UNTIED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

Registration

Statement Under

THE

SECURITIES ACT OF 1933

FORZA

INNOVATIONS INC.

(Exact

name of registrant as specified in charter)

| Wyoming |

|

3442 |

|

30-0852686 |

| (State

or other jurisdiction |

|

(Primary

Standard Classi- |

|

(IRS

Employer |

| of

incorporation) |

|

fication

Code Number) |

|

I.D.

Number) |

Forza

Innovations Inc.

406

9th Avenue, Suite 210

San

Diego, CA 92101

(702)

205-2064

(Address

and telephone number of principal executive offices)

406

9th Avenue, Suite 210

San

Diego, CA 92101

(Address

of principal place of business or intended principal place of business)

Registered

Agents Inc.

30

N Gould Street, Suite R

Sheridan,

Wyoming 82801

(307)

200-2803

(Name,

address and telephone number of agent for service)

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “ large accelerated filer, ” “ accelerated filer, ” “ smaller reporting

company, ” and “ emerging growth company ” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| (Do

not check if a smaller reporting company) |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, Dated April 19, 2022

PROSPECTUS

FORZA

INNOVATIONS INC.

This

Prospectus (this “Prospectus”) relates to the offer and sale from time to time by the Selling Stockholders (the “Selling

Stockholders”) of up to 12,189,628 shares of common stock, par value $0.001 (“Common Stock”), of Forza Innovations

Inc., a Wyoming corporation.

We

are registering the resale of (i) 2,500,000 shares of Common Stock issued to Mast Hill Fund, L.P. (“Mast Hill”); (ii) up

to 5,000,000 shares of Common Stock issuable under an equity line in the amount of $5,000,000 (the “Equity Line”) established

by the Equity Purchase Agreement entered into on January 20, 2022, between us and Mast Hill (iii) 3,500,000 shares of Common Stock that

are issuable under a convertible promissory note in the amount of $350,000 (the “Note”) established by a Convertible Promissory

Note entered into on January 20, 2022, between us and Mast Hill; (iv) 700,000 shares of Common Stock issuable upon exercise of a common

stock purchase warrant (the “First Warrant”) issued to Mast Hill; (v) 350,000 shares of Common Stock issuable upon exercise

of a common stock purchase warrant (the “Second Warrant”) issued to Mast Hill and (vi) up to 139,628 shares of Common Stock

issued or issuable upon exercise of the Common Stock Purchase Warrants (the “Placement Warrants”) issued to J.H. Darbie &

Co., Inc. For a more complete discussion of the terms and conditions of the Equity Purchase Agreement, the Note and the Warrant Agreements,

see the discussion under the heading “Recent Financings” in the Section entitled “Prospectus Summary.”

The

resale of the 12,189,628 shares by the Selling Stockholders pursuant to this Prospectus is referred to as the “Offering.”

We

are not selling any securities under this Prospectus and will not receive any of the proceeds from the sale of shares of Common Stock

by the Selling Stockholders. We will, however, receive proceeds from our sale of our shares of Common Stock under the Equity Line and

exercise of the First Warrant, the Second Warrant and the Placement Warrants (collectively, the “Warrants”) if they are exercised

for cash.

The

Equity Purchase Agreement provides that the Selling Stockholders party thereto is committed to purchase up to $5,000,000 (“Maximum

Commitment Amount”) of our Common Stock over the course of its term. The term of the Equity Purchase Agreement will end on the

earlier of (i) the date on which such Selling Stockholders has purchased Common Stock from us pursuant to the Equity Purchase Agreement

equal to the Maximum Commitment Amount, (ii) January 20, 2024, (iii) written notice of termination by us, (iv) the date the registration

statement of which this Prospectus (the “Registration Statement”) forms a part is no longer effective after the initial effective

date of the Registration Statement, or (v) the date that, pursuant to or within the meaning of any Bankruptcy Law, the Company commences

a voluntary case or any Person commences a proceeding against the Company, a custodian is appointed for the Company or for all or substantially

all of its property or the Company makes a general assignment for the benefit of its creditors.

We

may draw on the Equity Line from time to time, as and when we determine appropriate in accordance with the terms and conditions of the

Equity Purchase Agreement. The 5,000,000 shares of Common Stock included in this prospectus represent a portion of the Common Stock issuable

to the Selling Stockholders under the Equity Purchase Agreement. To date, we have not sold any shares pursuant to the Equity Purchase

Agreement.

The

Selling Stockholders are an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act. The Selling Stockholders

may sell the shares of Common Stock described in this Prospectus in a number of different ways and at varying prices. See “Plan

of Distribution” for more information about how the Selling Stockholders may sell the shares of Common Stock being registered pursuant

to this Prospectus.

We

will pay the expenses incurred in registering the shares of Common Stock, including legal and accounting fees. See “Plan of Distribution.”

Our

principal executive offices are located at 406 9th Avenue, Suite 210, San Diego, California 92101.

Our Common Stock is currently quoted on the OTC Market Group,

Inc.’s Pink tier under the symbol “FORZ.” On April 18, 2022, the average of the high and low sales prices of the

Company’s common stock on the OTC Pinks was $0.0330.

Investing

in our common stock involves a high degree of risk. See the “Risk Factors” section of this Prospectus.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus is April 19, 2022

TABLE

OF CONTENTS

You

should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with information that

is different from that contained in this Prospectus. This Prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any state where the offer or sale is not permitted. The information in this Prospectus is complete and

accurate only as of the date on the front cover regardless of the time of delivery of this Prospectus or of any sale of our securities.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements included and incorporated by reference in this prospectus constitute “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21B of the Securities Exchange Act of 1934,

as amended, or the Exchange Act.

Words

such as “may,” “should,” “anticipate,” “estimate,” “expect,” “projects,”

“intends,” “plans,” “believes” and words and terms of similar substance used in connection with any

discussion of future operating or financial performance, identify forward-looking statements. Forward-looking statements represent management’s

present judgment regarding future events and are subject to a number of risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements. These risks include, but are not limited to, risks and uncertainties

relating to our current cash position and our need to raise additional capital in order to be able to continue to fund our operations;

our ability to retain our managerial personnel and to attract additional personnel; competition; our ability to protect intellectual

property rights, and any and other factors, including the risk factors identified in the documents we have filed, or will file, with

the Securities and Exchange Commission. Please also see the discussion of risks and uncertainties under the caption “Risk Factors.”

In

light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in

this prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance

on the forward-looking statements, which speak only as of the respective dates of this prospectus or the date of the document incorporated

by reference in this prospectus. We expressly disclaim any obligation to update or alter any forward-looking statements, whether as a

result of new information, future events or otherwise, except as required by federal securities laws.

You

should rely only on the information contained in or incorporated by reference in this prospectus we have authorized to be delivered to

you in connection with this offering. We have not authorized anyone to provide you with information that is different. The information

contained or incorporated by reference in this prospectus we authorize to be delivered to you in connection with this offering is accurate

only as of the respective dates thereof, regardless of the time of delivery of this prospectus or of any sale of our securities offered

hereby. It is important for you to read and consider all information contained in this prospectus we authorize to be delivered to you

in connection with this offering, including the documents incorporated by reference therein, in making your investment decision. You

should also read and consider the information in the documents to which we have referred you under the captions “Where You Can

Find More Information.”

PROSPECTUS

SUMMARY

This

summary highlights material information concerning our business and this offering. This summary does not contain all of the information

that you should consider before making your investment decision. You should carefully read the entire prospectus and the information

incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors”

and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that

involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking

statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking

Statements.”

In

this prospectus, unless the context indicates otherwise, the “Forza Innovations Inc.” “Company,” “we,”

“our,” “ours” or “us” refer to Forza Innovations Inc., a Wyoming corporation, and its subsidiaries.

Overview

We

are in the health-tech wearable performance business. We have acquired the ownership and rights to certain late developmental stage products,

including the WarmUp product line which is comprised of the J4 Sport, J4 X and J4 Fitbelt. These products are wearable back compression

devices, used to relax, warmup, loosen, or relax stiff & sore muscles. The therapeutic application of heat causes a change in temperature

of the soft tissues which decreases joint stiffness and relieves inflammation.

We

have recently successfully completed our first acquisition of “Sustainable Origins” which is an eco-friendly ESG company,

that converts used cooking oil to reusable biodiesel. This acquisition is part of our ongoing strategic plan for future revenue and expansion.

While our primary focus will always be revolving around the innovation of wearable technology, these projects will take time to market.

We want to align ourselves with like-minded Entrepreneurs that will mesh well with our team and collective interest. Having the ability

to acquire companies current operations to generate steady revenue streams, will also help aid in financing the production of “WarmUp”

and other products we will develop.

Our

executive offices are located at 406 9th Avenue, Suite 210, San Diego, California 92101, and our telephone number is (702) 205-2064.

Securities

Offered:

In

order to provide a possible source of funding for our operations, we have entered into an Equity Purchase Agreement with Mast Hill Fund,

L.P.

Under

the Equity Purchase Agreement, Mast Hill has agreed to provide us with up to $5,000,000 of funding during the period ending: (1) on the

date which is 24 months after the date we signed the Equity Purchase Agreement; (2) written notice of termination by the Company to the

Investor (which shall not occur during any Valuation Period or at any time that the Investor holds any of the Put Shares); (3) this Registration

Statement is no longer effective after the initial effective date of the Registration Statement; or (4) the date that, pursuant to or

within the meaning of any Bankruptcy Law, we commence a voluntary case or any Person commences a proceeding against us, a Custodian is

appointed for us or for all or substantially all of our property or we make a general assignment for the benefit of our creditors.

During

this period, we may sell shares of our common stock to Mast Hill, and Mast Hill will be obligated to purchase the shares. These shares

may be offered for sale from time to time by means of this prospectus by or for the account of Mast Hill.

The

minimum amount we can raise at any one time is $15,000, and the maximum amount we can raise at any one time is the lesser of (a) $500,000.00

or (b) 175% of the Average Daily Trading Value of our common stock.

We

are under no obligation to sell any shares under the Equity Purchase Agreement.

The

number of shares to be sold by Mast Hill in this offering will vary from time-to-time and will depend upon the number of shares purchased

from us pursuant to the terms of the Equity Purchase Agreement. However, 5,000,000 shares of common stock, which represents approximately

1.7% of our outstanding shares as of April 18, 2022, is the maximum number of shares which we may sell to Mast Hill. See the section

of this prospectus captioned “Equity Purchase Agreement” for more information.

Based

upon the average of the two lowest volume weighted average prices of the Company’s Common Stock on the Principal Market during

the Valuation Period (the period of seven Trading Days immediately following the Clearing Date associated with the applicable Put Notice

during which the Purchase Price of the Common Stock is valued) and the terms of the Equity Purchase Agreement, the sale of these 5,000,000

shares would result in net proceeds to us of approximately $155,250.

As

of April 18, 2022, we had 298,449,961 outstanding shares of common stock. The number of outstanding shares does not give effect to shares

which may be issued pursuant to the Equity Purchase Agreement or upon the exercise of options or warrants

We

will not receive any proceeds from the sale of the shares by Mast Hill. However, we will receive proceeds from any sale of common stock

to Mast Hill under the Equity Purchase Agreement. We expect to use substantially all the net proceeds for our operations.

Risk

Factors:

The

purchase of the securities offered by this prospectus involves a high degree of risk. Risk factors include our history of losses and

need for additional capital. See the "Risk Factors" section of this prospectus for additional Risk Factors.

Trading

Symbol: FORZ

Forward-Looking

Statements

This

prospectus contains or incorporates by reference "forward-looking statements," as that term is used in federal securities laws,

concerning our financial condition, results of operations and business. These statements include, among others:

| • | statements

concerning the benefits that we expect will result from our business activities; and |

| • | statements

of our expectations, beliefs, future plans and strategies, anticipated developments and other

matters that are not historical facts |

You

can find many of these statements by looking for words such as "believes," "expects," "anticipates," "estimates"

or similar expressions used in this prospectus.

These

forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially

different from any future results expressed or implied in those statements. Because the statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or implied. We caution you not to put undue reliance on these statements, which

speak only as of the date of this prospectus. Further, the information contained in this prospectus, or incorporated herein by reference,

is a statement of our present intention and is based on present facts and assumptions, and may change at any time.

RISK

FACTORS

Investors

should be aware that this offering involves certain risks, including those described below, which could adversely affect the value of

our common stock. We do not make, nor have we authorized any other person to make, any representation about the future market value of

our common stock. In addition to the other information contained in this prospectus, the following factors should be considered carefully

in evaluating an investment in our securities.

Our

auditor has indicated in its report that there is substantial doubt about our ability to continue as a going concern as a result of our

lack of revenues and if we are unable to generate significant revenue or secure financing we may be required to cease or curtail our

operations.

Our

auditor has indicated in its report that our lack of revenues raises substantial doubt about our ability to continue as a going concern. The

financial statements do not include adjustments resulting from the outcome of this uncertainty. If we are unable to generate significant

revenue or secure financing we may be required to cease or curtail our operations.

If

we fail to effectively manage our growth, our business, brand and reputation, results of operations and financial condition may be adversely

affected.

We

may experience a rapid growth in operations, which may place significant demands on our management team and our operational and financial

infrastructure. As we continue to grow, we must effectively identify, integrate, develop and motivate new skilled employees, and maintain

the beneficial aspects of our corporate culture. To attract top talent, we believe we will have to offer attractive compensation packages.

The risks of over-hiring or over compensating and the challenges of integrating a rapidly growing employee base may impact profitability.

Additionally,

if we do not effectively manage our growth, the quality of our services could suffer, which could adversely affect our business, brand

and reputation, results of operations and financial condition. If operational, technology and infrastructure improvements are not implemented

successfully, our ability to manage our growth will be impaired and we may have to make significant additional expenditures to address

these issues. To effectively manage our growth, we will need to continue to improve our operational, financial and management controls

and our reporting systems and procedures. This will require that we refine our information technology systems to maintain effective online

services and enhance information and communication systems to ensure that our employees effectively communicate with each other and our

growing base of customers. These system enhancements and improvements will require significant incremental and ongoing capital expenditures

and allocation of valuable management and employee resources. If we fail to implement these improvements and maintenance programs effectively,

our ability to manage our expected growth and comply with the rules and regulations that are applicable to publicly reporting companies

will be impaired and we may incur additional expenses.

We

need additional capital.

We

need additional capital to fund our operations. We do not know what the terms of any future capital raising may be but any future

sale of our equity securities will dilute the ownership of existing stockholders and could be at prices substantially below the market

price of our common stock. Our failure to obtain the capital which we require may result in the slower implementation of our business

plan.

Potential

competitors could duplicate our business model.

There

is no aspect of our business which is protected by patents, copyrights, trademarks, or trade names. As a result, potential competitors

could duplicate our business model with little effort.

We

are subject to the credit risk of our customers.

We

are subject to the credit risk of our potential customers because we will be providing credit to our new customers in the normal course

of business. All of our customers are sensitive to economic changes and to the cyclical nature of the building industry. Especially during

protracted or severe economic declines and cyclical downturns in the building industry, our potential customers may be unable to perform

on their payment obligations, including their debts to us. Any failure by our customers to meet their obligations to us may have a material

adverse effect on our business, financial condition, and results of operations. In addition, we may incur increased expenses related

to collections in the future if we find it necessary to take legal action to enforce the contractual obligations of a significant number

of our customers.

We

are dependent on our management team and the loss of any of these individuals would harm our business.

Our

future success depends largely upon the management experience, skill, and contacts of our officers and directors. The loss of the services

of either of these officers, whether as a result of death, disability or otherwise, may have a material adverse effect upon our business.

The

applicability of "penny stock rules" to broker-dealer sales of our common stock may have a negative effect on the liquidity

and market price of our common stock.

Trading

in our shares is subject to the "penny stock rules" adopted pursuant to Rule 15g-9 of the Exchange Act, which apply to companies

that are not listed on an exchange and whose common stock trades at less than $5.00 per share or which have a tangible net worth of less

than $5,000,000, or $2,000,000 if they have been operating for three or more years. The penny stock rules impose additional sales practice

requirements on broker-dealers which sell such securities to persons other than established customers and institutional accredited investors.

For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received

the purchaser's written consent to the transaction prior to sale. Consequently, the penny stock rules may affect the ability of broker-dealers

to sell shares of common stock and may affect the ability of shareholders to sell their shares in the secondary market, as compliance

with such rules may delay and/or preclude certain trading transactions. The rules could also have an adverse effect on the market price

of our common stock.

These

disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our common stock. Many

brokers may be unwilling to engage in transactions in our common stock because of the added disclosure requirements, thereby making it

more difficult for shareholders to dispose of their shares. You may also find it difficult to obtain accurate information about, and/or

quotations as to the price of our common stock.

We

need to retain key personnel to support our products and ongoing operations.

The

development and marketing of our products and services will require the services of specialized and technical personnel. The sourcing,

hiring and retention of such key personnel will be highly important to our future plans and success.

We

may issue shares of preferred stock that would have a liquidation preference to our common stock.

Our

articles of incorporation currently authorize the issuance of 25,000,000 shares of our preferred stock. The board has the power to issue

shares without shareholder approval, and such shares can be issued with such rights, preferences, and limitations as may be determined

by our board of directors. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights

of any holders of preferred stock that may be issued in the future. We presently have no commitments or contracts to issue any shares

of preferred stock. Authorized and unissued preferred stock could delay, discourage, hinder or preclude an unsolicited acquisition of

our company, could make it less likely that shareholders receive a premium for their shares as a result of any such attempt, and could

adversely affect the market prices of, and the voting and other rights, of the holders of outstanding shares of our common stock.

The

market price of our common stock may decline due to the Equity Purchase Agreement.

An

unknown number of shares of common stock, which may be sold by means of this prospectus, are issuable under an Equity Purchase Agreement

to Mast Hill Fund, L.P. As we sell shares of our common stock to Mast Hill under the Equity Purchase Agreement, and Mast Hill sells the

common stock to third parties, the price of our common stock may decrease due to the additional shares in the market. The more shares

that are issued under the Equity Purchase Agreement, the more our then outstanding shares will be diluted and the more our stock price

may decrease. Any decline in the price of our common stock may encourage short sales, which could place further downward pressure on

the price of our common stock. Short selling is a practice of selling shares which are not owned by a seller with the expectation that

the market price of the shares will decline in value after the sale. See “Equity Purchase Agreement” for more information

concerning the Equity Purchase Agreement.

DESCRIPTION

OF BUSINESS

Background

Forza

Innovations Inc. (‘we” “our”, “us”, “Forza”, or “the Company”) a Wyoming

corporation, was originally formed as a Florida corporation under the name Genesys Industries, Inc. On February 17, 2022, the Company

filed Articles of Continuance with the Secretary of State for the state of Wyoming. Accordingly, the Company transferred its state of

formation from Florida to Wyoming and became a Wyoming entity and is, now, subject to the provisions of the Wyoming Business Corporation

Act

We

are in the health-tech wearable performance business. We have acquired the ownership and rights to certain late developmental stage products,

including the WarmUp product line which is comprised of the J4 Sport, J4 X and J4 Fitbelt. These products are wearable back compression

devices, used to relax, warmup, loosen, or relax stiff & sore muscles. The therapeutic application of heat causes a change in temperature

of the soft tissues which decreases joint stiffness and relieves inflammation.

We

have recently successfully completed our first acquisition of “Sustainable Origins” which is an eco-friendly ESG company,

that converts used cooking oil to reusable biodiesel. This acquisition is part of our ongoing strategic plan for future revenue and expansion.

While our primary focus will always be revolving around the innovation of wearable technology, these projects will take time to market.

We want to align ourselves with like-minded Entrepreneurs that will mesh well with the team and collective interest. Having the ability

to acquire companies current operations to generate steady revenue streams, will also help aid in financing the production of “WarmUp”

and other products we will develop.

Products

and Services

We

have developed the WarmUp series product line designed as wearable health-tech products.

WarmUp

is a cutting edge, innovative, wearable back compression device, used to relax, WarmUp, loosen, or relax stiff & sore muscles. The

therapeutic application of heat causes a change in temperature of the soft tissues which decreases joint stiffness and relieves inflammation.

When combined with the strategic placement of our medical grade support ribs & ergonomic design, WarmUp’s Thermal Therapy is

unmatched. Warmup was originally designed to help aid marquee Pro Athletes perform at their best. However, the “WarmUp Series”

will be for everyone. Ideal for a chilly day on the links, Ski/Snowboarding, Hunter/Fishers, Outdoor work force, Medical, Military, &

everything in between.

The

product line utilizes a low-cost technology that has multi-functional use servicing everyone from marquee pro athletes to a couch potato.

WarmUp is a low cost, yet highly efficient, multi-use heating technology. WarmUp uses next gen, carbon micro fibers combined with powerful,

safe rechargeable Lithium Batteries.

The

cutting-edge, technical, innovative, and wearable back compression devices are used to warmup, loosen, or relax stiff and sore muscles.

Our technology is designed to maximize the benefits of strategically applying heat to your target areas of pain, providing fast relief.

Our

WarmUp product line currently consists of the following three products:

J4

Sport: Target Retail Price $99

The

Original. Sleek ergonomic design, that you can wear while playing, recovering, or performing daily activities at work, home or on the

road.

J4

X: Target Retail Price $150

1

of 1 Dual Zone Patent Pending Heating Tech. Undergoing Class 1 Medical Device Evaluation from FDA. Ideal for patients with Chronic Back

Pain Conditions such as Arthritis, Osteoporosis, Fibromyalgia, & Ligament strains.

J4

Fitbelt: Target Retail Price $129

Fitbelt

is an innovative, high intensity, core toning wearable. Powered by a new EMS nano tech unfamiliar to all current products on the market.

FitBelt has dual functionality, so the user can choose to target both the abdominal and lower back muscles or just one of the muscle

groups.

Built-in

LED interface with pre-programed settings that targets specific muscle types by adjusting the frequencies, which can all be controlled

via Bluetooth through your phone.

Whether

looking for a tool to boost your fitness and strength or recover from an injury quickly, electric muscle stimulation (EMS) can help you

achieve your goal.

Product

Development Services

In

addition to our own products, we take ideas from other like-minded individuals and provide strategic solutions to develop innovative

products for athletes, artists, influencers and entrepreneurs.

We

aim to bridge the gap between the classic short term brand deals for athletes, artists, influencers and entrepreneurs. Our goal is to

alleviate the financial pressures and workload pressures for owners that are wearing too many hats and have stalled growth for businesses

that are generating significant revenue.

Our

services include:

| • | Product

Idea- We take ideas and bring them to life. |

| • | Financing-

We provide money management solutions for ideas. |

| • | Design

& Development - With a team of world class engineers and graphic artists we design &

develop your vision into a MVP (minimum viable product). |

| • | Logistics

& Marketing - Packed, Picked, Shipped and Play. |

| • | Product

Sales- Scaling your business into lead generating machines. |

Sales

& Marketing

We

are actively working with current and former professional athletes who are currently using our products. It is no secret that athlete

endorsement is both tried and tested marketing strategy to appeal to the masses. Our athlete ambassadors and investors will actively

leverage their social media profiles to promote our products online. With tens of millions combined followers between them, the opportunities

for exponential growth are pronounced.

Customers

We

are currently pre-launch for our Warm Up Series product line; however, we have built several connections and business relationships in

this industry over the last 8 years. Through these channels we are confident they will lead to major sales. Not only in the sporting

world, but in the health industry as well. Including but not limited to head equipment managers, as well.

Competition

We

face competition in the health-tech wearable performance business markets. The largest being “Hyperice” which currently has

greater financial resources. Although they are in the “Wearable Health Tech Industry” their focus is primarily on Cooling/recovery

devices, whereas we specialize in constructing the most innovative, functional, heated wearable technology. We will compete on the basis

of price, technological expertise, & nearly a decade of constant R&D on the manufacturing of wearable technology.

Some

of our closest competitors and their comparable products are as follows:

| • | SlenderTone

Waist Trainer |

We

face direct competition from companies with far greater financial, technological, manufacturing and personnel resources. Competition

is primarily based on product quality, service, timely delivery, and price.

Research

and Development; Intellectual Property

We

are developing proprietary technologies that will give it an edge in competing with its competitors. We intend to file patents to protect

our IP. We intend to file utility, design, full spectrum patents on the created IP. We will also register product as Medical Device so

patients with chronic pain can get the product free through insurance.

Suppliers

Prior

to the pandemic our team spent time in the Orient, designing and developing WarmUp beta samples, some having patentable IP. Our V1 base

“Sport” version is manufacture/retail ready. This product has already been tested by the LA Clippers. Prior to the pandemic,

their head equipment manager said the players love the product and it works much better than the other available products. Upon receiving

funding, we will place our first order from licensed overseas suppliers the president has used before and built a solid relationship

with for years. While production gets underway, the goal is to begin engineering work on redesigning a sleek new button/control switch

for our products.

Employees

We

currently have two full-time employees, our President Johnny Forzani and Garrett Morosky our Vice President & Director of Joint Ventures.

We engage others on a part-time basis such as product-designers and engineers. We also have two full time employees at our wholly owned

subsidiary Sustainable Origins Inc.

Foreign

and Domestic Operations and Export Sales

We

currently have no operations or any significant sales in any foreign country.

Government

Regulation

Our

operations are subject to certain foreign, federal, state and local regulatory requirements relating to, among others, environmental,

waste management, labor and health and safety matters. Management believes that our business is operated in material compliance with

all such regulations.

USE

OF PROCEEDS

This

Prospectus relates to shares of our common stock that may be offered and sold from time to time by the Selling Stockholders. We will

receive no proceeds from the sale of shares of common stock by the Selling Stockholders in this Offering. The proceeds from the sales

will belong to the Selling Stockholders. However, we will receive proceeds from the sale of the Put Shares to the Selling Stockholder

pursuant to the Equity Purchase Agreement and from the exercise of the Warrants held by the Selling Stockholders if they are exercised

for cash and not on a “Cashless” basis.

We

intend to use the proceeds that we may receive for general corporate purposes and working capital requirements. There can be no assurance

that we will sell any of the Put Shares or that the Warrants Warrant will be exercised.

We

cannot provide any assurance that we will be able to draw down any or all of the remaining Maximum Commitment Amount, such that the proceeds

received would be a source of financing for us.

We

intend to raise additional capital through equity and debt financing, as needed, though there cannot be any assurance that such funds

will be available to us on acceptable terms, on an acceptable schedule, or at all.

MARKET

FOR OUR COMMON STOCK

Market

Information

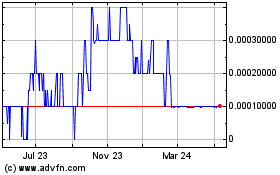

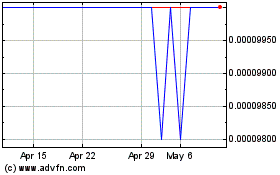

Our

common stock is quoted on the OTC Markets Group, Inc.’s Pink Current tier under the symbol “FORZ.” The following is

a summary of the high and low sales prices of our common stock for the periods indicated, as reported by the OTC Markets Group, Inc.

The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual

transactions.

| Fiscal Year Ending June 2021 | |

HIGH | |

LOW |

| Quarter Ending September 30, 2020 | | |

$ | 0.035 | | |

$ | 0.003 | |

| Quarter Ending December 31, 2020 | | |

$ | 0.05 | | |

$ | 0.003 | |

| Quarter Ending March 31, 2021 | | |

$ | 0.70 | | |

$ | 0.014 | |

| Quarter Ending June 30, 2021 | | |

$ | 4.82 | | |

$ | 0.11 | |

| | | |

| | | |

| | |

| Fiscal Year Ending June 2020 | | |

| HIGH | | |

| LOW | |

| Quarter Ending September 30, 2019 | | |

| — | | |

| — | |

| Quarter Ending December 31, 2019 | | |

$ | 0.102 | | |

$ | 0.047 | |

| Quarter Ending March 31, 2020 | | |

$ | 0.077 | | |

$ | 0.005 | |

| Quarter Ending June 30, 2020 | | |

$ | 0.045 | | |

$ | 0.007 | |

On

March 29, 2022, the closing price of our common stock was $0.03405.

Stockholders

As

of March 29, 2022, we had 20 shareholders of record and 298,449,961 outstanding shares of common stock. The number of stockholders of

record does not include beneficial owners of our common stock, whose shares are held in the names of various dealers, clearing agencies,

banks, brokers and other fiduciaries.

Dividends

We

have not declared or paid any cash dividends on our capital stock in our history as a public company. We currently intend to retain all

future earnings to finance our business and do not anticipate paying cash or other dividends on our common stock in the foreseeable future.

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As

a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act), we are not required to provide the information called for

by Item 304 of Regulation S-K.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain

statements set forth below under this caption constitute forward-looking statements. See “Forward-Looking Statements” in

the Prospectus Summary.

You

should read the following discussion and analysis of financial condition and results of operations in conjunction with the consolidated

financial statements and related notes appearing elsewhere in this Prospectus.

Overview

Forza

Innovations Inc. (‘we” “our”, “us”, “Forza”, or “the Company”) a Wyoming

corporation, was originally formed as a Florida corporation under the name Genesys Industries, Inc. On February 17, 2022, the Company

filed Articles of Continuance with the Secretary of State for the state of Wyoming. Accordingly, the Company transferred its state of

formation from Florida to Wyoming and became a Wyoming entity and is, now, subject to the provisions of the Wyoming Business Corporation

Act

We

are in the health-tech wearable performance business. We have acquired the ownership and rights to certain late developmental stage products,

including the WarmUp product line which is comprised of the J4 Sport, J4 X and J4 Fitbelt. These products are wearable back compression

devices, used to relax, warmup, loosen, or relax stiff & sore muscles. The therapeutic application of heat causes a change in temperature

of the soft tissues which decreases joint stiffness and relieves inflammation.

We

have recently successfully completed our first acquisition of “Sustainable Origins” which is an eco-friendly ESG company,

that converts used cooking oil to reusable biodiesel. This acquisition is part of our ongoing strategic plan for future revenue and expansion.

While our primary focus will always be revolving around the innovation of wearable technology, these projects will take time to market.

We want to align ourselves with like-minded Entrepreneurs that will mesh well with the team and collective interest. Having the ability

to acquire companies current operations to generate steady revenue streams, will also help aid in financing the production of “WarmUp”

and other products we will develop.

Results

of Operation for the Year Ended June 30, 2021 Compared to the Year Ended June 30, 2020

Revenues

and Cost of Revenue

Due

to the termination of our CNC manufacturing and fabrication business, we did not have any revenue or cost of revenue from continuing

operations for the years ended June 30, 2021 and 2020.

Operating

Expenses from Continuing Operations

Operating

expenses from continuing operations for the years ended June 30, 2021 and 2020, consisted of general and administrative expenses of $60,165

and $33,255, respectively, General and administrative expenses consisted primarily of accounting and audit fees. During the year ended

June 30, 2021, we incurred $21,200 of audit fees, $8,100 for accounting and $1,500 for legal. We also had $10,931 of depreciation and

amortization expense and $14,437 of miscellaneous general and administrative expense. In the prior year operating expenses from continuing

operations consisted of mostly of accounting and audit expense.

Other

Income from Continuing Operations

During

the year ended June 30, 2021, we incurred $26,033 of interest expense, $12,500 of debt discount amortization, recognized a $365,019 loss

on the disposition of assets and liabilities and a loss of $2,704,865 on the acquisition of assets from a related party. During the year

ended June 30, 2020, we incurred $5,484 of interest expense, $137,500 of debt discount amortization, recognized a $40,000 loss on the

issuance of common stock and a loss of $75,000 on the issuance of convertible debt.

Net

Loss from Continuing Operations

Our

net loss from continuing operations for the years ended June 30, 2021 was $3,168,582 compared to $291,239 for the year. The large increase

in our net loss in mainly due to the loss on asset acquisition and the loss on the disposition of the assets and liabilities.

Liquidity

and Capital Resources

As

reflected in the accompanying financial statements, the Company has an accumulated deficit of $3,494,730 at June 30, 2021, and had a

net loss from continuing operations of $3,168,582 for year ended June 30, 2021.

For

the year ended June 30, 2021, we netted $66,297 of cash from operating activities, compared to $21,613 for the year ended June 30, 2020.

Net

cash used in investing activities for the year ended June 30, 2021 and 2020 was $110,117 and $256,227, respectively, for the purchase

of property and equipment.

Net

cash received from financing activities for the year ended June 30, 2021 was $57,497 compared to $239,288 provided by financing activities

in the prior period.

On

January 2, 2020, the Company executed a 10% convertible promissory note in which it agreed to borrow up to $300,000. The note is convertible

at a price per share equal to the lower of (a) the Fixed Conversion Price (which is fixed at a

price equal to $0.30); or (b) 80% of the lowest trading price of the Company’s common stock during the 5 consecutive trading days

prior to the date on which lender elects to convert all or part of the Note. The initial deposit of $125,000 was made on January

15, 2020 and included a $25,000 OID. As of June 30, 2021, there is $150,000 and $40,250 of principal and interest due on this loan, respectively.

On

November 5, 2017, to fund its working capital requirements the Company obtained a Special Line of Credit (“LOC”) also

recognized as a Blanket Secured Promissory Note for the total draw down amount of up to $500,000, from Twiga Capital Partners, LLC (“TCP”),

an entity controlled by the Company’s former sole officer and largest stockholder, Shefali Vibhakar. This Note is secured by all

of the assets of the Company in accordance with the Security Agreement by and between the Company and the Holder dated as of November

5, 2017. The LOC bears interest at 5% per annum and is due on demand. On January 21, 2021, TCP assigned all of its rights, title and

interest in the debt to Front Row Seating Inc. As of June 30, 2021 the Company owes $122,729 of principal and $17,339 of accrued interest

on the LOC.

Results

of Operation for the Three Months Ended December 31, 2021 Compared to the Three Months December 31, 2020

Revenues

and Cost of Revenue

Due

to the termination of our CNC manufacturing and fabrication business, we did not have any revenue or cost of revenue from continuing

operations for the three months ended December 31, 2021 and 2020.

Operating

Expenses from Continuing Operations

Operating

expenses from continuing operations for the three months ended December 31, 2021 and 2020, consisted of general and administrative expenses

(“G&A”) of $68,248 and $7,900, respectively. G&A expenses consisted primarily of marketing and consulting fees. During

the three months ended December 31, 2021, we incurred approximately $73,900 of marketing fees and $15,700 for consulting expense. We

also had $8,090 of depreciation and amortization. Our total G&A expense for the three months ended December 31, 2021 was decreased

by a credit memo for audit fees of $41,665. We had no operating expenses from continuing operations in the prior period.

Officer

Compensation

Officer

Compensation for the six months ended December 31, 2021 and 2020, was $110,280 and $0, respectively. During the current period we made

payments of $30,280 to our officers. We also accrued $80,000 for services provided by our CEO.

Other

Income from Continuing Operations

During

the three months ended December 31, 2021, we recognized total other expense of $208,693 compared to $12,473 for the prior period. During

the three months ended December 31, 2021, we incurred a $298,710 loss on the issuance of convertible debt and $32,095 of debt discount

amortization expense. This was offset by a gain of $131,052 from the change in the fair value of our derivatives related to the new convertible

notes. We also incurred $8,940 of interest expense. For the three months ended December 31, 2020, we incurred $12,473 of interest expense.

Net

Loss from Continuing Operations

Our

net loss from continuing operations for the three months ended December 31, 2021 was $387,221 compared to $20,373 for the prior period.

Results

of Operation for the Six Months Ended December 31, 2021 Compared to the Six Months Ended December 31, 2020

Revenues

and Cost of Revenue

Due

to the termination of our CNC manufacturing and fabrication business, we did not have any revenue or cost of revenue from continuing

operations for the six months ended December 31, 2021 and 2020.

Operating

Expenses from Continuing Operations

Operating

expenses from continuing operations for the six months ended December 31, 2021 and 2020, consisted of G&A expenses of $166,608 and

$7,900, respectively. G&A expenses consisted primarily of accounting, audit and marketing fees. During the six months ended December

31, 2021, we incurred $21,247 of audit fees, $6,422 for accounting and $63,900 for marketing expense. We also had $16,117 of depreciation

and amortization and $15,700 of consulting expense. Our total G&A expense for the six months ended December 31, 2021 was decreased

by a credit memo for audit fees of $41,665. We had no operating expenses from continuing operations in the prior period.

Officer

Compensation

Officer

Compensation for the six months ended December 31, 2021 and 2020, was $110,280 and $0, respectively. During the current period we made

payments of $30,280 to our officers. We also accrued $80,000 for services provided by our CEO.

In

the current period we incurred an $854,550 non-cash expense for the issuance of stock options to our officers and directors.

Other

Income from Continuing Operations

During

the six months ended December 31, 2021, we recognized total other expense of $217,045 compared to $26,503 for the prior period. During

the six months ended December 31, 2021, we incurred a $298,710 loss on the issuance of convertible debt and $32,095 of debt discount

amortization expense. This was offset by a gain of $131,052 from the change in the fair value of our derivatives related to the new convertible

notes. We also incurred $17,292 of interest expense. For the six months ended December 31, 2020, we incurred $14,003 of interest expense

and $12,500 of debt discount amortization.

Net

Loss from Continuing Operations

Our

net loss from continuing operations for the six months ended December 31, 2021 was $1,348,483 compared to $34,403 for the prior period.

Liquidity

and Capital Resources

As

reflected in the accompanying financial statements, the Company has an accumulated deficit of $4,843,213 at December 31, 2021, and had

a net loss from continuing operations of $1,348,483 for the six months ended December 31, 2021.

For

the six months ended December 31, 2021, we used $175,240 of cash in operating activities, compared to receiving $75,146 for the six months

ended December 31, 2020.

We

neither received or used any cash in investing activities from continuing operations for the six months ended December 31, 2021 or 2020.

Net

cash received from financing activities for the six months ended December 31, 2021 was $184,525 compared to $0 provided by financing

activities in the prior period. In the current period we received $161,500 from the issuance of convertible debt and $24,043 from the

exercise of stock options. We also received $27,088 from our CEO, with $28,106 repaid.

On

January 2, 2020, the Company executed a 10% convertible promissory note in which it agreed to borrow up to $300,000. The note is convertible

at a price per share equal to the lower of (a) the Fixed Conversion Price (which is fixed at a price equal to $0.30); or (b) 80% of the

lowest trading price of the Company’s common stock during the 5 consecutive trading days prior to the date on which lender elects

to convert all or part of the Note. The initial deposit of $125,000 was made on January 15, 2020 and included a $25,000 OID. As required

by ASC 470-20-30-6 the Company recognized and measured the embedded beneficial conversion feature at the commitment date of $200,000

which was credited to paid in capital, a $150,000 debt discount and a $75,000 loss on the issuance of convertible debt. As of December

31, 2021, all of the debt discount has been amortized to interest expense. On August 17, 2021, $30,000 of the note was converted into

144,231 shares of common stock per the terms of the agreement. As of December 31, 2021, there is $120,000 and $52,499 of principal and

interest due on this loan, respectively.

On

November 5, 2017, to fund its working capital requirements the Company obtained a Special Line of Credit (“LOC”) also recognized

as a Blanket Secured Promissory Note for the total draw down amount of up to $500,000, from Twiga Capital Partners, LLC (“TCP”),

an entity controlled by the Company’s former sole officer and largest stockholder, Shefali Vibhakar. This Note is secured by all

of the assets of the Company in accordance with the Security Agreement by and between the Company and the Holder dated as of November

5, 2017. The LOC bears interest at 5% per annum and is due on demand. On January 21, 2021, TCP assigned all of its rights, title and

interest in the debt to Front Row Seating Inc. On September 28, 2021, $100,000 of the note was converted into 10,000,000 shares of common

stock. As of December 31, 2021, the shares have not been issued and are disclosed as common stock to be issued. As of December 31, 2021,

the Company owed $22,729 of principal and $19,232 of accrued interest.

During

the six months ended December 31, 2021, the Company issued three new convertible promissory notes. They are as follows:

| Note Holder | |

Date | |

Maturity Date | |

Interest Rate | |

Balance December 31, 2021 |

| Power Up Lending Group Ltd (1) | |

| 10/1/2021 | | |

10/1/2022 | |

| 10 | % | |

$ | 55,000 | |

| Fast Capital LLC (2) | |

| 10/26/2021 | | |

10/26/2022 | |

| 10 | % | |

$ | 65,000 | |

| Sixth Street Lending LLC (3) | |

| 11/17/2021 | | |

11/17/2022 | |

| 10 | % | |

$ | 55,000 | |

| | |

| | | |

| |

| Total | | |

$ | 175,000 | |

Conversion

Terms

| (1) | 61%

of the average of the three lowest trading price for 15 days prior to conversion date. |

| (2) | 61%

of the lowest trading price for 15 days, including conversion date. |

| (3) | 61%

of the lowest trading price for 15 days prior to conversion date. |

Total

accrued interest on the three convertible notes as of December 31, 2021 is $3,210.

Off-Balance

Sheet Arrangements

None.

Significant

Accounting Policies

See

Note 2 to the June 30, 2021 financial statements included as part of this prospectus for a description of our significant accounting

policies.

Recent

Accounting Pronouncements

From

time to time, the FASB or other standards setting bodies issue new accounting pronouncements. Updates to the FASB ASCs are communicated

through issuance of an Accounting Standards Update (“ASU”). Unless otherwise discussed, we believe that the impact of recently

issued guidance, whether adopted or to be adopted in the future, is not expected to have a material impact on our consolidated financial

statements upon adoption.

To

understand the impact of recently issued guidance, whether adopted or to be adopted, please review the information provided in Note 2

to the financial statements included as part of this prospectus.

DIRECTORS

AND EXECUTIVE OFFICERS

MANAGEMENT

Our

executive officers and directors are listed below. Directors are generally elected at our annual shareholders’ meeting and hold

office until the next annual shareholders’ meeting, or until their successors are elected and qualified. Our executive officers

are elected by our directors and serve at the board’s discretion.

| |

|

|

|

|

| Name |

|

Age |

|

Positions |

| Johnny

Forzani |

|

34 |

|

President,

CEO, Treasurer, CFO, Secretary and Director |

| Garrett

Morosky |

|

28 |

|

Vice

President & Director of Joint Ventures |

| Tom

Forzani |

|

70 |

|

Director |

| Geoff

Stanbury |

|

70 |

|

Director |

The

following is a brief summary of the background of each officer and director including their principal occupation during the five preceding

years. Neither of these persons is a financial expert as that term is defined by the SEC. All directors will serve until their successors

are elected and qualified or until they are removed.

Johnny

Forzani, is a former Professional Football Player and is an Entrepreneur and Inventor. Mr. Forzani played Division 1 NCAA Football

at Washington State University, where he set an NCAA record for the longest touchdown reception. During his professional football career,

playing with his hometown Calgary Stampeders, Mr. Forzani started creating his first invention. In 2017, Mr. Forzani’s founded,

G-Tech Apparel USA Inc. and G-Tech Apparel Canada Inc. and was issued a Utility & Design Patent from the USPTO, for G-Tech’s

Battery Powered Thermal Handwarmer.

Mr.

Forzani has been the founder of G-Tech Apparel USA Inc. and G-Tech Apparel Canada Inc since 2014. From, 2014 to 2020, Mr. Forzani acted

as CEO and CTO of both companies. He has been our President, CEO, Treasurer, CFO, Secretary and a Director since January 21, 2022.

Garrett

Morosky, has been the President of G, LLC, a private company, from 2019 until present. From 2017 to 2019, Mr. Morosky was the VP

of WarmUp wearables, a private company. From 2015 to 2017, Mr. Morosky was the Strategic Marketing & Advertising Consultant for Keller

Williams Reality, Snackerz Inc., Pace & Pace Joint, IDG, WATT Companies, Curio, LA Local SEO, KrampKrusher. From 2014 to 2016 he

was a SAG Actor and TV personality.

Tom

Forzani, is a one of three brothers to play for the Calgary Stampeders of the CFL. Described as one of the best wide receivers to

ever play at Utah State, Mr. Forzani earned honorable mention All-America honors from The Associated Press as a senior in 1972 as he

led the nation with receptions, while adding 1,169 receiving yards to set then-single-season school records in both categories.

Following

his Utah State career, Mr. Forzani played professionally for the Calgary Stampeders from 1972-83 and was a five-time CFL All-Star. He

finished his CFL career ranking second all-time in Stampeders history in receptions (553), receiving yards (8,825) and receiving touchdowns

(62). Mr. Forzani was named to Utah State's All-Century Football Team in 1993.

Mr.

Forzani began his business career towards the end of his football career, earning his realtors license in 1979. Mr. Forzani started Kelvion

Properties in 1990, which specialized in most aspects of the Real Estate business including Land Purchase, Land Zoning, House Building,

Land Sub Division, Mortgage Loaning and Renovations.

In

1974, Mr. Forzani was one of the Original Founders and Owners of Forzani Locker Room which became the Canadian publicly traded company

The Forzani Group in 1993. The Forzani Group went from one store in 1974, to a retail empire encompassing more than 500 retail locations

and over 13,000 employees. In 2011, The Forzani Group sold to Canadian conglomerate Canadian Tire Corporation for $800,000,000 (Canadian

Dollars). Tom Forzani has been a Director since January 21, 2022.

Geoff

Stanbury, was born and raised in South West England and immigrated to North America at 19. In 1981 shortly after settling in Alberta,

Mr. Stanbury founded his company Good Earth Environs which specializes in Land, Snow, and Erosion management. Good Earth has maintained

contracts with some of Alberta’s largest Residential companies including Brookfeild RP, for over 20 years.

Today,

Mr. Stanbury is a seasoned Investor with a portfolio ranging in both the private and public sector. Mr. Stanbury is passionate about

entrepreneurship and innovation. He looks forward to providing veteran leadership to the board, assisting in the best way possible, on

the path to success. Mr. Stanbury has been a Director since January 21, 2022.

Employment

Agreements

We

currently do not have any employment agreements with any of our directors or executive officers.

Audit

Committee and Audit Committee Financial Expert

We

do not currently have an audit committee or a committee performing similar functions. Our board as a whole participates in the review

of financial statements and disclosure. We also do not have an audit committee financial expert.

Compensation

Committee Interlocks and Insider Participation

None

of our executive officers served as a member of the compensation committee or as a director of another entity one of whose executive

officers served on our compensation committee or as one of our directors.

Code

of Ethics

We

have not adopted a Code of Business Conduct and Ethics.

EXECUTIVE

COMPENSATION

The

following Summary Compensation Table sets forth for fiscal 2021, 2020 and 2019, the compensation awarded to, paid to, or earned by our

executive officers.

| Name and Principal Position | |

Year | |

Salary

($) | |

Bonus

($) | |

Option Awards

($) | |

Non-equity

incentive plan compensation

($) | |

Change in pension value and nonqualified deferred compensation earnings

($) | |

All Other Compensation

($) | |

Total

($) |

| Johnny Forzani | |

| 2021 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| CEO, CFO, Director | |

| 2020 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| | |

| 2019 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Garrett Morosky | |

| 2022 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| VP & Director of | |

| 2020 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Joint Ventures | |

| 2019 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Tom Forzani | |

| 2022 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Director | |

| 2020 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| | |

| 2019 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Geoff Stanbury | |

| 2022 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Director | |

| 2020 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| | |

| 2019 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Stock

Incentive Plans

We

have one Stock Incentive Plan. The terms and conditions of any stock issued and the terms and conditions of any options granted,

including the price of the shares of common stock issuable on the exercise of options, are governed by the provisions of the Plans and

any agreements with the Plan participants.

On

July 21, 2021, we adopted our 2021 Equity Award Plan. On August 3, 2021 we granted options to the persons shown below pursuant to this

plan.

| Name | |

Shares issuable Upon Exercise of Option | |

Option Exercise Price | |

Expiration Date |

| Johnny Forzani | |

| 1,000,000 | | |

$ | 0.05 | | |

8/3/2023 |

| Tom Forzani | |

| 250,000 | | |

$ | 0.05 | | |

8/3/2023 |

| Geoff Stanbury | |

| 250,000 | | |

$ | 0.05 | | |

8/3/2023 |

Employee

Pension, Profit Sharing or other Retirement Plans

We

do not have a defined benefit, pension plan, profit sharing or other retirement plan, although we may adopt one or more of such plans

in the future.

Compensation

of Directors

During

the fiscal year ended June 30, 2021 we did not compensate our directors for acting as such.

Transactions

with Related Parties

On

January 21, 2021, we entered into an acquisition agreement with Johnny Forzani to acquire all of the ownership and the rights to certain

late developmental stage products, including the J4 Sport, J4 X and J4 Fitbelt in exchange for the issuance of 10,000,000 common shares.

The shares were valued at $0.28, the closing stock price on the date of the agreement, for a total value of $2,800,000. The assets were

valued at cost of $95,135, resulting in a loss on asset acquisition of $2,704,865. As a result of this acquisition, we moved out of the

precision CNC manufacturing and fabrication business and moving into the health-tech wearable performance business.

During

the year ended June 30, 2021, Mr. Forzani advanced the Company $54,833, for general operating expenses, the advance is non-interest bearing

and due on demand.

PRINCIPAL

SHAREHOLDERS

The

following table shows the ownership of our common stock and Series A preferred shares as of the date of this prospectus, by (i) each

person whom we know beneficially owns more than 5% of the outstanding shares of our common stock or preferred shares; (ii) each of our

executive officers; (iii) each of our directors; and (iv) all of our executive officers and directors as a group. Unless otherwise indicated,

to our knowledge each of the stockholders listed below has sole voting and investment power over the shares beneficially owned. Unless

otherwise specified, the address of each of the persons set forth below is in care of Forza at 406 9th Avenue, Suite 210, San Diego,

California 92101.

| | |

Number of Shares | |

Percentage |

| Name | |

Owned | |

of Class(4) |

| Johnny Forzani | |

| 270,969,007 | (1) | |

| 90.49 | % |

| Tom Forzani | |

| 250,000 | (2) | |

| (5 | ) |

| Geoff Stanbury | |

| 250,000 | (3) | |

| (5 | ) |

| All executive officers and directors as a group (five persons) | |

| 271,469,007 | | |

| 90.66 | % |

1

Includes 600,000 shares underlying currently exercisable stock options held by Johnny Forzani.

2

Comprised solely of shares underlying currently exercisable stock options held by Tom Forzani.

3

Comprised solely of shares underlying currently exercisable stock options held by Geoff Stanbury.

4

Calculated based on all outstanding shares plus all currently exercisable stock options as of March 29, 2022.

4

Less than 1 percent.

EQUITY

PURCHASE AGREEMENT

On

January 20, 2022, we entered into an Equity Purchase Agreement with Mast Hill in order to establish a possible source of funding for

our operations.

Under

the Equity Purchase Agreement Mast Hill has agreed to provide us with up to $5,000,000 of funding during the period ending: (1) on the

date which is 24 months after the date we signed the Equity Purchase Agreement; (2) written notice of termination by the Company to the

Investor (which shall not occur during any Valuation Period or at any time that the Investor holds any of the Put Shares); (3) this Registration

Statement is no longer effective after the initial effective date of the Registration Statement; or (4) the date that, pursuant to or

within the meaning of any Bankruptcy Law, we commence a voluntary case or any Person commences a proceeding against us, a Custodian is

appointed for us or for all or substantially all of our property or we make a general assignment for the benefit of our creditors.

We

may, in our sole discretion, deliver a Put Notice to Mast Hill. The Put Notice will specify the number of shares of common stock which

we intend to sell to Mast Hill on a closing date.

The

minimum amount we can raise at any one time is $15,000, and the maximum amount we can raise at any one time is the lesser of (a) $500,000.00

or (b) 175% of the Average Daily Trading Value of our common stock.

The

number of shares to be sold by Mast Hill in this offering will vary from time-to-time and will depend upon the number of shares purchased

from us pursuant to the terms of the Equity Purchase Agreement. However, 5,000,000 shares of common stock is the maximum number

of shares which we may sell to Mast Hill pursuant to this Prospectus.

For

purposes of the foregoing:

Purchase

Price means 90% of the Market Price on such date on which the Purchase Price is calculated in accordance with the terms and conditions

of this Agreement.

Market

Price means the average of the two lowest volume weighted average prices of the Company’s Common Stock on the Principal Market

during the Valuation Period, in each case as reported by Quotestream or other reputable source designated by the Investor.

Valuation

Period means the period of seven Trading Days immediately following the Clearing Date associated with the applicable Put Notice during

which the Purchase Price of the Common Stock is valued. The Valuation Period shall begin on the first Trading Day following the Clearing

Date.

Trading

Day means a day on which the Principal Market shall be open for business.

Clearing

Date is the date on which the Investor receives the Put Shares in its brokerage account.

Principal

Market means any of the national exchanges (i.e. NYSE, NYSE AMEX, and Nasdaq), or principal quotation systems (i.e. OTCQX, OTCQB, and

OTC Pink), or other principal exchange or recognized quotation system which is at the time the principal trading platform or market for

the Common Stock.

The

number of shares to be sold by Mast Hill in this offering will vary from time-to-time and will depend upon the number of shares purchased

from us pursuant to the terms of the Equity Purchase Agreement.

We

are under no obligation to sell any shares under the equity line of credit and we may terminate the Equity Purchase Agreement at any

time by written notice to Mast Hill, except during any Valuation Period or at any time that the Investor holds any of the Put Shares.

In addition, this Agreement shall automatically terminate at the end of the Commitment Period.

We

will not receive any proceeds from the sale of the shares by Mast Hill. Mast Hill may resell the shares it acquires by means of this

prospectus from time to time in the public market. We are paying the costs of registering the shares offered by Mast Hill. Mast Hill

will pay all other costs of the sale of the shares which it may purchase from us. During the past three years neither Mast Hill nor its

controlling persons had any relationship with us, or our officers or directors.

The shares of common stock owned, or which may be acquired by Mast Hill, may be offered and sold by means of this prospectus from time

to time as market conditions permit in the over-the-counter market, or otherwise, at prices and terms then prevailing or at prices related

to the then-current market price, or in negotiated transactions. These shares may be sold by one or more of the following methods, without

limitation:

| • | a

block trade in which a broker or dealer so engaged will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases

by a broker or dealer as principal and resale by such broker or dealer for its account pursuant

to this prospectus; |

| • | ordinary

brokerage transactions and transactions in which the broker solicits purchasers; and |

| • | face-to-face

transactions between sellers and purchasers without a broker/dealer. |

In

competing sales, brokers or dealers engaged by Mast Hill may arrange for other brokers or dealers to participate. These brokers or dealers

may receive commissions or discounts from Mast Hill in amounts to be negotiated.

Mast

Hill is an “underwriter” and any broker/dealers who act in connection with the sale of the shares by means of this prospectus

may be deemed to be “underwriters” within the meaning of the Securities Acts of 1933, and any commissions received by them

and profit on any resale of the shares as principal might be deemed to be underwriting discounts and commissions under the Securities

Act. We haves agreed to indemnify Mast Hill against certain liabilities, including liabilities under the Securities Act as underwriters

or otherwise.

We

have advised Mast Hill that it and any securities broker/dealers or others who may be deemed to be statutory underwriters will be subject