Pacific Rubiales Seeks US$200 Million Credit Line With BofA's Aid

February 17 2010 - 10:56AM

Dow Jones News

Toronto-listed Pacific Rubiales Energy Corp. (PEGFF, PRE.T) has

engaged Banc of America Securities as lead arranger for an

unsecured two-year credit facility of up to $200 million, the oil

company said in a statement Wednesday.

Rubiales expects the creditors to be both international and

Colombian lenders. Closing is expected to occur on or before Mar.

31, 2010. The company said it does not expect to fully draw down

the facility during 2010.

In Bogota, Pacific Rubiales shares gained 2.35% to 30,460

Colombian pesos ($15.83) recently.

The share price is rising due to firmer crude prices and strong

local demand, rather than because of Wednesday's announcement, said

Natalia Agudelo, an analyst with local brokerage InterBolsa.

"It's a rollover of debt; I don't think this is additional

debt," Agudelo said.

Pacific Rubiales is now trading at volumes in Bogota that could

allow it to be included in Colombia's benchmark IGBC stock index

next quarter, Agudelo added.

Pacific Rubiales produces around 110,000 barrels of oil a day

from its Colombian operations, equivalent to around 54,000 barrels

after subtracting its partners' share of production and paying

royalties to the Colombian state.

-By Matthew Bristow, Dow Jones Newswires; 57-3142983277;

colombia@dowjones.com

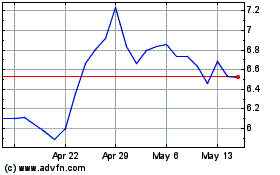

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From May 2024 to Jun 2024

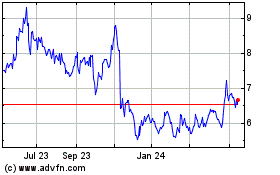

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From Jun 2023 to Jun 2024