CMG Holdings Reports Strong Second Quarter Results and Provides Update

August 13 2019 - 11:00AM

InvestorsHub NewsWire

CMG Holdings Reports Strong Second

Quarter Results and Provides Update

Revenues of $1MM+ up 358% YoY,

Profitability Maintained

XA Sales Funnel Builds with Multiple Seven-Figure Contract Bids

Progressing

Approved 100MM Share Repurchase and Began Returning Capital to

Stockholders

Company Pursuing Legal Action Against Former

Attorneys

Chicago, IL -- August 13, 2019 -- InvestorsHub

NewsWire -- CMG Holdings Group, Inc. (CMGO/OTC)

today released strong second quarter 2019 results and provided a

shareholder update from the Office of the CEO, Glenn

Laken:

“As you

can see, CMG executed well during the three-month period ended June

30, 2019. Total revenues of $1.06MM were up 358% YoY from

$232K in the prior year’s same period aided by strong execution and

financial management. The Company generated a net profit of

$481K up significantly from a loss of ($183K) in 2Q18. We

remain debt free at the XA level leaving the business in a great

position going forward. XA’s fundamentals are improving and

the unit has a very clean capital structure, which are the best of

both worlds.

CMG

finished the quarter with a cash position of $409,589, and with

XA’s return to profitability this year and another two years of

payments expected from a substantial litigation settlement in the

March quarter, CMG is only getting stronger as the days go

by.

We are

pursuing legal remedies for monetary damages with two of the former

attorneys for CMG in its lawsuit which was resolved in January.

Discussions of settlement are underway, and if that does not

bring closure, we will be filing suit in the near future. More

details will be released as they become

available.”

Additionally, CMG would like to give an update

on its business outlook. During the quarter, XA, the

Company’s operating subsidiary, closed a six-figure contract with a

world-renowned clothing retailer which has the potential to become

a seven-figure relationship after its initial scope of work is

completed. Further, XA continues to work with several new

clients on installations each to be in excess of $1 million and

expects to close at least a couple of these opportunities this year

which will become 2019 and 2020 business. XA continues to see

clients returning with $50K - $100K jobs on a continual basis,

which builds its book of business and provides visibility to future

results.

Said

Laken: “Overall, we have returned XA to strong growth and sustained

profitability, which management projected heading into this

year. With this operational momentum and our expected cash

proceeds from non-operating activities, the Company is in the best

state of operational health and liquidity position it has enjoyed

in years. I believe we have laid the foundation for a great

future for the Company and expect to create substantial value for

shareholders in the future. For these reasons, our Board of

Directors approved a 100 million share repurchase program, which we

initiated in June and which continues to be executed

today.”

Management has posted CMG Holdings’ last two

years of financial statements on a recently-designed CMG website

at https://www.cmgholdingsinc.com

and filed them with

OTCMarkets.com, bringing the Company current with its

financial reporting requirements and removing YIELD and STOP signs

that have been hindrances to investors in the Company’s stock over

the past few years.

About

CMG Holdings Group, Inc.

CMG

Holdings Group, Inc. is a Chicago holding company whose primary

operating subsidiary is XA – The Experiential Agency, Inc.

(http://www.experientialagency.com) - which engages in

the alternative advertising, digital media, experiential and

interactive marketing, and entertainment sectors. XA is

involved in production and promotion, event design, sponsorship

evaluation, negotiation and activation, talent buying, show

production, stage and set design, and data analysis and management

activities. The business also offers branding and design

services, such as graphic, industrial and package designs across

traditional and new media, public relations, social media, media

development and relations, and interactive marketing platforms to

provide its clients with customary private digital media networks

to design and develop individual broadcasting digital media

channels to sell, promote, and enhance their digital media video

content through mobile, online, and social mediums. XA serves

clients across the marketing communication industry.

Separately, CMG Holdings Group owns Lincoln Acquisition Corp., a

subsidiary formed to manage its portfolio

investments.

Disclosure Statement

Statements in this press release about our

future expectations, including without limitation, the likelihood

that CMG Holdings Group, Inc. will meet minimum sales expectations,

be successful and profitable, bring significant value to its

stockholders, and leverage capital markets to execute its growth

strategy, constitute "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, Section 21E

of the Securities Exchange Act of 1934, and as that term is defined

in the Private Litigation Reform Act of 1995. Such forward-looking

statements involve risks and uncertainties and are subject to

change at any time, and our actual results could differ materially

from expected results. The Company undertakes no obligation to

update or release any revisions to these forward-looking statements

to reflect events or circumstances after the date of this statement

or to reflect the occurrence of unanticipated events, except as

required by law. CMG’s business strategy described in this press

release is subject to innumerable risks, most significantly,

whether the Company is successful in securing adequate financing

and materially decreases its convertible debt. No information in

this press release should be construed in any form shape or manner

as an indication of the Company’s future revenues, financial

condition or stock price.

Contact

Glenn

Laken

CEO

CMG

Holdings Group, Inc.

(773)

770-3440

ceo@cmgholdingsinc.com

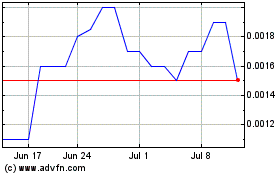

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Jul 2023 to Jul 2024