SECURITIES

AND EXCHANGE COMMISSION

Washington

DC 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

OF

THE

SECURITIES EXCHANGE ACT OF 1934

For 30

June 2020

InterContinental Hotels Group PLC

(Registrant's

name)

Broadwater

Park, Denham, Buckinghamshire, UB9 5HJ, United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F

Form 40-F

Indicate

by check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes

No

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): Not

applicable

EXHIBIT

INDEX

|

99.1

|

Pre-close

update dated 30 June 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

No: 99.1

30 June 2020

InterContinental Hotels Group PLC

Pre-close update

InterContinental Hotels Group ("IHG") [LON:IHG, NYSE:IHG (ADRs)]

provides an update on recent trading.

Status of hotel re-opening programme

The pace of hotels reopening has continued to accelerate through

the second quarter, with only 10% of the global estate currently

still closed. In the Americas region, around 5% are closed;

these are predominantly managed luxury and upscale hotels, and

those outside of the US. Good progress has been made across

the EMEAA region as government-mandated hotel closures have eased;

around 30% currently remain closed. In Greater China, just 1%

are closed.

RevPAR performance

We expect to report a comparable RevPAR decline of ~(75)% for Q2

(resulting in ~(52)% for H1), including (82)% in April, (76)% in

May and an estimated (70)% for June. The small but steady

improvements in RevPAR through the second quarter are mostly

attributed to the Americas franchised estate and the Greater China

region. Occupancy levels in comparable open hotels have

improved to over 40% in the US.

The Q2 RevPAR decline for the Americas region is estimated at

(72)%. The US franchised estate, which benefits from a

weighting towards domestic demand-driven mainstream hotels, with a

lower reliance on large group business and higher distribution in

non-urban markets, is estimated to have declined ~(67)% in

Q2. This compares to an estimated ~(87)% decline in Q2 for

the US managed estate, which is weighted to luxury and upper

upscale hotels in urban markets that individually contribute higher

fee revenue than a mainstream franchised hotel.

Other financial updates ahead of the interim results for the period

ending 30 June 2020

Owned, Leased and Managed Lease hotels

There are 17 of IHG's 26 Owned, Leased and Managed Lease hotels

that remain closed, and those that are open are operating at very

low occupancies. As a result of these challenging trading

conditions, we expect to report first half operating losses before

exceptional items in the region of $25m from Owned, Leased and

Managed Lease hotels. A gradual reopening of these hotels is

currently expected through the third quarter, and once open we

expect to experience low occupancies and lower than usual non-room

revenues.

Cost efficiency savings

As confirmed at our Q1 results, we remain on track to reduce Fee

Business costs by $150m from 2019 levels; more than two-thirds of

these savings will be delivered in the second half of the

year.

Liquidity

As at 26 June, IHG continued to have ~$2bn in available

liquidity. We have taken steps to protect cash flow by

reducing costs and capital expenditure, and by proactively managing

our working capital with measures including fee relief and

increased payment flexibility for owners, which has resulted in

continued payments being received through May and June. We

will assess any further need for owner payment flexibility as the

trading environment evolves.

-Ends-

For further information, please contact:

|

Investor Relations (Stuart

Ford; Matt

Kay; Rakesh Patel)

|

+44 (0)1895 512 176

|

+44 (0)7527 419 431

|

|

Media Relations (Yasmin Diamond; Mark Debenham)

|

+44 (0)1895 512 097

|

+44 (0)7527 424 046

|

Note 1: Revenue

per available room (RevPAR) growth is on a comparable hotels basis

and at constant exchange rates (CER) unless otherwise

stated.

Note on forward-looking statements

This document may contain projections and forward-looking

statements. The words "believe", "expect", "anticipate",

"intend" and "plan" and similar expressions identify

forward-looking statements. All statements other than

statements of historical facts included in this document,

including, without limitation, those regarding the Company's

financial position, potential business strategy, potential plans

and potential objectives, are forward-looking statements.

Such forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the

Company's actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on

numerous assumptions regarding the Company's present and future

business strategies and the environment in which the Company will

operate in the future. Further, certain forward-looking

statements are based upon assumptions of future events which may

not prove to be accurate. The forward-looking statements in

this document speak only as at the date of its publication and the

Company assumes no obligation to update or provide any additional

information in relation to such forward-looking

statements.

The merits or suitability of investing in any securities previously

issued or issued in future by the Company for any investor's

particular situation should be independently determined by such

investor. Any such determination should involve, inter alia,

an assessment of the legal, tax, accounting, regulatory, financial,

credit and other related aspects of the transaction in

question.

Note to Editors

IHG® (InterContinental Hotels Group) [LON:IHG, NYSE:IHG (ADRs)] is a global

organisation with a broad portfolio of hotel brands,

including Six Senses Hotels

Resorts Spas , Regent Hotels & Resorts , InterContinental

® Hotels & Resorts , Kimpton ® Hotels &

Restaurants , Hotel Indigo ® , EVEN ® Hotels , HUALUXE

® Hotels and Resorts , Crowne Plaza ® Hotels &

Resorts , voco™ , Holiday Inn ® Hot els & Resorts ,

Holiday Inn Express ® , Holiday Inn Club Vacations ® ,

avid™ hotels , Staybridge Suites ® , Atwell

Suites™ , and

Candlewood Suites ®

.

IHG franchises, leases, manages or owns more than 5,900 hotels and

nearly 88 2 ,000 guest rooms in more than 100 countries, with

almost 2,0 00 hotels in its development pipeline. IHG also

manages IHG ® Rewards

Club , our global loyalty

programme, which has more than 100 million enrolled

members.

InterContinental Hotels Group PLC is the Group's holding company and is incorporated

in Great Britain and registered in England and Wales. More than

400,000 people work across IHG's hotels and corporate offices

globally.

Visit ww w.ihg.com

for hotel information and reservations

and www.ihgrewardsclub.com for more on IHG Rewards Club. For our latest news,

visit: www.ihgplc.

com/news-and-media and follow

us on social media at: https://twitter.com/ihgcorporate ,

www.facebook.com/ihgcorporate and www.linkedin.com/company/intercontinental-hotels-group

.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

InterContinental Hotels Group PLC

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ F. Cuttell

|

|

|

Name:

|

F.

CUTTELL

|

|

|

Title:

|

ASSISTANT

COMPANY SECRETARY

|

|

|

|

|

|

|

Date:

|

30 June 2020

|

|

|

|

|

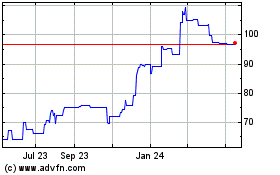

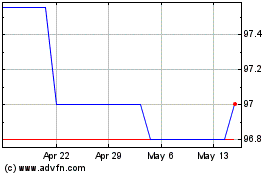

Intercontinental Hotels (PK) (USOTC:ICHGF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intercontinental Hotels (PK) (USOTC:ICHGF)

Historical Stock Chart

From Jul 2023 to Jul 2024