FDCTech's Quarterly Release for the First Quarter (FY22 Q2) Results - The increase in revenue by 2,294.79% after the successful acquisition of AD Advisory Services Pty Ltd.

May 11 2022 - 9:15AM

InvestorsHub NewsWire

FDCTech's Quarterly Release for the First Quarter (FY22

Q2) Results

The increase in revenue by

2,294.79% after the successful acquisition of AD Advisory Services

Pty Ltd. The Company continues to build on its technology-driven

acquisition growth strategy and is confident that the recent market

correction may provide opportunities for more strategic acquisition

targets.

Irvine, CA -- May 11,

2022 -- InvestorsHub NewsWire -- FDCTech, Inc. ("FDC" or the

"Company,"

OTCQB:

FDCT), a fintech-driven

company specializing in buying and integrating small to mid-size

legacy financial services companies, today announced the following

results for the quarter ended March 31, 2022, as compared to the

corresponding period of last fiscal year:

- The revenues generated for the three

months ended March 31, 2022, and 2021 were $1,541,122 and $64,353,

respectively.

- The increase in revenue by 2,294.79%

results from the consolidation of AD Advisory Services Pty Ltd.

revenues.

- During the three months ended March

31, 2022, and 2021, the Company incurred a net loss of $389,196 and

$221,838.

- The cash on hand was $297,643 as of

March 31, 2022, compared to $93,546 on December 31, 2021. The

increase in cash on hand is mainly due to funds from issuing the

promissory note with a face value of $550,000.

- On March 31, 2022, the total

stockholders' equity was $1,515,708 compared with a total

stockholders' equity of $1,625,448 on December 31,

2021.

Outlook on Company's

Subsidiary – AD Advisory Services Pty Ltd.

AD Advisory Services Pty Ltd. (ADS)

is an Australian-regulated wealth management company with 20

offices, 28 advisors, and $530+ million in funds under advice. ADS

offers different licensing, compliance, and education solutions to

financial planners to meet the specific needs of their

practice.

SCHEDULE OF FINANCIAL

STATEMENTS

|

|

|

For the three months

ended

03/31/22(1)

(Unaudited)

|

|

|

Revenue, $

|

|

|

1,473,622

|

|

|

Cost of sales, $

|

|

|

1,314,956

|

|

|

Gross

Profit, $

|

|

|

158,666

|

|

|

(1)

|

Consolidated in the Company financial

statements.

|

ADS' revenues, cost of sales, and

gross profits for the three months ended March 31, 2022, were

$1,473,622, $1,314,956, and $158,666, respectively. ADS reported a

net profit of $30,098.

According to the Adviser Ratings 2022

Financial Advice Landscape Report, the median fees charged to

consumers seeking financial advice (Advised Clients) increased from

AUD$3,256 to AUD$3,529 a year, representing an 8% percent increase,

or 40% over the three years to December 2021. The demand for advice

remains steady as 29% of Australians desire professional advice;

however, the affordability for consumers seeking professional

advice is decreasing. The Company believes that the market timing

is right to develop (or acquire), market, and launch a digital

wealth management solution to cover investments, retirement,

insurance, and estate planning end-to-end solutions.

Update of NFT Marketplace and

Condor Investing & Trading App

The Company is developing the Condor

Investing & Trading App, a simplified trading platform for

traders with varied experiences in trading stocks, ETFs, and other

financial markets from their mobile phones. The Company expects to

test the App with the live field by the end of June 30, 2022 and

expects to commercialize the App soon after completing the

guaranteed test run.

The Company is developing NFT

Marketplace, a decentralized NFT peer-to-peer marketplace on the

Ethereum blockchain with an option to add multichain. The Company

expects to commercialize the NFT Marketplace by the end of the

second quarter of the fiscal year ended December 31,

2022.

Please visit

our SEC filings or Company's website for more information

on the full results and management's plan.

AD Advisory Services Pty

Ltd.

AD Advisory Services Pty Ltd. – AFSL

No. 237058, an independent specialist dealer group, provides

licensing solutions for select education and compliance-focused

financial advisors & accountants. ADS has a dedicated

management team are qualified financial planners that service metro

and regional practices around Australia.

FDCTech, Inc.

FDCTech, Inc. ("FDC") is a US-based,

fully integrated financial technology company. FDC specializes in

buying and integrating small to mid-size legacy financial services

companies. FDC develops and delivers a full suite of technology

infrastructure solutions to forex, crypto, wealth management, and

other future-proof financial sectors.

Press Release Disclaimer

This press release's statements may

be forward-looking statements or future expectations based on

currently available information. Such statements are naturally

subject to risks and uncertainties. Factors such as the development

of general economic conditions, future market conditions, unusual

catastrophic loss events, changes in the capital markets, and other

circumstances may cause the actual events or results to be

materially different from those anticipated by such statements. The

Company does not make any representation or warranty, express or

implied, regarding the accuracy, completeness, or updated status of

such forward-looking statements or information provided by the

third party. Therefore, in no case whatsoever will Company and its

affiliate companies be liable to anyone for any decision made or

action taken in conjunction with the information and/or statements

in this press release or any related damages.

Contact Media

Relations

FDCTech, Inc.

info@fdctech.com

www.fdctech.com

+1 877-445-6047

200 Spectrum Center Drive, Suite

300,

Irvine, CA, 92618

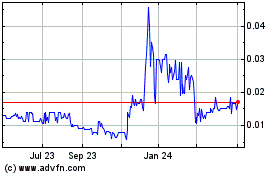

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Dec 2024 to Jan 2025

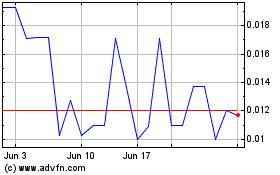

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Jan 2024 to Jan 2025