false

0001908984

0001908984

2024-01-12

2024-01-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 12, 2024

ENDI

CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-56469 |

|

87-4284605 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

| 2400

Old Brick Rd., Suite 115 |

|

|

| Glen

Allen, VA |

|

23060 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(434)

336-7737

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Amendment

to Merger Agreement

On

January 12, 2024, ENDI Corp., a Delaware corporation (the “Company”) entered into a third amendment (the “Merger Agreement

Amendment”) to the Agreement and Plan of Merger ( “Merger Agreement”) dated December 29, 2021, pursuant to which the

Company previously completed, on August 11, 2022, its business combination with Enterprise Diversified, Inc. and CrossingBridge Advisors,

LLC (the “Business Combination”). The Merger Agreement Amendment shortened the time period during which the Company is obligated

to keep the Form S-4 relating to the Business Combination in effect to December 31, 2023 (the “Outside Date”), allowing the

Company at any time after the Outside Date to terminate the offerings and deregister all the unsold securities registered under the Form

S-4.

The

foregoing description of the Merger Agreement Amendment is a summary only, does not purport to be complete and is qualified in its entirety

by the full text of the Merger Agreement Amendment, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by

reference.

Amendment

to Registration Rights Agreement

On

January 12, 2024, the Company entered into Amendment No. 4 (the “RRA Amendment”) to the Registration Rights Agreement (“RRA”)

dated August 11, 2022 by and among the Company, Cohanzick and the parties listed on the signature page thereto. Pursuant to the RRA Amendment,

the parties indefinitely deferred the Company’s obligation to file a shelf registration statement relating to the resale of certain

of the Company’s securities as set forth in the RRA.

The

foregoing description of the RRA Amendment is a summary only, does not purport to be complete and is qualified in its entirety by the

full text of the RRA Amendment, a copy of which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

Item

8.01 Other Events.

On

January 12, 2024, the Company issued a press release announcing its intention to deregister its Class A common stock under the Securities

Exchange Act of 1934, as amended, and to transfer trading of its Class A common stock from the OTCQB (venture market) to the OTC Pink

market. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

d)

Exhibits

| Exhibit

No. |

|

Description |

| 10.1 |

|

Amendment No. 3 to Merger Agreement, dated January 12, 2024, by and among the Company, Enterprise Diversified, Inc., CrossingBridge Advisors LLC and Cohanzick Management LLC |

| 10.2 |

|

Amendment No. 4 to Registration Rights Agreement, dated January 12, 2024, by and among the Company, Cohanzick Management, LLC and the parties listed on the signature page thereto |

| 99.1 |

|

Press Release issued by ENDI Corp. on January 12, 2024 |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ENDI

CORP. |

| |

|

| Date:

January 12, 2024 |

/s/

David Sherman |

| |

David

Sherman |

| |

Chief

Executive Officer |

Exhibit

10.1

January

12, 2024

Cohanzick

Management, L.L.C.

427

Bedford Road

Pleasantville,

NY 10570

Attention:

David K Sherman and Jonathan Barkoe

Gentlemen:

Reference

is made to that certain Agreement and Plan of Merger, dated as of December 29, 2021 (the “Merger Agreement”), by and

among ENDI Corp., a Delaware corporation (“Parent”), Enterprise Diversified, Inc., a Nevada corporation (“Pubco”),

Zelda Merger Sub 1, Inc., a Delaware corporation (“First Merger Sub”), Zelda Merger Sub 2, LLC, a Delaware limited

liability company (“Second Merger Sub”), CrossingBridge Advisors, LLC, a Delaware limited liability company (“CBA”)

and Cohanzick Management, L.L.C., a Delaware limited liability company (“CBA Member”). All capitalized terms in this

letter agreement not defined herein have the meanings ascribed to such terms in the Merger Agreement.

On

August 11, 2022, as contemplated by the Merger Agreement, (i) First Merger Sub merged with and into Pubco, with Pubco being the surviving

entity and becoming a wholly-owned subsidiary of Parent, and (ii) Second Merger Sub merged with and into CBA, with CBA being the surviving

entity and becoming a wholly-owned subsidiary of Parent.

Pursuant

to Section 11.1 of the Merger Agreement, the Merger Agreement may be amended, modified or supplemented by an instrument in writing specifically

designated as an amendment thereto, signed on behalf of each Party. The Parties desire to amend the Merger Agreement, and this letter

agreement constitutes an amendment thereto.

Accordingly,

the Parties (with (i) Pubco acting on its own behalf and as successor to First Merger Sub and (ii) CBA acting on its own behalf and as

successor to Second Merger Sub) agree and acknowledge that Section 7.1(a) of the Merger Agreement is hereby amended to read in its entirety

as follows:

“As

promptly as reasonably practicable following the date of this Agreement, and in any event within forty-five (45) days after the execution

of this Agreement, (i) Pubco shall prepare and cause to be filed with the SEC the Proxy Statement in preliminary form with respect to

the Stockholders Meeting and (ii) Pubco and Parent shall jointly prepare and cause to be filed with the SEC, a registration statement

on Form S-4 under the Securities Act (the “Form S-4”), which will include the Proxy Statement, to register under the

Securities Act the shares of Parent Class A Common Stock and Parent Class B Common Stock to be issued in the Merger, and the Warrants

and the Parent Class A Common Stock issuable pursuant to the Warrants (the “Registered Securities”). Each of Pubco

and Parent shall use its reasonable best efforts to (A) have the Form S-4 declared effective under the Securities Act as promptly as

practicable after such filing, (B) ensure that the Form S-4 complies in all material respects with the applicable provisions of the Exchange

Act and the Securities Act and (C) keep the Form S-4 effective until December 31, 2023 (after which date Parent may at any time, in its

discretion, file (or cause Pubco to file) a post-effective amendment to the Form S-4 to terminate the offerings thereunder and to deregister

all unsold securities thereunder (such a post-effective amendment being referred to as a “Withdrawal Amendment”).

Each of Pubco, Parent and CBA shall furnish all information concerning itself, its Affiliates and the holders of its capital stock to

the other Party and provide such other assistance as may be reasonably requested in connection with the preparation, filing and distribution

of the Form S-4 and the Proxy Statement and, as applicable, shall provide to their and each other’s counsel such representations

as reasonably necessary to render the opinions required to be filed therewith. The Form S-4 and the Proxy Statement shall include all

information reasonably requested by such other Party to be included therein. Each of Pubco and Parent shall promptly notify the other

Party and CBA upon the receipt of any comments from the SEC or any request from the SEC for amendments or supplements to the Form S-4

or the Proxy Statement, and shall, as promptly as practicable after receipt thereof, provide the other Party and CBA with copies of all

correspondence between it and its Representatives, on the one hand, and the SEC, on the other hand, and all written comments with respect

to the Form S-4 or the Proxy Statement received from the SEC and advise the other Party and CBA of any oral comments with respect to

the Form S-4 or the Proxy Statement received from the SEC. Each of Pubco and Parent shall use its reasonable best efforts to respond

as promptly as practicable to any comments from the SEC with respect to the Form S-4 or the Proxy Statement, as applicable. Notwithstanding

the foregoing, prior to filing the Form S-4 (or any amendment or supplement thereto, other than a Withdrawal Amendment, with the SEC,

mailing the Proxy Statement (or any amendment or supplement thereto) or responding to any comments of the SEC with respect thereto, other

than the Withdrawal Amendment, each of Pubco and Parent, as applicable, shall cooperate with the other Party and CBA, and provide the

other Party and CBA a reasonable opportunity to review and comment on such document or response (including the proposed final version

of such document or response) and shall give due consideration to all reasonable comments provided by the other Party and CBA. Pubco

shall notify Parent and CBA, promptly after it receives notice thereof, of the time of effectiveness of the Form S-4, the issuance of

any stop order relating thereto or the suspension of the qualification for offering or sale in any jurisdiction of the Registered Securities

(other than with respect to or as a result of the filing and/or effectiveness of the Withdrawal Amendment), and Pubco shall use its reasonable

best efforts to have any such stop order or suspension lifted, reversed or otherwise terminated (other than with respect to or as a result

of the filing and/or effectiveness of the Withdrawal Amendment). Pubco shall also use its reasonable best efforts to take any other action

required to be taken under the Securities Act, the Exchange Act, any applicable foreign or state securities or “blue sky”

Laws and the rules and regulations thereunder in connection with the issuance of the Registered Securities, and Parent and CBA shall

furnish all information concerning such Person and its equity holders as may be reasonably requested in connection with any such actions.”

This

letter agreement shall be governed by and construed in accordance with the Laws of the State of Delaware, without giving effect to any

conflict of law provisions. Except as set forth in this letter agreement, all provisions of the Merger Agreement shall remain unchanged

and in full force and effect.

Please

acknowledge your agreement with the foregoing by signing and returning a copy of this letter to the undersigned.

This

letter agreement may be executed in separate counterparts, each of which when so executed and delivered shall be an original, but all

such counterparts shall together constitute one and the same instrument.

| |

Sincerely, |

| |

|

|

| |

ENDI

CORP. |

| |

|

|

| |

By: |

/s/

David Sherman |

| |

Name: |

David

Sherman |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

Agreed and Accepted |

| |

as of the date first written above: |

| |

|

|

| |

ENTERPRISE

DIVERSIFIED, INC. (FOR ITSELF AND AS SUCCESSOR TO FIRST MERGER SUB) |

| |

|

|

| |

By: |

/s/

David Sherman |

| |

Name: |

David

Sherman |

| |

Title: |

President |

| |

CROSSINGBRIDGE

ADVISORS, LLC (FOR ITSELF AND AS SUCCESSOR TO SECOND MERGER SUB) |

| |

|

|

| |

By: |

/s/

David Sherman |

| |

Name: |

David

Sherman |

| |

Title: |

Authorized

Agent |

| |

|

|

| |

COHANZICK

MANAGEMENT, L.L.C. |

| |

|

|

| |

By: |

/s/

David Sherman |

| |

Name: |

David

Sherman |

| |

Title: |

Managing

Member |

Exhibit

10.2

AMENDMENT

NO. 4 TO REGISTRATION RIGHTS AGREEMENT

This

amendment (“Amendment”) is dated as of January 12, 2024 and amends the Registration Rights Agreement, dated August

11, 2022 by and among ENDI Corp., a Delaware corporation (the “Company”), and Cohanzick Management, LLC, a Delaware

limited liability company (the “CBA Member”), and the undersigned parties listed under Holder on the signature page

thereto (each such party, a “Holder” and collectively, the “Holders”), as amended by that certain

Amendment to Registration Rights Agreement dated August 31, 2022, that certain Amendment No. 2 to Registration Rights Agreement dated

May 1, 2023, and that certain Amendment No. 3 to Registration Rights Agreement dated August 1, 2023 (as amended, the “Registration

Rights Agreement”).

RECITALS

A.

WHEREAS, the Company, the CBA Member and certain Holders entered into the Registration Rights Agreement on August 11, 2022 and such Registration

Rights Agreement was amended on August 31, 2022, May 1, 2023 and August 1, 2023.

B.

WHEREAS, the Company, the CBA Member and certain Holders desire to defer indefinitely the Company’s obligation to file a Form S-1

Shelf or Form S-3 Shelf under Section 2.3 of the Registration Statement.

C.

WHEREAS, pursuant to 5.6 of the Registration Rights Agreement, upon the written consent of (a) the Company and (b) the holders of a majority

of the total Registrable Securities (on an as converted to Common Stock basis), compliance with any of the provisions, covenants and

conditions set forth in the Registration Rights Agreement may be waived, or any of such provisions, covenants or conditions may be amended

or modified.

D.

WHEREAS, the CBA Member and Holders signatory to this Amendment hold at least a majority of the total Registrable Securities.

E.

WHEREAS, all capitalized terms used herein and not defined shall have the meanings set forth in the Registration Rights Agreement.

AGREEMENT

NOW,

THEREFORE, the parties hereto hereby covenant and agree to be bound as follows:

(1)

Amendments.

(a)

The first sentence in Section 2.3.1 of the Registration Rights Agreement, is hereby amended and replaced in its entirety to read as

follows:

“On

or before the Agreed Filing Date (as defined below), the Company shall submit to or file with the Commission a Registration Statement

for a Shelf Registration on Form S-1 (the “Form S-1 Shelf”) or a Registration Statement for a Shelf Registration

on Form S-3 (the “Form S-3 Shelf”), if the Company is then eligible to use a Form S-3 Shelf, in each case,

covering the resale of all the Registrable Securities (determined as of two (2) business days prior to such submission or filing) on

a delayed or continuous basis and shall use its commercially reasonable efforts to have such Shelf declared effective as soon as practicable

after the filing thereof, but no later than the earlier of (a) the sixtieth (60th) calendar day (or ninetieth (90th) calendar day if

the Commission notifies the Company that it will “review” the Registration Statement) following Closing and (b) the tenth

(10th) business day after the date the Company is notified (orally or in writing, whichever is earlier) by the Commission that the Registration

Statement will not be “reviewed” or will not be subject to further review (such earlier date, the “Effectiveness

Deadline”); provided, however, that if such Effectiveness Deadlines falls on a Saturday, Sunday or other day that the Commission

is closed for business, the Effectiveness Deadlines shall be extended to the business day on which the Commission is open for business.”

(b)

A new sentence is hereby added to Section 2.3.1 of the Registration Rights Agreement at the end of said section, as follows:

“Agreed

Filing Date” means such date, if any, as may be mutually agreed to in a writing executed by the Company and the CBA Member

at any time after January 12, 2024, each acting in their respective sole discretion.

(2) Acknowledgement.

The parties acknowledge that except for the amendment expressly set forth in this Amendment, all other terms and conditions of the

Registration Rights Agreement shall be unaffected hereby and remain in full force and effect.

(3)

Miscellaneous.

(a)

This Amendment may be executed in multiple counterparts (including PDF counterparts), each of which shall be deemed an original, and

all of which together shall constitute the same instrument, but only one of which need be produced.

(b)

To the extent that any provision of the Registration Rights Agreement needs to be waived or amended in order to allow the amendment made

herein to be effective, such provisions are hereby waived and/or amended to the extent necessary to allow for the amendment made herein

to be effective.

(c)

This Amendment and all disputes or controversies arising out of or relating to this Amendment or the transactions contemplated hereby

shall be governed by, and construed in accordance with, the internal laws of the State of Delaware, without regard to the laws of any

other jurisdiction that might be applied because of the conflicts of laws principles of the State of Delaware.

(d)

On or after the date of this Amendment, each reference in the Registration Rights Agreement to “this Agreement,” “hereunder,”

“hereof,” “herein” or words of like import referring to the Registration Rights Agreement shall mean and be a

reference to the Agreement as amended by this Amendment, and this Amendment shall be deemed to be a part of the Registration Rights Agreement.

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed as of the date and year first above written.

| ENDI

CORP. |

|

| |

|

|

| By: |

/s/

Alea Kleinhammer |

|

| Name: |

Alea

Kleinhammer |

|

| Title: |

Chief

Financial Officer |

|

| |

|

|

| Confirmed

and Agreed: |

|

| |

|

|

| Cohanzick

Management, LLC |

|

| |

|

|

| By:

|

/s/

David Sherman |

|

| Name: |

David

Sherman |

|

| Title: |

Managing

Member |

|

| |

|

|

| /s/

David Sherman |

|

| David

Sherman |

|

| |

|

|

| /s/

Steven Kiel |

|

| Steven

Kiel |

|

| |

|

|

| Arquitos

Capital Offshore Master, Ltd. |

|

| |

|

| By:

|

/s/

Steven Kiel |

|

| Name: |

Steven

Kiel |

|

| Title: |

Authorized

Signor |

|

Exhibit

99.1

ENDI

Corp. Announces Planned SEC Deregistration and Transfer of Trading to OTC Pink Market

Glen

Allen, VA, January 12, 2024 — ENDI Corp. (OTCQB: ENDI) (“ENDI” or the “Company”) today announced its

intention to deregister its Class A common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

by filing a Form 15 with the U.S. Securities and Exchange Commission (the “SEC”) on or about January 12, 2024. The filing

of the Form 15 will immediately suspend ENDI’s obligation to file current and periodic reports pursuant to the Exchange Act, and

effective 90-days thereafter, is expected to terminate the registration of the Company’s Class A common stock under Section 12(g)

of the Exchange Act. The Company still intends to file a Form 10-K annual report for its fiscal year ended December 31, 2023 in accordance

with SEC requirements.

The

Company anticipates that as a result of deregistration, trading in the Company’s Class A common stock will transfer from the OTCQB

(venture market) to the OTC Pink market (“OTC Pink”) under its current trading symbol “ENDI.” The Company currently

intends to continue to provide information to its stockholders and to take such actions within its control to enable its Class A common

stock to be quoted on the OTC Pink, so that a trading market may continue to exist for its Class A common stock. There is no guarantee,

however, that a broker will continue to make a market in the Class A common stock and that trading of the Class A common stock will continue

on the OTC Pink or otherwise.

The

Company made the decision to pursue deregistration following the careful review and consideration by its Board of a number of factors,

including, but not limited to, (i) the limited number of Company stockholders and trading in the Company’s securities, (ii) the

expected reduction in operating expenses by eliminating SEC reporting costs and reducing the Company’s associated audit expenses,

and (iii) the expectation that continued trading of the Company’s Class A common stock on the OTC Pink will afford the Company’s

stockholders a substantially equivalent opportunity to trade in the Company’s Class A common stock as is currently afforded to

the Company’s stockholders on the OTCQB.

About

ENDI Corp.

ENDI

Corp. is an investment company primarily focused on financial products and services. ENDI operates in the following sectors: (i) CrossingBridge

Operations (investment advisory and sub-advisory services offered through various SEC registered mutual funds and an exchange-traded

fund through CrossingBridge Advisors, LLC); (ii) Willow Oak Operations (joint ventures, service offerings, and initiatives undertaken

in the asset management industry through Willow Oak Asset Management, LLC and its subsidiaries); and (iii) the sale of internet access,

e-mail and hosting, storage, and other ancillary services through Sitestar.net, Inc. For more information, please visit: www.endicorp.com.

Forward

Looking Statements

Certain

statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements may be identified using words such as “anticipate,” “believe,” “forecast,”

“estimated” and “intend” or other similar terms or expressions that concern ENDI’s expectations,

strategy, plans or intentions. These forward-looking statements are based on ENDI’s current expectations and actual results

could differ materially. There are several factors that could cause actual events to differ materially from those indicated by such

forward-looking statements. These factors include, but are not limited to, statements regarding the timing and effect of the

Company’s deregistration of its securities, the transfer of trading from the OTCQB to the OTC Pink, and the continued

existence of a trading market in the Company’s Class A common stock. Investors should read the risk factors set forth in our

Form 10-K for the year ended December 31, 2022. However, these risks are not exhaustive and new risks and uncertainties

emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the

forward-looking statements contained in this press release. Forward-looking statements included herein

are made as of the date hereof, and ENDI does not undertake any obligation to update publicly such statements to reflect subsequent

events or circumstances, except as may be required by law.

Investor

Relations Contact

Email:

info@endicorp.com

https://www.endicorp.com/

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

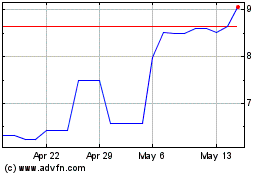

ENDI (QB) (USOTC:ENDI)

Historical Stock Chart

From Oct 2024 to Nov 2024

ENDI (QB) (USOTC:ENDI)

Historical Stock Chart

From Nov 2023 to Nov 2024