Trending: Glencore Buys Majority Stake in Rival's Coal Unit for $6.93 Billion

November 14 2023 - 9:00AM

Dow Jones News

1330 GMT - Glencore is among the most mentioned companies across

news items over the past 12 hours, according to Factiva data, after

the Anglo-Swiss commodity miner bought a majority stake in the coal

unit of Teck Resources. The deal--among this year's biggest in

mining--values the steelmaking coal business, named Elk Valley

Resources, at around $9 billion, as Glencore will pay $6.93 billion

for a 77% stake. The world's biggest miner by revenue plans to spin

off a combined coal company once it has sufficiently reduced its

debt, which it expects to do up to two years after the transaction

closes. "This is a striking move on the part of the diversified

miner and commodities trader," AJ Bell investment director Russ

Mould says in a market comment, adding the deal will do little for

Glencore's public reputation, but clearly makes business sense.

Japan-based steelmaker Nippon will hold a 20% stake after

converting existing holdings in some of Teck's coal operations and

paying cash, while South Korean steelmaker Posco will hold a 3%

position after converting its holdings. Dow Jones & Co. owns

Factiva. (christian.moess@wsj.com)

(END) Dow Jones Newswires

November 14, 2023 08:45 ET (13:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

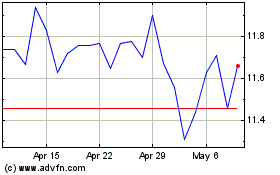

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

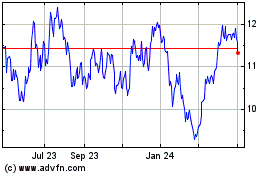

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024