Cash Never Hurts: Bet on 4 Cash-Rich Stocks - Investment Ideas

March 25 2014 - 1:12AM

Zacks

Buying stocks of companies that are sitting on a cash pile is a

common bear-market strategy. The assurance stems from the

protection that cash offers during market upheaval. The need for at

least a steady income increases the demand for cash-rich stocks in

bad times. But what is it that stops you from taking on this

strategy and investing in cash-rich stocks in any other market

phase, in particular a bull market like now?

The common perception is that huge cash holding in a bull market

means failure to grab opportunities. This notion is not wrong at

all; companies of this nature will end up burning through their

cash stash to fund operations.

But those hoarding huge cash on their balance sheets by balancing

their deposit and withdrawal rates offer a higher margin of safety

compared to those with low cash balances. So I don’t see any reason

to not prioritize true cash-rich stocks in any market situation.

After all, who doesn’t require

protection?

What I mean by protection...

While investing in a stock, not only are you paying for the ongoing

business of the company, but also its cash power. While the

business can flop, the cash will not. Even if the company

loses earnings power and chooses to liquidate, it should not affect

your investment much. And if you get the opportunity to pay less

than the market value of the company’s business plus the cash it

holds, the liquidation could bring rewards.

But is liquidation that easy for these companies? Of course,

because the potential acquirer needs to actually pay the difference

between the current market capitalization and hoarded cash

(considering a no-debt situation). So, higher the cash position,

lesser the expense for the acquirer. This whets the appetite of

potential acquirers.

The Benefits

Cash-rich companies not only guarantee protection, these also have

high chances of returning to shareholders from their deep cash

balances through dividend and repurchase. Past records affirm that

dividends and share buybacks contribute more to the growth of a

majority of portfolios than price appreciation.

On the other hand, these companies have the option to pay down debt

and grow organically and inorganically that can translate into

share price momentum. It all depends on how the companies plan to

efficiently deploy their cash balances.

But the possibility of dual return -- from dividend/share

repurchases and price appreciation -- is always there.

The Tactic to Find Real Cash-Rich Bargains

It’s not easy to find real cash-rich stocks unless you know the

trick. Here I have discussed the method and created a screen (using

Research Wizard) that you can run in any market, good or bad, to

find potential winners.

How to Look at Cash?

Of course, it is a relative measure, so a high number doesn’t

necessarily indicate affluence. How much cash a company holds

relative to its market capitalization is the actual way to look at

it -- the higher percentage the better.

So cash as percentage of market cap is the key to finding cash-rich

bargains. I searched companies with cash and marketable securities

of at least 80% of their market capitalization. If you buy stocks

of these companies, less than 20% of your investment will be

directed to their ongoing business -- the risky part. So at least

80% of your invested capital will be secure if the company is

debt-free. Even if the company has some debt, your risk exposure is

marginal.

Screening Criterion: (Cash and Marketable Securities/Market

Capitalization) >= 0.80

Look for True Cash Generators

A company hoarding ample cash does not do any good for your

investment if it is burning through it only to fund operations. If

the company doesn’t have the potential to earn sufficiently to

refill its initial cash, the reserves could be ultimately

exhausted.

To guard against that, first I required positive cash flow from

operations. Then I looked for companies that are expected to be

profitable in the current fiscal year. Here are the screening

criteria that I added:

Operating Cash Flow > 0

Current Fiscal Year Consensus Estimate > 0

Eliminate Typical Cash Owners

Some businesses demand huge cash holding by their very nature. I

eliminated companies from Finance and Medical sectors as these tend

to have a lot of cash on hand for the nature of their businesses.

Cash is the basic operating asset for finance companies while

medical companies keep cash in hand to fund their R&D.

Screening Criteria: Sector <> Finance; Sector <>

Medical

Ensure Favorable Zacks Rank

Good market or bad, stocks with a favorable Zacks Rank

http://www.zacks.com/education/stock-education generally

outperform. Zacks Rank #1 (Strong Buy) and #2 (Buy) stocks, which

have a proven history of success, have actually witnessed positive

earnings estimate revisions over the past few weeks.

(See the performance of Zacks' portfolios and strategies here:

About Zacks Performance).

Screening Criterion: Zacks Rank <= 2

How Successful the Strategy Is

For examining how profitable this screen would have been in the

past, I backtested it with a 24-week holding period over the last

10 years. I found that the group of stocks matching these

parameters significantly outperformed the S&P 500, as you can

see here:

4 Cash-Rich Stocks to Buy Now

The screening actually gave me the following 4 stocks, all of which

hold a Zacks Rank #2:

Air France-KLM SA (AFLYY): Headquartered in in

Paris, France, the company provides passenger transportation

services on scheduled flights.

Cash and Marketable Securities/Market Capitalization = 1.42

Operating Cash Flow (million) = $1,824

Current Fiscal Year Consensus Estimate = $0.88

YRC Worldwide Inc. (YRCW): This Overland Park,

Kansas-based trucking company provides various transportation

services primarily in North America.

Cash and Marketable Securities/Market Capitalization = 1.10

Operating Cash Flow ($million) = $98

Current Fiscal Year Consensus Estimate = $0.21

Gafisa S.A. (GFA): Headquartered in Sao Paulo,

Brazil, the company is engaged in the development of residential

buildings.

Cash and Marketable Securities/Market Capitalization = 1.56

Operating Cash Flow ($million) = $448

Current Fiscal Year Consensus Estimate = $0.17

China Zenix Auto Int'l (ZX): This Chinese

investment holding company produces tubed steel wheels, tubeless

steel wheels, off-road steel wheels and wheel components for

commercial vehicles. It directly sells its products in China and

exports them to India and 30 other countries.

Cash and Marketable Securities/Market Capitalization = 1.25

Operating Cash Flow ($million) = $79

Current Fiscal Year Consensus Estimate = $1.03

To Conclude

This screen is just a starting point for your research. However,

safety is the name of the game in investing. No matter the health

of the stock market, real cash-rich stocks are always safe.

Cash is king, so don’t ignore it.

Want More of Our Best Recommendations?

Zacks Executive VP Steve Reitmeister knows when key trades are

about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

Disclosure: The author has no positions in any stocks

mentioned.

AIR FRANCE-ADR (AFLYY): Get Free Report

GAFISA SA-ADR (GFA): Free Stock Analysis Report

YRC WORLDWD INC (YRCW): Free Stock Analysis Report

CHINA ZENIX AUT (ZX): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

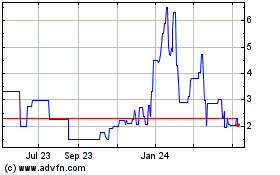

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Jan 2025 to Feb 2025

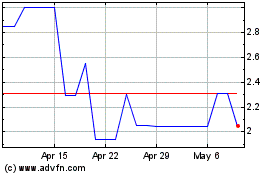

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Feb 2024 to Feb 2025