Trump Administration Backs Madoff Trustee's Hunt for $3 Billion Foreign Loot

April 13 2020 - 1:15PM

Dow Jones News

By Andrew Scurria

The Justice Department is backing efforts to force European

banks and other overseas investors to give back roughly $3 billion

they received from foreign investment funds that moved money in and

out of Bernard Madoff's Ponzi scheme.

The U.S. solicitor general on Friday urged the U.S. Supreme

Court to pave the way for continued litigation against these

foreign institutions, some of the last remaining targets in the

global hunt for stolen cash from Mr. Madoff's $20 billion

fraud.

The nation's highest court is considering whether to take up an

appeal from banks and other foreign recipients that have been sued

by Irving Picard, the trustee who has spent more than a decade

digging up money for Mr. Madoff's victims. The dispute concerns Mr.

Picard's attempts to reclaim tainted money that passed between

foreign institutions before Mr. Madoff's arrest.

Mr. Picard has long insisted that under U.S. bankruptcy law, he

can recoup Ponzi scheme proceeds that were distributed from

offshore funds in the British Virgin Islands, Cayman Islands and

Bermuda. These feeder funds pooled investors' cash, parked most or

all of it with Mr. Madoff and collected proceeds from the Ponzi

scheme before it was exposed in 2008.

The trustee has recouped more than $13 billion over the past

decade, arguing that money withdrawn from Mr. Madoff's phantom

investment firm should help repay average investors who lost money

in the fraud. As part of his global legal campaign, Mr. Picard sued

the feeder funds for the money they collected and followed the cash

trail to their underlying investors.

Banks including HSBC Holdings PLC, Crédit Agricole SA and

Société Générale SA have said that transfers occurring entirely

outside the U.S. were beyond the trustee's reach. A New York

appeals court last year brought these transfers within Mr. Picard's

grasp, ruling that to declare them off-limits would disadvantage

legitimate creditors and encourage fraudsters to stash stolen

assets overseas.

The appellate ruling covered roughly $4 billion in foreign

transfers, but Mr. Picard subsequently reached a settlement with

two British Virgin Islands funds managed by Kingate Management Ltd.

that reduced the amount in dispute by $860 million.

The Supreme Court could either take up that decision for review

or cement it in place by denying the banks' appeal. If the justices

side with Mr. Picard, he would be able to continue suing the banks,

laying the groundwork for potential settlements that would bring

back more money for victims.

In Friday's court filing, the solicitor general said the lower

court was correct in focusing on the initial transfer of funds from

Mr. Madoff's New York bank accounts to the offshore funds to

justify clawing back the money, even if it was later passed between

two foreign firms. The justices sometimes ask for the solicitor

general's input on pending cases that could have a significant

impact on federal law.

Mr. Madoff is serving a 150-year prison sentence in North

Carolina after pleading guilty to running the largest Ponzi scheme

in history.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

April 13, 2020 13:00 ET (17:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

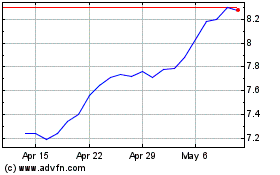

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jun 2024 to Jul 2024

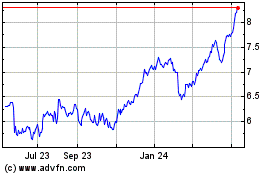

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024