UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

March 21, 2016

Date of Report (Date of earliest event reported)

CreditRiskMonitor.com, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1-8601

|

36-2972588

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

704 Executive Boulevard

Valley Cottage, NY 10989

(Address of principal executive offices, including zip code)

(845) 230-3000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On March 21, 2016, CreditRiskMonitor.com, Inc. issued a press release relating to, among other things, its financial results for the year ended December 31, 2015. This press release is filed as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in this Item 2.02 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| |

Exhibit No.

|

|

Description

|

| |

|

|

|

| |

|

|

Press Release dated March 21, 2016.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CREDITRISKMONITOR.COM, INC. |

| |

|

|

|

Date: March 21, 2016

|

By:

|

/s/ Lawrence Fensterstock

|

| |

|

Lawrence Fensterstock

|

| |

|

Chief Financial Officer

|

| |

|

(Principal Financial and

|

| |

|

Accounting Officer)

|

Exhibit 99.1

NEWS RELEASE

CONTACT:

CreditRiskMonitor.com, Inc.

Jerry Flum, CEO

(845) 230-3030

info@creditriskmonitor.com

FOR IMMEDIATE RELEASE

CreditRiskMonitor 2015 Operating Results

VALLEY COTTAGE, NY—March 21, 2016—CreditRiskMonitor (OTCQX: CRMZ) reported that revenues for the year ended December 31, 2015 increased 2% to $12.49 million compared to fiscal 2014. Net income for fiscal 2015 was approximately $493,200 compared to $370,600 in the prior year. Cash, cash equivalents and marketable securities at the end of 2015 increased to $8.96 million from the 2014 year-end balance of $8.89 million.

Jerry Flum, CEO, said, “Reported earnings for 2015 is the highest since 2012. In 2015 we began investing in new marketing programs and are continuing to do so in 2016. We believe these programs should start positively impacting operating results in late 2016 and 2017. At the same time, we continue to be debt-free and our strong balance sheet provides us with financial flexibility to manage for the long-term.”

CREDITRISKMONITOR.COM, INC.

STATEMENTS OF INCOME

FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

| |

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

Operating revenues

|

|

$

|

12,486,316

|

|

|

$

|

12,203,526

|

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Data and product costs

|

|

|

4,665,360

|

|

|

|

4,721,114

|

|

|

Selling, general and administrative expenses

|

|

|

6,685,528

|

|

|

|

6,568,885

|

|

|

Depreciation and amortization

|

|

|

218,621

|

|

|

|

221,452

|

|

| |

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

11,569,509

|

|

|

|

11,511,451

|

|

| |

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

916,807

|

|

|

|

692,075

|

|

|

Other income, net

|

|

|

2,344

|

|

|

|

17,127

|

|

| |

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

919,151

|

|

|

|

709,202

|

|

|

Provision for income taxes

|

|

|

(425,934

|

)

|

|

|

(338,648

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

493,217

|

|

|

$

|

370,554

|

|

| |

|

|

|

|

|

|

|

|

|

Net income per share of common stock:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.05

|

|

|

$

|

0.04

|

|

|

Diluted

|

|

$

|

0.05

|

|

|

$

|

0.03

|

|

CREDITRISKMONITOR.COM, INC.

BALANCE SHEETS

DECEMBER 31, 2015 AND 2014

| |

|

2015

|

|

|

2014

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

8,717,899

|

|

|

$

|

7,529,468

|

|

|

Marketable securities

|

|

|

245,474

|

|

|

|

1,363,439

|

|

|

Accounts receivable, net of allowance of $30,000

|

|

|

1,927,428

|

|

|

|

2,078,710

|

|

|

Other current assets

|

|

|

749,925

|

|

|

|

516,585

|

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

11,640,726

|

|

|

|

11,488,202

|

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

395,026

|

|

|

|

337,339

|

|

|

Goodwill

|

|

|

1,954,460

|

|

|

|

1,954,460

|

|

|

Other assets

|

|

|

33,999

|

|

|

|

23,682

|

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

14,024,211

|

|

|

$

|

13,803,683

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

$

|

7,436,764

|

|

|

$

|

7,612,836

|

|

|

Accounts payable

|

|

|

78,267

|

|

|

|

137,258

|

|

|

Accrued expenses

|

|

|

1,241,317

|

|

|

|

1,230,966

|

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

8,756,348

|

|

|

|

8,981,060

|

|

| |

|

|

|

|

|

|

|

|

|

Deferred taxes on income, net

|

|

|

806,161

|

|

|

|

743,691

|

|

|

Other liabilities

|

|

|

4,314

|

|

|

|

2,546

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

9,566,823

|

|

|

|

9,727,297

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value; authorized 5,000,000 shares; none issued

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $.01 par value; authorized 32,500,000 shares; issued and outstanding 10,722,321 and 10,472,042 shares, respectively

|

|

|

107,223

|

|

|

|

104,720

|

|

|

Additional paid-in capital

|

|

|

29,473,845

|

|

|

|

29,175,750

|

|

|

Accumulated deficit

|

|

|

(25,123,680

|

)

|

|

|

(25,204,084

|

)

|

| |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

4,457,388

|

|

|

|

4,076,386

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

14,024,211

|

|

|

$

|

13,803,683

|

|

Note

On October 21, 2015, the Company's Board of Directors authorized a 1.3-for-1 split of its common stock, in the form of a 30% stock dividend, payable to stockholders of record as of November 30, 2015. Shares resulting from the split were issued on December 15, 2015. In connection therewith, the Company transferred $24,745 from accumulated deficit to common stock, representing the par value of additional shares issued. All share and per share amounts for all periods presented have been retroactively adjusted to reflect the stock split.

About CreditRiskMonitor

CreditRiskMonitor (http://www.creditriskmonitor.com) helps corporate credit and procurement professionals stay ahead of and manage financial risk quickly, accurately and cost effectively. It offers comprehensive commercial credit and financial risk analysis covering public companies worldwide. Unlike other commercial credit bureaus like Dun & Bradstreet, CreditRiskMonitor’s primary focus is on financial analysis of publicly traded company risk.

Over 35% of the Fortune 1,000 depend on CreditRiskMonitor’s timely news alerts and reports featuring detailed analyses of financial statements, ratio analysis, peer analyses, bond agency ratings, and the Company’s proprietary FRISK® scores, proven 95% predictive in anticipating corporate financial stress, including bankruptcy.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", “believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

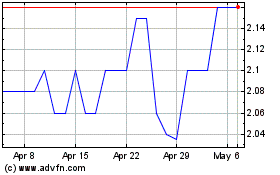

Credit Risk Monitor Com (QX) (USOTC:CRMZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Credit Risk Monitor Com (QX) (USOTC:CRMZ)

Historical Stock Chart

From Nov 2023 to Nov 2024