UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a – 16 OR 15d

– 16 UNDER THE

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2018

Commission File No. 0-53646

Novicius Corp.

|

(Translation of Registrant’s name

into English)

1 King Street West, Suite 1505

Toronto, Ontario, Canada M5H 1A1

|

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

TABLE OF CONTENTS

1.

Novicius Corp., Material Change Report and News Release dated July 12, 2018, as filed on Sedar on July 12, 2018.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: July 12, 2018

|

|

NOVICIUS CORP.

|

|

|

|

|

|

|

|

|

By:

|

/s/ James Cassina

|

|

|

|

|

Name: James Cassina

|

|

|

|

Title: Chief Financial Officer

|

FORM

51-102F3

MATERIAL

CHANGE REPORT

|

|

Item

1.

|

Name

and Address of Company

|

Novicius

Corp. (“Novicius” or the “Company”)

Suite

1505, 1 King Street West,

Toronto,

Ontario, M5H 1A1

|

|

Item

2.

|

Date

of Material Change

|

July

11, 2018

Attached

as Schedule “A” is a press release issued by the Company on July 12, 2018, and disseminated using Market News Publishing

Inc.

|

|

Item

4.

|

Summary

of Material Change

|

The

Company announced an update to the Company’s previously announced amended and restated non-binding letter of intent with

Grown Rogue Unlimited, LLC, an Oregon limited liability company (“

Grown Rogue

”) pursuant to which it is contemplated

that the Company may combine its business operations with Grown Rogue by way of a three-cornered amalgamation (the “

RTO

Transaction

”) resulting in a reverse take-over of the Company by Grown Rogue and the listing for trading of the shares

of the resulting issuer on the Canadian Securities Exchange (the “

Exchange

”).

In

addition, the Company and Grown Rogue Canada are pleased to announce that Grown Rogue Canada has completed an initial tranche

of its planned financing for a total issuance of 5,673,417 subscription receipts (the “

Subscription Receipts

”)

at a price of $0.44 each for total proceeds of $2,496,303.48 (the “

Private Placement

”). Each Subscription Receipt

is convertible, without additional consideration, into a unit (a “

GRC Unit

”) consisting of one common share

in Grown Rogue Canada (“

GRC Share

”) and one common share purchase warrant in Grown Rogue Canada (“

GRC

Warrant

”). Each GRC Warrant entitles the holder to purchase one GRC Share at a price of $0.55 per share until 24 months

after the RTO Transaction has been completed.

|

|

Item

5.

|

Full

Description of Material Change

|

The

Company provided an update to the Company’s previously announced amended and restated non-binding letter of intent with

Grown Rogue Unlimited, LLC, an Oregon limited liability company (“

Grown Rogue

”) pursuant to which it is contemplated

that the Company may combine its business operations with Grown Rogue by way of a three-cornered amalgamation (the “

RTO

Transaction

”) resulting in a reverse take-over of the Company by Grown Rogue and the listing for trading of the shares

of the resulting issuer on the Canadian Securities Exchange (the “

Exchange

”).

The

non-binding letter of intent has been amended and restated (the “

Amended LOI

”) to extend the term of the Amended

LOI, to reflect the amended terms of the Private Placement (as defined below) to be completed by Grown Rogue Canada Inc. (“

Grown

Rogue Canada

”) prior to the closing of the RTO Transaction, and to reflect continuing discussions between Grown Rogue

and the Company with respect to the terms of the RTO Transaction.

-

2 -

Pursuant

to the Amended LOI, it is expected that prior to the completion of the RTO Transaction, all of the unitholders of Grown Rogue

will exchange their units of Grown Rogue for common shares in Grown Rogue Canada, a company incorporated under the laws of Ontario,

which will result in Grown Rogue Canada owning, directly or indirectly, all of the units in Grown Rogue (the “

Grown Rogue

Securities Exchange

”). Upon completion of the Grown Rogue Securities Exchange, Grown Rogue Canada will amalgamate with

a subsidiary of Novicius and the shareholders of Grown Rogue Canada will receive common shares of Novicius at a deemed price of

$0.44 per share.

In

addition, the Company and Grown Rogue Canada are pleased to announce that Grown Rogue Canada has completed an initial tranche

of its planned financing for a total issuance of 5,673,417 subscription receipts (the “

Subscription Receipts

”)

at a price of $0.44 each for total proceeds of $2,496,303.48 (the “

Private Placement

”). Each Subscription Receipt

is convertible, without additional consideration, into a unit (a “

GRC Unit

”) consisting of one common share

in Grown Rogue Canada (“

GRC Share

”) and one common share purchase warrant in Grown Rogue Canada (“

GRC

Warrant

”). Each GRC Warrant entitles the holder to purchase one GRC Share at a price of $0.55 per share until 24 months

after the RTO Transaction has been completed.

Grown

Rogue Canada plans to complete a second tranche and raise up to an additional

$3,500,000 in

Subscription Receipts prior

to the completion of the RTO Transaction. The GRC Units and the Compensation Options (as defined below) will be exchanged for

corresponding securities, respectively, in Novicius (as the resulting issuer) upon completion of the RTO Transaction.

All

of the gross proceeds received by Grown Rogue Canada under the Private Placement are being held in escrow and are to be released

to Grown Rogue Canada upon satisfying certain conditions including, among other things, (i) CSE approval of the RTO Transaction

and (ii) the Grown Rogue Securities Exchange (the “

Escrow Release Condition

”). If the Escrow Release Condition

is not satisfied or waived by October 3, 2018, the Subscription Receipts will automatically be cancelled and the proceeds of the

Private Placement will be returned to the holders of the Subscription Receipts in an amount per Subscription Receipt equal to:

(i) the purchase price of the Subscription Receipt; and (ii) a pro rata share of interest, if any, earned thereon.

M

Partners Inc. and PI Financial Corp. acted as co-lead agents for GRC (the “

Agents

”) in connection with the

Private Placement and will receive, upon closing of the RTO Transaction, a cash commission equal to 7% of the aggregate proceeds

of the portion of the Private Placement sold to subscribers sourced by the Agents, and a cash commission equal to 3.5% of the

aggregate proceeds from all other subscribers participating in the private placement. The Agents have received an aggregate

number of compensation options (the “

Compensation Options

”) equal to 7% of the number of Subscription Receipts

issued to subscribers sourced by the Agents, and an aggregate number of Compensation Options equal to 3.5% of the number of Subscription

Receipts issued to all other subscribers participating in the private placement. Each Compensation Option entitles the holder

to purchase one GRC Unit at a price of $0.44 per unit until 24 months after completing the RTO Transaction.

-

3 -

There

can be no assurance that the RTO Transaction will occur, or that it will occur on the terms and conditions contemplated in this

news release. The RTO Transaction could be modified, restructured or terminated. Actual results could differ materially from those

currently anticipated due to a number of factors and risks. The completion of the RTO Transaction is contingent on a number of

conditions precedent including, but not limited to, (i) receipt of all requisite corporate, shareholder and regulatory approvals,

(ii) completion of satisfactory due diligence by each of the parties, (iii) completion of the Grown Rogue Securities Exchange,

(iv) completion of the Brokered Offering, (v) completion of the Company’s anticipated consolidation of 1.4 pre-consolidated

common shares for one 1 post-consolidated common share, (vi) the reduction of Novicius debt, and (vii) the execution of a definitive

agreement between the parties. No assurance is given that the Transaction will close as contemplate

d.

|

|

Item 6.

|

Reliance on sub-section 7.1(2) of National Instrument 51-102

|

Not

Applicable.

|

|

Item 7.

|

Omitted

Information

|

No

information has been omitted from this material change report.

|

|

Item 8.

|

Executive Officer

|

The

following executive officer of the Company is knowledgeable about the material change and the Report and may be contacted by the

Commission as follows:

James

Cassina, Chief Financial Officer

Telephone:

416 364-4039

Facsimile: 416

364-8244

July

12, 2018

-

4 -

Schedule

“A”

NOT

FOR DISTRIBUTION IN THE UNITED STATES

OR

DISTRIBUTION

TO U.S. NEWS WIRE SERVICES

Novicius

Corp. and Grown Rogue RTO Update and Brokered Financing

TORONTO,

ON / July 12, 2018 /

NOVICIUS CORP

.

(CSE: NVS) (“

Novicius

” or the “

Company

”),

is pleased to provide an update to the Company’s previously announced amended and restated non-binding letter of intent

with Grown Rogue Unlimited, LLC, an Oregon limited liability company (“

Grown Rogue

”) pursuant to which it is

contemplated that the Company may combine its business operations with Grown Rogue by way of a three-cornered amalgamation (the

“

RTO Transaction

”) resulting in a reverse take-over of the Company by Grown Rogue and the listing for trading

of the shares of the resulting issuer on the Canadian Securities Exchange (the “

Exchange

”).

The

non-binding letter of intent has been amended and restated (the “

Amended LOI

”) to extend the term of the Amended

LOI, to reflect the amended terms of the Private Placement (as defined below) to be completed by Grown Rogue Canada Inc. (“

Grown

Rogue Canada

”) prior to the closing of the RTO Transaction, and to reflect continuing discussions between Grown Rogue

and the Company with respect to the terms of the RTO Transaction.

Pursuant

to the Amended LOI, it is expected that prior to the completion of the RTO Transaction, all of the unitholders of Grown Rogue

will exchange their units of Grown Rogue for common shares in Grown Rogue Canada, a company incorporated under the laws of Ontario,

which will result in Grown Rogue Canada owning, directly or indirectly, all of the units in Grown Rogue (the “

Grown Rogue

Securities Exchange

”). Upon completion of the Grown Rogue Securities Exchange, Grown Rogue Canada will amalgamate with

a subsidiary of Novicius and the shareholders of Grown Rogue Canada will receive common shares of Novicius at a deemed price of

$0.44 per share.

In

addition, the Company and Grown Rogue Canada are pleased to announce that Grown Rogue Canada has completed an initial tranche

of its planned financing for a total issuance of 5,673,417 subscription receipts (the “

Subscription Receipts

”)

at a price of $0.44 each for total proceeds of $2,496,303.48 (the “

Private Placement

”). Each Subscription Receipt

is convertible, without additional consideration, into a unit (a “

GRC Unit

”) consisting of one common share

in Grown Rogue Canada (“

GRC Share

”) and one common share purchase warrant in Grown Rogue Canada (“

GRC

Warrant

”). Each GRC Warrant entitles the holder to purchase one GRC Share at a price of $0.55 per share until 24 months

after the RTO Transaction has been completed.

Grown

Rogue Canada plans to complete a second tranche and raise up to an additional

$3,500,000 in

Subscription Receipts prior

to the completion of the RTO Transaction. The GRC Units and the Compensation Options (as defined below) will be exchanged for

corresponding securities, respectively, in Novicius (as the resulting issuer) upon completion of the RTO Transaction.

-

5 -

All

of the gross proceeds received by Grown Rogue Canada under the Private Placement are being held in escrow and are to be released

to Grown Rogue Canada upon satisfying certain conditions including, among other things, (i) CSE approval of the RTO Transaction

and (ii) the Grown Rogue Securities Exchange (the “

Escrow Release Condition

”). If the Escrow Release Condition

is not satisfied or waived by October 3, 2018, the Subscription Receipts will automatically be cancelled and the proceeds of the

Private Placement will be returned to the holders of the Subscription Receipts in an amount per Subscription Receipt equal to:

(i) the purchase price of the Subscription Receipt; and (ii) a pro rata share of interest, if any, earned thereon.

M

Partners Inc. and PI Financial Corp. acted as co-lead agents for GRC (the “

Agents

”) in connection with the

Private Placement and will receive, upon closing of the RTO Transaction, a cash commission equal to 7% of the aggregate proceeds

of the portion of the Private Placement sold to subscribers sourced by the Agents, and a cash commission equal to 3.5% of the

aggregate proceeds from all other subscribers participating in the private placement. The Agents have received an aggregate

number of compensation options (the “

Compensation Options

”) equal to 7% of the number of Subscription Receipts

issued to subscribers sourced by the Agents, and an aggregate number of Compensation Options equal to 3.5% of the number of Subscription

Receipts issued to all other subscribers participating in the private placement. Each Compensation Option entitles the holder

to purchase one GRC Unit at a price of $0.44 per unit until 24 months after completing the RTO Transaction.

There

can be no assurance that the RTO Transaction will occur, or that it will occur on the terms and conditions contemplated in this

news release. The RTO Transaction could be modified, restructured or terminated. Actual results could differ materially from those

currently anticipated due to a number of factors and risks. The completion of the RTO Transaction is contingent on a number of

conditions precedent including, but not limited to, (i) receipt of all requisite corporate, shareholder and regulatory approvals,

(ii) completion of satisfactory due diligence by each of the parties, (iii) completion of the Grown Rogue Securities Exchange,

(iv) completion of the Brokered Offering, (v) completion of the Company’s anticipated consolidation of 1.4 pre-consolidated

common shares for one 1 post-consolidated common share, (vi) the reduction of Novicius debt, and (vii) the execution of a definitive

agreement between the parties. No assurance is given that the Transaction will close as contemplated.

About

Grown Rogue

Grown

Rogue is the first “seed to experience” cannabis brand to crowdsource consumers’ cannabis experiences through

scientifically grounded methodologies. Grown Rogue operates approximately 100,000 square feet of cultivation facilities featuring

two distinct outdoor farms and a state of the art indoor facility. The management team has over 75 years of combined cannabis

expertise with significant operational history through the asset purchase of a former medical marijuana operator who provided

quality cannabis to Oregon patients for over 10 years. Grown Rogues is established in Oregon with statewide distribution

featuring multiple brands. The flagship Grown Rogue brand classifies products by experience to better engage consumers and dispensary

partners. Grown Rogue plans to expand into California and Nevada in 2018.

To

learn more, please visit us at

www.grownrogue.com

.

About

Novicius Corp.

Novicius

Corp is an emergent media and internet company that focuses on the experience of the website user.

FOR

FURTHER INFORMATION PLEASE CONTACT:

Novicius

Corp.

Email:

NVSCorpIR@gmail.com

- 6 -

Certain

information regarding the Company in this news release may constitute forward-looking statements or future oriented financial

information under applicable securities laws. The forward-looking information includes, without limitation, successful completion

of the proposed transaction, projections or estimates made by us and our management in connection with our business operations.

Various assumptions were used in drawing the conclusions or making the forecasts and projections contained in the forward-looking

information contained in this press release, which assumptions are based on management’s analysis of historical trends,

experience, current conditions and expected future developments pertaining to the Company and the industry in which it operates

as well as certain assumptions as specifically outlined in the release above. Forward-looking information is based on current

expectations, estimates and projections that involve a number of risks, which could cause actual results to vary and in some instances

to differ materially from those anticipated by the Company and described in the forward-looking information contained in this

press release. Undue reliance should not be placed on forward-looking information, which is not a guarantee of performance and

is subject to a number of risks or uncertainties. Readers are cautioned that the foregoing list of risk factors is not exhaustive.

Forward-looking information is based on the estimates and opinions of the Company’s management at the time the information

is released and the Company disclaims any intent or obligation to update publicly any such forward-looking information, whether

as a result of new information, future events or otherwise, other than as expressly required by applicable securities law.

Safe

Harbor Statement

This

press release may contain forward-looking information within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), including all statements that are not statements of historical fact regarding the

intent, belief or current expectations of the company, its directors or its officers with respect to, among other things: (i)

the company’s financing plans; (ii) trends affecting the company’s financial condition or results of operations; (iii)

the company’s growth strategy and operating strategy; and (iv) the declaration and payment of dividends. The words “may,”

“would,” “will,” “expect,” “estimate,” “anticipate,” “believe,”

“intend” and similar expressions and variations thereof are intended to identify forward-looking statements. Also,

forward-looking statements represent our management’s beliefs and assumptions only as of the date hereof. Except as required

by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could

differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the

future. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve

risks and uncertainties, many of which are beyond the company’s ability to control, and that actual results may differ materially

from those projected in the forward-looking statements as a result of various factors including the risk disclosed in the Company’s

Form 20-F and 6-K filings with the Securities and Exchange Commission.

1

King Street West, Suite 1505, Toronto, ON, Canada Telephone: 416 364 4039, Facsimile: 416 364-8244

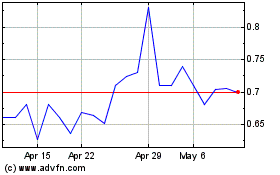

Grown Rogue (PK) (USOTC:GRUSF)

Historical Stock Chart

From Apr 2024 to May 2024

Grown Rogue (PK) (USOTC:GRUSF)

Historical Stock Chart

From May 2023 to May 2024