Launch of Convertible Bond Offerings

February 18 2013 - 5:08AM

OTC Markets

Impala

Platinum Holdings Limited

(Incorporated

in the Republic

of South Africa)

(Registration

No. 1957/001979/06)

ISIN:

ZAE000083648

JSE

Share Code : IMP

ADR

Code : IMPUY

(“Implats”

or the “Company”)

NOT

FOR

PUBLICATION,

DISTRIBUTION

OR

RELEASE,

DIRECTLY

OR

INDIRECTLY,

IN

OR

INTO

THE

UNITED STATES OF AMERICA

(INCLUDING ITS TERRITORIES AND DEPENDENCIES), AUSTRALIA, CANADA OR

JAPAN.

RELEASED IN SOUTH AFRICA FOR

INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE A PUBLIC OFFER

IN SOUTH AFRICA

Results of Convertible Bond Offering

Implats

is pleased to announce the final terms of its dual offering of

ZAR2,672 million

senior unsecured convertible bonds due 2018 (the "ZAR Bonds") and

US$200

million senior unsecured convertible bonds due 2018 (the "US$

Bonds"

and together with the ZAR Bonds, the “Bonds”).

The

Bonds will be issued and redeemed at par and will carry a coupon of

5.00% per

annum for the ZAR Bonds and 1.00% per annum for the US$ Bonds. The

ZAR Bonds’

initial conversion price has been set at ZAR 214.9000 per share, a

premium of 35%

above the volume weighted average price of the shares from launch

to pricing

while the US$ Bonds’ initial conversion price has been set at US$

24.1300 per

share, a premium of 35% above the volume weighted average price of

the shares

from launch to pricing, converted at the prevailing ZAR:US$ spot

rate at the

time of pricing.

The

Company will have the option to call the Bonds at par plus accrued

interest at

any time on or after 13 March 2016, if the aggregate value of the

underlying shares

per Bond for a specified

period of

time is 130% or more of the principal amount of that

Bond.

Implats’

shareholders will be requested to grant specific authority for the

directors to

issue ordinary shares pursuant to the conversion rights which will

attach to

the Bonds.

It is expected that settlement of the Bonds will take place on or

about

Thursday, 21 February 2013. Implats intends to apply for admission

of the ZAR

Bonds to trade on the Main Board of the JSE and the US$ Bonds to

trade on a European

stock exchange within 3 months following settlement of the

Bonds.

UBS Limited (“UBS”) is acting as Global Co-ordinator. The

Standard Bank of South Africa Limited (in

connection with the offering of the ZAR Bonds) and Standard Bank

Plc (in

connection with the offering of US$ Bonds) and UBS are acting as

Joint

Bookrunners. Basis Point Capital is acting as the local partner in

connection

with the offering of the Bonds

Johannesburg

14 February 2013

Sponsor: Deutsche

Securities (SA) (Proprietary) Limited

Stabilisation/FSA.

This

announcement is

not for publication, distribution or release, directly or

indirectly, in or

into the United States

(including its territories and dependencies, any State of

the United States and the

District of Columbia). The

securities

referred to herein have not been and will not be registered under

the U.S.

Securities Act of 1933, as amended (the "Securities Act"), and

may

not be offered or sold in the United States without registration

there under or

pursuant to an available exemption therefrom. Neither this

announcement nor the

information contained herein constitutes or forms part of an offer

to sell or

the solicitation of an offer to buy securities in the United

States.

There will be no public offer of the Bonds in the United

States or in any

other

jurisdiction.

In the United

Kingdom

this communication is directed only at those persons (i) who have

professional

experience in matters relating to investments falling within

Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005,

as amended (the "Order") or (ii) who fall within Article 49(2)(A)

to

(D) of the Order, and (iii) to whom it may otherwise lawfully be

communicated.

This

announcement is

not intended to be nor is it an offer to the public for sale or

subscription of

the Bonds as contemplated under Chapter 4 of the South African

Companies Act,

No.71 of 2008, as amended nor does it constitute an offer for

subscription,

sale or purchase of the US$ Bonds to any South African resident

persons or

company or any non-South African company which is a subsidiary of a

South

African company. A South African resident person or company or any

non-South

African company which is a subsidiary of a South African company is

not

permitted to acquire the US$ Bonds unless such person has obtained

exchange

control approval to do so.

This

announcement is

not an offer of securities or investments for sale nor a

solicitation of an

offer to buy securities or investments in any jurisdiction where

such offer or

solicitation would be unlawful.

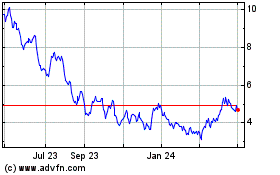

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Dec 2024 to Jan 2025

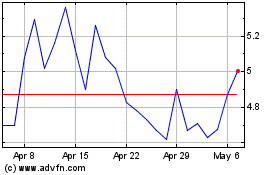

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Jan 2024 to Jan 2025