The FTSE 100 closed down 0.2% on Wednesday with British Land Co.

the biggest faller, down 8.7%, followed by Ocado Group which ended

the day down 7.2%. The day's biggest gainers were Standard

Chartered, which finished up 2.9%, and then AstraZeneca, which

ended up 2.5%. "It's a well-worn phrase that markets don't like

uncertainty and at the moment that's all she wrote. Rate hikes are

clearly the primary focus with investors trying to second guess

when inflation will peak in different nations and how far and fast

central banks are likely to raise rates in a bid to make that peak

sooner," Danni Hewson, AJ Bell financial analyst, says. Elsewhere,

Whitbread said that Dominic Paul has been appointed as its next

chief executive, succeeding Alison Brittain who has decided to

retire at the end of fiscal 2023.

Companies News:

Capita Sees 2022 Revenue Growth in Line with Views

Capita PLC said Wednesday that revenue for the first half of the

year was in line with expectations and that it remains on track to

deliver revenue growth in 2022.

---

UK Government Minded to Clear Parker-Hannifin Takeover of

Meggitt

The U.K. government said late Tuesday that it is 'minded' to

accept Parker-Hannifin Corp.'s undertakings to address its concerns

over the U.S. company's planned 6.3 billion pound ($7.68 billion)

takeover of Meggitt PLC.

---

Mulberry FY22 Pretax Profit Rose Significantly

Mulberry Group PLC reported Wednesday a significant rise in

pretax profit for fiscal year 2022 and said that its performance

for the first quarter of fiscal 2023 is ahead of the same period a

year earlier.

---

DP Aircraft I to Raise up to $750,000 via Tap Issue

DP Aircraft I Ltd. said Wednesday that it plans to raise up to

$750,000 via a tap issue, and that it will use the proceeds as

additional working capital.

---

Shoe Zone Set to Post Rise in Pretax Profit for FY22

Shoe Zone PLC said Wednesday that it expects to end its fiscal

2022 year with a rise in pretax profit, as its performance for the

third quarter has seen strong margin improvements and cost

savings.

---

PPHE to Launch Share Buyback of Up to GBP1.7 Mln; Dividend

Dependent on Performance

PPHE Hotel Group Ltd. said Wednesday that it was launching a

share buyback program of up to 1.7 million pounds ($2.1 million),

and that the declaration of a dividend remained subject to a

continuation of its performance in the year to date.

---

McBride Says Lender Waives June Covenant Tests to September

McBride PLC said Wednesday that its banking group has agreed to

waive the June covenant tests until Sept. 30, and that it is

performing in line with market expectations.

---

Lookers Sees 1H Adj Pretax Profit Fall, Warns of Supply

Restrictions

Lookers PLC said Wednesday that it expects to report a fall in

underlying pretax profit for the first half of 2022, but that it is

ahead of expectations, and warned of both new and used vehicle

supply restrictions for the remainder of the year.

---

Mulberry FY 2022 Pretax Profit Rose Materially Boosted by UK,

China Sales -- Update

Mulberry Group PLC on Wednesday reported a significant rise in

pretax profit for fiscal year 2022, and said that its performance

for the first quarter of fiscal 2023 is ahead of the same period a

year earlier.

---

UK Government Minded to Clear Parker Hannifin Takeover of

Meggitt -- Update

The U.K. government said late Tuesday that it is minded to

accept Parker Hannifin Corp.'s undertakings to address its concerns

over the U.S. company's planned 6.3 billion pound ($7.68 billion)

takeover of Meggitt PLC.

---

Union Jack Starts Capital Reduction Process to Enable

Shareholder Returns

Union Jack Oil PLC said Wednesday that it is pursuing a

reduction of capital exercise through the court procedure following

approval by shareholders at the general meeting held on

Tuesday.

---

Moonpig FY 2022 Pretax Profit Rose; Backs FY 2023 Guidance

Moonpig Group PLC said Wednesday that pretax profit for fiscal

2022 rose in its first full-year performance after floating, and

that it remains confident in its fiscal 2023 guidance.

---

Trakm8 FY 2022 Pretax Loss Narrowed; Warns of Supply Issues

Trakm8 Holdings PLC said Wednesday that pretax loss narrowed in

fiscal 2022, but that it has started the new financial year with

continuing supply challenges and inflationary pressures.

---

Safestay 1Q Revenue Ahead of Views; 2021 Underlying Profit

Effected by Covid-19 Closures

Safestay PLC said Wednesday that revenue for the first quarter

of 2022 was slightly ahead of management's expectations, and that

its 2021 underlying profit before disposals will reflect the effect

of pandemic-related closure periods.

---

Windar Photonics Shares Dive on Expected 2021 Revenue Fall

Shares in Windar Photonics PLC fell 58% in early trade Wednesday

after the company said that it expects to report a 50% fall in 2021

revenue due to project delays in China, and that these accounts

will be delayed past the regulatory deadline.

---

Oxford Cannabinoid Says 11-Month Performance Was as Expected

Oxford Cannabinoid Technologies Holdings PLC said Wednesday that

it expects to report results in line with expectations for the

eleven months ended April 30.

Market Talk:

Lookers Gains After Strong 1H; Shares Look Cheap

0913 GMT - Lookers rises 5% to 78 pence after the U.K. car

dealer said it expected annual underlying pretax profit to be ahead

of its expectations after strong 1H trading. Liberum Capital says

it is increasing its full-year adjusted pretax profit forecast by

29% to reflect the strength of 1H and a degree of caution on 2H,

given the consumer environment, despite a strong new car order

book. "Even as supply starts to improve and demand comes under

pressure going into 2023, our analysis suggests a crash is

unlikely," Liberum analysts say in a note, adding that the stock

looks good value and reiterating their buy recommendation. Liberum

also increases its target price to 122p from 110p.

(philip.waller@wsj.com)

UK Draft 2023-28 Power Distribution Regulation Better Than

Analysts Feared

0851 GMT - The energy regulator for Great Britain, Ofgem, has

released its draft determinations for the 2023-28 regulatory cycle

for power distribution companies. On first sight, the overall

package is better than feared with an allowed cost of equity of

4.75% versus consensus expectation of 4.7%, Citi's utilities

analyst Jenny Ping says in a note. As for total expenditure, the

proposal is 22% lower than what utility SSE had requested and 19%

lower for National Grid. This limits the companies' investment and

spending and eventual costs for consumers. "While this draft set of

regulations is not as bad as feared--given the focus on energy

bills--it is at best in-line with market expectations and nothing

to get excited about," she says. (jaime.llinares@wsj.com)

Draft Regulation Proposals on UK Power Distribution Profits Are

Slightly Positive

0825 GMT - The draft determination released by the U.K.'s energy

regulator Ofgem for power distribution networks' returns in

2023-2028 is a slight positive for the companies, John Musk at RBC

Capital Markets says in a note. Total expenditure levels have been

set 17% below business plan requests, but market expectations were

around that level, he says. In addition, the return-on-equity

allowance has been set at 4.75% compared with company requests of

5%-6% and market expectations of 4.6%. "Overall we regard the ED2

Draft Determination as slightly positive for U.K. electricity

distribution companies given the higher than expected RoE [return

on equity] and totex [total expenditure] levels that have not been

drastically cut versus business plans," Musk says.

(jaime.llinares@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

June 29, 2022 12:58 ET (16:58 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

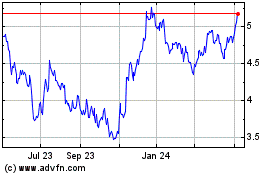

British Land (PK) (USOTC:BTLCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

British Land (PK) (USOTC:BTLCY)

Historical Stock Chart

From Jan 2024 to Jan 2025