Cooper Tire Retained at Neutral - Analyst Blog

January 07 2014 - 4:50PM

Zacks

On Jan 3, we maintained our Neutral recommendation on

Cooper Tire & Rubber Co. (CTB) due to its poor

performance in the second quarter of 2013 and termination of the

company’s merger agreement with Apollo Tyres. However, we are

optimistic about the benefits from the high-performance products

and the company’s focus on improving business operations.

Why the Reiteration?

On Aug 8, 2013, Cooper Tire posted second-quarter 2013 earnings of

55 cents per share, down 33% from 82 cents in the prior-year

quarter. The results lagged the Zacks Consensus Estimate of 89

cents.

Net earnings also declined significantly to $35 million from $52

million in the second quarter of 2012. Revenues fell 16.5% year

over year to $884 million in the quarter, missing the Zacks

Consensus Estimate of $986 million.

Following the release of second-quarter results, the Zacks

Consensus Estimate for 2013 fell 6.7% to $2.50 per share. The Zacks

Consensus Estimate for 2014 declined 1.7% to $2.87 per share.

Hence, Cooper Tire now carries a Zacks Rank #3 (Hold). Notably,

some of its competitors in the tire and rubber industry include

The Goodyear Tire & Rubber Co. (GT) and

Bridgestone Corp. (BRDCY).

We expect Cooper Tire to benefit from its high-performance products

which cater to the current market demand. The company is also

poised to increase profitability by focusing on its product mix.

Cooper Tire’s latest products include WM-SA2, Weather-Master Snow

and Discoverer M+S Sport, which are useful in winter. The company

also launched the Mastercraft premium off-road tire.

Cooper Tire will expectedly gain from its efforts to improve

business operations. The company is optimally positioned due to its

quality brands, loyal customer base, and worldwide network of

manufacturing facilities, efficient workforce and advanced

technology.

However, we are concerned about the termination of the merger

agreement with Apollo Tyres Ltd. The acquisition would have

resulted in benefits of operating scale, sourcing benefits,

technology, product optimization and manufacturing improvements.

These would have bolstered earnings before interest, taxes,

depreciation and amortization (EBITDA) by $80–120 million per annum

after 3 years.

Other Stocks That Warrant a Look

A better-placed stock in the industry in which Cooper Tire operates

is Continental AG (CTTAY), with a Zacks Rank #1

(Strong Buy).

BRIDGESTONE ADR (BRDCY): Get Free Report

COOPER TIRE (CTB): Free Stock Analysis Report

CONTL AG-SP ADR (CTTAY): Get Free Report

GOODYEAR TIRE (GT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

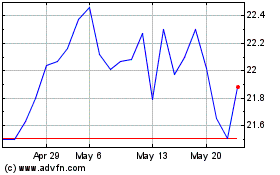

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

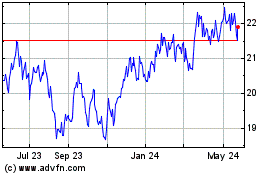

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Nov 2023 to Nov 2024