As

filed with the Securities and Exchange Commission on December 19, 2022

Registration

No. 333-265817

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No. 2

to

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

EOM

PHARMACEUTICAL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware

|

|

2834 |

|

93-1301885 |

| (State

or other jurisdiction of |

|

(Primary

Standard Industrial |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Classification

Code Number) |

|

Identification

Number) |

136

Summit Avenue

Montvale,

NJ 07645

Telephone:

(201) 351-0605

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Eli

Goldberger

Chairman

and Chief Operating Officer

136

Summit Avenue

Montvale,

NJ 07645

Telephone:

(201) 351-0605

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

copies to:

Louis

A. Brilleman, Esq.

1140

Avenue of the Americas, 9th Floor

New

York, NY 10036

(212)

537-5852 |

|

Jeffrey

Fessler, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10112

(212)

653-8700 |

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box: ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

DECEMBER 19, 2022 |

EOM

PHARMACEUTICAL HOLDINGS, INC.

____________

Shares of Common Stock

This

is a firm commitment underwritten public offering of common stock, par value $0.0001 per share (“Common Stock”) of EOM Pharmaceutical

Holdings, Inc., a Delaware corporation. We expect the public offering price of our Common Stock to be between [$.00 and $.00]

per share.

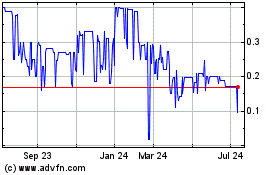

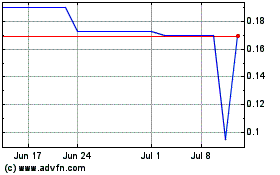

Our

Common Stock is currently traded on the Pink Sheets of the OTC Markets under the symbol “IMUC.” As of December 16,

2022, the reported closing price of our Common Stock as quoted on the Pink Sheets was $0.81 per share.

We

have applied to list our Common Stock on The Nasdaq Capital Market under the symbol “EOM.”

The

offering price of the Common Stock will be determined between us and EF Hutton, division of Benchmark Investments, LLC, the representative

of the underwriters in connection with this offering, taking into consideration our historical performance and capital structure, prevailing

market conditions, and overall assessment of our business, and will not be based upon the price of our common stock on the Pink Sheets

of the OTC. Therefore, the assumed public offering price of the Common Stock used throughout this prospectus may not be indicative of

the actual public offering price for our Common Stock.

Investing

in our securities involves a high degree of risk. Before buying any of our securities, you should carefully read the discussion of the

material risks of investing in our securities under the heading “Risk Factors” beginning on page 11 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| |

|

Per

Share |

|

|

Total |

|

| Public

offering price |

|

$ |

|

|

|

$ |

|

|

| Underwriting

discounts and commissions (1) |

|

$ |

|

|

|

$ |

|

|

| Proceeds

to us, before expenses |

|

$ |

|

|

|

$ |

|

|

| (1) |

We

refer you to “Underwriting” beginning on page 98 of this prospectus for additional information regarding underwriting

compensation. |

We

have granted the underwriters a 45-day option to purchase up to ____ additional shares, solely to cover over-allotments, if any (the

“Over-Allotment Option”). If the underwriters exercise the Over-Allotment Option in full, the total underwriting discounts

payable by us will be $_____ and the total proceeds to us, before expenses, will be $ ______.

The

underwriters expect to deliver the securities against payment to the investors in this offering on or about _____, 2023.

Sole

Book-Running Manager

EF

HUTTON

division

of Benchmark Investments, LLC

The

date of this prospectus is ____________, 2023

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize

to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained

in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only

be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this

prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results

of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where

the offer is not permitted.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our Common Stock, you should carefully read this entire prospectus, including

our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless

the context otherwise requires, references to “we,” “our,” “us,” in this prospectus mean EOM Pharmaceutical

Holdings, Inc., a Delaware corporation, and its wholly owned subsidiary, EOM Pharmaceuticals, Inc.

Our

Company

We

are a clinical-stage pharmaceutical company focused on the development of novel therapeutics and delivery technologies for the treatment

of inflammatory conditions and ocular diseases. Our development pipeline consists of multiple programs and clinical indications at various

stages of development. Our portfolio currently consists of two product candidates: EOM613 and EOM147.

EOM613

EOM613

is an investigational, dynamically dual-acting immunomodulator. EOM613 is a peptide-nucleic acid solution and, based on past clinical

data published by third parties, that we believe to have both an anti-inflammatory and pro-inflammatory effect at the site of

cytokine and chemokine overactivity, and a pro-inflammatory effect when needed. EOM is designed to counteract the most severe inflammatory

effects of viruses, such as a cytokine storm or hyperimmune response following infection with the novel coronavirus that cause COVID-19,

autoimmune attacks that cause joint damage and pain associated with rheumatoid arthritis and gastrointestinal disorders, and chemokine-related

body-wasting syndromes such as cachexia. In human cell culture studies, EOM613 demonstrated a “dynamic dual action” by suppressing

or stimulating monocytes and macrophages depending on the activation state and environment of those key immune cells. We believe that

this dynamic dual action may overcome a limitation of many approved immunomodulators that only reduce the inflammatory state, without

achieving total immune system balance. EOM613 has a development program as supported by multiple exploratory previous clinical stage

data across multiple therapeutic applications associated with hyperimmune responses, including cachexia associated with HIV/AIDS or cancer

and rheumatoid arthritis. The current open-label trial for COVID-19 in Brazil for EOM613 meets the regulatory Phase 1/2a clinical trial

requirements of the Comissao Nacional de Etica em Pesquisa and the Brazilian regulatory body ANVISA. However, additional, larger Phase

2 placebo-controlled trials will be required for the further clinical development of EOM613 in the United States.

Our operating subsidiary,

EOM Pharmaceuticals, Inc., commenced its current operations in March 2020. Since that date, we have been conducting a clinical trial

in Brazil, as well as pre-clinical animal studies. We have also been performing additional research and development through contract

research organizations for both our product candidates EOM613 and EOM147. In addition, we have been seeking sources of additional capital

to further our research and development efforts along with future clinical trials.

We

believe that EOM613 may be used as a therapy for the following diseases:

Severe

Effects of Infectious Disease, Including COVID-19

COVID-19

is a highly infectious and potentially fatal disease. According to WHO, as of June 17, 2022, it has caused over 6.3 million

deaths and over 500 million cases worldwide. Research shows that cytokine storms are highly correlated with mortality in COVID-19.

Aggressive inflammatory responses such as cytokine storms can lead to acute respiratory distress syndrome (ARDS), which is a cause of

death in 70% of fatal COVID-9 cases.

Chemokine-Related

Body Wasting Syndromes: Cancer Cachexia

Cachexia

is a wasting syndrome that causes loss of weight, body fat, muscle mass, and appetite due to a chronic disease, such as cancer. It results

in weakness, fatigue, malnourishment, and can be life-threatening. It is caused principally by chemotherapy and radiation treatments.

Cancer cachexia affects approximately 50% of all cancer patients. Cancer cachexia is caused by a combination of decreased nutritional

intake and altered metabolism and is defined as ongoing loss of skeletal muscle mass that cannot be reversed by conventional nutritional

support. It is characterized by progressive functional impairment and contributes to more than 20% of cancer deaths. Since around 50%

of patients with malignant disease cannot be cured and more than 80% of advanced cancer patients experience cachexia, the toll of this

condition is severe both for society and the individual patient. The pathogenesis of cancer cachexia is highly dependent on the patient’s

immune response. Inflammatory cytokines and pro-cachectic factors induce muscle degradation even in the face of adequate nutrition. The

prevalence of cachexia is as high as 87% in patients with pancreatic and gastric cancer, 61% in patients with colon, lung, and prostate

cancer and non-Hodgkin lymphoma, and 40% in breast cancer, sarcoma, leukemia, and Hodgkin lymphoma. There are no approved cancer cachexia

therapies.

Autoimmune

Diseases: Rheumatoid Arthritis

Rheumatoid

arthritis (RA) is a debilitating chronic autoimmune disease that affects the joints, connective tissues, muscle, tendons, and fibrous

tissue, and causes pain and deformity. The World Health Organization estimates that more than 23 million people, mostly women, live with

RA.

EOM147

EOM

147 is an investigational, broad-spectrum aminosterol with a novel intracellular mechanism for the treatment of retinal diseases. Based

on prior clinical data, we believe that EOM147 can affect multiple angiogenic growth factors such as VEGF, PDGF, and bFGF. This mechanism

of action is differentiated from other retinal therapies that are only anti-VEGF and administered as an intraocular injection. The novel

formulation, administered as an eye drop, represents a potential breakthrough that does not require intraocular injection. EOM147 is

being developed as a proprietary, newly reformulated eye drop, containing a steroid-polyamine conjugate compound with broad-spectrum

antimicrobial activity and anti-angiogenic activity. We believe that EOM147 may be used as therapy for retinal diseases, including retinal

tear, retinal detachment, diabetic retinopathy, epiretinal membrane, macular hole, macular degeneration, and retinitis pigmentosa, all

of which affect the vital tissue of the eye and can lead to blindness.

Age-Related

Macular Degeneration (AMD)

Age-related

macular degeneration is an eye disease that can blur the sharp, central vision needed for activities like reading and driving. “Age-related”

means that it often happens in older people. “Macular” means it affects a part of the eye within the retina called the macula.

AMD is a common condition and a leading cause of vision loss for people age 50 and older. Although AMD does not necessarily cause complete

blindness, it does impact central vision that can make it harder to see faces, drive, or do close-up work like cooking or fixing things

around the house. The National Eye Institute estimates that by 2050, the number of people with AMD in the U.S. is expected to double

from 2.07 million (2010) to 5.44 million. According to the Bright Focus Foundation, the number of people living with some form of macular

degeneration is expected to reach 196 million worldwide by 2020 and increase to 288 million by 2050. There is no current therapeutic

treatment for dry macular degeneration, but certain vitamin and mineral supplements may delay progression of the disease. Wet macular

degeneration is often treated by eye injections of anti-VEGF medicines, which inhibit the abnormal growth of blood vessels. A type of

laser treatment called photodynamic therapy also can be used to help break down the extra blood vessels in the back of the eye.

Diabetic

Retinopathy (DR):

Diabetes

is the leading cause of new cases of blindness in adults. About 1 in 3 people with diabetes have Diabetic Retinopathy, affecting almost

one-third of adults over age 40 years with diabetes, and more than one-third of African-Americans and Mexican Americans. According to

the Centers for Disease Control and Prevention, diabetic retinopathy affects 7.7 million Americans, and that number is projected to increase

to more than 14.6 million people by 2030. The most common diabetic eye disease and a leading cause of blindness in American adults, diabetic

retinopathy is caused by changes in the blood vessels of the retina due to excess sugar in the bloodstream. Currently, diabetic retinopathy

is typically treated by shrinking abnormal blood vessels in the eye with laser therapy, by surgically evacuating and replacing fluid

in the eye (vitrectomy), or by injecting anti-VEGF medicines into the eye.

Retinal

Vein Occlusions (RVOs)

Retinal

vein occlusions are blockages of the small veins that carry blood away from the retina. Such compromised blood flow can cause reduction

in blood flow, causing sudden blurred vision and blind spots in the center of one’s visual field. The persistent build-up of blood

in the retina, particularly in the macular area can cause substantial vision loss. Retinal vein occlusions are of two types- central

retinal vein occlusions (CRVOs), which are caused by the blockage of the main retinal vein, and branch retinal vein occlusions (BRVOs),

which affect one or more of the smaller branch veins from the main retinal vein. There is no current cure for retinal vein occlusions;

laser treatment or repeated treatments with intravitreally injected anti-VEGF agents is most often used in the treatment in order to

reduce the levels of macular edema. An estimated 20 million or more people currently suffer from RVOs worldwide.

We have generated no revenues, have incurred operating

losses since inception, and expect to continue to incur significant operating losses for the foreseeable future and may never become

profitable. For the nine-months ended September 30, 2022 and for the year ended December 31, 2021, we incurred net losses

from operations of approximately $2,200,000 and $2,600,000, respectively. In addition, for the nine-months ended September

30, 2022 and for the year ended December 31, 2021, we incurred negative cash flows from operating activities of approximately

$1,900,000 and $2,300,000 respectively. We expect to incur substantial losses for the foreseeable future, which will continue

to generate negative net cash flows from operating activities, as we continue to pursue research and development activities and the pre-clinical

and clinical development of our primary product candidates, EOM613 and EOM147. As of September 30, 2022, we had cash of $551,176,

a deficit in working capital (defined as current assets less current liabilities) of $20,254 and an accumulated shareholders’

deficit of $8,784,373. The Company’s primary sources of cash have included the issuance of a related

party bridge note facility, and the issuance of convertible promissory notes to related and unrelated parties.

These

factors, among others including the lengthy and costly drug development and regulatory approval process, raise substantial doubt as to

our ability to obtain additional debt or equity financing and our ability to continue as a going concern as described in the footnotes

to our September 30, 2022 unaudited interim condensed consolidated financial statements. Until such time as we are able to establish

a revenue stream from the sale of our therapeutic products, we are dependent upon obtaining necessary equity and/or debt financing to

continue operations. We cannot make any assurances that sales of our drug products will commence in the near term or that additional

financings will be available to us and, if available, on acceptable terms or at all.

To date, we have been funded primarily

by the family of Eli Goldberger, our Chairman and Chief Operating Officer, through a Bridge Note Facility in the amount of approximately

$1.5 million and the issuance of a Convertible Promissory Note in the amount of up to $5 million. To date, Mr. Goldberger’s father

has loaned us $2,751,399 through these two instruments. Under the terms of the Convertible Promissory Note, we have the right

to prepay up to 25% of the principal amount of the outstanding balance in the event we receive gross proceeds of no less than $10 million

from the sale of our common stock. We intend to repay approximately $688,000 out of the net proceeds of this offering. To date,

we have also raised $910,000 from an unrelated party through the issuance of two-year Mandatory Convertible Notes. The Mandatory Convertible

Notes require interest to be paid semi-annually at a 5% rate and are mandatorily convertible into our common stock at a 20% discount

to a underwritten public offering of our common stock resulting in gross proceeds to the Company in an amount of no less than $10 million.

There

can be no assurance that the Goldberger family will continue to fund our operations on favorable terms or at all or that we will be

successful in raising additional funds. Moreover, there can be no assurance that we will be able to secure the necessary third-party

debt or equity financings to continue our drug development, pre-clinical and clinical trial plans at all or on terms acceptable to us.

This could negatively impact our business and operations and could also lead to the reduction of our business and drug development operations.

We

intend to raise such additional capital through a combination of private and public equity offerings, debt financings, government funding

arrangements, strategic alliances or other sources. However, if such financing is not available at adequate levels and on a timely basis,

or such agreements are not available on favorable terms, or at all, as and when needed, we will need to reevaluate our operating plan

and may be required to delay or discontinue the development of one or more of our product candidates or operational initiatives. We expect

that our cash as of September 30, 2022 will be insufficient to fund our projected operations for the next twelve months and accordingly,

we are in the process of attempting to raise additional equity and/or debt funds to continue our operations through the end of 2023

and beyond.

Our

Competitive Strengths

We

believe that we possess a number of competitive strengths that position us to become a leading biopharmaceutical company focused on inflammatory

and immune-related diseases as well as retinal diseases, including:

| |

● |

Our

technology

and drug development capabilities. EOM613 and predecessor formulations have been explored

in several human studies and have shown potential in the treatment of diseases

such as rheumatoid arthritis. The present Phase 1/2a study in COVID-19 patients in Brazil

is generating important information on cytokines and the effect of EOM613 treatment on the

levels of these cytokines and the relevance to clinical effects. This information will increase

our knowledge of EOM613’s Mechanism of Acton and the relevance to various therapeutic

areas. However, additional, larger Phase 2 placebo-controlled trials will be required

for the further clinical development of EOM613 in the United States.

EOM147

represents a different and potentially safer mode of application of well accepted VEGF type treatments for Age Related Macular

Degeneration (AMD). |

| |

|

|

| |

● |

Pipeline addressing

large markets. By initially targeting large markets that have significant medical needs, we believe that we can drive adoption

of new products and improve our competitive position. For example, we believe that our immunomodulator lead asset, EOM613, a peptide

nucleic-acid solution with dual mechanism of action (both anti-inflammatory and pro-inflammatory) will be a cost-effective

therapeutic approach to aid millions in not only managing the symptoms of cancer cachexia and rheumatoid arthritis but in COVID-19

and other viral diseases. Moreover, the ease of administering EOM147 via an at-home eyedrop solution as opposed to a monthly

intraocular injection at a certified ophthalmologist, will ease the burden of millions of people suffering from Aged Related Macular

degeneration, diabetic retinopathy and other debilitating retinal diseases. These diseases can have significant effects on

patients’ quality of life and save employers from significant workplace-related costs and limitations. |

| |

|

|

| |

● |

Experienced

leadership. Our leadership team possesses core capabilities in infectious diseases, cancer cachexia, retinal diseases, drug development,

chemistry, manufacturing and controls, and finance. In addition to our internal capabilities, we have also established a network

of key opinion leaders, contract research organizations, contract manufacturing organizations and consultants. As a result, we believe

we are well positioned to efficiently develop novel treatments for inflammatory and immune-related diseases. Nevertheless, we

only recently commenced operations, never received approval for any IND, NDA or comparable foreign regulatory filing and may never

receive any such approval. Moreover, we may not be successful in obtaining market approval for any of our drug candidates. |

Our

Business Strategy

Our

business strategy is to develop and commercialize innovative drug products that address medical needs for large markets with limited

competition.

Our

mission is to Rescue, Repair, and RestoreTM health in patients suffering from debilitating and life threatening diseases.

EOM Pharmaceuticals was founded with a specific vision to pursue innovative approaches to address some of today’s medical needs.

We believe our investigational products have mechanisms of action that may transform the therapeutic paradigm of debilitating diseases

such as the hyperimmune effects in patients with severe COVID-19, cancer cachexia, rheumatoid arthritis, and inflammatory conditions

of the retina characterized by a breakdown of the blood-retinal barrier.

Key

elements of our strategy include:

| ● |

Advance

EOM613 clinical development in the U.S. for cancer cachexia |

| ● |

Conduct

an exploratory study in the U.S. for EOM613 in rheumatoid arthritis |

| ● |

Advance

EOM147 clinical development for diabetic retinopathy in initial clinical trials ex-USA, and retinal vein occlusions in

US clinical trials |

| ● |

Build

out a commercialization organization and if approved, commercialize EOM613 in the United States |

| ● |

Pursue

market opportunities for EOM613 outside the United States |

| |

● |

Develop

EOM613 as a cost-effective therapy for Cancer Cachexia and Rheumatoid Arthritis. We are applying our expertise in immune modulation

and inflammation therapies, and clinical trial management, to develop EOM613 as a potential cost-effective treatment for Cancer Cachexia

and Rheumatoid Arthritis. Based on multiple prior clinical trials, such as exploratory trials in cancer cachexia in the United States

and Canada concluded in 2013, and a trial in rheumatoid arthritis conducted in Argentina a decade prior, we believe EOM613 presents

a strong development program. Based on these positive past clinical trial results and the results of additional and ongoing

animal studies conducted during the latter half of 2022 we are evaluating opportunities to apply, as applicable, for expedited

regulatory review programs, which could potentially lead to faster clinical development and commercialization timelines. In general,

any IND application is subject to a lengthy regulatory review. Although under limited circumstances, drug candidates may be approved

for the FDA’s fast-track approval program, we can provide no assurance that our drug candidates will be approved for the fast-track

approval program, or that if approved, we will successfully complete the review process of EOM613 on an accelerated basis, if at

all. |

| |

|

|

| |

|

We

are in the process of initiating all the necessary IND-enabling preclinical safety pharmacology studies and toxicology studies that

would enable us to proceed into new Phase II clinical trials in cancer cachexia and/or rheumatoid arthritis. We are conducting these

studies with CROs. We are also conducting studies using established animal models of cancer cachexia and rheumatoid arthritis

that simulate human disease, whose results are typically evaluated by the FDA as well. We expect that these animal studies will also

enable us to elucidate the pharmacological mechanisms of action of EOM613 and correlate them with previously established laboratory

cell culture studies. We expect these studies to be concluded by the second quarter of 2023, at which time we expect

to have selected at least one of these disease states to conduct an initial Phase I/II clinical trial, based on a thorough evaluation

of the animal data. At that point we intend to seek a pre-IND meeting with the FDA in preparation of filing an IND application, with

the intent of commencing a trial in the chosen clinical indication in the fourth quarter of 2023. |

| |

|

|

| |

● |

Establish

EOM147 as the leading treatment for chronic and debilitating retinal diseases. Our goal is to obtain regulatory approval for

EOM147 and commercialize EOM147 for use in the treatment of chronic retinal disease including Age Related Macular degeneration, diabetic

retinopathy among other angiogenic retinal disorders. Based on previous early-stage clinical trial results in which patients treated

with EOM147 experienced meaningful improvements of their symptoms with minimal side effects, we plan on conducting additional research

and development to improve our drug therapy and initiate a confirmatory Phase 2b clinical study evaluating EOM147 in chronic retinal

disease patients starting in the second quarter of 2024. Because our drug delivery method is via non-invasive eyedrops

rather than an intraocular injection directly into the eye, we believe our novel delivery application along with positive past trials

results will improve vision outcomes beyond that achieved with current standard of care. We are developing a new synthetic procedure

for the manufacture of the Squalamine Lactate active pharmaceutical ingredient of EOM147 eye drops and conducting the development

of novel formulations with potentially enhanced retinal uptake, based on our proprietary technology. We plan on establishing a commercial

cGMP manufacturing process for the novel formulations and evaluating the new eye drop formulations in rabbit eye studies at a preclinical

testing CRO site. We intend to conduct the FDA-required rabbit eye toxicology studies as well as studies measuring the drug uptake

into the rabbit eyes’ retinas from the front of the eye administration using specialized techniques of measuring the drug uptake

and concentration in the ocular tissues These studies are expected to be completed by the second or third quarter of 2023. We currently

envision initial ex-US clinical trials in diabetic retinopathy and in wet-AMD in India and Mexico and confirmatory investigator-sponsored

trials in the US for treatment of retinal vein occlusions and macular edema secondary to proliferative diabetic retinopathy. |

| |

|

|

| |

● |

Maximize

our current portfolio opportunity by expanding use across multiple indications. We aim to expand our current drug portfolio to

treat multiple diseases. Our assets are designed to modulate pathways that are implicated across a number of immune and inflammatory

conditions. We plan on developing future proof-of-concept clinical studies of EOM613 as a potential treatment for patients with a

number of autoimmune gastrointestinal disorders as well as disorders affecting the central nervous system. |

| |

|

|

| |

● |

In-license

promising product candidates. We are applying our cost-effective development approach to advance and expand our pipeline. Although

we currently rely on a limited number of candidates, our long- term objective is to maintain a well-balanced portfolio with product

candidates across various stages of development. In general, we seek to identify product candidates and technology that represent

a novel therapeutic approach, are supported by compelling science, target a medical need, and provide a meaningful commercial

opportunity. We do not currently intend to invest significant capital in basic research, which can be expensive and time-consuming.

|

| |

|

|

| |

● |

Maximize

our current portfolio opportunity by expanding use across multiple indications. We aim to expand our current drug portfolio to

treat multiple diseases. While we believe our assets are designed to modulate pathways that are implicated across a number of immune

and inflammatory conditions, we currently only have a limited number of product candidates. We plan on developing future proof-of-concept

clinical studies of EOM613 as a potential treatment for patients with a number of autoimmune gastrointestinal disorders as well as

disorders affecting the central nervous system.

|

Corporate

History

We

filed our original Certificate of Incorporation with the Secretary of State of Delaware on March 20, 1987, under the name Redwing Capital

Corp. On June 16, 1989, we changed our name to Patco Industries, Ltd. and conducted an unrelated business under that name until 1994.

On January 30, 2006, we amended our Certificate of Incorporation to change our name to Optical Molecular Imaging, Inc. On November 2,

2006, we amended our Certificate of Incorporation to change our name to ImmunoCellular Therapeutics, Ltd.

On

December 1, 2021, we completed the acquisition of EOM Pharmaceuticals, Inc., a Delaware corporation. The transaction was accounted for

as a reverse merger, with EOM Pharmaceuticals, Inc. deemed to be the accounting acquirer and ImmunoCellular Therapeutics Ltd. deemed

to be the legal acquirer. As such, the consolidated financial statements herein reflect the historical activity of EOM Pharmaceuticals,

Inc. since its inception on March 27, 2020.

On

November 7, 2022, we amended our Certificate of Incorporation to change our name to EOM Pharmaceutical Holdings, Inc. to reflect

the acquisition of EOM Pharmaceuticals, Inc. and the new direction of our business.

Our

Corporate Information

Our

principal executive offices are located at 136 Summit Avenue, Suite 100 Montvale, NJ 07645, and our telephone number at that address

is (201) 351-0605.

Our

Team

We

have assembled an experienced management team and board of directors (the “Board of Directors”) to pursue innovative

approaches to solving the problems of urgent and medical needs. EOM is led by an accomplished team with a deep legacy in multiple therapeutic

areas and drug development.

Our

Founder, Chairman and Chief Operating Officer, Eli Goldberger, is a successful entrepreneur, focusing on advancing innovations in pharmaceuticals,

women’s health and energy. Our Chief Executive Officer, Irach Taraporewala, PhD., is a highly seasoned pharmaceutical company executive

with specific experience in leadership of start-up pharmaceutical companies and over 25 years of experience in drug development and regulatory

strategy. Our Chief Scientific Officer and Medical Director, Shalom Hirschman, M.D., has had a long and illustrious career as an academic

physician, research scientist, educator, biotechnology entrepreneur and consultant. A graduate of the Albert Einstein College of Medicine,

Dr. Hirschman served as intern and resident in medicine at The Massachusetts General Hospital of the Harvard Medical School followed

by years of conducting research in molecular biology at the National Institutes of Health in Bethesda, MD. He joined the faculty of The

Mount Sinai School of Medicine where he was Director of the Division of Infectious Diseases and Professor of Medicine. Our Chief Financial

Officer, Wayne Danson, a former partner in multiple Big 4 public accounting firms and accomplished C level executive, has over 35 years

of experience in international and corporate taxation, financial advisory services including investment banking, and mergers and acquisitions,

business strategy, and entrepreneurship.

Nevertheless,

the Company has never submitted an IND, NDA or comparable foreign regulatory filing and may not be successful in obtaining market approval

for any product candidate.

Summary

of Risks Associated with Our Business

Our

business and an investment in our company is subject to numerous risks and uncertainties, including those highlighted in the section

titled “Risk Factors” immediately following this prospectus summary. Some of these risks include:

| |

● |

We

are a pre-revenue company with a limited operating history. Since inception, we have incurred significant operating losses. At September

30 2022, we had an accumulated deficit of approximately $8.8 million; |

| |

|

|

| |

● |

We

will need substantial additional funding to finance our operations through regulatory approval of one or more of our product candidates.

If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs

or commercialization efforts; |

| |

|

|

| |

● |

To

date, we have been primarily funded by the Goldberger family. Eli Goldberger is our co-founder, Chairman, Chief Operating

Officer and largest stockholder. There can be no assurance that the Goldberger family will continue to fund our operations on favorable

terms, if at all. We currently expect to use $688,000 of the net proceeds from this offering to repay approximately 25% of

the principal on the outstanding promissory note issued to a member of the Goldberger family. |

| |

|

|

| |

● |

We

are entirely dependent on the success of our drug product candidates. If we are unable to obtain regulatory approval or commercialize

one or more of these experimental treatments, or experience significant delays in doing so, our business will be materially harmed; |

| |

|

|

| |

● |

The FDA might not allow us to pursue the Section 505(b)(2)

pathway for EOM613 and EOM147 and, if so, we may be unable to meet our anticipated development and commercialization timelines and

may be unable to generate the additional required data at a reasonable cost; |

| |

|

|

| |

● |

We

may not be able to successfully develop or commercialize our existing drug product candidates or develop new drug product candidates

on a timely or cost-effective basis; |

| |

|

|

| |

● |

Our

business may be negatively affected by the ongoing COVID-19 pandemic; |

| |

● |

We

depend on a limited number of drug product candidates and our business could be materially adversely affected if one or more of our

key drug product candidates do not perform as well as expected and do not receive regulatory approval; |

| |

|

|

| |

● |

We

may be in the future, a party to legal proceedings that could result in adverse outcomes; |

| |

● |

Our

competitors and other third parties may allege that we are infringing their intellectual property, forcing us to expend substantial

resources in resulting litigation, and any unfavorable outcome of such litigation could have a material adverse effect on our business; |

| |

|

|

| |

● |

We

may experience failures of or delays in clinical trials which could jeopardize or delay our

ability to obtain regulatory approval and commence product commercialization;

|

| |

● |

We

face intense competition from both brand and generic companies who have significant financial

resources which could limit our growth and adversely affect our financial results;

|

| |

● |

Our

employees, principal investigators, consultants and commercial partners may engage in misconduct or other improper activities, including

noncompliance with regulatory standards and requirements and insider trading, which could cause significant liability for us and

harm our reputation. |

| |

|

|

| |

● |

We

will be competing against large existing well-funded pharmaceutical companies with existing and proposed competing products. |

| |

|

|

| |

● |

We

are subject to extensive governmental regulation and we face significant uncertainties and potentially significant costs associated

with our efforts to comply with applicable regulations; |

| |

|

|

| |

● |

We

may not be able to develop or maintain our sales capabilities or effectively market or sell our products; |

| |

|

|

| |

● |

Manufacturing

or quality control problems may damage our reputation, require costly remedial activities or otherwise negatively impact our business; |

| |

|

|

| |

● |

Our

profitability may depend on coverage and reimbursement by third-party payors including government agencies, and healthcare reform

and other future legislation may lead to reductions in coverage or reimbursement levels; |

| |

|

|

| |

● |

We

face risks related to health epidemics and outbreaks, including the COVID-19 pandemic, which could significantly disrupt our preclinical

studies and clinical trials, research activities and therefore our receipt of necessary regulatory approvals could be delayed or

prevented; |

| |

|

|

| |

● |

We do not currently own any patents and our technology

is largely based on expired patents. If we are unable to obtain and maintain patent protection for our product candidates we may

develop, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize

products and technology similar or identical to ours, and our ability to successfully commercialize our products we may develop may

be adversely affected; |

| |

|

|

| |

● |

We

currently, and may in the future need to, license certain intellectual property from third parties, and such licenses may not be

available or may not be available on commercially reasonable terms; |

| |

|

|

| |

● |

We

may not identify relevant third-party patents or may incorrectly interpret the relevance, scope or expiration of a third-party patent,

which might adversely affect our ability to develop, manufacture and market our products and product candidates; |

| |

|

|

| |

● |

If

we fail to comply with our obligations under any of our third-party agreements, we could lose license rights that are necessary to develop

our product candidates;

|

| |

|

|

| |

● |

Our

future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel; and |

| |

|

|

| |

● |

After

this offering, our directors, executive officers and certain stockholders (one of which is an affiliate of our Founder and Chief

Operating Officer) will continue to own a majority of our common stock and, if they choose to act together, will be able to exert

absolute control over matters subject to stockholder approval. |

Summary

of the Offering

| Shares

being Offered: |

|

|

| |

|

|

Common

Stock Outstanding

Before

this Offering |

|

113,270,751 |

| |

|

|

Common

Stock Outstanding

After

this Offering |

|

|

| |

|

|

| Use

of Proceeds |

|

We

expect to receive net proceeds, after deducting underwriting discounts and commissions and

estimated expenses payable by us, of approximately $_____ million (or approximately $______

million if the underwriters exercise their option to purchase additional shares in full).

We

intend to use substantially all of the net proceeds from this offering to continue to fund research and development of our EOM613

and EOM147 drug candidates, conduct clinical trials, repay a portion of our outstanding Convertible Promissory Note issued to a principal

stockholder, and for working capital and other general corporate purposes. See “Use of Proceeds”

|

| Underwriters’

over-allotment option |

|

We

have granted the underwriters a 45-day option from the date of this prospectus to purchase up to an additional _________ shares (15%

of the total number of shares to be offered by us in the offering). |

| |

|

|

Trading

Market for our Common

Stock |

|

Our

Common Stock is currently traded on the Pink Sheets of the OTC Market under the symbol “IMUC”. We have applied to have

our Common Stock listed for trading on the Nasdaq Capital Market. There can be no assurance that our Common Stock will be approved

for trading on the Nasdaq. |

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” beginning on page 11 of this prospectus and the other information included in this prospectus for a discussion

of factors you should carefully consider before investing in our securities. |

The

number of shares of our common stock to be outstanding after this offering is based on 113,270,751 shares of our common stock outstanding

as of the date hereof, and does not include:

●

4,418,998 shares of common stock issuable upon exercise of outstanding warrants; and

●

4,585,665 shares of common stock issuable upon the conversion, at the option of the Holder of our Convertible Promissory Note,

at an exercise price of $0.60 per share.

Except

as otherwise indicated herein, all information in this prospectus assumes:

●

no exercise by the underwriters of their option to purchase an additional _____ shares of common stock, to cover over-allotments, if

any; and

●

a 1-for- reverse stock split of our common stock that was implemented on ______________, 2023, pursuant to which (i) every

shares of outstanding common stock were decreased to one share of common stock, (ii) the number of shares of common stock for which each

outstanding warrant or option to purchase common stock is exercisable was proportionally decreased on 1-for- basis, and (iii)

the exercise price of each outstanding warrant or option to purchase common stock was proportionately increased on a 1-for- basis,

(the “Reverse Stock Split”).

SUMMARY

FINANCIAL DATA

You

should read the following summary financial data together with our financial statements and the related notes appearing at the end of

this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section

of this prospectus. We have derived the statement of operations data from our audited consolidated financial statements for the year

ended December 31, 2021, and for the period from March 27, 2020 (Inception) through December 31, 2020, and from our unaudited interim

condensed consolidated financial statements for the periods ended September 30, 2022, and 2021. We have derived the balance sheet

data from our unaudited interim condensed consolidated financial statements for the period ended September 30, 2022. Our historical

results are not necessarily indicative of results that should be expected in any future period.

On

December 1, 2021, we completed the acquisition of EOM Pharmaceuticals, Inc. The transaction was accounted for as a reverse merger, with

EOM Pharmaceuticals, Inc. deemed to be the accounting acquirer and EOM Pharmaceutical Holdings, Inc (formerly ImmunoCellular Therapeutics

Ltd.) deemed to be the legal acquirer. Accordingly, these summary financial data reflect the historical activity of EOM Pharmaceuticals,

Inc.

| | |

| |

|

From March 27, 2020 |

|

|

Nine Months Ended | |

| | |

| |

|

(Inception) to |

|

|

September 30, | |

| | |

December 31, 2021 | |

|

December 31, 2020

|

|

|

2022 | | |

2021 | |

| | |

| |

|

|

|

|

|

| | |

| |

| Statement of Operations Data: | |

| | |

|

|

|

|

|

| | | |

| | |

| Research and Development | |

$ | 1,301,437 | |

|

$ |

696,718 |

|

|

$ | 900,426 | | |

$ | 1,224,400 | |

| Marketing and Advertising | |

| 554,025 | |

|

|

474,000 |

|

|

| 44,101 | | |

| 535,756 | |

| General and administrative | |

| 758,000 | |

|

|

282,274 |

|

|

| 1,206,279 | | |

| 435,178 | |

| Total Operating Expenses | |

| 2,613,462 | |

|

|

1,452,992 |

|

|

| 2,150,806 | | |

| 2,195,334 | |

| Loss from Operations | |

| (2,613,462 | ) |

|

|

(1,452,992 |

) |

|

| (2,150,806 | ) | |

| (2,195,334 | ) |

| Other income (expense) | |

| - | |

|

|

|

|

|

| - | | |

| - | |

| Interest income (expense) (net) | |

| (8,462 | ) |

|

|

- |

|

|

| 8,427 | | |

| (8,389 | ) |

| Derivative expense | |

| | |

|

|

|

|

|

| (70,000 | ) | |

| - | |

| Other income | |

| | |

|

|

|

|

|

| 30,000 | | |

| - | |

| Loss on debt extinguishment | |

| (2,527,078 | ) |

|

|

- |

|

|

| - | | |

| - | |

| Total Other income (expense) | |

| (2,535,540 | ) |

|

|

- |

|

|

| (31,573 | ) | |

| (8,389 | ) |

| Net loss | |

$ | (5,149,002 | ) |

|

$ |

(1,452,992 |

) |

|

$ | (2,182,379 | ) | |

$ | (2,203,723 | ) |

| | |

| | |

|

|

|

|

|

| | | |

| | |

| (Loss) per share - basic and diluted: | |

| (0.11 | ) |

|

|

(0.03 |

) |

|

| (0.02 | ) | |

| (0.05 | ) |

| Weighted Average common shares outstanding-basic and diluted(1): | |

| 47,535,953 | |

|

|

45,075,538 |

|

|

| 113,270,751 | | |

| 45,075,538 | |

| (1) |

See

Note 1 to our audited consolidated financial statements as of December 31, 2021 and our unaudited interim condensed consolidated

financial statement for the nine-month periods ended September 30, 2022 and 2021, appearing at the end of this prospectus

for further details on the calculation of basic and diluted net loss per common share. |

| |

|

September

30, 2022 |

|

| |

|

Actual |

|

|

As

Adjusted(1) |

|

| Balance

Sheet Data: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

551,176 |

|

|

$ |

|

|

| Working

capital |

|

$ |

(20,254 |

) |

|

$ |

|

|

| Total

assets |

|

$ |

714,365 |

|

|

$ |

|

|

| Accounts

payable and accrued expenses |

|

$ |

734,619 |

|

|

$ |

|

|

| Accumulated

deficit |

|

$ |

(8,784,373 |

) |

|

$ |

|

|

| Stockholders’

equity (deficit) |

|

$ |

(3,727,371 |

) |

|

$ |

|

|

| |

(1) |

As

adjusted giving effect to our issuance and sale of ___________ shares of our common stock in this offering at the assumed offering

price of $__________per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable

by us. |

RISK

FACTORS

Any

investment in our Common Stock involves a high degree of risk. Investors should carefully consider the risks described below and all

of the information contained in this prospectus before deciding whether to purchase our Common Stock. Our business, financial condition

and results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains

forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in

these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this

prospectus.

Risks

Related to Our Financial Position and Need for Additional Capital

We

are an early-clinical stage pharmaceutical company with a limited operating history.

We

were established and began operations in 2020. Our operations to date have been limited to financing and staffing our company, and conducting

clinical trials outside the United States of our EOM613 formulation for complications resulting from COVID-19. We have not yet demonstrated

the ability to successfully complete a large-scale, pivotal clinical trial, obtain marketing approval, manufacture a commercial scale

product, arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product

commercialization. Consequently, predictions about our future success or viability may not be as accurate as they could be if we had

a history of successfully developing and commercializing pharmaceutical products.

Accordingly,

you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in

the early stages of development, especially early clinical stage pharmaceutical companies such as ours. Potential investors should carefully

consider the risks and uncertainties that a company with a limited operating history will face. In particular, potential investors should

consider that we cannot assure you that we will be able to, among other things:

| |

● |

successfully

implement or execute our current business plan, and we cannot assure you that our business plan is sound; |

| |

|

|

| |

● |

successfully

manufacture our clinical product candidates and establish a commercial supply; |

| |

|

|

| |

● |

successfully

complete the clinical trials necessary to obtain regulatory approval for the marketing of our product candidates; |

| |

|

|

| |

● |

secure

market exclusivity and/or adequate intellectual property protection for our product candidates; |

| |

|

|

| |

● |

attract

and retain an experienced management and advisory team; |

| |

|

|

| |

● |

secure

acceptance of our product candidates in the medical community and with third-party payors and consumers; |

| |

|

|

| |

● |

raise

sufficient funds in the capital markets or otherwise to effectuate our business plan; and |

| |

|

|

| |

● |

utilize

the funds that we do have and/or raise in this offering or in the future to efficiently execute our business strategy. |

If

we cannot successfully execute any one of the foregoing, our business may fail and your investment will be adversely affected.

We

have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We are not currently

profitable, and we may never achieve or sustain profitability.

We are an early clinical stage

biopharmaceutical company with a limited operating history and have incurred losses since our formation. We incurred a net loss of approximately

$2,200,000 for the nine-months ended September 30, 2022 and $5.1 million for the year ended December 31, 2021. As

of September 30, 2022, we had an accumulated loss of approximately $8.8 million. We have not commercialized any product candidates

and have never generated revenue from the commercialization of any product. To date, we have devoted most of our financial resources

to research and development, including our clinical work, and to intellectual property.

We

expect to incur significant additional operating losses for the next several years, at least, as we advance EOM613 and EOM147 through

clinical development, complete clinical trials, seek regulatory approval and commercialize our formulas, if approved. The costs of advancing

product candidates into each clinical phase tend to increase substantially over the duration of the clinical development process. Therefore,

the total costs to advance any of our product candidates to marketing approval in even a single jurisdiction will be substantial. Because

of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing

or amount of increased expenses or when, or if, we will be able to begin generating revenue from the commercialization of any products

or achieve or maintain profitability. Our expenses will also increase substantially if and as we:

| |

● |

are

required by the FDA, to complete the various animal toxicity and dosing studies |

| |

● |

are

required by the FDA, to complete the various phases in human trials; |

| |

● |

establish

a sales, marketing and distribution infrastructure to commercialize our drugs, if approved, and for any other product candidates

for which we may obtain marketing approval; |

| |

● |

maintain,

expand and protect our intellectual property portfolio; |

| |

● |

hire

additional clinical, scientific and commercial personnel; |

| |

● |

add

operational, financial and management information systems and personnel, including personnel to support our product development and

planned future commercialization efforts, as well as to support our transition to a public reporting company; and |

| |

● |

acquire

or in-license or invent other product candidates or technologies. |

Furthermore,

our ability to successfully develop, commercialize and license any product candidates and generate product revenue is subject to substantial

additional risks and uncertainties, as described under “Risks Related to Development, Clinical Testing, Manufacturing and Regulatory

Approval” and “Risks Related to Commercialization.” As a result, we expect to continue to incur net losses and negative

cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect

on our stockholders’ equity and working capital. The amount of our future net losses will depend, in part, on the rate of future

growth of our expenses and our ability to generate revenues. If we are unable to develop and commercialize one or more product candidates,

either alone or through collaborations, or if revenues from any product that receives marketing approval are insufficient, we will not

achieve profitability. Even if we do achieve profitability, we may not be able to sustain profitability or meet outside expectations

for our profitability. If we are unable to achieve or sustain profitability or to meet outside expectations for our profitability, the

value of our common stock will be materially and adversely affected.

Even

if this offering is successful, we will require additional capital to fund our operations, and if we fail to obtain necessary financing,

we may not be able to complete the development and commercialization of our drugs.

Our

operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to advance the

clinical development of and launch and commercialize our product candidates if we receive regulatory approval. Following this offering,

we will require additional capital for further research and development and commencement of clinical trials of EOM613 and EOM147 and

may also need to raise additional funds sooner to pursue a more accelerated development of our formulas. If we are unable to raise capital

when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs, clinical

trials or any future commercialization efforts.

We

believe that the net proceeds from this offering will enable us to fund our operating expense requirements through December 2023 following

the closing of this offering. We have based this estimate on assumptions that may prove to be wrong, and we could deploy our available

capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors,

including, but not limited to the:

| |

● |

initiation,

progress, timing, costs and results of preclinical studies and clinical trials, including patient enrollment in such trials, for

EOM613 and EOM147 or any other future product candidates; |

| |

|

|

| |

● |

various

clinical development plans we establish for EOM613 and EOM147 and any other future product candidates; |

| |

|

|

| |

● |

number

and characteristics of product candidates that we discover or in-license and develop; |

| |

|

|

| |

● |

outcome,

timing and cost of regulatory review by the FDA and comparable foreign regulatory authorities, including the potential for the FDA

or comparable foreign regulatory authorities to require that we perform more studies than those that we planned for; |

| |

|

|

| |

● |

costs

of filing, prosecuting, defending and enforcing any patent claims and maintaining and enforcing other intellectual property rights; |

| |

|

|

| |

● |

effects

of competing technological and market developments; |

| |

|

|

| |

● |

costs

and timing of the implementation of commercial-scale manufacturing activities; |

| |

|

|

| |

● |

costs

and timing of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory

approval; and |

| |

|

|

| |

● |

cost

associated with being a public company. |

If

we are unable to expand our operations or otherwise capitalize on our business opportunities due to a lack of capital, our ability to

become profitable will be compromised.

Raising

additional capital may cause dilution to our stockholders, including purchasers of common stock in this offering, restrict our operations

or require us to relinquish rights to our technologies or product candidates.

Until

such time, if ever, as we can generate substantial revenue, we may finance our cash needs through a combination of equity offerings,

debt financings, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or

other sources. We do not currently have any committed external source of funds. In addition, we may seek additional capital due to favorable

market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

To

the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be

diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a common

stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting

our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise

additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties,

we may be required to relinquish valuable rights to our technologies, intellectual property, future revenue streams or product candidates

or grant licenses on terms that may not be, in hindsight, favorable to us. If we are unable to raise additional funds through equity

or debt financings when needed, we may be required to delay, limit, reduce or terminate product candidate development or future commercialization

efforts.

There

is substantial doubt about our ability to continue as a going concern.

Our

independent public accounting firm in its report included herein included an explanatory paragraph expressing substantial doubt

in our ability to continue as a going concern without additional capital becoming available. Going concern contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business over a reasonable length of time. Our ability to continue

as a going concern ultimately is dependent on our ability to generate a profit which is dependent upon our ability to obtain additional

equity or debt financing, attain further operating efficiencies and, ultimately, to achieve profitable operations. As a result, our financial

statements do not reflect any adjustment which would result from our failure to continue to operate as a going concern. Any such adjustment,

if necessary, would materially affect the value of our assets.

Risks

Related to Development, Clinical Testing, Manufacturing and Regulatory Approval

Clinical

trials are expensive, time-consuming and difficult to design and implement, and involve an uncertain outcome.

Clinical

testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during

the clinical trial process. Because the results of early clinical trials are not necessarily predictive of future results, EOM613 and

EOM147 may not have favorable results in future preclinical and clinical studies or receive regulatory approval. We may experience delays

in initiating and completing any clinical trials that we intend to conduct, and we do not know whether planned clinical trials will begin

on time, need to be redesigned, enroll patients on time or be completed on schedule, or at all. Clinical trials can be delayed for a

variety of reasons, including delays related to:

| |

● |

the

FDA or comparable foreign regulatory authorities disagreeing as to the design or implementation of our clinical studies; |

| |

|

|

| |

● |

obtaining

regulatory approval to commence a trial; |

| |

|

|

| |

● |

reaching

an agreement on acceptable terms with prospective contract research organizations (“CROs”), and clinical trial sites,

the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| |

|

|

| |

● |

obtaining

Institutional Review Board (“IRB”), approval at each site, or Independent Ethics Committee (“IEC”), approval

at sites outside the United States; |

| |

|

|

| |

● |

recruiting

suitable patients to participate in a trial in a timely manner and in sufficient numbers; |

| |

|

|

| |

● |

having

patients complete a trial or return for post-treatment follow-up; |

| |

|

|

| |

● |

imposition

of a clinical hold by regulatory authorities, including as a result of unforeseen safety issues or side effects or failure of trial

sites to adhere to regulatory requirements or follow trial protocols; |

| |

|

|

| |

● |

clinical

sites deviating from trial protocol or dropping out of a trial; |

| |

|

|

| |

● |

addressing

patient safety concerns that arise during the course of a trial; |

| |

|

|

| |

● |

adding

a sufficient number of clinical trial sites; or |

| |

|

|

| |

● |

manufacturing

sufficient quantities of product candidate for use in clinical trials. |

We

could also encounter delays if a clinical trial is suspended or terminated by us, the IRBs or IECs of the institutions in which such

trials are being conducted, the Data Safety Monitoring Board (“DSMB”) for such trial or the FDA or other regulatory authorities.

Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial

in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the

FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects,

failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate

funding to continue the clinical trial. Furthermore, we rely on CROs and clinical trial sites to ensure the proper and timely conduct

of our clinical trials, including clinical trial data collection, and, while we have agreements governing their committed activities,

we have limited influence over their actual performance, as described in “Risks Related to Our Dependence on Third Parties”.

The

regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable,

and if we are ultimately unable to obtain regulatory approval for EOM613 and/or EOM147 or any other product candidates, our business

will be substantially harmed.

The

time required to obtain approval by the FDA and comparable foreign authorities is unpredictable but typically takes many years following

the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities.

In addition, approval policies, regulations or the type and amount of clinical data necessary to gain regulatory approval may change

during the course of a product candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory

approval for any product candidate and it is possible that we will never obtain regulatory approval for EOM613 and EOM147 or any other

product candidate. We are not permitted to market any of our product candidates in the United States until we receive regulatory approval

of an New Drug Application (“NDA”) from the FDA. Our product candidates could fail to receive regulatory approval for many

reasons, including the following:

| |

● |

we

may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate

is safe and effective for its proposed indication; |

| |

|

|

| |

● |

serious

and unexpected drug-related side effects experienced by participants in our clinical trials or by individuals using drugs similar

to our product candidates, or other products containing the active ingredient in our product candidates; |

| |

|

|

| |

● |

negative

or ambiguous results from our clinical trials or results that may not meet the level of statistical significance required by the

FDA or comparable foreign regulatory authorities for approval; |

| |

|

|

| |

● |

we

may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| |

|

|

| |

● |

the

FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical

trials; |

| |

|

|

| |

● |

the

data collected from clinical trials of our product candidates may not be acceptable or sufficient to support the submission of an

NDA or other submission or to obtain regulatory approval in the United States or elsewhere, and we may be required to conduct additional

clinical trials; |

| |

|

|

| |

● |

the

FDA or comparable foreign authorities may disagree regarding the formulation, labeling and/or the specifications of our product candidates; |

| |

|

|

| |

● |

the

FDA or comparable foreign regulatory authorities may fail to approve or find deficiencies with the manufacturing processes or facilities

of third-party manufacturers with which we contract for clinical and commercial supplies; and |

| |

|

|

| |

● |

the

approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering

our clinical data insufficient for approval. |

Prior

to obtaining approval to commercialize a product candidate in the United States or abroad, we must demonstrate with substantial evidence

from well-controlled clinical trials, and to the satisfaction of the FDA or foreign regulatory agencies, that such product candidates

are safe and effective for their intended uses. Results from preclinical studies and clinical trials can be interpreted in different

ways. Even if we believe the preclinical or clinical data for our product candidates are promising, such data may not be sufficient to

support approval by the FDA and other regulatory authorities.

The

FDA or any foreign regulatory bodies can delay, limit or deny approval of our product candidates or require us to conduct additional