Current Report Filing (8-k)

April 05 2016 - 2:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20509

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

March 7, 2016

Date of Report

(Date of earliest event reported)

FONU2 INC

.

(Exact name of registrant as specified

in its charter)

|

NEVADA

|

|

000-49652

|

|

65-0773383

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employee I.D. No.)

|

135 Goshen Road Ext., Suite 205

Rincon, GA 31326

(Address of Principal Executive Offices)

(912) 655-5321

Registrant's Telephone Number

N/A

Former name or former address, if changed

since last report

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.02 – Termination of a Material Definitive Agreement

On

April 4, 2016, The Company signed a termination agreement on a lease originally entered into on August 21, 2013, with the Effingham

County Industrial Development Authority (the “IDA”) to lease, approximately 1,560 acres of land located in Effingham

County, Georgia. This action was taken pursuant to a non-binding Memorandum of Understanding signed by the parties on October

30, 2015, which reduced the lease to 51 acres as well as the Company’s other obligations under the original agreement. The

Company is currently evaluating the new lease proposal from the IDA on the 51 acre parcel as well as other alternatives.

Item

2.03 - Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

Previously,

On January 19 2016, Moon River Studios (“the Company”) announced that it has entered into Film production and financing

agreements for the motion picture

Mara

(the “Film”)

.

On

March 24, 2016, initial funding was released to begin pre-production with principal photography expected to begin in mid April

2016. The Company will be providing the majority of the production services for the Film’s, including but not limited

to equipment rental, transportation, and post-production. In addition to the revenue generated by providing the Film services,

the Company expects to recoup its investment in the Film, as described below, plus a premium of Twenty Percent (20%). If

and/or when the Film reaches profitability, the Company shall receive profit participation of approximately twenty five percent

(25%) from all revenue streams of the Film on a global basis.

In

order to finance its investment in the Film, on January 6, 2016, the Company entered into a loan agreement by and among Hutton

Ventures LLC, a Delaware limited liability company (“Lender”), Moon River Rentals, LLC, formerly Studioplex City Rentals,

LLC, a Georgia limited liability company and Studioplex City Crews, Inc., a Georgia corporation (“Studioplex”) (together,

the “Borrowers”). Under the terms of the loan agreement, the Company shall receive two loans from the Lender

in the aggregate principal amount of up to $879,000, net of upfront costs of the Loan of approximately $800,000, to be used exclusively

for the production of the Film under the terms and conditions set forth in the loan agreement and the other loan documents. The

loans have an interest rate of eighteen percent (18%) per annum, and no conversion features.

Item

2.04 - Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement

The

Company is in default on several convertible notes due to a shortage of available share reserve and due to the company not being

current on its financial reporting. On March 31, 2016 the Company filed its 10K for year ending September 30, 2015 and management

is working diligently to ensure that the 10Q for quarter ending December 31, 2015 will be filed shortly.

Item

3.02 – Unregistered Sales of Equity Securities

On

March 7, 2016, the Company issued a Convertible note in the amount of $10,000 to LG Capital, which provides conversion features

equal to 55% of the lowest trading price of the Company’s common stock for the last 20 trading days prior to conversion,

as well as 8% per annum interest, and become due and payable on March 7, 2017. This issuance of shares was exempt under Section

4(a)(2) of the Securities Act.

On

March 7, 2016, the Company issued a Convertible note in the amount of $10,000 to SBI Investments, which provides conversion features

equal to 55% of the lowest trading price of the Company’s common stock for the last 20 trading days prior to conversion,

as well as 8% per annum interest, and become due and payable on March 7, 2017. This issuance of shares was exempt under Section

4(a)(2) of the Securities Act.

On

March 11, 2016, the Company issued a Convertible note in the amount of $13,000 to CareBourn Capital LP, which provides conversion

features equal to 55% of the lowest trading price of the Company’s common stock for the last 20 trading days prior to conversion,

as well as 12% per annum interest, and become due and payable on December 11, 2016. This issuance of shares was exempt under Section

4(a)(2) of the Securities Act.

As

of April 5, 2016, there are 847,689,235 common shares issued and outstanding.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

FONU2 INC., a Nevada corporation

|

|

|

|

|

|

Date: April 5, 2016

|

By:

|

/s/ Roger Miguel

|

|

|

|

Roger Miguel,

Chief Executive Officer

|

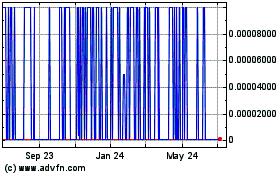

FONU2 (PK) (USOTC:FONU)

Historical Stock Chart

From Dec 2024 to Jan 2025

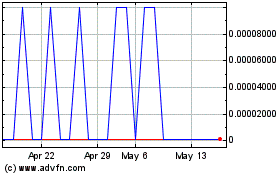

FONU2 (PK) (USOTC:FONU)

Historical Stock Chart

From Jan 2024 to Jan 2025