GoGold

Announces

NPV

of US$295M

for

Los

Ricos

South

PEA

Halifax,

NS, 20th Jan 2021 -- InvestorsHubNewsWire

-- GoGold

Resources

Inc. (TSX: GGD) (OTCQX:

GLGDF) ("GoGold",

"the Company") is pleased to release

the results of

its initial Preliminary Economic

Assessment ("PEA") at its Los Ricos South Project located in

Jalisco State, Mexico.

Highlights of the

PEA, with

a base case silver price of US$21.00/oz and gold price of

US$1,550/oz are as follows (all figures

in US dollars unless otherwise stated):

-

GoGold

completes

PEA at

its first target

in Los Ricos district – Los

Ricos

South;

-

After-Tax NPV (using a discount rate

of 5%) of

$295 Million with an

After-Tax

IRR of

46%

(Base

Case);

-

11-year mine life

producing a total of

69.6

million

payable silver equivalent ounces

("AgEq"), consisting of

42.9 million

silver ounces, 352,000 gold ounces

and 4.5 million

copper pounds;

-

Initial capital

costs of $125 million, including $16

million in contingency costs, over an expected

18 month

build,

and

additional

sustaining

capital costs of $62 million over the life of mine

("LOM");

-

Average

LOM

operating

cash costs of $8.65/oz AgEq, and all in sustaining

costs ("AISC") of

$11.35/oz AgEq

-

At approximate

spot metal prices of $24.40

silver/oz

and $1,800 gold/oz, provides an After-Tax NPV (using a discount rate

of 5%) of

$408 million and an IRR of

58%;

-

Average annual

production of 8.7 million

AgEq

in years two

through six;

-

Approximately 2/3

of LOM production is open pit ("OP"), and approximately 1/3 is

bulk underground ("UG") mining;

-

22 months from

project acquisition to PEA, including

initial Mineral Resource on first target at Los

Ricos

South.

"The acquisition of

the

Los

Ricos

district, only 22

months ago in March 2019, has proven to be a tremendous catalyst of

growth for GoGold," said Brad

Langille, President and CEO.

"More importantly,

this has been

accomplished with the first of many targets in the

Los Ricos district. This PEA demonstrates

the

strong

economics of the district

which will

continue to expand as we drill

additional targets. We feel the

PEA is the

first step

in unlocking the significant

potential of

the Los Ricos district and creating additional value for our

shareholders. With our strong balance sheet

and cash flow from our operating mine, we are now aggressively

advancing Los Ricos North with a 100,000m drill

program and targeting an initial Mineral

Resource in 2021."

What's

Next

for Los Ricos

South

In 2021, the

Company will continue the

engineering

studies

required for a

pre-feasibility study. These studies

include further

defining the capital and operating

costs including geotechnical drilling and bedrock studies, civil

earthworks, metallurgical studies, and socio-economic programs with

the local, State and Federal authorities.

Plan for

Resources and Discovery – Los Ricos

North

The

Company's

focus

for Los Ricos North in 2021 will be to define the

initial NI 43-101 compliant Mineral

Resource. During 2020,

GoGold's

exploration team

identified over 100 targets on the Los Ricos North properties,

demonstrating the significant exploration potential. The

Company plans to drill 10 of these targets as part of its 2021

drilling program which is planned to exceed 100,000

metres

of drilling and

will be one of the largest in Mexico.

PEA

Summary

The PEA

was

prepared by independent

consultants P&E Mining Consultants

Inc ("P&E"),

with metallurgical test work completed by SGS Canada Inc.'s

Lakefield office ("SGS"), geotechnical study by

Golder & Associates of Tucson, process plant design and costing by

D.E.N.M. Engineering Ltd., and environmental and permitting led by

CIMA Mexico.

Table 1 below

shows the key economic assumptions and

results of the PEA, with Table 2 showing a sensitivity analysis

based on varying metal prices and assumptions, and Table 3 showing a

sensitivity analysis based on changes to operating and capital

costs.

Table 1 –

Los Ricos

South PEA

Key Economic Assumptions and Results

|

Assumption

/ Result

|

Unit

|

Value

|

|

Assumption

/ Result

|

Unit

|

Value

|

|

Total OP

Plant Feed

Mined

|

Kt

|

10,228

|

|

Net

Revenue

|

US$M

|

1,437.6

|

|

Total UG

Plant Feed

Mined

|

Kt

|

4,983

|

|

Initial Capital

Costs

|

US$M

|

125.1

|

|

Total

Plant Feed

Mined

|

Kt

|

15,211

|

|

Sustaining

Capital Costs

|

US$M

|

62.3

|

|

Operating

Strip

Ratio

|

Ratio

|

7.7

|

|

OP Mining

Costs

|

$/t

Feed

|

18.33

|

|

Silver

Grade1

|

g/t

|

99.59

|

|

UG Mining

Costs

|

$/t

Feed

|

30.31

|

|

Gold

Grade1

|

g/t

|

0.78

|

|

LOM Mining

Costs

|

$/t

Feed

|

22.32

|

|

AgEq

Grade1

|

g/t

|

157.31

|

|

Operating Cash

Cost

|

US$/oz

AgEq

|

8.65

|

|

Silver

Recovery

|

%

|

88

|

|

All in Sustaining

Cost

|

US$/oz

AgEq

|

11.35

|

|

Gold

Recovery

|

%

|

93

|

|

Mine

Life

|

Yrs

|

11

|

|

Silver

Price

|

US$/oz

|

21.00

|

|

Average process

rate

|

t/day

|

5,000

|

|

Gold

Price

|

US$/oz

|

1,550

|

|

After-Tax NPV

(5% discount)

|

US$M

|

295.0

|

|

Copper

Price

|

US$/lb

|

3.00

|

|

Pre-Tax NPV

(5% discount)

|

US$M

|

465.9

|

|

Payable Silver

Metal

|

Moz

|

42.9

|

|

After-Tax

IRR

|

%

|

45.8

|

|

Payable Gold

Metal

|

Koz

|

352.9

|

|

Pre-Tax

IRR

|

%

|

64.1

|

|

Payable

Copper

|

Mlb

|

4.5

|

|

After-Tax Payback

Period

|

Yrs

|

2.0

|

|

Payable

AgEq

|

Moz

|

69.6

|

|

|

|

|

-

Grades

shown are

LOM average

feed

grades including

both OP and UG sources.

Dilution of

approximately

15% for OP material and 34% for UG material was used.

Table 2 –

Los Ricos

South

PEA Gold and

Silver Price Sensitivities

|

Sensitivity

|

|

|

|

Base

Case

|

|

|

|

|

Gold Price

(US$/oz)

|

1,200

|

1,300

|

1,450

|

1,550

|

1,650

|

1,800

|

2,000

|

|

Silver

Price (US$/oz)

|

16.26

|

17.61

|

19.65

|

21.00

|

22.35

|

24.39

|

27.10

|

|

After-Tax NPV (5%) (US$M)

|

136.5

|

181.8

|

249.7

|

295.0

|

340.2

|

408.1

|

498.7

|

|

After-Tax IRR

|

26.5%

|

32.4%

|

40.6%

|

45.8%

|

50.8%

|

58.1%

|

67.4%

|

|

After-Tax Payback

(years)

|

3.6

|

3.0

|

2.5

|

2.0

|

1.9

|

1.8

|

1.7

|

Table 3 –

Los Ricos

South PEA

Operating Expense and Capital Expense Sensitivities

|

Sensitivity

|

-20%

|

-10%

|

Base

Case

|

10%

|

20%

|

|

Operating

Costs – NPV (US$M)

|

352.3

|

323.6

|

295.0

|

266.3

|

237.6

|

|

Operating Costs –

IRR

|

52.2%

|

49.0%

|

45.8%

|

42.5%

|

39.1%

|

|

Capital Costs –

NPV (US$M)

|

318.4

|

306.7

|

295.0

|

283.2

|

271.5

|

|

Capital Costs –

IRR

|

56.9%

|

50.3%

|

45.8%

|

40.2%

|

36.1%

|

Capital and

Operating Costs

The

Los

Ricos

South

Project has been envisioned as a

combined open pit and underground mining

operation, with contract open pit mining in

years one to six of the mine plan, and contract

underground mining in years six to eleven.

The processing

plant is comprised of conventional crushing and grinding followed

by cyanide tank leaching. Back end filtration is

required

to maximize water

recycling (dry stack tailings)

as well as a SART

(sulfidation, acidification re-neutralization and thickening)

circuit to re-generate cyanide back to the process and to produce a

saleable Cu2S

copper sulfide

product. Water supply to the process plant

is provided by a

nearby seasonally charged water dam and high voltage

grid power

is provided

by the

local utility.

Key components of

the capital cost estimate are provided in

Table 4 and operating costs are

provided in Table 5.

Table 4 –

Capital Cost Estimate

|

Initial

Capital

|

Cost

(US$M)

|

|

Sustaining

Capital

|

Cost

(US$M)

|

|

Plant direct

costs

|

68,008

|

|

Underground

Development

|

45,723

|

|

Pre-stripping

|

17,628

|

|

Plant Direct

Costs

|

7,800

|

|

Project indirect

costs

|

9,098

|

|

Open Pit

Development

|

680

|

|

EPCM

|

9,187

|

|

|

|

|

Infrastructure

|

4,890

|

|

|

|

|

Total

|

108,811

|

|

Total

|

54,203

|

|

Contingency

(15%)

|

16,321

|

|

Contingency

(15%)

|

8,130

|

|

Total –

Initial Capital

|

125,132

|

|

Total –

Sustaining Capital

|

62,333

|

|

Capital

– Initial

& Sustaining

|

187,465

|

|

|

|

|

|

|

|

|

|

Table 5 –

Operating Costs (Average LOM)

|

Operating

Costs

(Average

LOM)

|

US$/tonne

Plant

Feed

|

US$/tonne

Rock

|

|

Open

Pit Mining1

|

18.33

|

1.89

|

|

Underground

Mining2

|

30.31

|

|

|

Total

LOM

Mining3

|

22.32

|

|

|

Processing

($/t processed)

|

16.26

|

|

|

General

and admin

($/t

processed)

|

1.54

|

|

|

Total ($/t

processed)

|

40.12

|

|

-

Open pit mining

costs include a double-benched waste rock

of $1.82/t and mineralized material

cost of

$2.52/t.

-

Bulk

underground

long hole

mining.

$30.31 is the cost of

in-stope

mining, additional development

costs

of

$12.35/t mined are included in sustaining

capital in

table 4, providing a total UG mining cost of $42.66/t.

-

Average LOM mining

cost of both open pit and underground.

Mining

The open pit

mining will be contracted and

carried out by

drill and blast followed by conventional loading and truck haulage

to the waste rock storage facilities and

the processing plant. The

contract

underground

mining

will involve long

hole stoping and cemented paste back filling of the

mined-out stopes. A cement reinforced

plug

will be

placed in

the bottom of the open pits after they are mined out to provide

additional support for underground

mining of the crown pillars to maximize mineralized material

recovery.

Metallurgy

A metallurgical

test program was carried out by SGS Lakefield of Ontario, Canada.

The program included grinding and leaching as well as comminution

testing. The leach samples comprised of drill core rejects

representing the various zones of the Mineral Resource and whole HQ drill

core for the comminution work. This preliminary

test program

estimated a gold and silver recovery of 93% and 88%,

respectively.

Surface

Rights Agreement

The Company has

signed an agreement with the Ejido of Cinco Minas, which owns the

surface rights over all of those concessions

included in this PEA. The agreement allows

GoGold

to mine and

explore the 1,280 hectares of

land that is

owned by the local Ejido for a period of twelve years with an option to renew

for a further twelve years.

Mineral

Resource Estimate

The

basis for the PEA

is the Mineral Resource Estimate completed by P&E

in the National

Instrument 43-101 Technical Report on the Initial Mineral Resource

Estimate for the Los Ricos South Project located in

Jalisco State, Mexico, which has an effective date of July

28, 2020. A summary of the

Mineral Resource Estimate is provided in Table 6.

Table

6:

Los Ricos

South

Mineral Resource Estimate – Pit Constrained and

Out-of-Pit(1-8)

|

Mining

Method

|

Category

|

Tonnes

|

Average

Grade

|

Contained

Metal

|

|

Au

|

Ag

|

AuEq

|

AgEq

|

Au

|

Ag

|

AuEq

|

AgEq

|

|

|

|

(Mt)

|

(g/t)

|

(g/t)

|

(g/t)

|

(g/t)

|

(koz)

|

(koz)

|

(koz)

|

(koz)

|

|

Pit

Constrained5

|

Measured

|

1.1

|

1.10

|

152

|

2.84

|

249

|

39

|

5,464

|

102

|

8,917

|

|

Indicated

|

8.7

|

0.89

|

113

|

2.18

|

191

|

247

|

31,681

|

610

|

53,330

|

|

Measured &

Indicated

|

9.8

|

0.91

|

118

|

2.26

|

197

|

287

|

37,146

|

711

|

62,243

|

|

Inferred

|

2.3

|

0.75

|

73

|

1.58

|

138

|

56

|

5,421

|

118

|

10,296

|

|

Out-of-Pit6,7

|

Indicated

|

0.2

|

1.23

|

185

|

3.35

|

293

|

6

|

907

|

16

|

1,434

|

|

Inferred

|

0.9

|

1.21

|

209

|

3.60

|

315

|

37

|

6,360

|

110

|

9,588

|

|

Total

|

Measured

|

1.1

|

1.10

|

152

|

2.84

|

249

|

39

|

5,464

|

102

|

8,917

|

|

Indicated

|

8.8

|

0.89

|

115

|

2.20

|

193

|

253

|

32,588

|

626

|

54,765

|

|

Measured

& Indicated

|

10.0

|

0.91

|

119

|

2.27

|

199

|

293

|

38,053

|

728

|

63,677

|

|

Inferred

|

3.3

|

0.88

|

112

|

2.17

|

190

|

93

|

11,781

|

227

|

19,884

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability. The estimate of Mineral Resources may be materially

affected by environmental, permitting, legal, title, taxation,

socio-political, marketing, or other relevant issues.

-

The Inferred

Mineral Resource in this estimate has a lower level of confidence

than that applied to an Indicated Mineral Resource and must not be

converted to a Mineral Reserve. It is reasonably expected that the

majority of the Inferred Mineral Resource could be upgraded to an

Indicated Mineral Resource with continued exploration.

-

The Mineral

Resources in this news release

were estimated in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum (CIM), CIM Standards on Mineral Resources and Reserves,

Definitions and Guidelines prepared by the CIM Standing Committee

on Reserve Definitions and adopted by the CIM Council.

-

Historically mined

areas were depleted from the Mineral Resource model.

-

The pit

constrained AuEq cut-off grade of 0.43 g/t Au

was derived from US$1,400/oz Au price, US$16/oz Ag price, 93%

process recovery, US$18/tonne process and G&A cost. The

constraining pit optimization parameters were $2.00/t mineralized

mining cost, $1.50/t waste mining cost and

50-degree pit slopes.

-

The

out-of-pit AuEq cut-off grade of

1.4

g/t Au was derived

from US$1,400/oz Au price, US$16/oz Ag price, 93% process recovery,

$40/t mining cost, US$18/tonne

process and G&A cost. The out-of-pit Mineral Resource grade

blocks were quantified above the 1.4 g/t AuEq cut-off, below the

constraining pit shell and within the constraining mineralized

wireframes. Out–of-Pit Mineral Resources are restricted to the

Los Ricos and Rascadero Veins, which exhibit historical

continuity and reasonable potential for extraction

by cut and fill

and longhole mining

methods.

-

No

out-of-pit

Mineral Resources are

classified

as

Measured.

-

AgEq

and

AuEq

were

calculated at an Ag/Au ratio of

87.5:1.

The Preliminary

Economic Assessment Technical Report will be filed on SEDAR within

45 days of this news release.

Qualified

Persons

Robert Harris,

P.Eng. and David Duncan, P.Geo. are the GoGold Qualified Persons and

Eugene

Puritch, P.Eng., FEC, CET, president

of P&E Mining Consultants Inc. is the Independent Qualified

Person all as defined by National

Instrument 43-101 and whom are responsible for the technical

information in this press release.

VRIFY Slide

Deck and 3D Presentation

VRIFY is a

platform being used by companies to communicate with investors

using 360° virtual tours of remote mining assets, 3D models and

interactive presentations. VRIFY can be accessed by website and

with the VRIFY iOS and Android apps.

Access the

GoGold

Company Profile

on VRIFY at:

https://vrify.com

The VRIFY

Slide Deck and 3D Presentation for GoGold

can be

viewed at:

https://vrify.com/explore/decks/9404 and on

the Company's website at:

www.gogoldresources.com.

Los

Ricos

District

Exploration

Projects

The

Company's two exploration projects at

its Los Ricos property are in Jalisco state, Mexico.

The Los Ricos South Project began in March

2019 and includes the 'Main' area, which is

focused on drilling around a number of historical mines including

El Abra, El Troce, San Juan, and

Rascadero, as well as the

Cerro

Colorado, Las Lamas and East Vein

targets.

An initial

Mineral

Resource

on the Los Ricos South project

was announced on

July 29,

2020 and indicated a Measured & Indicated

Mineral Resource of 63.7 million ounces AgEq grading 199 g/t

AgEq

contained in 10.0

million tonnes, and an Inferred Mineral Resource of 19.9 million

ounces AgEq grading 190 g/t

AgEq

contained in

3.3 million tonnes.

The Los

Ricos

North Project was

launched in March 2020 and includes drilling at the

El

Favor, La Trini,

and El Orito targets.

About

GoGold

Resources

GoGold

Resources

(TSX: GGD) is a Canadian-based silver and gold

producer focused on operating, developing, exploring and acquiring

high quality projects in Mexico. The Company

operates

the Parral Tailings mine in the state of Chihuahua and

has the Los Ricos South and Los

Ricos

North exploration

projects in the state of Jalisco. Headquartered in Halifax,

NS, GoGold is building

a portfolio of

low cost, high margin projects. For more information

visit

gogoldresources.com.

For

further information please contact:

Steve

Low

Corporate

Development

GoGold

Resources

T:

416 855

0435

E:

steve@gogoldresources.com

CAUTIONARY STATEMENT:

The securities

described herein have not been, and will not be, registered under

the United States Securities Act of 1933, as amended (the "U.S.

Securities Act"), or any state securities laws, and may not be

offered or sold within the United States or to, or for the benefit

of, U.S. persons (as defined in Regulation S under the U.S.

Securities Act) except in compliance with the registration

requirements of the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions therefrom. This release

does not constitute an offer to sell or a solicitation of an offer

to buy of any of GoGold's securities in the United

States.

This news release

may contain "forward-looking information" as defined in applicable

Canadian securities legislation. All statements other than

statements of

historical fact, included in this release, including, without

limitation, statements regarding the Los Ricos South and North

projects, and future plans and

objectives of GoGold, including the

NPV, IRR, initial

and sustaining capital costs, operating costs, and LOM production of

Los Ricos South, constitute forward

looking

information that

involve various risks and uncertainties. Forward-looking

information is based on a number of factors and assumptions

which have been

used to develop such information but which may prove to be

incorrect, including, but not limited to, assumptions in

connection with the continuance of

GoGold

and its

subsidiaries as a going concern, general economic and market

conditions, mineral prices, the accuracy of Mineral Resource Estimates, and the performance

of the Parral project. There can be no assurance that

such information will prove to be accurate and actual results

and future events could differ materially from those anticipated in

such forward-looking information.

Important factors

that could cause actual results to differ materially from

GoGold's

expectations

include exploration and development risks associated with

GoGold's

projects, the

failure to establish estimated Mineral Resources or

Mineral

Reserves, volatility of

commodity prices, variations of recovery rates,

and global economic conditions. For additional information with respect to

risk factors applicable to GoGold, reference should be made

to GoGold's continuous disclosure

materials filed from time to time with securities

regulators, including, but not limited to, GoGold's Annual Information Form. The

forward-looking information contained in this release is

made as of the date of this release.

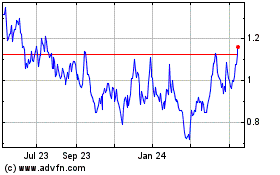

GoGold Resources (QX) (USOTC:GLGDF)

Historical Stock Chart

From Nov 2024 to Dec 2024

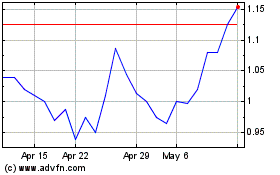

GoGold Resources (QX) (USOTC:GLGDF)

Historical Stock Chart

From Dec 2023 to Dec 2024