false

0001166708

0001166708

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November

13, 2024

| BROWNIE’S

MARINE GROUP, INC. |

| (Exact

name of registrant as specified in its charter) |

| Florida |

|

333-99393 |

|

90-0226181 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS.

Employer

Identification

No.) |

| 3001

NW 25th Avenue, Suite 1, Pompano Beach, Florida |

|

33069 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(Registrant’s

telephone number, including area code): (954) 462-5570

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging

growth company |

☐ |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 | Entry

into a Material Definitive Agreement. |

On November

13, 2024, Brownie’s Marine Group, Inc., a Florida corporation (the “Company”), and Charles Hyatt, a member of the Company’s

board of directors (“Hyatt”), executed (a) an amendment to a promissory note in the principal amount of $150,000, which was

originally issued by the Company to Hyatt on November 7, 2023 (the “2023 Note”), to extend the 2023 Note’s maturity

date from May 7, 2024 to May 7, 2025, and (b) an amendment to a promissory note in the principal amount of $280,000, which was originally

issued by the Company to Hyatt on February 5, 2024 (the “2024 Note”), to extend the 2024 Note’s maturity date from

August 5, 2024 to May 5, 2025. Except as specifically amended by the amendments, the terms and conditions of the 2023 Note and

2024 Note remain in full force and effect.

The

foregoing descriptions of the amendments to the 2023 Note and 2024 Note are qualified in their entirety by reference to the full text

of such documents, copies of which are attached to this report as Exhibits 4.1 and 4.2, respectively, and are incorporated herein by

reference.

| Item

2.03 | Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant. |

Reference

is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BROWNIE’S MARINE GROUP, INC. |

| |

|

|

| Date: November 19, 2024 |

By: |

/s/ Robert

Carmichael |

| |

|

Robert

Carmichael |

| |

|

Chief

Executive Officer |

Exhibit

4.1

AMENDMENT

NO. 1 TO PROMISSORY NOTE

THIS

AMENDMENT NO. 1 TO PROMISSORY NOTE (this “Amendment”), dated as of November 13, 2024, is entered into by and between

Brownie’s Marine Group, Inc., a Florida corporation (“Borrower” or “Company”), and Charles

F. Hyatt, a member of the Company’s board of directors (the “Lender”). The Borrower and the Lender may be referred

to herein individually as a “Party” and jointly as the “Parties.”

W

I T N E S S E T H:

WHEREAS,

on November 7, 2023, the Borrower issued a promissory note to the Lender in the principal amount of $150,000 (the “Note”),

to evidence a loan the Lender made to the Borrower on that date and in that amount; and

WHEREAS,

the Parties desire to amend certain terms of the Note, as set forth below.

NOW,

THEREFORE, in consideration of the mutual promises set forth herein, and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, each of the Parties agrees with the other as follows:

1.

Capitalized Terms. Unless otherwise defined herein, all terms and conditions used in this Amendment shall have the meanings assigned

to such terms in the Note.

2.

Amendments to Note.

| (a) | Section

2 of the Note is hereby deleted in its entirely and replaced with the following: |

“2.

Security; Payments. This Note shall be secured by ERC reimbursement funds. Interest payments on this Note shall be due and payable

on a monthly basis in the amounts and dates set forth on the Payment Schedule attached to this Note (the “Payment Schedule”).

This Note shall be payable in one (1) final balloon payment of all unpaid principal and accrued but unpaid interest on May 7, 2025 (the

“Maturity Date”). The time period from the date of this Note through and including the satisfaction of all obligations

under this Note is hereinafter referred to as the “Loan Term”. All payments against this Note shall be payable without

setoff, deduction or demand and shall be made in lawful money of the United States of America at the Lender’s principal place of

business, or at such other place as Lender may from time to time designate in writing.”

| (b) | The

Payment Schedule attached to the Note is hereby deleted in its entirety and replaced with

Annex A attached hereto. |

3.

Full Force and Effect. Except as herein amended, the Note shall remain in full force and effect. Upon the effectiveness of this

Amendment, each reference in the Note to “this Note,” “hereunder,” “herein” or words of like import

shall mean and be a reference to the Note, as amended by this Amendment.

4.

Further Assurances. Each Party hereto, without additional consideration, shall cooperate, shall take such further action and shall

execute and deliver such further documents as may be reasonably requested by the other Party hereto in order to carry out the provisions

and purposes of this Amendment.

5.

Counterparts. This Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Delivery of an executed Amendment by one Party to the other may be made by physical or

electronic transmission to the applicable address and email address set forth in the Note.

6.

Headings. The section headings herein are for convenience only and shall not affect the construction hereof.

7.

Governing Law. The substantive laws of the applicable state, as well as terms regarding forum and jurisdiction, as originally

provided in the Note shall govern the construction of this Amendment and the rights and remedies of the parties hereto.

[REMAINDER

OF PAGE LEFT BLANK INTENTIONALLY]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

| |

BORROWER: |

| |

|

| |

BROWNIE’S

MARINE GROUP, INC. |

| |

|

|

| |

By: |

/s/

Robert Carmichael |

| |

Name: |

Robert Carmichael |

| |

Title: |

Chief Executive Officer |

|

LENDER: |

| |

|

| |

/s/

Charles F. Hyatt |

|

Charles F.

Hyatt |

Annex

A

PAYMENT

SCHEDULE

| Summary | |

| |

| Principal borrowed: | |

$ | 150,000.00 | |

| Final Balloon Payment: | |

$ | 150,000.00 | |

| Interest-only payment: | |

$ | 1,237.50 | |

| *Total Repaid: | |

$ | 172,275.00 | |

| *Total Interest Paid: | |

$ | 22,275.00 | |

| Total Payments: | |

| 18 | |

| Annual interest rate: | |

| 9.9 | % |

| Payment Schedule |

| Date | |

Amount | |

| 12/7/2023 | |

$ | 1,237.50 | |

| 1/7/2024 | |

$ | 1,237.50 | |

| 2/7/2024 | |

$ | 1,237.50 | |

| 3/7/2024 | |

$ | 1,237.50 | |

| 4/7/2024 | |

$ | 1,237.50 | |

| 5/7/2024 | |

$ | 1,237.50 | |

| 6/7/2024 | |

$ | 1,237.50 | |

| 7/7/2024 | |

$ | 1,237.50 | |

| 8/7/2024 | |

$ | 1,237.50 | |

| 9/7/2024 | |

$ | 1,237.50 | |

| 10/7/2024 | |

$ | 1,237.50 | |

| 11/7/2024 | |

$ | 1,237.50 | |

| 12/7/2024 | |

$ | 1,237.50 | |

| 1/7/2025 | |

$ | 1,237.50 | |

| 2/7/2025 | |

$ | 1,237.50 | |

| 3/7/2025 | |

$ | 1,237.50 | |

| 4/7/2025 | |

$ | 1,237.50 | |

| 5/7/2025 | |

$ | 151,237.50 | |

Exhibit

4.2

AMENDMENT

NO. 1 TO PROMISSORY NOTE

THIS

AMENDMENT NO. 1 TO PROMISSORY NOTE (this “Amendment”), dated as of November 13, 2024, is entered into by and between

Brownie’s Marine Group, Inc., a Florida corporation (“Borrower” or “Company”), and Charles

F. Hyatt, a member of the Company’s board of directors (the “Lender”). The Borrower and the Lender may be referred

to herein individually as a “Party” and jointly as the “Parties.”

W

I T N E S S E T H:

WHEREAS,

on February 5, 2024, the Borrower issued a promissory note to the Lender in the principal amount of $280,000 (the “Note”),

to evidence a loan the Lender made to the Borrower on that date and in that amount; and

WHEREAS,

the Parties desire to amend certain terms of the Note, as set forth below.

NOW,

THEREFORE, in consideration of the mutual promises set forth herein, and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, each of the Parties agrees with the other as follows:

1.

Capitalized Terms. Unless otherwise defined herein, all terms and conditions used in this Amendment shall have the meanings assigned

to such terms in the Note.

2.

Amendments to Note.

| (a) | Section

2 of the Note is hereby deleted in its entirely and replaced with the following: |

“2.

Security; Payments. This Note shall be secured by ERC reimbursement funds. Interest payments on this Note shall be due and payable

on a monthly basis in the amounts and dates set forth on the Payment Schedule attached to this Note (the “Payment Schedule”).

This Note shall be payable in one (1) final balloon payment of all unpaid principal and accrued but unpaid interest on May 5, 2025 (the

“Maturity Date”). The time period from the date of this Note through and including the satisfaction of all obligations

under this Note is hereinafter referred to as the “Loan Term”. All payments against this Note shall be payable without

setoff, deduction or demand and shall be made in lawful money of the United States of America at the Lender’s principal place of

business, or at such other place as Lender may from time to time designate in writing.”

| (b) | The

Payment Schedule attached to the Note is hereby deleted in its entirety and replaced with

Annex A attached hereto. |

3.

Full Force and Effect. Except as herein amended, the Note shall remain in full force and effect. Upon the effectiveness of this

Amendment, each reference in the Note to “this Note,” “hereunder,” “herein” or words of like import

shall mean and be a reference to the Note, as amended by this Amendment.

4.

Further Assurances. Each Party hereto, without additional consideration, shall cooperate, shall take such further action and shall

execute and deliver such further documents as may be reasonably requested by the other Party hereto in order to carry out the provisions

and purposes of this Amendment.

5.

Counterparts. This Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Delivery of an executed Amendment by one Party to the other may be made by physical or

electronic transmission to the applicable address and email address set forth in the Note.

6.

Headings. The section headings herein are for convenience only and shall not affect the construction hereof.

7.

Governing Law. The substantive laws of the applicable state, as well as terms regarding forum and jurisdiction, as originally

provided in the Note shall govern the construction of this Amendment and the rights and remedies of the parties hereto.

[REMAINDER

OF PAGE LEFT BLANK INTENTIONALLY]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

| |

BORROWER:

|

| |

|

| |

BROWNIE’S

MARINE GROUP, INC. |

| |

|

|

| |

By: |

/s/

Robert Carmichael |

| |

Name: |

Robert Carmichael |

| |

Title: |

Chief Executive Officer |

| |

LENDER: |

| |

|

| |

/s/

Charles F, Hyatt |

| |

Charles

F. Hyatt |

Annex

A

PAYMENT

SCHEDULE

| Summary | |

| |

| Principal borrowed: | |

$ | 280,000.00 | |

| Final Balloon Payment: | |

$ | 280,000.00 | |

| Interest-only payment: | |

$ | 2,310.00 | |

| *Total Repaid: | |

$ | 314,650 | |

| *Total Interest Paid: | |

$ | 34,650 | |

| Total Payments: | |

| 15 | |

| Annual interest rate: | |

| 9.9 | % |

| Payment Schedule |

| Date | |

Amount | |

| 3/5/2024 | |

$ | 2,310.00 | |

| 4/5/2024 | |

$ | 2,310.00 | |

| 5/5/2024 | |

$ | 2,310.00 | |

| 6/5/2024 | |

$ | 2,310.00 | |

| 7/5/2024 | |

$ | 2,310.00 | |

| 8/5/2024 | |

$ | 2,310.00 | |

| 9/5/2024 | |

$ | 2,310.00 | |

| 10/5/2024 | |

$ | 2,310.00 | |

| 11/5/2024 | |

$ | 2,310.00 | |

| 12/5/2024 | |

$ | 2,310.00 | |

| 1/5/2025 | |

$ | 2,310.00 | |

| 2/5/2025 | |

$ | 2,310.00 | |

| 3/5/2025 | |

$ | 2,310.00 | |

| 4/5/2025 | |

$ | 2,310.00 | |

| 5/5/2025 | |

$ | 282,310.00 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

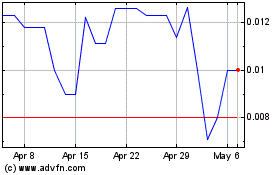

Brownies Marine (PK) (USOTC:BWMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

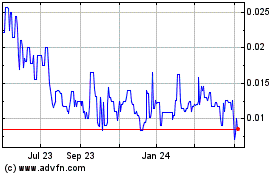

Brownies Marine (PK) (USOTC:BWMG)

Historical Stock Chart

From Dec 2023 to Dec 2024