NGCG - Company To Focus On Reclaiming Electronic Waste to Recover Lithium, Gold, Silver Copper and Other Metals

April 09 2018 - 10:16AM

InvestorsHub NewsWire

NGCG – Company To Focus On Reclaiming Electronic Waste to Recover

Lithium, Gold, Silver Copper and Other Metals

Vancouver, Canada -- April 9, 2018 -- www.penniesgonewild.com via InvestorsHub NewsWire

-- a leading independent micro cap media portal with an extensive

history of providing unparalleled content for undervalued

companies, reports on New Generation Consumer Group, Inc. (OTC Pink: NGCG).

Highlights:

NGCG Lithium main Focus

CEO Tom Kim and Shareholders

Gold and Silver

NGCG may not be at these levels much

longer.

See the 2018 filing and more on New Generation Consumer Group,

Inc. (OTC Pink: NGCG) on

https://penniesgonewild.com/wild-picks-due-diligence

New Generation Consumer Group Inc. is a US based metal/minerals

company with a primary focus on the rare metals, headquartered in

Los Angeles, California. NGCG specializes in metals such as

Lithium, Gold and Silver. There will be a emphasis on niche based

metals such as Lithium due to the growing demand because of the new

energy storage technology.

Lithium Main Focus

As lithium continue to show strength in price NGCG states “New

Generation will focus on reclaiming electronic waste to recover

lithium, gold, silver copper and other metals”. https://backend.otcmarkets.com/otcapi/company/financial-report/187399/content

The demand for lithium is projected to rise 8.9 percent per year

through 2019 to 49,350 metric tons. In lithium carbonate equivalent

(LCE) terms, the value of the global lithium market is projected to

reach $1.7 billion. NGCG is setting itself and preparing itself for

a major opportunity. https://www.freedoniagroup.com/industry-study/world-lithium-3331.htm

The Asia/Pacific region will see the fastest gains in lithium

demand through 2019. China dominates the world lithium market due

to the country’s massive output of goods manufactured with lithium

-- including batteries, glass, grease, air conditioning equipment,

and synthetic rubber. China is expected to register the world’s

strongest yearly increases in lithium demand, boosted by a nearly

threefold expansion in the country’s rechargeable battery segment.

https://www.freedoniagroup.com/industry-study/world-lithium-3331.htm

CEO Tom Kim and Shareholders

NGCG With Mr. Kim's many business interests in the US, Philippines,

Hong Kong, China and Canada he has decided that in the best

interest of NGCG and the shareholders that the company enter into

to the mining sector and in particular Lithium mining in which Mr.

Kim has many opportunities for NGCG.

Mr. Kim decided to focus the company on the mining sector after

months of research. He decided that becoming involved in real

assets would benefit the company and shareholders financial assets,

as real assets are at a 100 year low compared to financial assets.

https://www.otcmarkets.com/stock/NGCG/news/New-Generation-Consumer-Group-Announces-Corporate-Update-on-Company-Direction?id=137625

New Generation will concentrate it’s effort on increasing

shareholder value with asset based acquisitions of mineral property

rights and Joint Ventures with established mining companies. In

addition to acquisitions of electronic waste recyclers. https://backend.otcmarkets.com/otcapi/company/financial-report/187399/content

Gold and Silver

NGCG is also shifting to the gold and silver market which is

extremely undervalued.

Rob Kirby, a forensic macroeconomic analyst says people should be

looking to buy gold and silver for protection because it’s still

relatively cheap compared to the exploding value of some crypto

currencies. Kirby explains, “When you look at the price

differential between silver and gold, you see an ounce of silver

selling for around $18, and you see an ounce of gold going for

$1,340, and that means you would need to sell 75 ounces of silver

to buy one ounce of gold.

The ratio in nature suggests you should be able to sell eight

ounces of silver to buy one ounce of gold. This tells me one

of those two prices is very wrong. Either silver is too cheap

or gold is too expensive. I don’t think gold is too expensive

because I think it’s undervalued too. That leads me to

believe that silver is insanely priced and probably the most

underpriced asset on the planet. . . . I think silver will be going

up in price much more than gold, even though gold is going to go up

in price dramaticallyhttps://goldsilver.com/blog/silver-the-most-undervalued-asset-in-the-world/

Conclusion

With a new direction and new strategy NGCG is ready to reap major

profits from industries that are consider undervalued by many

experts. Gold and Silver could see a significant move any day now

as fear of trade war hit the markets. Lithium is a giant sleeper

who woke up last year to surprise many and is now set to soar in

the coming years. Every investor should look and consider NGCG for

their portfolio in our opinion.

NGCG may not be at these levels

much longer.

See the Filings and more on

New Generation Consumer Group Inc.

at https://penniesgonewild.com/wild-picks-due-diligence

(OTC Pink: NGCG)

Other News:

WRFX- WorldFlix Secures up to $16 Million in Carden

Capital Deal and Hosts Facebook Live CEO Chat

Company has seen a major surged do to a

$16 Million-dollar deal.

GRCV- Grand Capital Ventures Inc. Announces 3 Billion

Share Reduction

Company saw major volume spike last week

on share reduction news. Looks like traders/Investors did not take

the news well.

VTNL- Vet Online Supply Announces a $6.5M Purchase

Order

The company received a BIG purchase

order, but many Traders/Investors believe that do to the high AS

the stock is not performing.

About www.penniesgonewild.com

www.penniesgonewild.com is a

leading independent micro cap media portal with an extensive

history of providing unparalleled content for undervalued

companies. www.penniesgonewild.com focus on micro cap stocks that Wall Street stock

traders have ignored or haven’t found out about yet. We look for

strong management, innovation, strategy, execution, and the overall

potential for long- term growth. We are well known for discovering

undervalued companies. Read full disclosure at https://penniesgonewild.com/disclosure

All information contained herein as well

as on the www.penniesgonewild.com website is obtained from sources believed to be

reliable but not guaranteed to be accurate or all-inclusive. All

material is for informational purposes only, is only the opinion

of www.penniesgonewild.com and should not be construed as an offer or

solicitation to buy or sell securities. The information may include

certain forward-looking statements, which may be affected by

unforeseen circumstances and / or certain risks.

Please consult an investment professional

before investing in anything viewed within. www.penniesgonewild.com has not been compensated for

this article. We may or may not have any shares in any companies

profiled by www.penniesgonewild.com

CONTACT:

Company: www.penniesgonewild.com

Contact Email: penniesgonewild@aol.com

SOURCE: www.penniesgonewild.com

Twitter: https://twitter.com/WildPennies

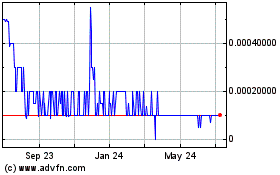

BrewBilt Manufacturing (CE) (USOTC:BBRW)

Historical Stock Chart

From Jan 2025 to Feb 2025

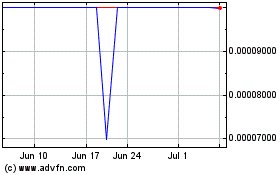

BrewBilt Manufacturing (CE) (USOTC:BBRW)

Historical Stock Chart

From Feb 2024 to Feb 2025