EIG Drops Bid To Buy Oil Firm Pacific

March 26 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 3/26/16)

By Stephanie Gleason

Investment firm EIG Global Energy Partners has pulled its buyout

offer for Pacific Exploration & Production Corp., one of a few

possible deals that the Canadian-Colombian oil company was hoping

would stave off a bankruptcy filing.

Pacific Exploration, which is listed on the Toronto Stock

Exchange but has most of its assets in Colombia, has been hit hard

by falling oil prices and a lack of new discoveries.

EIG Pacific Holdings, the entity formed by Washington,

D.C.-based EIG Global to acquire Pacific, said Friday it had ended

its offer for $4.1 billion worth of Pacific's senior bonds. The

tender offer expired Thursday, and EIG said all tendered bonds have

been returned. EIG had offered the bondholders 16 cents on the

dollar and had promised an overhaul of Pacific's management and the

sale of assets.

As Pacific worked to complete the deal with EIG in February, 40%

of the bondholders agreed to take no action against the company

before March 31, despite a missed interest payment.

Bondholders could agree to give Pacific more time to arrange a

deal. But as it stands, Pacific is down to only a few days before

bondholders can demand immediate payment or force the company to

file for bankruptcy protection.

Earlier this month, The Wall Street Journal reported that the

EIG deal was one of six options the company was considering. The

other deals, which included one from Pacific's management and a

debt-for-equity swap that would include $500 million in fresh

financing, were due Wednesday.

A company spokesman declined to comment on EIG's withdrawal or

any pending offers.

Founded by a trio of Venezuelan and Italian oil and mining

executives in 2003, Pacific focused on the Colombia's mineral-rich

eastern savanna as the Colombian army pushed insurgents from the

region. The company grew to be the country's second largest by

revenue. Last year, it pumped an average of 156,000 barrels of oil

equivalent a day.

But the company's market capitalization has since shrunk to

about $200 million, from more than $7 billion dollars in early

2012. In January, the firm said it would skip $66 million in

interest payments in the hope it could restructure its $5.4 billion

in debt amid collapsing oil prices.

EIG and its subsidiary Harbour Energy first approached the

company's noteholders in January, offering 17.5 cents on the

dollar. EIG later lowered the offer, citing low oil prices and

Pacific Exploration's deteriorating financial condition.

The investment firm, which has about $14 billion in assets under

management, has invested in other energy companies, including

Breitburn Energy Partners LP and Chesapeake Energy Corp.

---

Anatoly Kurmanaev and Sara Schaefer Munoz contributed to this

article.

(END) Dow Jones Newswires

March 26, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

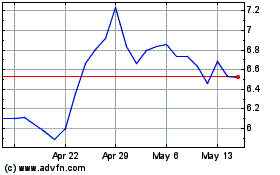

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From May 2024 to Jun 2024

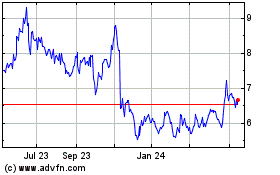

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From Jun 2023 to Jun 2024