Form CB/A - Tender Offer/Rights Offering Notification Form: [Amend]

May 08 2024 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

(Amendment No. 2)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

Cresco Labs Inc.

(Name of Subject Company (Issuer))

Cresco Labs Inc., as Issuer and Offeror

(Name of Filing Persons (Identifying status as offeror, issuer, or other person))

Options to purchase subordinate voting shares, no par value per share

(Title of Class of Securities)

CA22587M1068 for the subordinate voting shares

(CUSIP Number of Class of Securities)

John Schetz

Cresco Labs Inc.

600 West Fulton Street, Suite 800

Chicago, IL 60661

(312) 929-0993

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copy to:

Heidi Steele

McDermott Will & Emery LLP

444 West Lake Street, Suite 4000

Chicago, IL 60606

(312) 372-2000

☐ Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

This Amendment to the Tender Offer Statement on Schedule TO (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed with the U.S. Securities and Exchange Commission on April 9, 2023 (as amended and together with its exhibits, the “Schedule TO”), by Cresco Labs Inc., a corporation organized under the laws of the Province of British Columbia (the “Company”), relating to the offer by the Company to certain optionholders to exchange certain outstanding options to purchase the Company’s subordinate voting shares for new options to purchase the Company’s subordinate voting shares (the “Exchange Offer”).

This Amendment is being filed in accordance with Rule13e-4(c)(4) under the Securities Exchange Act of 1934, as amended, to report the final results of the Exchange Offer. Except as specifically set forth herein, this Amendment does not modify any of the information previously reported on the Schedule TO. You should read this Amendment together with the Schedule TO. All capitalized terms used herein have the same meanings as given in the Schedule TO.

ITEM 4. Terms of the Transaction.

Item 4(a) of the Schedule TO is hereby amended and supplemented by adding the following information:

(a)Material Terms.

The Exchange Offer expired at 11:59 p.m., Eastern Time, on Monday, May 6, 2024. Pursuant to the Exchange Offer, 266 Eligible Participants elected to exchange, and the Company accepted for cancellation, Eligible Options to purchase an aggregate of 3,903,093 subordinate voting shares, representing approximately 61% of the total subordinate voting shares underlying the Eligible Options. On May 7, 2024, promptly following the expiration of the Exchange Offer, the Company granted New Options to purchase 2,246,275 subordinate voting shares, pursuant and subject to the terms of the Exchange Offer (including Shareholder Approval) and the 2018 Incentive Plan. The exercise price of the New Options granted pursuant to the Exchange Offer was $2.10 per share, which was the closing price of the subordinate voting shares as reported on the OTC on May 6, 2024. The vesting terms of the New Options are described in detail in the Exchange Offer. Consummation of the Exchange Offer, including cancellation of Eligible Options tendered for exchange and the grant of New Options therefor, remains subject to Shareholder Approval which is expected to occur in June 2024.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Cresco Labs Inc. |

| | | | | | | | |

| | By: | | | /s/Charles Bachtell |

| | | | | Name: | | | Charles Bachtell |

| | | | | Title: | | | Chief Executive Officer |

Date: May 8, 2024

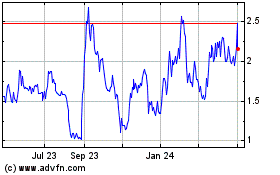

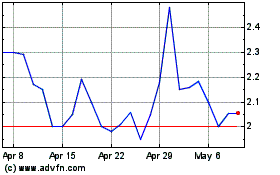

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Feb 2024 to Feb 2025