Pacific WebWorks Upgrades Growth Forecast for 2009

July 29 2009 - 8:30AM

Business Wire

Pacific WebWorks, Inc. (OTCBB:PWEB) announced today that the

company is experiencing stronger revenue growth than earlier

forecast for 2009. While the growth rate has slowed, the company is

continuing to experience record monthly revenues and is now

comfortable upgrading its full-year forecast.

Last year, the company generated $9.2 MM in revenue and

previously forecast $16-$18 MM for the current year. The company

now believes that full-year revenue will be $23-$24 MM.

“The company is continuing to experience stronger than expected

results. For the full year, the company now anticipates 150%+

growth from 2008 to 2009, compared to the 70-80% growth rate

originally forecast. The company also anticipates record earnings

for the full year. The company is eager to announce Q2 2009

earnings in mid-August and is excited about our continued revenue

growth,” stated Ken Bell, CEO.

About Pacific WebWorks, IntelliPay and TradeWorks

Marketing

Pacific WebWorks provides a comprehensive suite of affordable,

easy-to-use software programs for small businesses that want to

create, manage, and maintain an effective Web strategy including

full e-commerce capabilities. Pacific WebWorks operates a number of

wholly owned subsidiaries including IntelliPay, TradeWorks

Marketing and others.

Forward-Looking Statements

All statements other than statements of historical fact included

in this press release are forward-looking statements. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend” and other

similar expressions as they relate to the Company or its

management, identify forward-looking statements. Such

forward-looking statements are based on the beliefs of the

Company’s management as well as assumptions made by and information

currently available to the Company’s management. These statements

are not a guarantee of future performance. Actual results could

differ materially from those contemplated by the forward-looking

statements as a result of certain factors, including the Company’s

ability to maintain sufficient credit card processing capabilities

to service the demands of their hosting portfolio and other risk

factors discussed under the caption “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2008 as filed

with the Securities and Exchange Commission. Such statements

reflect the current view of the Company’s management with respect

to future events and are subject to these and other risks,

uncertainties and assumptions related to the operations, result of

operations, growth strategy and liquidity of the Company. All

subsequent written and oral forward-looking statements attributable

to the Company or persons acting on its behalf are expressly

qualified in their entirety by this paragraph. The Company has no

intention, and disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future results or otherwise.

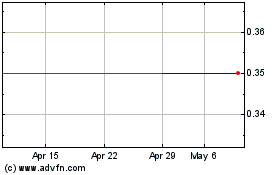

Heyu Biological Technology (PK) (USOTC:HYBT)

Historical Stock Chart

From Jun 2024 to Jul 2024

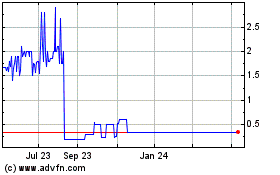

Heyu Biological Technology (PK) (USOTC:HYBT)

Historical Stock Chart

From Jul 2023 to Jul 2024