Cresco Labs: This Cannabis Stock Can Gain 10x In 10 Years

September 24 2021 - 10:42AM

Finscreener.org

Cannabis stocks are all set to

explode if the U.S. government legalizes weed for recreational use.

Right now, more than 35 states in the country have legalized the

use of medical marijuana while recreational cannabis use is

permitted in 16 states. In case cannabis is legalized in the U.S.,

it will allow producers easier access to debt capital in order to

fund their expansion plans, making stocks such as Cresco Labs

(OTC:

CRLBF) top bets right

now.

Cresco Labs is a cannabis giant

Cresco Labs is a multi-state

operator with a presence in 10 states in the U.S. It has 47 retail

licenses, while owning 20 production facilities and 37

dispensaries, making it one of the largest pot producers in the

world. Cresco Labs is a vertically integrated cannabis producer and

its offerings are sold in 700 dispensaries all over the country,

which shows that it is a major wholesale player too in this

space.

In the fiscal first quarter of

2021, Cresco sales rose by 169% year over year to $178 million. Its

wholesale business derived 54% of total sales. This business saw

sales increase by 151% year over year to $96 million while retail

sales grew 193% to $83 million in Q1. Cresco’s retail business

includes medical and recreational cannabis sales in the U.S. as

well as vape sales north of the border.

While profit margins are low in

the wholesale business, it remains a key revenue driver for Cresco

Labs. Unlike several other cannabis companies, Cresco Labs reports

a consistent profit.

The company’s sales have grown

from just $43.5 million in 2018 to $476.25 million in

2020.

Cresco’s robust revenue growth in

2020 was attributed to the legalization of cannabis in Illinois,

where it operates 10 dispensaries. Illinois generated $1 billion

in

legal cannabis sales last

year with recreational

cannabis accounting for $669 million of total sales. Research

reports forecast recreational cannabis sales to touch $1 billion in

2021 in the Land of Lincoln.

This allowed Cresco to report an

operating profit of $55.8 million last year compared to an

operating loss of $34.25 million in 2019. In the first quarter,

Cresco’s adjusted EBITDA expanded to $35 million, up from $16.5

million in the year-ago period.

The recent wave of legalization

in the U.S. has helped the marijuana heavyweight to report robust

growth in both revenue and profits. This trend is likely to

continue going forward as Cresco operates in six of the 10 largest

states (in terms of population) such as California, Florida, and

New York.

Adjusted profit is on the horizon

Similar to most other marijuana

producers, Cresco Labs is also investing heavily in acquisitions.

Earlier this year, it acquired Verdant Creations that has four

dispensaries in Ohio as well as Cultivate Processing that has two

dispensaries in Massachusetts.

Cresco also completed the

big-ticket acquisition of Bluma Wellness which is a large cannabis

operator in Florida, giving it access to the Sunshine State, a

billion-dollar market for pot producers. Bluma already has eight

dispensaries in Florida and has licenses to open seven other

outlets in this state.

These acquisitions might allow

Cresco Labs to increase sales by 81.9% year over year to $866.31

million in 2021 and by 40% to $1.21 billion in 2022, according to

consensus estimates. Wall Street also expects the bottom line to

improve from a loss per share of $0.24 in 2020 to earnings of $0.02

in 2021 and $0.31 in 2022.

Further, Cresco Labs remains on

track to achieve annualized revenue run rate of over $1 billion by

the end of 2021.

Cresco stock will attract value investors

too

Cresco stock has gained 69% in

market value in less than three years. However CL stock is also

down 49% from all-time highs, allowing you to buy the dip. Cresco

Labs stock is valued at a market cap of $2.31 billion which suggests its price to

sales multiple is less than 3x, making it one of the cheapest

stocks on the market.

Analysts tracking Cresco have a

12-month average price target of $19 for the stock which is 140%

higher than its current trading price.

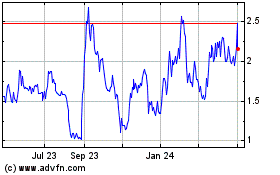

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Dec 2024 to Jan 2025

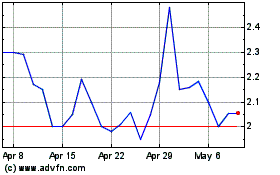

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Jan 2024 to Jan 2025