Pacific Exploration & Production on Track to Emerge From Bankruptcy

September 29 2016 - 4:43PM

Dow Jones News

By Tom Corrigan

Pacific Exploration & Production Corp.'s plan to wipe some

$5 billion in debt from its books cleared a final hurdle Wednesday,

putting the company on track to emerge from bankruptcy within two

weeks.

Following a hearing in Manhattan, U.S. Bankruptcy Court Judge

James Garrity Jr. said he would sign off on a global restructuring

plan, which has already won approval in courts in both Canada and

Colombia.

Pacific, an oil and natural gas producer, is based in Canada but

operates primarily in Colombia, where it is the largest independent

oil and natural gas company, court papers showed. Much of the

company's mountain of debt, however, is held in the U.S.

Judge Garrity, who is overseeing Pacific's U.S. bankruptcy

proceeding, had already agreed to formally recognize the Canadian

court as Pacific's primary restructuring venue, but he had asked

lawyers for the company to return to his courtroom Wednesday to

present the final version of the plan before he would agree to

discharge any debt.

The restructuring plan, which the company says is one of the

largest and most complicated restructurings ever attempted in Latin

America, wipes out $5.3 billion, court papers showed. Pacific,

which is continuing normal operations during the bankruptcy, said

the strategy not only aims to cut debt but will also save it $253

million in annual interest expenses.

In an earlier court hearing, Judge Garrity called the plan "a

very, very good result." When put to a vote last month, 98.4% of

creditors agreed.

Pacific racked up its multibillion-dollar debt load through an

acquisition spree, but ran into trouble when crude oil prices

fell.

In April, the oil producer said it had reached an agreement with

a group of bank lenders, unsecured bondholders as well as with

Canadian investment firm Catalyst Capital Group Inc. on a

restructuring blueprint.

Soon after, Pacific sought protection under Canada's Companies'

Creditors Arrangement Act, or CCAA, and days later filed for

chapter 15 bankruptcy protection in Manhattan. Pacific also

launched an insolvency proceeding in Colombia in May.

The company has now won approval for its plan in all three

courts.

Catalyst and unsecured bondholders together offered $500 million

in bankruptcy financing to help fund Pacific's operations while it

restructured. In return, the plan calls for Catalyst to receive

29.3% of Pacific's new shares and the bondholders will receive

12.5% of the new common shares as well as new five-year secured

notes, according to court papers.

Creditors including lenders behind $1.2 billion in loans, the

holders of $4.1 billion in senior unsecured bonds and other

unsecured creditors will share the remaining 58.2% of new shares.

Current shareholders, including significant shareholder O'Hara

Administration Co., will just receive no more than 0.006% ownership

in the reorganized company, court papers showed.

Write to Tom Corrigan at tom.corrigan@wsj.com

(END) Dow Jones Newswires

September 29, 2016 16:28 ET (20:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

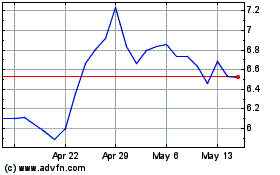

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From May 2024 to Jun 2024

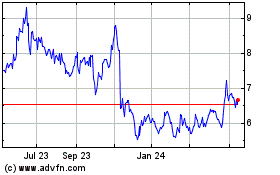

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From Jun 2023 to Jun 2024