false

0001527702

0001527702

2024-07-16

2024-07-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 16,

2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 7 – Regulation FD Disclosure

| | Item 7.01 | Regulation FD Disclosure |

iQSTEL, Inc. (the “Company”) is furnishing presentation materials

(the “Corporate Presentation”) that management intends to use, possibly with modifications, in one or more meetings from time

to time with current and potential investors. The Corporate Presentation includes an update on the Company’s current operations

and major projects, as well as information relating to the Company’s strategic plans, goals, growth initiatives and outlook, and

forecasts for future performance and industry development.

The foregoing description of the Corporate Presentation does not purport

to be complete and is qualified in its entirety by reference to the complete text of the Corporate Presentation attached as Exhibit 99.1

to this Current Report on Form 8-K.

The information contained in the Corporate Presentation is summary information

that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements

the Company may make by press release or otherwise from time to time. The Corporate Presentation speaks as of the date of this Current

Report. While the Company may elect to update the Corporate Presentation in the future to reflect events and circumstances occurring or

existing after the date of this Current Report, the Company specifically disclaims any obligation to do so.

By furnishing this Current Report on Form 8-K and furnishing the Corporate

Presentation, the Company makes no admission as to the materiality of any information in this Current Report, including without limitation

the Corporate Presentation. The Corporate Presentation contains forward-looking statements. See Page 2 of the Corporate Presentation for

a discussion of certain forward-looking statements that are included therein and the risks and uncertainties related thereto.

The information set forth in this Item 7.01 of this Report, including without

limitation the Corporate Presentation, is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as may be expressly set forth by specific reference in such a filing.

SECTION 9 – Financial Statements and Exhibits

| |

Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date July 16, 2024

COMPANY DECK Jul 17, 2024 www.iqstel.com

This presentation has been prepared by iQSTEL Inc . (“we,” “us,” “our,” “iQSTEL” or the “Company”) . This presentation does not constitute an offer of any securities for sale . Any securities offered privately will not be or have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements, nor shall there be any offer or sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction . The information set forth herein does not purport to be complete or to contain all of the information you may desire . Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof . This presentation contains forward - looking statements . These forward - looking statements should not be used to make an investment decision . The words ‘believe,’ ‘expect,’ ‘may,’ ‘strategy,’ ‘future,’ ‘likely,’ ‘goal,’ ‘plan,’ 'estimate,' 'possible' and 'seeking' and similar expressions identify forward - looking statements, which speak only as to the date the statement was made . All statements other than statements of historical facts included in this presentation regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward - looking statements . Examples of forward - looking statements include, among others, statements we make regarding our recent acquisitions and joint venture projects, the plans and objectives of management for future operations, including plans relating to the development of new products or services, and our future financial performance . Forward - looking statements are neither historical facts nor assurances of future performance . Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control . Our actual results and financial condition may differ materially from those indicated in the forward - looking statements . Therefore, you should not rely on any of these forward - looking statements . Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward - looking statements include, among others, competition within the industries in which we operate, the timing, cost and success or failure of new product and service introductions and developments, our ability to attract and retain qualified personnel, maintaining our intellectual property rights and litigation involving intellectual property rights, legislative, regulatory and economic developments, and the other risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our most recently filed Annual Report on Form 10 - K and any subsequently filed Quarterly Report(s) on Form 10 - Q . Any forward - looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made . We undertake no obligation to publicly update any forward - looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise . IMPORTANT CAUTIONS REGARDING FORWARD LOOKING STATEMENTS 2

AGENDA 1 Introduction to iQSTEL Inc. 2 History and Evolution of iQSTEL 3 Mission and Vision 4 Business Units 5 Enhanced Telecommunications Services Division 6 Telecommunications Subsidiaries 7 Fintech Division 8 Electric Vehicles Division 9 AI - Enhanced Metaverse Division 10 Revenue Growth and Diversification 11 Nasdaq Uplisting 12 Management Team Overview 3

INTRODUCTION TO IQSTEL Inc Company Overview iQSTEL Inc. is a multinational telecommunications and technology company, incorporated in Nevada, United States in 2011. The company is traded on OTCQX under the ticker symbol IQST and aims to uplist to a national exchange . Key Financials In FY - 2023, iQSTEL reported a full - year revenue of $144.5 million and projects a revenue run rate of $290 million for FY - 2024. The company anticipates $7.5 million in gross profit and a seven - digit positive operating income for FY - 2024. Traded on OTCQX As a SEC reporting company, iQSTEL is traded on OTCQX under the ticker symbol IQST. The company has met the requirements for the OTCQX certification, demonstrating its commitment to transparency and shareholder protection. Revenue Projections With an expected annual revenue run rate of $290 million for FY - 2024, iQSTEL is on track for significant growth, averaging $700,000 in revenue per day. The company just reported: Q2 revenue (unaudited) is $77M vs. $51.4M in Q1 (49% increase), and Preliminary Q2 gross profit (unaudited) is $2M vs. $1.3M in Q1 (53% increase) Preliminary 4

MISSION AND VISION OF IQSTEL Purpose iQSTEL's mission is to bridge societal gaps by providing access to essential communication services, virtual banking solutions, affordable mobility options, and information content. The company's commitment to connectivity and accessibility underpins its operational ethos. Goals Driven by a vision of global industry leadership, iQSTEL aims to achieve a revenue target of at least $1 billion by 2027. The company's strategic goals encompass sustainable growth, innovation, and value creation for stakeholders. Revenue Target by 2027 With a clear trajectory towards revenue diversification and expansion, iQSTEL is poised to capitalize on market opportunities and technological advancements to realize its ambitious revenue target of $1 billion by 2027. The company's vision reflects a strategic roadmap for sustainable growth and industry prominence. 6

HISTORY AND EVOLUTION OF IQSTEL • Founding : iQSTEL traces its origins back to 2008 when engineer Leandro Jose Iglesias established Etelix . com USA LLC, focusing on international voice (VoIP) services . The company's roots in telecommunications laid the foundation for its future growth and evolution . • Name Change : In 2018 , Etelix . com USA LLC merged with PureSnax International Inc . , leading to the formation of iQSTEL Inc . The rebranding represented a new phase in the company's evolution, symbolizing its vision for innovation and progress . • Acquisitions : Since 2018 , iQSTEL has completed 12 acquisitions and ventures to enhance its capabilities and broaden its market presence . Strategic acquisitions have been pivotal in driving the company's expansion and diversification . • Market Presence Expansion : Through strategic moves and organic growth initiatives, iQSTEL has expanded its market reach and emerged as a prominent player in the telecommunications and technology landscape . The company's journey reflects a commitment to continuous advancement and adaptation . ACQUISITIONS AND VENTURES 12 in Total 5 Notice: The acquisition of Lynktel is in process, and the company is actively conducting due diligence. While we expect to close this deal during the Q3 FY - 2024, there are no assurances that the deal will close as planned. SD0

7 HUMAN NEEDS & BUSINESS DIVISIONS

8 BUSINESS LINES AND SUBSIDIARIES Notice: The acquisition of Lynktel is in process, and the company is actively conducting due diligence. While we expect to close this deal during the Q3 FY - 2024, there are no assurances that the deal will close as planned.

ENHANCED TELECOMMUNICATIONS OUR CORE BUSINESS DIVISION • Market Position : In a market estimated at $ 10 . 7 billion annually, iQSTEL holds a 2 % market share in the International Long - Distance traffic segment and 0 . 2 % in the Global A 2 P SMS Market . The company aims to significantly increase its market share through strategic growth initiatives and competitive differentiation . • Growth Strategies : To capture a larger market share, iQSTEL focuses on outpacing competitors and expanding its service offerings . The company plans to leverage its existing capabilities, innovative solutions, and industry expertise to drive growth and establish a stronger foothold in the telecommunications sector . 9 Notice: The acquisition of Lynktel is in process, and the company is actively conducting due diligence. While we expect to close this deal during the Q3 FY - 2024, there are no assurances that the deal will close as planned.

ABOUT OUR TELECOM BUSINESS • Product Offerings : iQSTEL's subsidiaries offer a wide range of products and services, including VoIP, SMS, international fiber - optic solutions, IoT services, and a mobile number portability blockchain platform . These offerings cater to different communication needs and technology requirements in the market . • Revenue Sources : The voice (VoIP) business accounts for approximately 70 % of the telecommunications revenue, with SMS services contributing to the remaining revenue . iQSTEL's revenue streams are diversified across various services, providing stability and growth opportunities in the competitive telecom sector . • Customer Base : iQSTEL serves a diverse customer base that includes large operators and telecommunications companies with over 500 interconnections globally . By establishing strong partnerships and delivering reliable services, the company has built a trusted network of clients that contribute to its revenue growth and market presence . 10 COMMERCIAL PRESENCE Notice: The acquisition of Lynktel is in process, and the company is actively conducting due diligence. While we expect to close this deal during the Q3 FY - 2024, there are no assurances that the deal will close as planned.

11 OUR TELECOM BUSINESS

12 FINTECH DIVISION • Maxmo . vip Portal Services : The Fintech Division of iQSTEL offers services through the Maxmo . vip portal, including a MasterCard debit card, US bank accounts without SSN requirements, and a mobile app for tracking recharges and remittances . These services aim to enhance financial accessibility and streamline banking processes for customers . • Financial Accessibility Goals : Through the Global Money One application and various financial services, iQSTEL's Fintech Division seeks to democratize access to US banking services, international remittances, telecommunications solutions, and mobile recharges . The division focuses on providing convenient and inclusive financial options for a broad range of users .

13 ELECTRIC VEHICLES DIVISION Product Offerings iQSTEL's Electric Vehicles Division focuses on providing environmentally friendly transportation options, including electric motorcycles and mid - speed electric cars. The division has secured trademarks, certifications, and strategic partnerships for the production and introduction of these vehicles in multiple markets. Expansion Plans The Electric Vehicles Division plans to introduce electric motorcycles and mid - speed cars in Spain, Portugal, the United States, and select Latin American countries. By strategically expanding its market reach and establishing a presence in key regions, iQSTEL aims to position itself as a leading provider of sustainable transportation solutions. Even though this business line is important for iQSTEL, once we reach certain development, we plan to spin off this business to get listed separately

14 AI - ENHANCED METAVERSE DIVISION Technology Platform Features iQSTEL's AI - Enhanced Metaverse Division offers a white - label platform with features such as digital avatar creation, real - time interactions, 3D environments, and AI - powered virtual assistants. These advanced technologies provide clients with immersive and customizable virtual experiences. Target Market The AI - Enhanced Metaverse Division targets a diverse global market seeking interactive and engaging virtual experiences. By catering to various industries and user preferences, the division aims to capture a broad audience interested in innovative digital interactions and personalized virtual environments. New Product Launch iQSTEL plans to launch a new product leveraging AI and Metaverse technology to reach millions of potential customers worldwide. This innovative offering is designed to enhance user engagement, encourage interactive experiences, and establish the company as a leading provider of cutting - edge Metaverse solutions.

15 REVENUE GROWTH AND DIVERSIFICATION • Organic Growth : iQSTEL's organic growth strategy involves integrating acquired subsidiaries, implementing cross - selling initiatives, and optimizing operational costs . In 2023 , the company achieved a significant organic revenue growth of $ 51 million, reflecting a 55 % increase compared to the previous year . The projected organic growth for FY - 2024 is $ 90 Million . • Acquisitions : Strategic acquisitions are a key part of iQSTEL's growth strategy to enhance capabilities and expand market presence . The key factor of the IQSTEL success is to acquire companies with strategic value increasing the portfolio of products, and reduce cost to improve bottom line profits .

16 FINANCIAL PERFORMANCE • Financial Performance Trends : iQSTEL reported audited revenue of $ 13 . 8 million in its first year as a publicly traded company, which grew nearly tenfold to $ 144 . 5 million in 2023 . With projected revenue of $ 290 million for FY - 2024 , the company aims to continue exceeding financial forecasts through strategic growth and performance optimization .

17 NASDAQ UPLISTING Listing Aspirations iQSTEL is traded on OTCQX and aims to uplist to Nasdaq, meeting all listing requirements except the minimum share price. The company plans to enhance shareholder value by transitioning to a national exchange and unlocking new growth opportunities through increased market visibility and investor interest. Compliance While iQSTEL meets Nasdaq listing requirements in various aspects, the minimum share price remains a hurdle for uplisting . Management is confident that as the company continues to deliver strong financial results and operational performance, the share price will organically reflect its true value, paving the way for a successful Nasdaq transition. Investor Engagement To support its Nasdaq uplisting efforts and raise market visibility, iQSTEL plans to engage in key investor conferences and explore strategic partnerships with underwriters. Increased investor engagement and market exposure are essential for achieving the desired Nasdaq listing and expanding shareholder base.

18 CORPORATE REQUIREMENTS FOR NASDAQ

19 July 10, 2024 COMPANY OWNERSHIP CAP TABLE SD0

20 CURRENT OUTSTANDING DEBT

21 COMPANY BUSINESS AND CORPORATE PLAN • Transformation to Telecommunications Corporation • Lynk Telecom Acquisition • Technological Platform Consolidation • Revenue Growth • Marketing Enhancement • Capital Raising “We intend to raise up to $10.5 million to optimize our capital structure, leaving approximately $5 million of free cash after debt redemption”

22 TIME TO DOUBLE OUR BUSINESS SIZE As a culmination of the first step of our acquisition strategy, and as we prepare the Company for an exchange listing, iQSTEL will pursue the acquisition or merger with a private or public company, aiming to elevate iQSTEL to a business size of at least $ 500 million in revenues per year . Upon identifying a suitable target, the company plans to raise an additional $ 30 million, on top of the current capital raising plan, to complete this strategic acquisition . The amount is based on preliminary search of potential targets . .

23 MANAGEMENT TEAM OVERVIEW • Leandro Jose Iglesias, President & CEO, Chairman of the Board : With over 20 years of experience in the telecommunications industry, Leandro founded Etelix in 2008 and played a pivotal role in shaping iQSTEL's strategic direction . As the President & CEO, he leads the company's vision and growth initiatives, driving towards achieving strategic milestones and revenue targets . • Alvaro Quintana Cardona, CFO and Secretary of the Board : Alvaro brings over 20 years of telecommunications industry experience to his role . Joining Etelix in 2013 , he has served in various leadership positions, including Chief Operating Officer and Chief Financial Officer . Alvaro's financial acumen and strategic insights contribute to iQSTEL's financial success and growth strategies . • Raul A Perez, Independent Member of the Board and Head of Audit Committee : With over 40 years of finance experience, Raul currently serves as CFO of Deerbrook Family Dentistry PC . His financial expertise and industry knowledge enhance the governance and audit practices at iQSTEL, ensuring transparency and accountability in financial reporting . • Jose Antonio Barreto , Independent Member of the Board & Head of Ethic Code Committee : Jose brings over 30 years of telecommunications and technology experience to his role as Chief Business Development Officer at Xpectra Remote Management . His insights and leadership in ethical practices contribute to iQSTEL's corporate governance and commitment to ethical standards . • Italo R . Segnini , Independent Board of Director and Head of Compensation Committee : With over 20 years of experience in the telecommunications industry, Italo's role as Global Carrier Partnership Director at Sierra Wireless highlights his expertise in strategic partnerships and industry collaborations . He oversees compensation matters at iQSTEL, ensuring alignment with organizational goals and performance .

CEO & Chairman Leandro Jose Iglesias CONTACT THE FOUNDERS CFO Alvaro Quintana investors @ iqstel.com Detail information about the company is filed on 8 - K on July 12, 2024

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

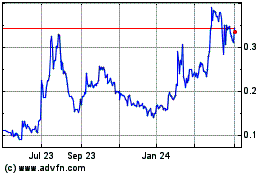

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Dec 2024 to Jan 2025

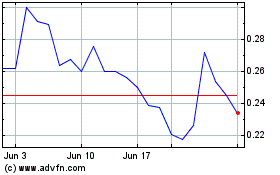

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Jan 2024 to Jan 2025