ Note is converted into common stock.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Unless the context requires otherwise, references to the “Company,” “we,” “us,” “our,” “Jammin Java” and “Jammin Java Corp.” refer specifically to Jammin Java Corp.

In addition, unless the context otherwise requires and for the purposes of this report only:

● “Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

● “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and

● “Securities Act” refers to the Securities Act of 1933, as amended.

You should carefully consider the risk factors described below, if any, and those described in our Annual Report on Form 10-K for the year ended January 31, 2015, filed with the SEC on May 1, 2015 (the “Annual Report”), as well as the other information included in this Quarterly Report on Form 10-Q, the Annual Report and in our other reports filed with the SEC, prior to making a decision to invest in our securities.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and the documents incorporated by reference, include “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they prove incorrect or never materialize, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements. Examples of forward-looking statements include, but are not limited to any statements, predictions and expectations regarding our earnings, revenues, sales and operations, operating expenses, anticipated cash needs, capital requirements and capital expenditures, needs for additional financing, use of working capital, plans for future products, services and distribution channels, anticipated growth strategies, planned capital raises, ability to attract distributors and customers, sources of net revenue, anticipated trends and challenges in our business and the markets in which we operate, the impact of economic and industry conditions on our customers and our business, customer demand, our competitive position, the outcome of any litigation against us, critical accounting policies and the impact of recent accounting pronouncements. Additional forward-looking statements include, but are not limited to, statements pertaining to other financial items, plans, strategies or objectives of management for future operations, our financial condition or prospects, and any other statement that is not historical fact. Forward-looking statements are often identified by the use of words such as “may,” “might,” “intend,” “should,” “could,” “can,” “would,” “continue,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” “plan,” “seek” and similar expressions and variations or the negativities of these terms or other comparable terminology.

These forward-looking statements are based on the expectations, estimates, projections, beliefs and assumptions of our management based on information currently available to management, all of which is subject to change. Such forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and could cause actual results to differ materially from those stated or implied by our forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified under “Risk Factors” in Item 1A of our Annual Report. We undertake no obligation to revise or update publicly any forward-looking statements to reflect events or circumstances after the date of such statements for any reason except as otherwise required by law.

In this Form 10-Q, we may rely on and refer to information regarding the market for our products and our industry in general, which information comes from market research reports, analyst reports and other publicly available information. Although we believe that this information is reliable, we cannot guarantee the accuracy and completeness of this information, and we have not independently verified any of it.

This information should be read in conjunction with the interim unaudited financial statements and the notes thereto included in this Quarterly Report on Form 10-Q, and the unaudited financial statements and notes thereto and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in our Annual Report on Form 10-K for the year ended January 31, 2015.

Overview

We provide premium roasted coffee and specialty coffee on a wholesale level to the service, hospitality, office coffee service and big box store markets, as well as to a variety of other business channels. Specifically, we currently provide award winning sustainably grown, ethically-farmed and artisan roasted gourmet coffee through multiple United States and international distribution channels. We intend to develop a significant share of these markets and achieve a leadership position by capitalizing on the global recognition of the “Marley” brand name. We hope to capitalize on the guidance and leadership of our Chairman, Rohan Marley, and to increase our sales through the marketing of products using the likeness of, and reflecting the personality of, Mr. Marley. Additionally, through a licensing agreement with the family of the late reggae performer, Robert Nesta Marley, professionally known as Bob Marley (which family members include Rohan Marley, our Chairman and the son of Bob Marley)(as described below), we are provided the worldwide right to use the name “Marley Coffee” and reasonably similar variations thereof.

We believe the key to our growth is a multichannel distribution and sales strategy. Since August 2011, we have been introducing a wide variety of coffee products through multiple distribution channels using the Marley Coffee brand name. The main channels of revenue for the Company are now and are expected to continue to be domestic retail in both grocery and away from home (for example, consumption at the office and on the go), international distribution, and online retail.

In order to market our products in these channels, we have developed a variety of coffee products in varying formats. The Company offers an entire line of coffee in whole bean and ground form with varying sizes including 2.5 ounce (oz), 8oz, 12oz and 2 pound (lbs) sizes. The Company also offers a “single serve” solution with its compostable Single-Serve Pods for Bunn® and other pod-based home and office brewers. The Company recently launched its Marley Coffee RealCup; compatible cartridges, for use in most models of Keurig®’s K-Cup brewing system.

License Agreement with Fifty-Six Hope Road

On September 13, 2012, the Company entered into a fifteen (15) year license agreement (renewable for two additional fifteen (15) year terms thereafter in the option of the Company) with an effective date of August 7, 2012 with Fifty-Six Hope Road Music Limited, a Bahamas international business company (“Fifty-Six Hope Road” and the “FSHR License Agreement”). Rohan Marley, our Chairman, owns an interest in Fifty-Six Hope Road. Pursuant to the FSHR License Agreement, Fifty-Six Hope Road granted the Company a worldwide, exclusive, non-transferable license to utilize the “Marley Coffee” trademarks (the “Trademarks”) in connection with (i) the manufacturing, advertising, promotion, sale, offering for sale and distribution of coffee in all its forms and derivations, regardless of portions, sizes or packaging (the “Exclusive Licensed Products”) and (ii) coffee roasting services, coffee production services, and coffee sales, supply, distribution and support services, provided that the Company may not open retail coffee houses utilizing the Trademarks. Fifty-Six Hope Road owns and controls the intellectual property rights in and to the late reggae performer, Robert Nesta Marley, professionally known as Bob Marley, including the Trademarks. In addition, Fifty-Six Hope Road granted the Company the right to use the Trademarks on advertising and promotional materials that pertain solely to the sale of coffee cups, coffee mugs, coffee glasses, saucers, milk steamers, machines for brewing coffee, espresso and/or cappuccino, grinders, water treatment products, tea products, chocolate products, and ready-to-use (instant) coffee products (the “Non-Exclusive Licensed Products”, and together with the Exclusive Licensed Products, the “Licensed Products”). Licensed Products may be sold by the Company pursuant to the FSHR License Agreement through all channels of distribution, provided that, subject to certain exceptions, the Company cannot sell the Licensed Products by direct marketing methods (other than the Company’s website), including television, infomercials or direct mail without the prior written consent of Fifty-Six Hope Road. Additionally, FSHR has the right to approve all Licensed Products, all advertisements in connection therewith and all product designs and packaging. The agreement also provides that FSHR shall own all rights to any domain names (including marleycoffee.com), incorporating the Trademarks.