SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

December 2024

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

|

Notice to Market

|

| |

|

São

Paulo, December 18, 2024 – GOL Linhas Aéreas Inteligentes S.A. (the “Company” or “GOL”) (B3: GOLL4),

one of the main airlines in Brazil, in response to Official Letter No. 314/2024/CVM/SEP/GEA-2, sent by the Brazilian Securities and Exchange

Commission ("CVM") on December 17, 2024, pursuant to Exhibit I hereby, which requested the Company clarification

on the news published on the website of the newspaper "O Globo" on December 12, 2024, titled "Treasury will fund 30%

of Gol's debt reduction effort" ("News"), hereby communicates to its shareholders and the market the following.

As informed in the material fact disclosed

by the Company on November 29, 2024 ("Material Fact 11/29"), the Company has filed with the Bankruptcy Court for the

Southern District of New York ("Court"), within the scope of its ongoing Chapter 11 proceeding, request for authorization

to enter into an individual settlement agreement with the Attorney General's Office of the National Treasury ("PGFN")

and the Special Secretariat of the Federal Revenue of Brazil ("RFB"), aiming to resolve the Company’s and its subsidiaries'

tax liabilities, covering social security, non-social security, and other tax obligations ("Agreement").

In this regard, the Company clarifies that,

although the description of the Agreement included in the News is, in general terms, aligned with the discussions between the Company,

the PGFN and the RFB, the additional information to that presented in the Material Fact 11/29 does not constitute a material act or fact,

considering that, as disclosed in the Material Fact 11/29:

| (i) | the formalization of the Agreement depends on the conclusion of discussions with, and its processing by,

the Brazilian authorities; |

| (ii) | as of the date hereof, the Agreement has not been concluded and therefore remains subject to changes in

all respects; and |

| (iii) | any potential reduction in the Company’s liabilities resulting from the execution of the Agreement

will not impact GOL’s financial net debt and, therefore, will not prevent a global restructuring of GOL’s indebtedness. |

In this sense, the Company emphasizes that

the potential execution of the Agreement is not, and should not be interpreted as, a definitive solution to the Company’s financial

crisis, as it will not enable the Company to meet its financial obligations without a significant restructuring of its debt. The effective

impacts on the Company's indebtedness arising from the potential execution of the Agreement are, on the date hereof, uncertain and will

be duly reflected in the Company's financial statements if the Agreement is indeed executed.

It is worth noting that, as disclosed in

the Material Fact 11/29, the execution of the Agreement had already been considered in the structuring of the Plan Support Agreement (“PSA”)

and, naturally, was reflected in the initial proposal for the Restructuring Plan within the scope of the Chapter 11 proceeding filed by

GOL with the Court (“Plan”).

On the date hereof, the Court authorized

the Company to enter into the Agreement, subject to the prior execution and registration of certain collateral instruments in favor of

the creditors of the debt-in-possession (DIP) financing within the context of GOL's Chapter 11 proceeding. Notwithstanding the above,

the Company clarifies that the PGFN and the RFB are not parties to the PSA, and the discussions of the Agreement with the Brazilian federal

government is conducted independently of GOL's Chapter 11 proceeding. Accordingly, the authorization granted by the Court should not be

mistaken for the effective execution and formalization of the Agreement, nor should it be construed as an anticipation of its effects.

Thus, the eventual execution of the Agreement

does not change the terms and conditions of the Plan, the main highlights of which are contained in the material fact disclosed by the

Company on December 9, 2024, including the capitalization of a significant part of the Company's debt.

The Company reported in its interim financial

information for the nine-month period ended September 30, 2024, a total net debt of R$27.6 billion and a net loss of R$830 million in

the quarter. Thus, as the capitalization will be carried out based on the economic value of the shares issued by GOL before capitalization,

in accordance with applicable law, a significant dilution of GOL's currently existing shares is expected (subject to the preemptive rights

of shareholders provided for in Brazilian law), as previously disclosed.

| Notice to Market |

| | |

.

About GOL

Linhas Aéreas Inteligentes S.A

GOL is one of Brazil's leading airlines

and is part of the Abra Group. Since it was founded in 2001, the company has had the lowest unit cost in Latin America, democratizing

air transport with the aim of “Being the First for All”. GOL has alliances with American Airlines and Air France-KLM and offers

customers more than 60 codeshare and interline agreements, making connections to any place served by these partnerships more convenient

and easier. GOL also has the Smiles loyalty program and GOLLOG for cargo transportation, which serves various regions in Brazil and abroad.

The company has 13,900 highly qualified professionals focused on safety, GOL's number one value, and operates a standardized fleet of

138 Boeing 737 aircraft. The Company's shares are traded on B3 (GOLL4). For further information, visit www.voegol.com.br/ir.

Investor Relations

ir@voegol.com.br

www.voegol.com.br/ir

EXHIBIT I

Official Letter No. 314/2024/CVM/SEP/GEA-2

Rio de Janeiro, December 17, 2024.

To

Eduardo Guardiano Leme Gotilla

Investor Relations Officer of

GOL LINHAS AEREAS INTELIGENTES S.A.

Phone: (11) 2128-4700

E-mail: ri@voegol.com.br

C/C: Superintendence of Listing and Supervision of Issuers of B3 S.A. –

Brasil, Bolsa, Balcão

E-mails: emissores@b3.com.br; ana.pereira@b3.com.br; ana.zane@b3.com.br

Subject: Request for clarification – News published in the media

Dear Officer,

| 1 | We refer to the news published on the website of the

O Globo newspaper on 12/12/2024, titled "National Treasure will fund 30% of the effort to reduce Gol's indebtedness",

with the following content: |

National Treasure will fund 30% of the effort to reduce Gol's indebtedness

Agreement provides for a discount of R$ 4.5 billion on Gol's debt with

the Federal Revenue, Social Security and Aeronautics

| Notice to Market |

| | |

By Mariana Barbosa

12/12/2024 15h14

The debt forgiveness negotiated by Gol with the Federal Government

will represent 30% of the debt reduction effort announced by the airline this week, as part of its restructuring plan under Chapter 11

of the United States Bankruptcy Code.

The company announced that it had reached an agreement with creditors

for the conversion or extinction of up to R$ 10.2 billion (US$ 1.7 billion) of debt financed before its entry into Chapter 11, at the

beginning of the year, in addition to another R$ 5 billion (US$ 850 million) of other debt.

The company did not detail how much will be converted into shares and

how much will be extinguished. But considering the added reduction of R$ 15 billion, the Federal Government will forgive about R$ 4.5

billion (US$ 750 million).

The Federal Government's discount represents 75% of the company's debt

of R$ 6 billion (just over US$ 1 billion) with the Federal Revenue, Social Security and Aeronautics.

Abra, the holding company that owns Gol and Avianca and which lent US$2.8

billion to the company, will receive approximately US$950 million, and possibly more, in new shares depending on the resolution of certain

outstanding issues, as well as US$850 million in restructured debt, according to the statement released by the company. Of this restructured

debt, US$ 250 million will be "mandatorily" converted into new shares in the future.

The negotiation of Gol's debt forgiveness with the government foresees

that of the remaining R$ 1.5 billion (US$ 250 million), a part (Social Security) will be paid in five years, and the rest in up to 10

years. Gol offered as collateral 20% of the company's slots in Congonhas, a public asset to which the company has the right to use —

which were valued at US$ 188 million.

Completing the guarantee, which corresponds to 120% of the amount

to be paid, are receivables from the sale of advertising on its media properties, receivables from ticket sales agreements with the operator

CVC, in addition to receivables from ticket sales agreements with the government itself, via the Ministry of Planning (Ministério

do Planejamento).

Before the discount, Gol owed US$ 700 million in federal taxes, US$ 185

million in social security contributions and US$ 117 million to the Department of Airspace Control (Departamento de Controle do Espaço

Aéreo).

| 2 | Regarding the content of the news, especially the

highlighted excerpts, we request your statement on the veracity of the information provided in the news, and, if so, we request additional

clarifications on the matter, as well as inform the reasons why it was understood that the matter was not a Material Fact, pursuant to

CVM Resolution No. 44/21. |

| 3 | The Company must also inform in which documents already

filed in the Empresas.NET System would contain more information about the possible debt forgiveness negotiated by Gol with the Federal

Government. |

| 4 | Such statement must include a copy of this Official

Letter and be sent through the Empresas.NET System, category "Notice to the Market", type "Clarifications on CVM/B3 questions".

Compliance with this request for manifestation by means of a Notice to the Market does not exempt the eventual determination of liability

for the non-timely disclosure of a Material Fact, pursuant to CVM Resolution No. 44/21. |

| Notice to Market |

| | |

| 5 | We emphasize that, pursuant to article 3 of CVM Resolution

No. 44/21, it is incumbent upon the Investor Relations Officer to disclose and communicate to the CVM and, if applicable, to the stock

exchange and organized over-the-counter market entity in which the securities issued by the company are admitted to trading, any material

act or fact that occurred or related to its business, as well as to ensure their wide and immediate dissemination, simultaneously in all

markets in which such securities are admitted to trading. |

| 6 | We also remind you of the obligation set forth in the

sole paragraph of article 4 of CVM Resolution No. 44/21, to inquire the Company's managers and controlling shareholders, as well as all

other persons with access to material acts or facts, in order to ascertain whether they are aware of information that must be disclosed

to the market. |

| 7 | Pursuant to the sole paragraph of article 6 of CVM

Resolution No. 44/21, it is the duty of the controlling shareholders or managers of the publicly-held company, directly or through the

Investor Relations Officer, to immediately disclose the material act or fact pending disclosure, in the event that the information is

out of control or if there is an atypical fluctuation in the quotation, price or quantity traded of the securities issued by the publicly-held

company or referenced thereto. Therefore, in the event of a leak of material information (its disclosure through a press vehicle, for

example), the Material Fact must be disclosed, regardless of whether or not the information originates from statements by representatives

of the Company. |

| 8 | As directed by Circular/Annual Letter-2024-CVM/SEP,

"the CVM understands that, in the event of a leak of information or if the company's issued papers fluctuate atypically, the material

fact must be immediately disclosed, even if the information refers to operations under negotiation (not concluded), initial negotiations,

feasibility studies or even the mere intention to carry out the business (see judgment of CVM Process No. RJ2006/5928 and CVM PAS No.

24/05)". |

| 9 | We also highlight that article 8 of CVM Resolution

No. 44/21 provides that it is incumbent upon controlling shareholders, officers, members of the board of directors, the fiscal council

and any bodies with technical or advisory functions, created by statutory provision, and employees of the company, to maintain the confidentiality

of information related to material act or fact to which they have privileged access due to the title or position they hold, until its

disclosure to the market, as well as ensuring that subordinates and third parties of its trust also do so, jointly and severally liable

with them in the event of non-compliance. |

| 10 | By order of the Superintendence of Corporate Relations

(Superintendência de Relações com Empresas), we warn that it will be up to this administrative authority, in

the use of its legal powers and, based on item II, of article 9, of Law No. 6,385/76, and on article 7, combined with article 8, of CVM

Resolution No. 47/21, to determine the application of a punitive fine, without prejudice to other administrative sanctions, in the amount

of R$ 1,000.00 (one thousand reais), for non-compliance with the requirements formulated, until December 18, 2024. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: December 18, 2024

| GOL LINHAS AÉREAS INTELIGENTES S.A. |

| |

|

| |

|

| By: |

/s/ Eduardo Guardiano Leme Gotilla |

|

| |

Name: Eduardo Guardiano Leme Gotilla

Title: Chief Financial and IR Officer |

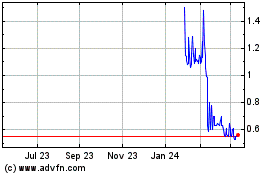

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

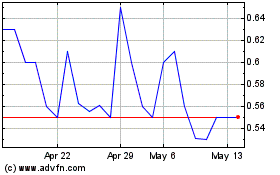

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Jan 2024 to Jan 2025