Point Roberts WA, Delta, BC -- May

28, 2020 -- InvestorsHub NewsWire -- Investorideas.com, a

leading investor news resource covering hemp and cannabis stocks

releases a special snapshot reporting on the continued growth in

sales and product offerings in the US hemp industry and how this

traction is beginning to attract outside

investment.

Earlier this month,

SinglePoint Inc. (OTCQB:SING) started their

Q2 with strong numbers achieving over $1,000,000 in

sales throughout Q1 a 309% increase and a focus on continued

growth. After evaluating reports for Q2, SinglePoint’s Hemp

vertical has been on track to double sales in its second quarter

alongside the launch of 1606 Hemp six-pack counter top display.

1606 Hemp has seen a sales growth rate of 133% this quarter over

the previous, a 233% growth in sales up to this point of the month

compared to the previous month at the same point. The company

has placed a focus on self-generated in-store placement by hiring

professional sales representatives to acquire new stores for the

sales of its products over the next four weeks. 1606’s goal is to

grow by more than 250 retail accounts throughout multiple states,

which the Company surpassed in the first couple weeks by placing

product in over 400 stores throughout 20 states.

According to management, stores are

selling through product quickly and many have already reordered

additional 1606 Hemp inventory.

As the company continues to see

success, management believes 1606 Hemp will be able to provide

approximately $2,750,000 to $5,500,000 in revenue selling to just

1,000 stores. “As the roll out is successful and we achieve

our goals over the next four weeks, 1606 Hemp will bring on

additional individuals to scale up to as many as 2,500 stores as

quickly as possible in order to achieve reorders from 1,000 stores.

Management believes the current total addressable market is

approximately 125,000 locations or more.”

“I've been trying to get friends

and family to make the switch to hemp for years, your product is

changing a lot of hearts. Thank you”

- Al, 1606 Hemp

Customer

1606 Hemp is working to become the

leading recognized brand in the combustible hemp market which is

the second fastest growing market in the hemp category. The big

differentiator for 1606 Hemp is the ability to place a countertop

display unit at retailers across the nation. “While others are

working to dominate the online market, we have a general belief

this type of consumable product will continue to be bought in

convenience stores, smoke shops and bodegas throughout the nation.”

However, the company provides an amazing online experience for

consumers to purchase 1606 Hemp and has amassed an online following

through social channels reaching over 17,000 followers on Instagram

and driving traffic to its online site at 1606Hemp.com

BDS Analytics and Arcview Market

Research project that the collective market for CBD sales in the US

will surpass $20 billion by 2024 while New York-based investment

bank Cowen & Co, estimates that the market could pull in $15

billion by 2025. The combustible hemp market currently represents

approximately 2% of the overall CBD market, but with a 250% growth

from 2017 to 2018, Brightfield Group, a Chicago-based cannabis

market research firm, identifies dried and combustible hemp flowers

as one of the fastest-growing segments of the CBD market.

With the passage of the 2018 Farm Bill and the mainstreaming of CBD

hemp, the market is growing rapidly. There is a significant need

for reliable suppliers with the capacity to move

products.

SinglePoint Inc. (OTCQB:

SING) Greg Lambrecht

CEO and Chairman discussed

the 1606 Hemp in a new video update – watch it here: https://www.youtube.com/watch?v=D6FxKUxQo6Y

Hemp, Inc. (OTC:

HEMP) has also been

showing strong growth, having announced

recently that sales to date from their premium hemp

flower, Pre-98 OG Bubba Kush, have surpassed their $1,000,000

groundbreaking milestone. The Company has reached

$1,035,817.04 (up $55,000 from sales reported in its last press

release). That’s a total of $1,035,817.04 over the past ten weeks

and six days ($265,200 during the first quarter and $770,617.04, to

date, in the second quarter). The Company expects to hit

groundbreaking milestones each week (maybe even $1,000,000 a week)

due to the explosive demand for its high quality hemp flower. The

premium Pre-98 OG Bubba Kush is just one of the many bio-diverse

hemp products the Company produces, among hemp for bioplastics and

LCM (Lost Circulation Material).

Hemp, Inc.’s CEO, Bruce Perlowin,

admits it was very frustrating and full of delays with sales for

about two months due to the COVID-19 pandemic but says the Company

is now ‘full speed ahead’. “Our Pre-98 OG Bubba Kush hemp

flower is exploding. We’re in full swing and are on track to

be able to sell our King of Hemp™ pre-rolls in all 50 states. We’re

also beginning our mass marketing campaigns so I’m certain we will

have revenue in the millions to report for the second quarter and

beyond. At this point, I wouldn’t be surprised if we hit $1,000,000

weekly. It’s definitely possible.”

Hemp Inc has bi-coastal processing

centers, including the 85,000 square foot multipurpose industrial

hemp processing facility on 9 acres in Spring Hope, NC, a 55,000

square foot state-of the art local processing center in White City,

Oregon, a 500-acre hemp growing Veteran Village Kins Community in

Golden Valley, Arizona, two model “Small Family Hemp Farms” in

North Carolina and Arizona, a pre-roll blending manufacturing

facility in Las Vegas, NV, and a 5,000 square-foot retail store

(The King of Hemp Store™) in Kingman, Arizona, Hemp, Inc. has a few

more infrastructure footprints to create but other than that, it’s

full speed ahead for the Company.

Charlotte's Web

(TSX:CWEB)

(OTCQX:CWBHF), one of the most well known CBD companies

in the US, has also achieved another milestone in its continued

commitment to innovation and consistency in hemp genetics. The

Company has earned US utility patent U.S. 10,653,085, its second US

patent for hemp genetics. This patent is for 'CW1AS1', a new hemp

variety created by company co-founder Joel Stanley and Sr. Director

of Cultivation R&D, Bear Reel. The patent takes

Charlotte's Web's premier proprietary genetics to the next

generation, and builds a strong wall of protection around it, and

the products made from it.

"This 'CW1AS1' patent gives

Charlotte's Web the highest level of protection for our proprietary

genetics and ensures that Charlotte's Web products will continue to

be available to the thousands who use them in a form that is

consistent and provides the same user experience time and time

again," said Deanie Elsner, Charlotte's Web CEO and

President.

Patents on hemp genetics are a new

frontier, and very few patents in this sector have been issued to

date. Charlotte's Web, the world's largest vertically

integrated hemp company, has been at the forefront of this new

frontier in hemp patents and will continue to invest in its

breeding program and in the science of hemp to ensure a consistent

and high-quality supply is available.

"This patent recognizes the progress

our breeding program has made to assure our farmer partners that

the plants they grow will yield better and have a high level of

phytocannabinoids," said Reel.

Charlotte's Web's flagship Original

Formula was the first CBD wellness product to be sold nationally to

consumers. Before Charlotte's Web was officially founded in 2013,

there was a waiting list of more than 15,000 individuals for

Original Formula, which uses the same proprietary phytochemical

profiles produced by the now patented 'CW1AS1' hemp

variety.

Aurora Cannabis

(TSX:

ACB)(NYSE: ACB)

has seen a massive stock jump in the last few weeks, climbing more

than 30 per cent last Thursday following the announcement of a deal

to expand the company’s reach south of the

border.

The Edmonton-based company is set to

acquire all issued and outstanding membership interests of the

Massachusetts-based CBD brand Reliva for US$40 million. The deal

also includes a potential earn-out of up to US$45 million in cash

or stock based on performance.

Aurora Cannabis Inc. and Reliva, LLC

announced

that they have entered into an agreement pursuant to which Aurora

will acquire all of the issued and outstanding membership interests

of Reliva. Under the terms of the agreement, members of Reliva will

receive approximately US$40 million of Aurora common shares.

The transaction also includes a potential earn-out of up to a

maximum of US$45 million payable in Aurora shares, cash or a

combination thereof, over the next two years contingent upon Reliva

achieving certain financial targets. The structure of the earn-out

is designed to align risk and reward between Aurora shareholders

and Reliva management to focus on continued strong operational and

financial execution. The transaction is expected to close, subject

to customary closing conditions, in June 2020. It is anticipated

that the transaction will be immediately accretive to Aurora on an

Adjusted EBITDA basis, consistent with

Aurora's objective is to drive

towards Adjusted EBITDA profitability in its fiscal first quarter

of 2021. The transaction will combine Aurora's leading Canadian

recreational brands, and Canadian and European medical market

position with the leading U.S. hemp-derived CBD brand in retail

stores. Consistent with the announcement of Aurora's business

transformation plan in February 2020, the Company has aligned its

US investment strategy with the goals of the transformation plan,

namely: financial discipline, operational focus, and strong

execution. The transaction represents the culmination of a

multi-month strategic evaluation of the US hemp-derived CBD

industry. Reliva stood out among a lengthy list of potential

partners for its: (1) focus on regulatory, testing and compliance

protocols; (2) proven management team with extensive experience

selling and marketing regulated consumer packaged goods; (3) deep

relationships with critical trade partners that provide a US

national distribution footprint; and (4) financial discipline and

track record of growth and profitability. Together with Reliva,

Aurora is expected to be positioned as a meaningful player in the

United States, the world's largest cannabinoid

market.

Aurora said it expects the American

CBD market could reach US$24B by 2025. However, the company’s move

south comes at a time of regulatory uncertainty following the

federal decision to loosen restrictions on hemp production two

years ago.

The US Food and Drug Administration

is treading a cautious path. Currently companies are not allowed to

add CBD to food, drinks or cosmetics. The agency has been cracking

down on companies that do so. That hasn’t stopped a wide range of

edible and beverage products targeting wellness-minded consumers

from gaining mass popularity.

“The consumer CBD industry faces

temporary challenges in the U.S., but the industry has long-term

upside, valuations have pulled back, and we think Reliva has a

unique channel and price positioning that allowed it to perform

quite well pre-COVID,” Cantor Fitzgerald analyst Pablo Zuanic wrote

in a note to clients on Thursday.

“Aurora has the ability to start

building its infrastructure out to capitalize on the potential for

a more benign FDA environment on CBD and THC legislation that makes

it federally permissible to operate domestically,” Cowen analyst

Viven Azer wrote in a research note.

As more companies continue to see

strong sales, high consumer demand and focus more on premium high

quality products, there is no doubt that CBD/hemp will continue to

flourish, even amidst regulatory uncertainty.

About Investorideas.com - News that Inspires Big

Investing Ideas https://www.investorideas.com/About/

Follow us on Twitter https://twitter.com/Investorideas

Follow us on Facebook https://www.facebook.com/Investorideas

Follow us on YouTube https://www.youtube.com/c/Investorideas

Download our Mobile App

for iPhone and Android

Join our Investor Club https://www.investorideas.com/membership/

Disclaimer/Disclosure: Investorideas.com

Our site does not make recommendations

for purchases or sale of stocks, services or products. Nothing on

our sites should be construed as an offer or solicitation to buy or

sell products or securities. All investing involves risk and

possible losses. Disclosure: this news article

featuring SING is a paid for news release on Investorideas.com –

(two thousand four hundred) More

disclaimer info: https://www.investorideas.com/About/Disclaimer.asp

Learn more about publishing your news

release and our other news services on the Investorideas.com

newswire https://www.investorideas.com/News-Upload/

and tickertagstocknews.com Global investors must adhere to regulations of each

country.

Contact

Investorideas.com

800-665-0411

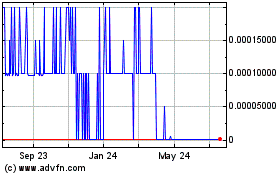

Hemp (CE) (USOTC:HEMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

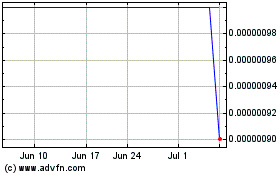

Hemp (CE) (USOTC:HEMP)

Historical Stock Chart

From Jan 2024 to Jan 2025