Carlsberg Sets Out Strategy to Counter Weak Earnings

March 16 2016 - 7:40AM

Dow Jones News

Carlsberg A/S plans to try to turn around its Russia business

and return cash to shareholders, as part of a broad business

strategy the world's fourth largest brewer laid out on

Wednesday.

The Danish brewer said it would work to improve its sales in

Russia, where it sells beer brands such as Baltika, Nevskoe and

Zatecky Gus.

Carlsberg has struggled for years with declining profits in

Eastern Europe, especially in Russia, as law changes intended to

curb alcohol consumption, Western sanctions and a generally

deteriorating economic climate have put pressure on sales.

Russia is one of the world's largest beer markets and Carlsberg

says its market share in the country is 38%.

Carlsberg also set a dividend payout ratio of 50%, once it

reaches a certain debt to earnings ratio. The company plans to

distribute any excess cash to shareholders via buybacks or special

dividends, but cautioned that it could choose to use the money for

an acquisition should a suitable one arise. Chief Executive Cees't

Hart, who took the helm in June, indicated last year that Carlsberg

was unlikely to bid for major assets soon.

But shares fell 2.5% in morning trading in Copenhagen as

investors appeared disappointed by parts of the strategy, which

didn't include firm targets on margins or return on invested

capital.

"It sounds sensible but hardly revolutionary," said RBC analyst

James Edwardes Jones. Still, he said the company's commitment to

returning cash to shareholders "marks a real shift in tone."

Carlsberg plans to streamline its brand portfolio in its core

markets, hinting at possible divestitures or phasing out of certain

beer brands.

Mr. Hart announced cost-cutting measures in November, targeting

annual savings on between 1.5 billion and 2 billion kroner ($223

million-$297 million) by 2018. On Wednesday, the company said half

of those savings would be used to fund the initiatives outlined in

its 2022 plan and the other half would be used to grow earnings,

particularly in Western Europe.

As part of an overarching strategy it plans to deliver by 2022,

Carlsberg said it will focus on growing in China, Vietnam and India

where it plans to launch new product and expand its footprint. The

company plans to push its line of non-alcoholic beer, in both

existing and new markets. It will focus on big cities and push

harder in craft beer, a relative growth area for the beer industry.

Carlsberg also said it would put muscle behind growing in China,

Vietnam and India, where it plans to launch new products and expand

its footprint.

"We now have a set of clear strategic and financial priorities,"

said Mr. Hart.

Exane BNP Paribas analyst Eamonn Ferry said he liked the fact

that two of the three financial metrics Carlsberg said it would aim

to find a balance between—market share, gross profit after

logistics margin and operating profit—are profit focused, adding

that he expects "a significant ramp in the dividend very soon and

then cash returns thereafter."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

March 16, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

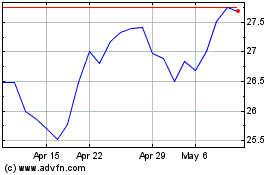

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

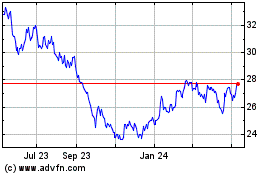

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Nov 2023 to Nov 2024