Pep Boys Says Icahn Could 'Frustrate' Bridgestone Deal

December 07 2015 - 9:50AM

Dow Jones News

Pep Boys - Manny Moe & Jack said Monday that Carl Icahn's

newly unveiled 12.1% stake in the firm could imperil Bridgestone

Corp.'s acquisition of the car-parts and repair company.

The company said in a statement that Icahn's stake has "raised

concerns" that the billionaire investor and other third parties

could be trying to purchase the company's auto-parts segment.

"Pep Boys shareholders' ability to realize the value presented

by the Bridgestone offer may be frustrated," the company wrote.

Pep Boys shares rose 6.6% in premarket trading.

Pep Boys said in October that it would be acquired by Japanese

tire company Bridgestone for roughly $835 million in cash, about

four months after the Philadelphia-based company put itself up for

sale.

On Friday, Icahn disclosed his stake, saying Pep Boys'

auto-parts division is an "excellent synergistic acquisition

opportunity" for Auto Plus, one of the companies Icahn Enterprises

controls.

At 6.6 million shares, Mr. Icahn's Icahn Enterprises would be

the second largest shareholder in the company. Mario Gabelli's

Gamco Investors Inc. reported a 6.9-million-share stake in Pep Boys

in October.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 07, 2015 09:35 ET (14:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

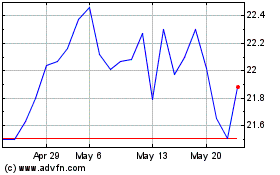

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

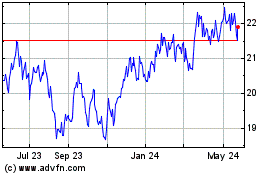

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Nov 2023 to Nov 2024