Table of Contents

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

| ☐ |

Preliminary Information Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ |

Definitive Information Statement |

DH ENCHANTMENT INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

NOTICE OF ACTION TAKEN PURSUANT TO

WRITTEN CONSENT OF STOCKHOLDERS

To the Stockholders of DH Enchantment Inc.:

This Notice and the accompanying Information Statement

are being furnished to the stockholders (the “Stockholders” and each a “Stockholder”)

of DH Enchantment Inc., a Nevada corporation (the “Company”, “we”, “us”,

“our”), in connection with actions taken by the holder of a majority of the issued and outstanding voting securities

of the Company, approving, by written consent dated February 12, 2025, the following actions:

A Certificate of Change to the Company’s

Articles of Incorporation, attached hereto as Appendix A (the “Certificate of Change of the Increase in Authorized

Capital”), authorized by the Company’s Board of Directors (the “Board” or the “Board

of Directors”) to increase its authorized shares of common stock of the Company, par value $0.001 per share (the “Common

Stock”), from 4,450,000,000 to 30,000,000,000 (the “Increase in Authorized Capital”).

This action will be taken at such future date

as determined by the Board of Directors, but in no event earlier than the 20th day after this Information Statement is

mailed or furnished to the Stockholders of record as of February 24, 2025.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY.

Your vote or consent is not requested or required

to approve these matters. The accompanying Information Statement is provided solely for your information.

| By order of our Board of Directors, |

| |

|

| By: |

/s/ Cheuk Yin Cheung |

| Name: |

Cheuk Yin Cheung |

| |

|

Dated: February 24, 2025

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF

STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH IS DESCRIBED IN THE ATTACHED INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY

OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO APPROVE THE INCREASE IN AUTHORIZED CAPITAL STOCK AND COMMON STOCK AND, CONSEQUENTLY,

NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THE INCREASE.

TABLE OF CONTENTS

INFORMATION STATEMENT

OF

DH ENCHANTMENT INC.

3/F, Yeung Yiu Chung (No.6) Industrial Building

19 Cheung Shun Street, Lai Chi Kok

Kowloon, Hong Kong 00000

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY

INTRODUCTION

DH ENCHANTMENT INC., a Nevada corporation (the

“Company”, “we”, “us”, “our”)

is distributing this Information Statement and Notice of Action Taken Without a Meeting of Stockholders to our stockholders (the “Stockholders”

and each a “Stockholder”) of record as of February 12, 2025 (the “Record Date”) to

inform them of the approval by written consent of the holder owning a majority of our outstanding shares of Common Stock as of the Record

Date of an amendment to our Certificate of Incorporation to increase the number of authorized shares of our capital stock from four billion

five-hundred million (4,500,000,000) shares to thirty billion fifty million (30,050,000,000) and to increase the number of authorized

shares of our Common Stock from 4,450,000,000 to 30,000,000,000 (the “Increase in Authorized Capital”). This

information statement is first being sent or given on or about February 24, 2025 (the “Mailing Date”) to our

stockholders.

No additional action will be undertaken by the

Company with respect to the receipt of written consents, and no dissenters' rights with respect to the receipt of the written consents,

and no dissenters' rights under applicable Nevada law are afforded to the Company's Stockholders as a result of the adoption of these

actions set forth herein.

VOTING RIGHTS AND OUTSTANDING SHARES

The Company is not seeking consents, authorizations

or proxies from you. Under the Nevada Revised Statutes (the “NRS”), the Increase in Authorized Capital can be

approved without a meeting of stockholders, simply by the written consent of stockholders representing a majority of the voting power

of our outstanding shares of Common Stock.

The amendment to our Certificate of Incorporation

was approved and declared advisable by the sole member of our Board of Directors and approved by the Joint Written Consent (“Joint

Written Consent”) of our sole director, who is the holder of a majority of our outstanding shares of Common Stock on the

Record Date.

As of the date of the Joint Written Consent, our

only outstanding voting securities were as follows:

| OUTSTANDING SECURITIES |

| Class |

Number of Shares of Each Class Outstanding |

Votes Per

Share |

Number of Votes

Represented |

Percentage of

Votes Represented |

| Common Stock |

3,831,310,013 |

1 |

3,831,310,013 |

99.74% |

| Series B Preferred Stock |

100,000 |

100 |

10,000,000 |

0.26% |

|

Total Votes

(Common Shares and Series B Shares) |

|

|

3,841,310,013

|

100.00%

|

As of the date of the stockholder consent, there

were issued and outstanding a total of 3,831,310,013 shares of Common Stock, par value $0.001 per share, and 100,000 shares of Series

B Preferred Stock entitled to vote. With respect to the action approved by the stockholder consent, each share of our Common Stock entitled

its holder to one vote and each share of Series B Preferred Stock entitled the holder to 100 votes. As such, there were a total of 3,841,310,013

votes on the actions set forth herein, which were approved by the holders of 2,529,000,000 votes, representing 65.84% of the votes. The

stockholder consent was signed by the holders of a majority of the votes that were entitled to be cast on these matters. Holders of Common

Stock have no preemptive rights to acquire or subscribe for any of the additional shares of Common Stock which have been authorized.

The following table sets forth the name of the

holder of the voting securities that voted in favor of the Amendment, the number of shares held by such holder, the total number of votes

that such holder voted in favor of the Amendment and the percentage of the issued and outstanding voting equity of the Company that voted

in favor thereof:

| VOTING SECURITIES |

| Name of Voting Stockholder |

Number of Voting Equity held |

Number of Votes held by Such Voting Stockholder |

Number of Votes that Voted in Favor of the Amendment |

Percentage of the Voting Equity that Voted in Favor of the Amendment |

Cheuk Yin Cheung, Chief Executive Officer,

Chief Financial Officer, Secretary, Sole Director |

2,529,000,000 shares of Common Stock |

2,529,000,000 |

2,529,000,000 |

65.84% |

Pursuant to Rule 14c-2 under the Securities

Exchange Act of 1934, as amended, the proposal will not be adopted until a date at least twenty days after the date on which this

Information Statement has been mailed to the stockholders. We anticipate that the actions contemplated herein will be effected on or

about March 17, 2025, upon filing of an amendment to our Certificate of Incorporation with the Secretary of State of the State of

Nevada.

We have asked brokers and other custodians, nominees

and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such brokers and

other custodians, nominees and fiduciaries and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

INTERESTS OF CERTAIN PERSONS IN MATTERS ACTED

UPON

Other than as described herein, and except in

their capacity as Stockholders and a Director (which interest does not differ from that of the other holders of Company’s Common

Stock), none of our officers, directors, or any of their respective affiliates or associates has any interest in the matters being acted

upon.

WHAT IS THE PURPOSE OF THE INFORMATION STATEMENT?

This Information Statement is being furnished

to you pursuant to Section 14 of the Exchange Act to notify our Stockholders of the corporate actions taken by the Majority Stockholder

pursuant to the Joint Written Consent.

SUMMARY OF THE CORPORATION ACTIONS

Increase in Authorized Capital

For the reasons discussed in this

Information Statement, the Board has approved the Increase in Authorized Capital by filing a certificate of change to the

Company’s Articles of Incorporation (the “Certificate of Change of the Increase in Authorized

Capital”) to effect such Increase in Authorized Capital. The Certificate of Change of the Increase in Authorized

Capital, in the form attached herein as Appendix A, has been approved by written consent of the Majority Stockholders.

In accordance with Rule 14c-2 under the Securities

Exchange Act, the stockholder actions taken by written consent will become effective no earlier than 20 calendar days after the date on

which this Information Statement is sent or given to our stockholders. This Information Statement is first being mailed on or about February

24, 2025 (“Mailing Date”) to the Company’s stockholders of record as of February 12, 2025 (the “Record

Date”).

APPROVAL AND VOTE OBTAINED

The Company is not seeking consents, authorizations

or proxies from you. Under the Nevada Revised Statutes (the “NRS”), the Increase in Authorized Capital can be

approved without a meeting of stockholders, simply by the written consent of stockholders representing a majority of the voting power

of our outstanding shares of Common Stock.

Section 78.320 of the NRS provides that, unless

otherwise provided in the Company’s Articles of Incorporation or Bylaws, any action required or permitted to be taken at a meeting

of the Stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by Stockholders

holding at least a majority of the voting power. Neither the Company’s Articles of Incorporation nor its Bylaws prohibit the taking

of action by its Stockholders by written consent. In order to eliminate the costs and management time involved in holding a special meeting,

our Board of Directors voted to utilize this provision under Nevada law and obtained the written consent of the holder of a majority in

interest of our Common Stock.

As of February 12, 2025, there were 3,831,310,013

shares of Common Stock of the Company issued and outstanding and 100,000 shares of Series B Preferred issued and outstanding. Each holder

of Common Stock is entitled to one (1) vote for each share held by such holder and each share of Series B Preferred is entitled to one

hundred (100) votes for each share held by such holder.

NOTICE PURSUANT TO THE NRS AND THE COMPANY’S

BYLAWS

This Information Statement serves the purpose

of informing stockholders of the matters described herein pursuant to Section 14(c) of the Securities Exchange Act and the rules and regulations

prescribed thereunder, including Regulation 14C, and serves as the notice required by Section 78.320 of the NRS of the taking of a corporate

action without a meeting by less than unanimous written consent of our stockholders.

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY

ACTION–AUTHORIZATION

OF INCREASE IN AUTHORIZED CAPITAL

Purposes of the Common Stock Increase

The principal purpose of the Increase in Authorized

Capital is to more closely align our capital structure. By implementing the Increase in Authorized Capital, we will still have a sufficient

number of authorized shares of Common Stock and Preferred Stock, which will afford us maximum flexibility to issue shares of either class

in the future while allowing us to have a proportionate capital structure.

Effect of the Common Stock Increase

Once we file the Certificate of Change of the

Increase in Authorized Capital for the Increase in Authorized Capital with the Secretary of State of the State of Nevada, it will have

the immediate effect of increasing the total amount of authorized Common Stock from 4,450,000,000 to 30,000,000,000. 3,210,001 shares

of Preferred Stock are outstanding and 50,000,000 shares of Preferred Stock are authorized, of which 5,000,000 shares have been designated

as Series A Preferred Stock and 10,000,000 shares have been designated as Series B Preferred Stock. The Increase in Authorized Capital

will have no impact on the number of shares of Common Stock or Preferred Stock you own.

No Dissenters’ Rights

Under the Nevada Revised Statutes, the Company’s

Stockholders are not entitled to dissenters’ rights with respect to the increase in authorized shares, and the Company will not

independently provide Stockholders with any such right.

Procedure for Effecting the Common Stock Increase

The Increase in Authorized Capital will become

effective at such future date as determined by the Board, as evidenced by the filing of the Certificate of Change of the Increase in Authorized

Capital with the Secretary of State of the State of Nevada, but in no event earlier than the 20th calendar day after this

Information Statement is mailed or furnished to the Stockholders of record as of February 12, 2025. Moreover, although the Increase in

Authorized Capital has been approved by the requisite number of Stockholders representing a majority of the voting power of our outstanding

shares of Common Stock, the Board reserves the right, in its discretion, to abandon the Increase in Authorized Capital prior to the proposed

effective date if it determines that abandoning the Increase in Authorized Capital is in the best interests of the Company. No further

action on the part of Stockholders would be required to either effect or abandon the Increase in Authorized Capital.

The text of the Certificate of Change of the Increase

in Authorized Capital is subject to modification to include such changes as may be required by the NRS and as the Board deems necessary

and advisable to effect the Increase in Authorized Capital. If the Board elects to implement the Increase in Authorized Capital, the number

of authorized shares of Common Stock would be increased from 4,450,000,000 to 30,000,000,000. The number of authorized shares of Preferred

Stock, which is 50,000,000, would remain unchanged.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of the Record

Date, information concerning ownership of our securities by (i) each director, (ii) each executive officer, (iii) all directors and executive

officers as a group, and (iv) each person known to us to be the beneficial owner of more than five percent (5%) of each class. This table

is based on 3,831,310,013 issued and outstanding shares of Common Stock and 100,000 issued and outstanding shares of Series B Preferred

Stock that have an aggregate of 100 common share equivalent votes as of the Record Date for a total Common Stock equivalent of 3,841,310,013

votes.

The number and percentage of shares beneficially

owned includes any shares as to which the named person has sole or shared voting power or investment power and any shares that the named

person has the right to acquire within 60 days.

The address of each person listed is the care

of the Company at 3/F, Yeung Yiu Chung (No.6) Industrial Building, 19 Cheung Shun Street, Lai Chi Kok, Kowloon, Hong Kong 00000.

| Name and Address of Beneficial Owner |

|

Series B Preferred Shares |

|

Percent of Class (%) |

|

Common Shares(*) |

|

Percent of Class (%) |

|

Total Votes All Classes |

| Directors and Executive Officers |

|

|

|

|

|

|

|

|

|

|

| Cheuk Yin Cheung (1) |

|

0 |

|

0 |

|

2,529,000,000 |

|

65.84 |

|

2,529,000,000 |

| |

|

|

|

|

|

|

|

|

|

|

| 5% or Greater Holders |

|

|

|

|

|

|

|

|

|

|

| Sally Kin Yi Lo (2) |

|

35,000 |

|

35 |

|

255,500,000 |

|

6.65 |

|

255,500,000 |

| Daily Success Development Limited (3) |

|

65,000 |

|

65 |

|

6,500,000 |

|

0.17 |

|

6,500,000 |

| Directors, officers, and 5% or greater stockholders as a group (10 persons) |

|

|

|

|

|

|

|

|

|

|

___________________________

(*) Includes preferred stock holdings on an as-converted-to-common

basis.

| (1) | Cheung Cheuk Yin was appointed to serve as our Chief Executive Officer, Chief Financial Officer, Secretary

and Director on July 5, 2024. |

| (2) | Sally Kin Yi Lo resigned from her positions of Chief Executive Officer, Chief Financial Officer, Secretary

and Director effective July 5, 2024. |

| (3) | Daily Success Development Limited is beneficially owned by Shing Lee. |

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING

AN ADDRESS

Only one Information Statement is being delivered

to multiple security holders sharing an address unless the Company has received contrary instructions from one or more of its security

holders. The Company undertakes to deliver promptly and without charge, upon written or oral request, a separate copy of the information

statement to a security holder at a shared address to which a single copy of the documents was delivered. Security holders sharing an

address and receiving a single copy may send a request to receive separate information statements to the Company at the following address:

DH ENCHANTMENT INC

3/F, Yeung Yiu Chung (No.6) Industrial Building

19 Cheung Shun Street, Lai Chi Kok

Kowloon, Hong Kong 00000

WHERE YOU CAN FIND ADDITIONAL INFORMATION ABOUT

THE COMPANY

The Company is subject to the information requirements

of the Exchange Act and, in accordance therewith, files reports, proxy statements and other information, including annual and quarterly

reports on Form 10-K and Form 10-Q with the SEC. Reports and other information filed by the Company can be accessed on the SEC website,

where reports, proxy and information statements and other information regarding issuers that file electronically with the SEC may be obtained

free of charge. In addition, you may send a request for any of our SEC filings to us at:

DH ENCHANTMENT INC

3/F, Yeung Yiu Chung (No.6) Industrial Building

19 Cheung Shun Street, Lai Chi Kok

Kowloon, Hong Kong 00000

INCORPORATION BY REFERENCE

Statements contained in this information statement,

or in any document incorporated in this information statement by reference regarding the contents of other documents, are not necessarily

complete and each such statement is qualified in its entirety by reference to that contract or other document filed as an exhibit with

the SEC. The SEC allows us to “incorporate by reference” into this information statement certain documents we file with the

SEC. This means that we can disclose important information to you by referring you to another document filed separately with the SEC.

The information incorporated by reference is considered to be part of this Information Statement, and later information that we file with

the SEC, prior to the effective date of the actions set forth herein, will automatically update and supersede that information. We incorporate

by reference the documents listed below and any documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act

after the date of this Information Statement and prior to the effective date of the actions set forth herein. These include periodic reports,

such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as information or proxy statements

(except for information furnished to the SEC that is not deemed to be “filed” for purposes of the Securities Exchange Act

of 1934). Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including

the related exhibits, is not incorporated by reference into this Information Statement.

Any person, including any beneficial owner, to

whom this Information Statement is delivered may request copies of reports, proxy statements or other information concerning us, without

charge, as described above in “Where You Can Find More Information.”

You should rely only on information contained

in or incorporated by reference in this information statement. No persons have been authorized to give any information or to make any

representations other than those contained in this information statement, and, if given or made, such information or representations must

not be relied upon as having been authorized by us or any other person.

THIS INFORMATION STATEMENT IS DATED FEBRUARY 13,

2025. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THAT DATE,

AND THE MAILING OF THIS INFORMATION STATEMENT TO STOCKHOLDERS DOES NOT CREATE ANY IMPLICATION TO THE CONTRARY.

This Information Statement is first being mailed

or furnished to Stockholders on or about February 24, 2025. The Company will pay all costs associated with the distribution of this

Information Statement, including the costs of printing and mailing. The Company will reimburse brokerage firms and other custodians, nominees

and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of the Common

Stock.

| Dated February 24, 2025 |

By order of our Board of Directors, |

| |

|

| |

By: /s/ Cheuk Yin Cheung |

| |

Name: Cheuk Yin Cheung |

| |

|

Appendix A

Form of Certificate of Change of the Increase

in Authorized Capital

Certificate

of Change Pursuant to NRS 78.209, Entity Information: DH ENCHANTMENT INC.; Entity or Nevada Business Identification Number (NVID): NV2004156132,

Current Authorized Shares: 4,450,000,000 shares of common stock, $0.001 par value per share 50,000,000 shares of preferred stock, $0.001

par value per share; 3. Authorized Shares After Change: 30,000,000,000 shares of common stock, $0.001 par value per share, 50,000,000

shares of preferred stock, $0.001 par value per share

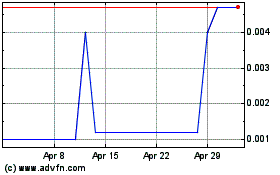

DH Enchantment (PK) (USOTC:ENMI)

Historical Stock Chart

From Feb 2025 to Mar 2025

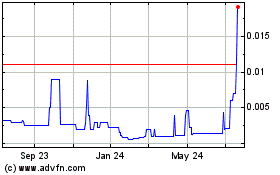

DH Enchantment (PK) (USOTC:ENMI)

Historical Stock Chart

From Mar 2024 to Mar 2025