Halitron, Inc. (HAON) Shareholder Update as Audit to OTCQB and Stock Buyback to $0.01 per share Continues

March 05 2018 - 7:19AM

InvestorsHub NewsWire

Halitron, Inc.

(HAON)

Shareholder Update as Audit to OTCQB and Stock Buyback to $0.01 per

share Continues

“Building Shareholder Value through Strategic Acquisitions”

Miami, FL -- March 5, 2018 --

InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Halitron, Inc. (OTC

Pink: HAON).

Halitron’s (OTC

Pink: HAON) just announced a shareholder update discussing

amongs other things the Company moving towards an OTCQB

up-list.

HAON may

not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Highlights from Halitron, Inc.'s

(OTC

Pink: HAON) update Press Release:

Sales growth, expansion, brand development, and strategic

acquisitions all part of the business plan for

2018.

- Audit and Up

List to OTCQB. Halitron has

re-engaged Freidman LLP to complete the 2017 audit, which is one of

the qualifying factors to up list to the OTCQB exchange.

Friedman was previously engaged to provide audit work for the

period ending September 30, 2016, and will continue to finalize the

project through September 30, 2017 over the coming

months.

- Share Buy

Back. Another requirement for the up list is a

share price of $0.01 or higher and the Company, as previously

announced, is currently engaged in a share buy back program to help

support increased share price. Management is forecasting

increased purchases over the coming months based on projected

increasing cash flows, as the New York facility is closed, and the

Company reaps the benefits of reduced

overhead.

- No Reverse

Split Planned. As previously communicated July

11, 2017, Management does not anticipate a reverse split of the

stock to achieve the increased share objective but rather is

forecasting for increased sales along with future accretive

acquisitions whereby the cash flow from operations can be utilized

to buy the shares back in the open market.

- Acquisitions.

Management has targeted a number of strategic and accretive

acquisitions and is varying stages of negotiations. One

target is in the retail display business and complements Hopp’s

business model and the other is a $8M+ revenue company in the

consumer products space. As the projects develop we will

provide updates on the process.

Halitron, Inc. also

recently announced that it reported

$724,000 in sales for 2017 and $407,000 in Q4 2017

alone.

- Sales have increased to

approximately $407K in Q4, 2017, which represents 150% over

approximately $163K for Q3 3017. There were no sales for 2016

to compare, as the strategic acquisition is now the foundation for

the team to build on.

According to OTC Markets,

the current market cap of Halitron, Inc. (OTC

Pink: HAON) is approximately $2.4 million and as such, its

shares can have a dramatic upside.

Other recent developments of Halitron, Inc. (OTC

Pink: HAON)

Halitron, Inc. (OTC

Pink: HAON) also announced the successful negotiations to

modify an existing agreement to reflect the following impact on

Halitron’s financial books and records.

Halitron has returned 56 million restricted common shares and 80

million Life’s Time Capsule Services, Inc.’s (“LTCP”) Preferred

Stock C shares to LTCP in exchange for the receipt of a note

payable for $3 million, bearing interest of 4%, which matures in

July 2020.

In the transaction, the assets sold to LTCP in the original

transaction will revert to a Halitron asset on its balance

sheet. In 2020, upon receipt of the $3 million principal and

interest along with Halitron’s Board of Directors’ approval,

Management will submit corporation action paperwork to FINRA for

the issuance of a cash dividend to its shareholders, of which

record, and payment dates will be announced post receipts of the

settlement of the note payable for $3 million.

Growth and shareholder valuation has always been Halitron’s

priority. We are excited to see the prior two years of hard

work come to fruition. Halitron has been looking into other

acquisition targets in many growth sectors as a further investment

for our shareholders, but in order to differentiate ourselves from

the masses, we will only enter into a transaction with a company

that has an already established foothold in a specific growth

space.

HAON may

not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Other Companies in the news and featured on

EmergingGrowth.com

Jammin Java Corp.

Jammin Java Corp., (OTC:

JAMN) from all but a dead stop, the company traded 527,000,000

shares and shot up over 100% before giving it all back to close at

its previous sessions close of .0003. There has been no news

or filings released in over a year with the exception of a for

15-12G, which typically terminates a registered security, or

suspends the duty to file, filed on 3/2. I’m not sure which

of these are worse than the other.

Have a look at Halitron, Inc.’s (OTC

Pink: HAON) shareholder update which details an up-list to the

QB as well as a share buyback to .01 per share.

Metrospaces, Inc.

With no news released at all, Metrospaces, Inc. (OTC:

MSPC) has been on a tear since February 15th with

shares hitting a new high on Friday. Share are up 500% over

the past two weeks, which appears to be pure speculation based on

speculation after review of the company’s filings.

Vet Online Supply, Inc.

Shares of Vet Online Supply, Inc. (OTC

Pink: VTNL) seemed to have slowed down a bit after the

company’s news of exceeding sales projections of February 28,

2018. The stock is still up from its close, but remains down

from its high off the news of .009 per share.

In the meantime, have a look at Halitron,

Inc., (OTC

Pink: HAON) who just releaed an update which details an

up-list to the QB as well as a share buyback to .01 per share.

About

EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a

niche in identifying companies that can be overlooked by the

markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging

Growth info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our parent Company, we also have the

ability to facilitate road shows to present your products and

services to the most influential investment banks in the

space.

Disclosure:

All information contained

herein as well as on the EmergingGrowth.com website is obtained

from sources believed to be reliable but not guaranteed to be

accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information may include certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://www.emerginggrowth.com/disclosure-4266/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares it

will sell those shares. In addition, please make sure you read and

understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

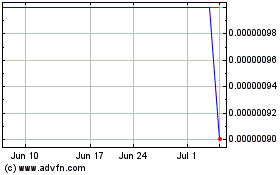

Halitron (CE) (USOTC:HAON)

Historical Stock Chart

From Nov 2024 to Dec 2024

Halitron (CE) (USOTC:HAON)

Historical Stock Chart

From Dec 2023 to Dec 2024