X10000310522falseFEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE00003105222024-12-202024-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2024

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

Fannie Mae

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Federally chartered corporation | 0-50231 | 52-0883107 | | 1100 15th Street, NW | | 800 | | 232-6643 |

| | | | Washington, | DC | 20005 | | | | |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) | | (Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 20, 2024, the Federal Housing Finance Agency (“FHFA”) released the 2025 Scorecard for Fannie Mae, Freddie Mac, and Common Securitization Solutions (the “2025 Scorecard”), which establishes corporate performance objectives for Fannie Mae, Freddie Mac, and Common Securitization Solutions for 2025.

A principal element of our 2025 executive compensation program (which is not applicable to our Chief Executive Officer) will be deferred salary, a portion of which will be subject to reduction, or “at-risk,” based on performance. We expect that one half of 2025 at-risk deferred salary for participating executives will be subject to reduction based on an assessment of the company’s performance against the 2025 Scorecard and additional objectives FHFA establishes. The 2025 Scorecard is set forth below.

2025 SCORECARD FOR FANNIE MAE, FREDDIE MAC, AND COMMON SECURITIZATION SOLUTIONS

For all Scorecard items, the Federal Housing Finance Agency (FHFA, the Conservator) will assess Fannie Mae and Freddie Mac (the Enterprises) and Common Securitization Solutions, LLC (CSS) based on the following criteria1:

Assessment Criteria

•Each entity’s products and programs foster liquid, competitive, efficient, and resilient housing finance markets that support affordable, sustainable, and equitable access to homeownership and rental housing.

•Each entity conducts business in a safe and sound manner.

•Each entity meets expectations under all FHFA requirements, including those pertaining to capital, liquidity, and credit risk transfer.

•Each entity continues to manage operations while in conservatorship in a manner that preserves and conserves assets through the prudent stewardship of resources.

•Each entity cooperates and collaborates with FHFA in developing plans, policies, and activities that align with the Conservator’s priorities and guidance, as well as with FHFA’s FAIR values (Fairness, Accountability, Integrity, and Respect).

•Each entity delivers work products that are high quality, thorough, creative, effective, and timely, while considering their effects on homeowners, multifamily property owners, renters, the Enterprises, the industry, the secondary mortgage market, and other stakeholders.

•Each entity prioritizes diversity, equity, and inclusion in all aspects of strategic planning, operations, and business development.

| | |

Promote Equitable Access to Affordable and Sustainable Housing (50%) |

Conduct business and undertake initiatives in a manner that supports affordable, sustainable, and equitable access to homeownership and rental housing, and fulfill all statutory mandates.

Take significant actions to ensure that borrowers and renters benefit from improvements to all stages of the mortgage lifecycle, including increased affordability in, and supply of, housing; greater efficiency in mortgage processes; enhanced resiliency of the Nation’s housing stock; and better sustainability in housing outcomes.

Affordability and Supply in Homeownership and Rental Housing

Efficiency in Mortgage Processes

Resiliency of the Nation’s Housing Stock

Sustainability in Housing Outcomes

Affordability and Supply

•Explore opportunities to support first-time homebuyers and homebuyers limited by wealth and income, by positively influencing affordability, including transaction costs, in a safe and sound manner.

•Reassess opportunities to positively affect housing supply.

1 The Enterprises will be assessed on all the criteria. CSS will be assessed on the criteria applicable to its operations.

•Reassess opportunities to improve liquidity for single-family small balance loan financing.

•Take meaningful actions to serve underserved communities.

•Manage new multifamily purchases to remain within the multifamily cap requirements, including a continued focus on workforce housing.

Efficiency

•Leverage data, technology, and other innovations to promote efficiency and cost savings in housing finance.

•Explore the benefits and risks of increased use of artificial intelligence and machine learning in the mortgage industry.

•Continue modernization of single-family property valuation processes and practices, including traditional appraisals and valuation alternatives.

•Work with industry stakeholders to improve loan quality and continue to harmonize processes and remedies that support the Single-Family Representations and Warranties Framework, including early identification of loan defects.

•Plan for implementation of the approved credit score models, informed by stakeholder outreach.

•Explore establishing aligned and consistent standards for multifamily borrowers to reduce risk of fraud.

Resiliency

•Continue research to monitor natural disaster/climate-related market developments; identify at-risk borrowers, properties, and communities; and inform policy.

•Disseminate research that enhances industry knowledge and consumer awareness of natural disaster/climate risk in housing.

•Continue to refine natural disaster/climate scenario analysis, building on refined inputs and data, increased modeling capacity, and industry best-practices.

Sustainability

•Identify opportunities to mitigate risk stemming from declining accessibility, availability, and affordability of property insurance.

•Assess the efficacy of the existing loss mitigation toolkit against various natural disaster scenarios to inform policy changes that further sustainable homeownership.

•Strengthen multifamily asset management capabilities and responsiveness to property condition issues.

•Enhance resident-centered practices, such as tenant protections, at Enterprise-backed multifamily properties.

| | |

Operate the Business in a Safe and Sound Manner (50%) |

Operate with heightened focus on safety and soundness and with a prudent risk profile consistent with continued support for housing finance markets throughout the economic cycle, while minimizing the risk to capital.

Ensure that the Enterprise is resilient to operational, market, credit, counterparty, economic, legal/litigation, and climate risks.

•Maintain effective risk management systems appropriate for entities to minimize risk to their capital as they rebuild their capital buffers.

•Take appropriate action to address risk exposure and enhance Enterprise counterparty risk controls.

•Strengthen risk management capabilities in identifying, assessing, controlling, monitoring, and reporting on climate risk and incorporate these capabilities into the overall Enterprise risk framework.

•Maintain the ability to respond to operational events without significant disruption to the primary or secondary mortgage market.

•Maintain liquidity at levels required by FHFA and sufficient to sustain the Enterprise’s operations through severe stress events.

•Oversee Enterprise operations and activities to promote consistency with the public interest and mitigate associated compliance risk.

•Develop and mature artificial intelligence/machine learning risk management activities that are appropriate for the Enterprise’s current and anticipated business needs.

Transfer a meaningful amount of credit risk to private investors in a commercially reasonable and safe and sound manner, reducing risk to taxpayers.

Ensure CSS operates in a safe and sound manner in support of Enterprise securitization activities.

Appendix A: Multifamily Definitions

1.Volume caps and review of market size

The 2025 Scorecard establishes a $73 billion cap on the multifamily purchase volume of each Enterprise, for a combined total of $146 billion applicable for calendar year 2025. Within this cap, certain loans in affordable and underserved market segments are considered “mission-driven.” The 2025 Scorecard requires that a minimum of 50 percent of an Enterprise’s multifamily loan purchases be mission-driven in accordance with the definitions herein. FHFA anticipates the $73 billion cap to be appropriate given current market forecasts. However, FHFA will continue to review its estimates of market size and mission-driven minimum requirements throughout the year. To prevent market disruption, if FHFA determines that the actual size of the 2025 market is smaller than initially projected, FHFA will not reduce the caps.

The following sections explain how FHFA will treat mission-driven loans for purposes of the 2025 Scorecard.

2. Loans on targeted affordable housing properties

Targeted affordable housing loans are loans on properties encumbered by a regulatory agreement or a recorded use restriction under which occupancy for all or for a portion of the units is reserved for tenants with limited incomes, and which restricts the rents that can be charged for those units. FHFA will classify as mission-driven a proportionate amount of each loan for properties in the targeted affordable category, depending on the percentage of units that are restricted by a regulatory agreement or recorded use restriction. FHFA will classify as mission-driven 50 percent of the loan amount if the percentage of restricted units is less than 50 percent of the total units in a project, and 100 percent of the loan amount if the percentage of restricted units is equal to or more than 50 percent.

The following are examples of loans on targeted affordable housing properties that FHFA will classify as mission-driven:

•Loans on properties subsidized by the Low-Income Housing Tax Credit (LIHTC) program, which limits tenant eligibility based on income levels required by LIHTC program rules;

•Loans on properties developed under state or local inclusionary zoning, real estate tax abatement, loan or similar programs, where the property owner has agreed to: (a) restrict a portion of the units for occupancy by tenants with limited incomes in accordance with the requirements of the state or local program and restrict the rents that can be charged for those units to rents affordable to those tenants; and (b) enforce these restrictions through a regulatory agreement or recorded use restriction;

•Loans on properties covered by a Section 8 Housing Assistance Payment contract where the contract limits tenant incomes to 80 percent of area median income (AMI) or below. FHFA will not consider a unit that is occupied by a Section 8 certificate or voucher holder as a targeted affordable housing unit unless there is also a contract, a regulatory agreement, or a recorded use restriction; and

•Loans on properties where a Public Housing Authority (PHA), or a nonprofit development affiliate of a PHA, is the borrower and where the regulatory agreement or recorded use restriction restricts all or a portion of the units for occupancy by tenants with limited incomes and/or restricts the rents that can be charged for those units.

On a case-by-case basis, FHFA will consider Enterprise requests to classify other loans as mission-driven that meet affordable housing and mission goals but do not meet the exact definition of targeted affordable housing. Requests may be submitted for consideration only after meeting with FHFA to discuss the request.

3. Loans to preserve affordability at workforce housing properties

Loans to preserve affordability at workforce housing properties may be exempt from the caps and classified as mission-driven if the property has units that are subject to either rent or income restrictions codified in loan agreements. FHFA will exempt from the volume cap the full loan amount of all loans where the loan agreements require a sponsor to preserve affordability, for at least 10 years or the term of the loan, at the “other affordable” market levels outlined below or that adhere to the standard of a state or local housing affordability initiative. Eligible loans on workforce housing properties may include those with financing from corporate-sponsored housing funds and initiatives that support affordable housing preservation. FHFA will classify as mission-driven 50 percent of the loan amount if the percentage of restricted units is less than 20 percent of the total units in a project, and 100 percent of the loan amount if the percentage of restricted units is equal to or more than 20 percent.

4. Loans on other affordable units

FHFA will classify as mission-driven those units — including conventional, small 5-50 unit, and seniors housing — whose rents are affordable to tenants at various income thresholds but that are not subject to a regulatory agreement or recorded use restriction. FHFA will count as mission-driven the pro rata portion of the loan amount based on the percentage of units with affordable, unsubsidized/market rents, as described below.

a. Loans on affordable units in standard markets

Standard markets are those that are not located in designated cost-burdened or very cost-burdened renter markets. For properties located in these markets, the income threshold for affordability is 80 percent of AMI or below.

b. Loans on affordable units in cost-burdened or very cost-burdened renter markets

In cost-burdened renter markets as designated by FHFA, the income threshold for affordability is 100 percent of AMI or below. In very cost-burdened renter markets as designated by FHFA, the income threshold for affordability is 120 percent of AMI or below.

5. Loans on properties located in rural areas

Rural areas are those areas designated as such in the Duty to Serve regulation. FHFA will classify as mission-driven, the pro rata portion of the loan amount based on the percentage of units affordable at 100 percent of AMI or below.

6. Manufactured housing community blanket loans

Loans to manufactured housing communities are blanket loans secured by the land and the rental pads. FHFA will classify as mission-driven the share of the loan amount of a manufactured housing community blanket loan that reflects the share that receives credit under the Duty to Serve regulation.

FHFA strongly encourages the adoption of tenant pad lease protections that meet or exceed those listed in the Duty to Serve regulation in all manufactured housing communities.

7. Loans to finance energy or water efficiency improvements

Loans to finance energy or water efficiency improvements are loans funded by the Enterprises under their own specialized financing programs for this purpose. For loans under the Fannie Mae Green Rewards and Freddie Mac Green Up and Green Up Plus loan programs, 50 percent of the loan amount will be classified as mission-driven if at least 20 percent but less than 50 percent of the unit rents are affordable at or below 80 percent of AMI, and 100 percent of the loan amount if the percentage of affordable units is equal to or more than 50 percent.

The renovations under the program (including subsequent program enhancements, as approved by FHFA) must project a minimum 15 percent reduction in annual whole property energy consumption and a minimum 15 percent reduction in annual whole property water and/or energy consumption. (Thus, a property projecting 30 percent energy consumption reduction would qualify for mission-driven credit, as would a property projecting 15 percent energy and 15 percent water consumption reduction, or 20 percent energy and 10 percent water consumption reduction.)

In addition, prior to Enterprise purchase, all Fannie Mae Green Rewards and Freddie Mac Green Up and Green Up Plus transactions must have a third-party data collection firm engaged for ongoing data collection for the life of the loan to receive mission-driven credit. This third-party firm can be funded by the borrower, the lender, or the Enterprise. FHFA will require specific data elements on all transactions where energy or water efficiency improvements are made for both Enterprises to determine the effectiveness of the programs in achieving policy outcomes, on an annual basis.

For loans funded under the Fannie Mae Green Building Certification program or the Freddie Mac Green Certified program, FHFA will classify as mission-driven 50 percent of the loan amount if at least 20 percent but less than 50 percent of the unit rents are affordable at or below 80 percent of AMI, and classify 100 percent of the loan amount if the percentage of affordable units is equal to or more than 50 percent.

8. Other Scorecard requirements

For purposes of reporting on loan and commitment activity under the 2025 caps, the Enterprises must: (a) use the definitions for determining unit affordability of seniors housing assisted living units, coop units, and shared living arrangements, including student housing, that are included in the housing goals regulation at 12 CFR 1282.1; (b) use affordability data as of the loan acquisition date; (c) report monthly to FHFA on their acquisition and commitment volumes using a reporting format defined by FHFA; and (d) report quarterly on their acquisition

volumes under the caps including detail on mission-driven loan purchases using a reporting format to be determined by FHFA.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | FEDERAL NATIONAL MORTGAGE ASSOCIATION |

| | |

| By | /s/ Thomas L. Klein |

| | Thomas L. Klein |

| | Enterprise Deputy General Counsel—Vice President |

Date: December 23, 2024

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

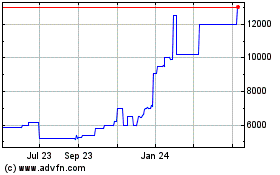

Federal National Mortgag... (PK) (USOTC:FNMFO)

Historical Stock Chart

From Dec 2024 to Jan 2025

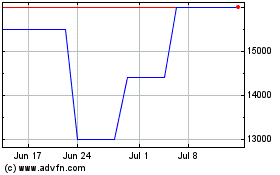

Federal National Mortgag... (PK) (USOTC:FNMFO)

Historical Stock Chart

From Jan 2024 to Jan 2025