Credit Agricole 3Q Net Profit Beat Expectations -- Earnings Review

November 04 2020 - 3:53AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA released third-quarter results on Wednesday.

Here is what you need to know.

NET PROFIT: Quarterly net profit dropped roughly 19% on year to

977 million euros ($1.15 billion), beating analysts' expectations

of EUR747 million, according to a consensus provided by

FactSet.

REVENUE: Revenue rose 2.4% to EUR5.15 billion.

WHAT WE WATCHED:

-INVESTMENT BANK: The French bank joined other European peers

reporting strong results from market operations. Credit Agricole's

fixed-income revenue grew almost 27%.

-PROVISIONS: The lender set aside EUR605 million for potential

loan losses, an increase of almost 81% from a year earlier but less

than in the second quarter. "Cost of risk was better than

expected," Citi says.

-CAPITAL: The bank's core Tier 1 ratio --a key measure of

capital strength--increased to 12.4% at the end of September from

12% in June. This was "significantly stronger than expected, driven

by stronger earnings and lower RWAs," Jefferies says, referring to

risk-weighted assets, a measure of a bank's assets weighted by how

risky they are.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com;

@pietrolombard10

(END) Dow Jones Newswires

November 04, 2020 03:38 ET (08:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

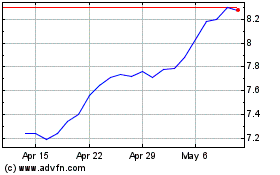

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jun 2024 to Jul 2024

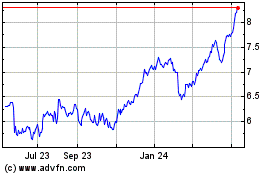

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024