Current Report Filing (8-k)

May 06 2022 - 5:19PM

Edgar (US Regulatory)

0001643154

false

A1

0001643154

2022-05-06

2022-05-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May

6, 2022

IANTHUS CAPITAL HOLDINGS, INC.

(Name of registrant in its charter)

| |

|

|

|

|

| British Columbia, Canada |

|

000-56228 |

|

98-1360810 |

|

(State or jurisdiction of incorporation

or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

420 Lexington Avenue, Suite 414

New York, NY 10170

(Address of principal executive offices)

(646) 518-9411

(Registrant’s telephone number)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instructions

A.2 below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Board of Directors (the “Board”) of

iAnthus Capital Holdings, Inc. (the “Company”) appointed Robert R. Galvin as

Interim Chief Executive Officer and a member of the Board of the Company in replacement of Randy

Maslow effective as of May 6, 2022 (the “Effective Date”). Mr. Maslow will continue to serve the Company in a consulting

role for a period of six months following the Effective Date.

Robert Galvin

has served as the Company’s Interim Chief Operating Officer since November 2020. In addition, since February 2019, he has served

as an operations and administrative advisor to the Company. From February 2019 to December 2019, he also served as a member of the Company’s

Board. Prior to the Company, Mr. Galvin served as a member of the board of directors and as audit committee chair of MPX Bioceutical

Corporation (“MPX”) from November 2017 until the completion of the acquisition of MPX by the Company in February 2019. In

addition, from 2016 to 2018, Mr. Galvin served as Chief Financial Officer of Holtec International, an energy company, and from 2009

to 2016, Mr. Galvin served as Chief Financial Officer of EQM Technologies & Energy, Inc., an environmental engineering firm.

Furthermore, from 2002 to 2009 Mr. Galvin served as Chief Financial Officer of NuCO2 Inc., a beverage carbonation company formerly listed

on Nasdaq. Mr. Galvin began his career with KPMG and holds a Bachelor of Science degree in accounting from Villanova University.

Mr. Galvin shall

serve as Interim Chief Executive Officer of the Company pursuant to his employment agreement effective

as of January 1, 2019, as amended on April 4, 2020.

There are no family relationships between Mr. Galvin

and any of our directors or executive officers. Except as set forth herein, there is no arrangement or understanding between Mr. Galvin

and any other persons pursuant to which Mr. Galvin was appointed an executive officer of

the Company. As set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as

a result of the Company’s acquisition of CBD For Life, LLC on June 27, 2019, Mr. Galvin received 36,969 common shares

of the Company (with a fair value of $0.1 million). Except as set forth herein, there are no related party transactions involving Mr.

Galvin that are reportable under Item 404(a) of Regulation S-K.

In connection with Mr. Maslow’s resignation,

the Company entered into a separation agreement (the “Separation Agreement”) with Mr. Maslow pursuant to which Mr. Maslow

will receive certain compensation and benefits valued to substantially equal the value of entitlements he would have received under Section

4(g) of his Employment Agreement. A portion of the cash compensation amount will be paid in lump sum on the Effective Date and remainder

shall be paid over a period of eight months following the Effective Date. Such compensation and benefits included, among other items,

an extension of exercise period of options to acquire the Company’s common shares which were held by Mr. Maslow until the earlier

of (i) five years from the Effective Date; (ii) the original expiration dates of the applicable option; or (iii) the closing of the Recapitalization

Transaction. Further, Mr. Maslow agreed to relinquish all entitlements to his restricted stock units under the contingent long-term incentive

plan that was announced on January 7, 2022.

Item

8.01 Other Events.

On

May 6, 2022, the Company issued a press release announcing the resignation of Randy Maslow, including the execution of the Separation

Agreement, and the appointment of Robert Galvin. In addition, the Company provided an update with respect to its previously

disclosed recapitalization transaction (the “Recapitalization Transaction”). Specifically, on April 1, 2022, the Maryland

Medical Cannabis Commission approved the proposed change of ownership and control of the Company’s wholly-owned subsidiary, S8 Management,

LLC, contemplated by the Recapitalization Transaction. Furthermore, on May 4, 2022, the Florida Department of Health, Office of Medical

Marijuana Use (the “OMMU”) dismissed the Petition for Formal Administrative Hearing, as amended, challenging the OMMU’s

approval of a variance request filed by the Company’s subsidiary, McCrory’s Sunny Hill Nursery, LLC (“McCrory’s”),

to approve the prospective change of beneficial ownership of McCrory’s contemplated by the Recapitalization Transaction. The Company

continues to pursue the remaining regulatory approvals in Massachusetts, New Jersey, and New York.

A

copy of the press release is attached hereto as Exhibit 99.1, and the information contained therein is incorporated by reference into

this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

IANTHUS CAPITAL HOLDINGS, INC. |

| |

|

|

|

| Date: May 6, 2022 |

|

|

|

By: |

|

/s/ Julius

Kalcevich |

| |

|

|

|

|

|

Julius Kalcevich

Chief Financial Officer |

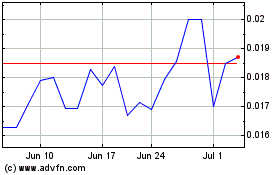

Ianthus Capital (QB) (USOTC:ITHUF)

Historical Stock Chart

From Jun 2024 to Jul 2024

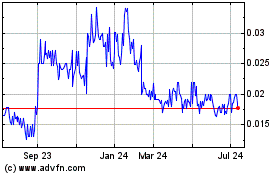

Ianthus Capital (QB) (USOTC:ITHUF)

Historical Stock Chart

From Jul 2023 to Jul 2024